Disability-related stats that are important to know

Accidents are unavoidable. On top of dealing with pain and possible physical or mental limitations, a disability can also result in financial difficulties because your ability to earn an income may be impacted too.

Here are some sobering statistics:

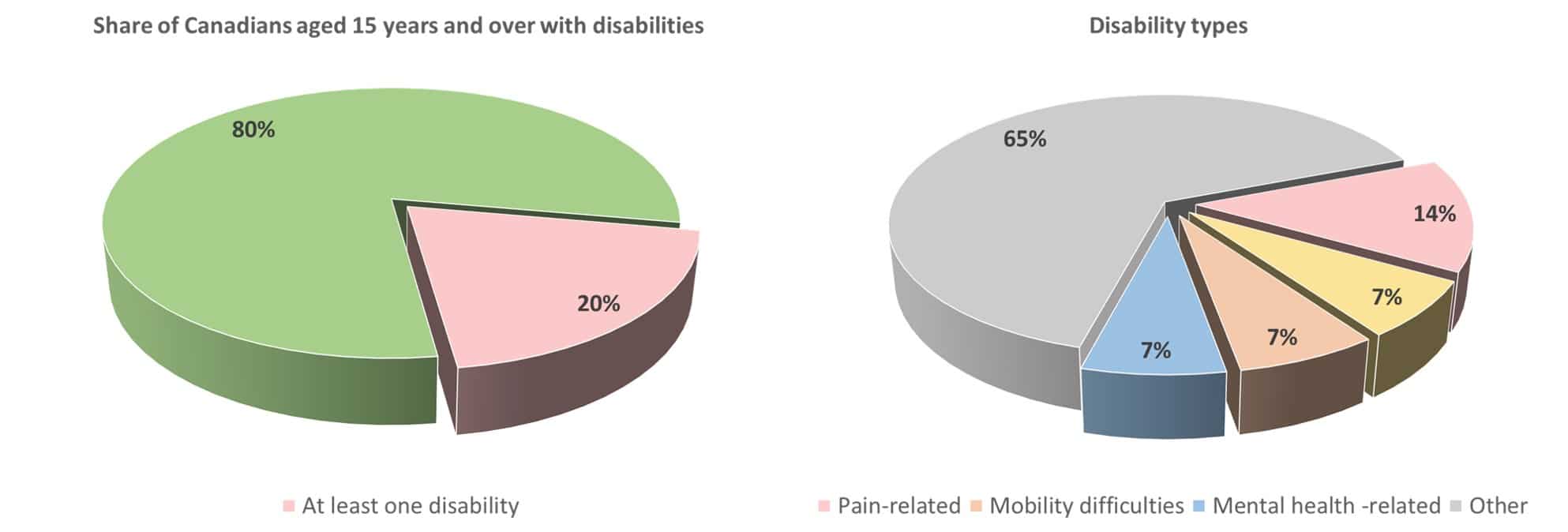

- According to Statistics Canada, 20% of Canadians aged 15 years and over (1 out of 5 or 6.2 million) had at least one disability in 2017.

- At least 24% of female Canadians and 20% of male Canadians have at least one disability.

- In terms of disability type, 14% are pain-related, 7% relate to flexibility issues, 7% are mobility difficulties, and 7% are mental health-related.

Fortunately, insurance policies do exist that can protect you. You may be aware of them all, or perhaps not. Common ones include those that come with employment, others can be purchased independently, and some are automatically in place through your federal and provincial government.

Disability is complex topic of discussion, even though it is becoming more and more a popular topic of conversation. A good explanation of the disability system can be hard to find, so we decided it was time to put together a comprehensive article that touches on everything you need to know.

What is disability insurance?

Generally speaking, disability insurance is a specific type of insurance that guards you financially if you were to become disabled and unable to work. In this case, disability insurance would help supplement your lost income until you regain your health, or until your policy term ends. Many disability insurance claims last years, or even into retirement, depending on the nature of the disability.

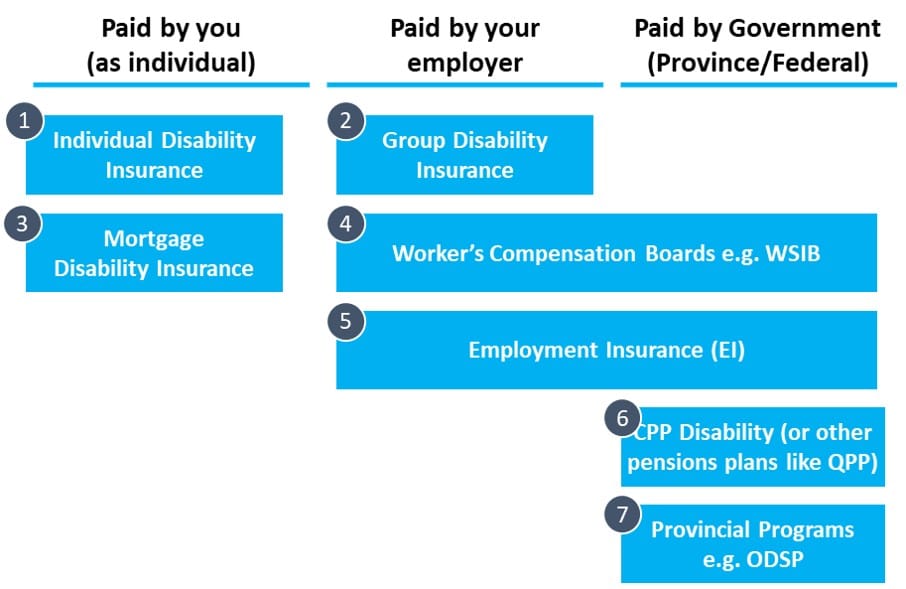

Note that disability insurance is not one-size-fits-all, and different disability insurance types exist. These include:

- Individual disability insurance

- Group disability insurance

- Mortgage disability insurance

- WSIB disability insurance (Workplace Safety and Insurance Board)

- EI sickness benefits (Employment Insurance)

- Canada Pension Plan disability protection / Quebec Pension Plan (QPP) disability protection

- Provincial disability plans (such as e.g. ODSP – Ontario Disability Support Program)

It’s important to recognize that not all disability insurance types apply to all situations – remember, this is not a one-size fits all situation, but we will explain each of the insurance types below.

Who needs disability Insurance?

If you are working and have an income (either as an employee or as a self-employed), you should have some form of disability insurance. Many Canadians do not have enough savings in place to sustain themselves if they found themselves suddenly unable to work.

What Disability insurance Covers?

Different accident situations are covered by different types of accident or disability insurances:

- Work-related accidents and injuries: Some types of protection e.g. WSIB insurance would cover work-related accidents/injuries

- Accidents / injuries during work and in off-work time: Some types of insurance e.g. disability insurance from private or group insurers would cover accidents/injuries that occurred both during work and in off-work time).

The primary function of any of these insurance products, however, is to replace or supplement a loss in income.

How much disability insurance do I need?

You need to look at your insurance needs the same way an insurer would. How much do you make right now? How much are your expenses on a monthly basis? This is a good place to start. Insurance providers will link your disability benefits to the income you were earning prior to the accident.

Disability insurance isn’t as simple as having your entire wage replaced. There are actually four numbers that are important when thinking about disability insurance benefit payouts:

- Benefits as a percentage of income:It could be any number between 50% and 85% of your current income. Beware that many disability benefits are limited to a typical maximum of 85% of gross income.

- Benefits cap:This is the maximum amount you can collect as benefits. Let’s say you are making $10,000 per month: an insurance provider can cap your benefits at $6,000 per month. For most plans where you pay the premium, the benefit is tax free.

- Length of benefits:That is how long your benefits are paid. Often, it is until you can return to your work or until you reach a particular age (e.g. 65 years old, when you can apply for retirement benefits).

- Waiting period:In most cases, benefits payments do not start immediately, but rather after a specified length of time, called a waiting period. In some cases, it is just a few days (e.g. for short-term disability), but it can be longer in other situations. A popular choice is 90 days, so consider if you have savings to cover the months before you receive your first cheque.

What kind of disability insurance plans are there?

There are several plans, as shown in the picture below. Remember, not all of these can protect you at the same time – they are particular to situations.

What is individual disability insurance?

You get individual disability insurance when you strike out on your own to secure coverage from an insurance company or broker, outside of what you may already have in place via your employer, or provincial benefits. Many people opt to do this if they are self-employed because there are no employer benefits at all, if they work for a small business that offers some benefits but not comprehensive ones, or if their employer simply doesn’t offer the maximum disability insurance coverage possible.

For example:

Fred’s employer has provided him with a good benefits package, but Fred is concerned because his disability insurance states it will only replace 50 per cent of the income he loses due to a disability. Just to be safe, Fred makes an appointment with an insurance broker to secure additional disability insurance that will ‘top up’ his existing policy.

Group disability insurance explained

To reference the previous example, group disability insurance is what Fred receives from his employer as a condition of being an employee. This protection is often bundled with life insurance and group health insurance. You need to understand how much coverage this insurance offers, and that it is only valid for as long as you are working in the company. The coverage ends if you leave the company, and it is typically not transferrable.

In most cases, group disability will stop paying benefits after 24 months if you are able to perform ANY occupation. These plans can also have a limit (called “no evidence maximum”) defining the maximum amount you would receive. In some cases, in order to go above this limit, you will need to qualify medically.

How does mortgage disability insurance work?

Mortgage disability insurance ONLY covers outstanding mortgage payments if you can not make them due to an accident or injury that has left you temporarily or permanently disabled.

Banks are typically the ones who sell this coverage, although it is available through independent insurers. This is a bit of a contentious topic for insurance providers because a comprehensive disability insurance plan will provide you coverage that will take care of all your expenses, not just one aspect of them. If you have your own disability insurance, and pay mortgage disability insurance, discuss with your insurer to determine if your mortgage disability coverage is redundant.

Mortgage disability insurance is also quite limited. Read your fine print. You may discover that it will only cover your payments for a short time, regardless of if you continue to be disabled or not. If this is the case, you might want to consider buying an individual disability policy, if you don’t have one yet.

What are WSIB and WCB?

WSIB – Workspace Safety and Insurance Board (WCB-Alberta in AB, WorkSafeBC in BC, etc.) is a protection that covers accidents/injuries that occurred specifically at work. It DOES NOT cover you for injuries outside of the workplace.

Not all companies have WSIB benefits (and other Worker’s Compensation Boards in other provinces) in place, so it is important for you to know what your company offers. For some industries, such as construction, WSIB coverage is mandatory; others, such as banks, travel agencies, computer software developers, trade unions, etc., do not have to have it. Also note that many small companies and start-ups will not have this coverage.

WSIB coverage eliminates the right of employees to sue their employer as it is a “no-fault” insurance.

What is EI?

EI (employment insurance) is a program that provides for a person who has lost their job or is unable to work through no fault of their own, which means said person cannot have resigned of their own accord, but would rather have to have been let go to qualify for this support. Typically, people pay into EI each pay cycle, as you can see on your pay statement, although there are exceptions. If you pay into EI then you can access this benefit if you meet all the other eligibility criteria.

EI (employment insurance) sickness benefits can be paid to those who cannot continue working because of health-related reasons, such as sickness, injury, or quarantine. The maximum coverage limit for EI sickness is 15 weeks.

Canada Protection Plan disability insurance explained

Canada Protection Plan disability is a Canadian Pension Plan disability pension that is paid to people who contributed Canada Protection Plan payments during their career. These benefits are typically auto deducted from your wage/salary, similarly to EI (employment insurance). It is similar for QPP – Quebec Pension Plan (Quebec residents or workers).

In addition to the Canada Protection Plan disability pension, there are a couple other benefits, such as:

Children’s benefit: You can receive this if you have dependent children and already receive a Canada Protection Plan disability pension.

Canada Protection Plan post-retirement disability benefits: If you are no longer eligible for a disability pension because you were getting it for longer than 15 months, this benefit could be an option for you.

How much does Canada Protection Plan disability pay?

For 2019, the average Canada Protection Plan disability monthly payment is $1,001.15 and the maximum payment anyone can get is $1,362.30.

The total amount you receive is calculated as $496.36 + an additional benefit (retirement income x .75) that is based on how much you’ve contributed to Canada Protection Plan throughout your career.

What is ODSP?

If you are an Ontario resident and have a disability and need help with your living expenses, you may be eligible for the Ontario Disability Support Program (ODSP).

The ODSP offers financial assistance to help you and your family with essential living expenses, as well as benefits, for you and your family, including prescription drugs and vision care. In addition to this, the program can help with finding and keeping a job and advancing your career. In other words, the two types of supports offered are income support, and employment support. Note that each type of ODSP support has different eligibility criteria, and you should consult the provincial government’s website to get the most current information.

Do disability plans stack?

While there are many different sources of disability benefits available in Canada, in order to prevent fraud, most of them CANNOT be combined (stacked) or received in full at the same time.

This is known as the “integration of benefits” and it limits the maximum income from all sources. Your benefits are situational as well, so your job type, employer coverage, etc., will all factor into the type and amount of benefits you qualify for.

How much disability insurance can I get?

The maximum is 85 per cent of pre-disability income. If it were possible to replace, say 100 per cent of your lost income, it would be too tempting for people to file false claims – in other words, commit fraud. It is normal to see disability payments range between 40 per cent and 85 per cent of your pre-disability income. Please remember that, because you could potentially receive disability benefits from multiple sources (e.g. WSIB, individual disability insurance, etc.), one or more of these insurance benefits will adjust their payout to you accordingly, to ensure you do not receive more than the allotted percentage of your pre-disability gross income.

Final Word

Hopefully you found this general overview helpful. While disability insurance can be complex, and very often not well-explained via online resources, remember that there are experienced disability insurance specialists available to help you figure out what coverage is available to you, and what you need most. Our disability insurance quotes and advisory service are no-obligation, and we look forward to hearing from you.