Home insurance guide: Intro

Welcome to your home insurance guide. Typically, home insurance can be divided into several categories:

— Home or house insurance

— Tenant’s (or renter’s) insurance

— Condo insurance protection

— Seasonal property (or cottage) insurance protection

These categories differ by the type of coverage included and, typically, by the level of insurance premiums. Complete the quote and find out how much you can save.

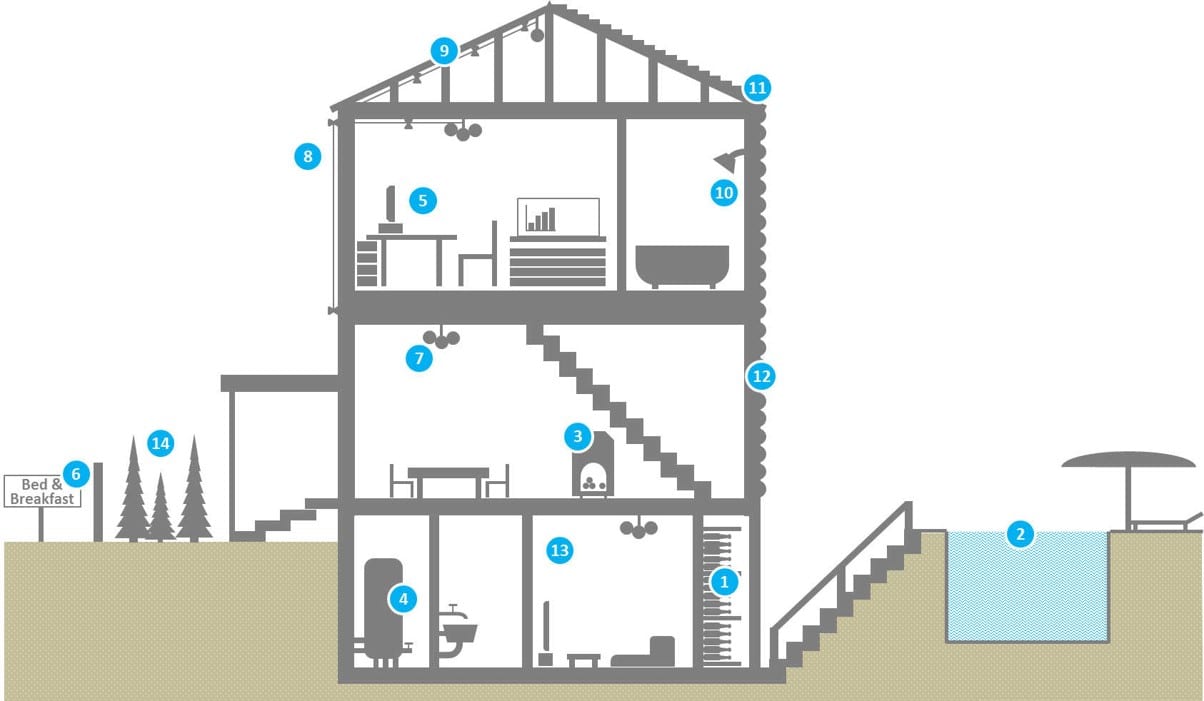

Some home elements result in higher insurance costs. Discover all of them.

Have you ever wondered why home insurance costs vary so widely? When searching for home insurance, a number of factors can increase your home insurance costs, from those related to the building to those outside the house.

- Expensive items: Jewellery, wine collections, art, musical instruments, expensive watches, silverware, furs, sporting equipment and bicycles.

- Swimming pools: Pools represent higher liability, especially when not protected by a fence.

- Fireplaces / woodstoves: In general, wood stoves are considered a potential source of fire and smoke damage.

- Oil-based heating: Insurers prefer electric heat or forced-air gas furnaces.

- Business property: Using your home for business would typically result in higher home insurance costs since there is a higher risk associated with those policies.

- Home being a part of your business: If your home is also used and equipped for particular types of business, it poses an additional risk in eyes of insurers.

- Aluminium wiring: This type of wiring was used in houses prior to 1970. It is not used anymore and insurance companies consider it an increased risk because of its potential to overheat and cause fires.

- Knob and tube wiring: That is a quite old type of wiring and requires connectors that use knobs to keep the wires isolated. Insulating tubes are used to guide wires through walls.

- Old house elements: Depending on the age of some building elements, like your home’s roof, insurance can be more expensive or even not available at all until a proper renovation is completed.

- Galvanized or lead pipes: Some types of pipes are less reliable, such as galvanized or lead pipes.

- Roof type: Different roof types are not seen as equal by insurers and that reflects in insurance premiums. The least reliable roofs are wood shake or shingle.

- Building frame: Wood frame homes are more likely to suffer from fire, so they may be considered less safe than concrete or brick homes.

- Basement: Finished basements drive up costs because water flows down, which means more chance for damage if a pipe bursts or sewage backs up into the home.

- Garden and Trees: Having a garden, including fencing, is not considered a higher risk just because you have them; but in most cases you do have to pay extra for this type of coverage.

Tenant and condo insurance: what you must know

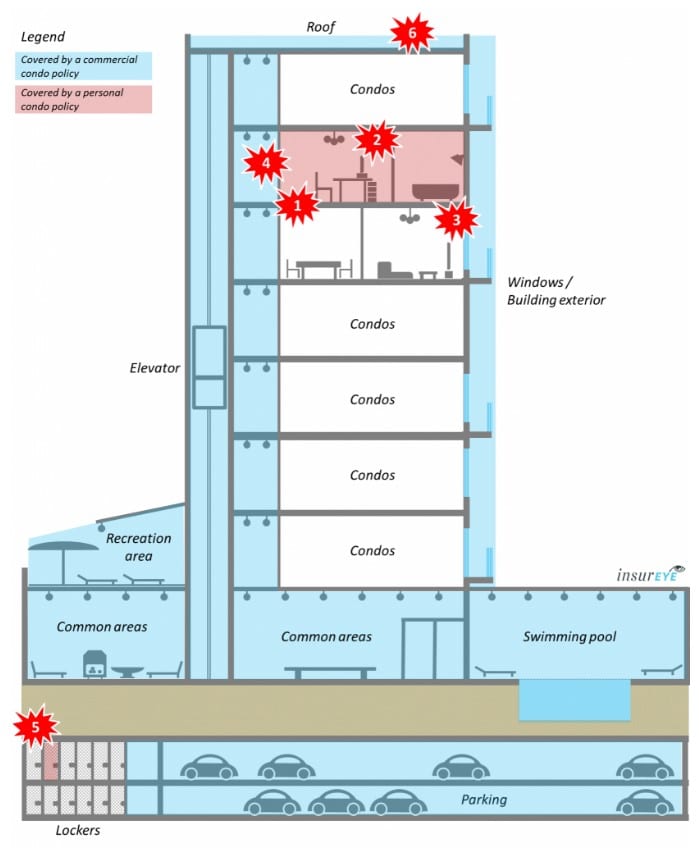

Are you a condo owner? In Canada, there are two different insurance policies involved in condo protection:- Condo insurance for homeowners covers contents, upgrades, third-party liability, theft, locker contents, additional living expenses, and special insurance assessments.

- Commercial condo insurance is purchased by the condo owner; it covers the building’s exterior, roof, infrastructure, and any common areas (elevators, lobby, halls, etc.)

Which policy do you need if you rent a condo in Canada? Condo tenant insurance covers your contents (should they be damaged through fire, theft, etc.), third party liability, and additional living expenses (the costs of the hotel room or rental unit you would need to stay in if the condo unit you were renting became unliveable (due to fire, flooding, etc.).

The overview below will help you understand what each insurance policy covers: individual condo insurance (shown in RED) and commercial condo insurance of your condominium corporation (shown in BLUE)

Here is an overview of elements covered by a typical condo insurance policy:

- Condo unit upgrades, e.g. hardwood floors, new cabinets, etc.

- Condo contents, e.g. any of your personal items, such as electronics, clothes, etc.

- Third-party liability, e.g. if you flood your neighbours beneath you.

- Theft from your condo unit, e.g. after a break-in

- Your locker’s content, e.g. any items you stored there that have been stolen.

- Special insurance assessments, e.g. passed to you by your condo corporation if their policy did not have enough coverage.

Do you know how to save on condo insurance? Get a quote—it only takes 5 minutes.

What are typical home insurance rates in Canada?

As is shown in the chart above, which outlines the average home insurance premiums for rented and owned property across Canada and in Alberta, insurance rates are typically lower for renters than they are homeowners’ premiums. Here’s why:

Renter’s insurance (also called tenant insurance) typically covers the content of your rented property, and it sometimes also covers liability. The building itself is not covered because it should be covered by the homeowner’s property insurance.

A homeowner’s policy covers the building, and thus covers the risks associated with that property, including earthquake, fire, theft, etc.

It is important to note that your insurance covers the rebuild value—not the market value. The rebuild value is often lower than the market value, but should something happen, the insurance company covers the costs required to rebuild an equivalent home.

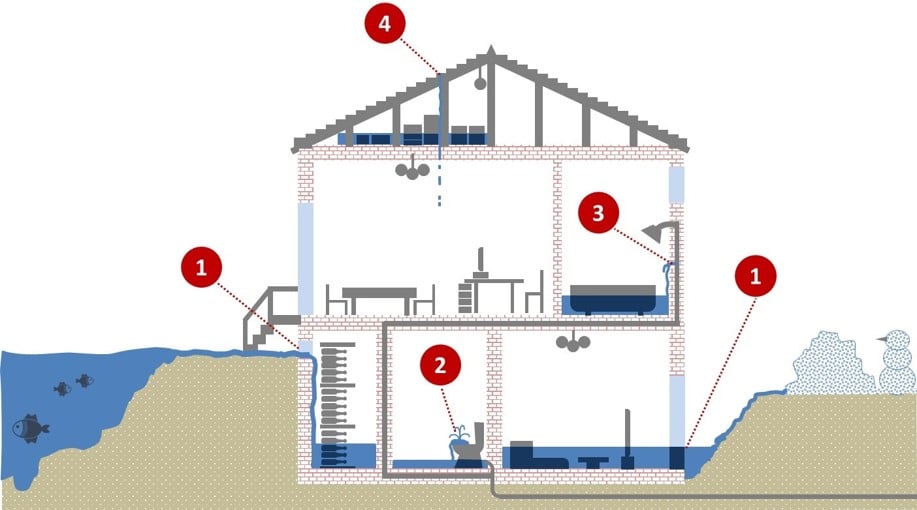

Home insurance and flooding – what you must know.

Nearly 50% of all home insurance claims in Canada are related to water damage and flooding, thus it is crucially important to understand this type of risk.

From an insurance company’s perspective, there are four types of flooding that can occur in Canada. Some are more likely to happen than others, and that means your insurance company is going to handle each of them differently. Knowing how each one is treated enables you to properly protect yourself—and your dwelling.

Take a look at the four different types of flooding that are listed below.

Here are the four main flooding types you should know about:

- Overland flooding: originates outside of your home; typically, you would need an additional overland water endorsement to cover this risk.

- Sewer backup: originates in your home when water enters your home, e.g. via a toilet or sewage. You would typically need an additional sewer backup endorsement to cover this risk.

- Plumbing issues: originate inside your home and are typically covered by a standard home insurance policy.

- Leaking roof: originates on the roof / in the attic and is often not covered if it occurs due to insufficient maintenance. If the same issue results from stormy weather, it might be covered.

Get home insurance to protect your home against flooding so you can stay dry.

How can you save on home insurance?

- Pipes: Insurers prefer copper or plastic plumbing. Consider upgrading your galvanized/lead pipes during your next renovation cycle.

- Renovations: Renovating your house can result in lower home insurance premiums because home insurance premiums for older, poorly maintained homes are usually higher. Also, updating only parts of your house, such as the basement or kitchen, may lead to savings on your insurance.

- Professional Memberships: Are you a member of a professional organization, such as Certified Management Accountants of Canada? Some companies offer discounts to professional members, and some organizations offer their members insurance policies.

- Stop smoking: Some insurers increase their premiums for homes with smokers since smoking adds an increased risk of fire.

- Claims-free discount: You can be rewarded for being claim free. Terms and conditions vary, and not all insurers offer this discount, so ask around if you have been claim free for a long time.

- Alumni: Graduates from some Canadian universities, such as University of Toronto and McGill University, may qualify for a discount through select providers.

- Avoid living in dangerous locations: Steer clear of buying a house in earthquake or flood-prone zones.

Interested in more saving tips for home insurance? Get an insurance quote below and connect with an experienced insurance professional to get more tips.

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]