4 Reasons to get a Life Insurance Quote

- Protect your family and loved ones

- Compare life Insurance quotes in Calgary from 20+ Canadian insurers

- Talk to a live insurance broker and ask any questions you want

- Benefit from low life insurance rates starting at just a few dollars per month

Life Insurance Average rates – how much do Calgarians and Albertians pay?

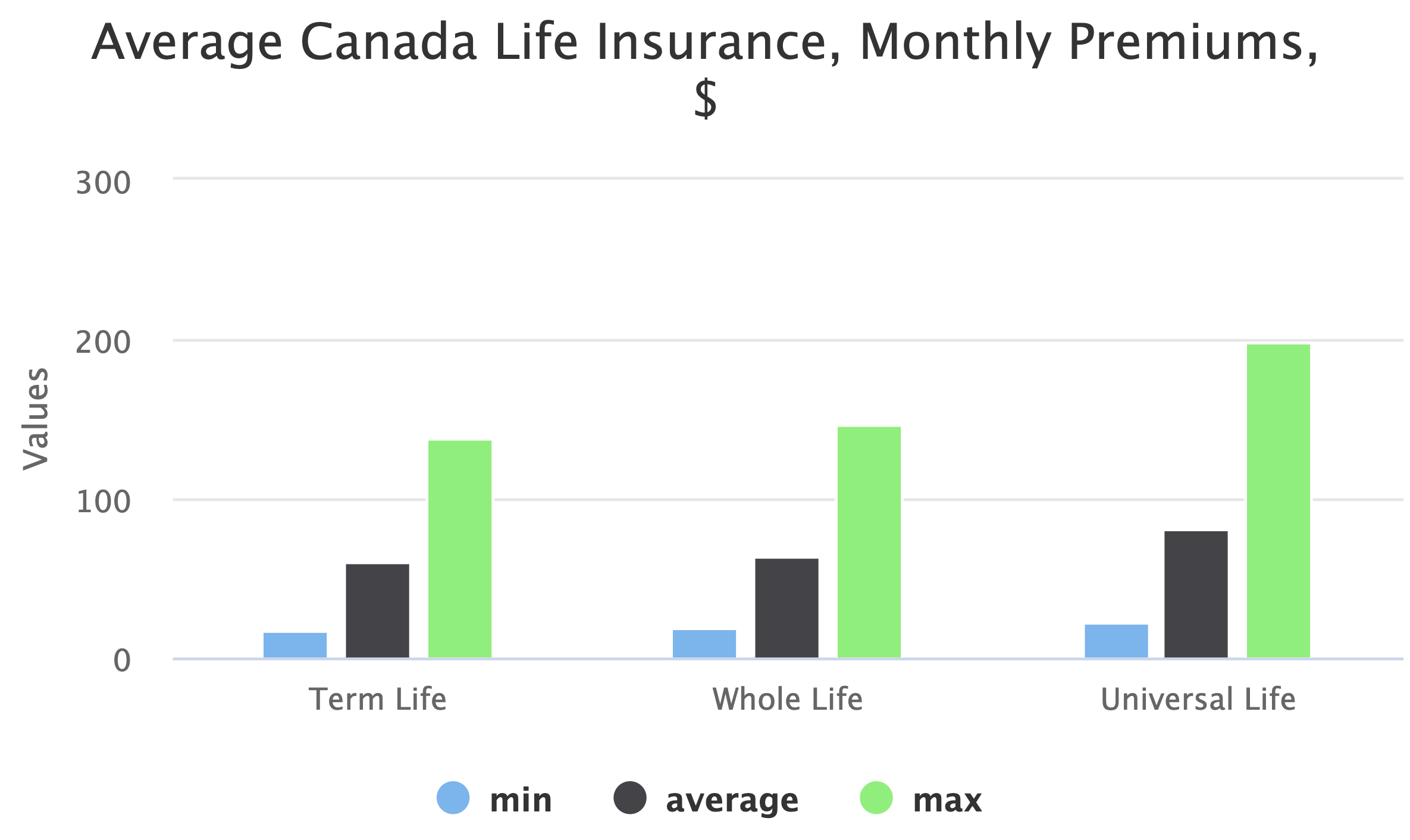

The chart, based on a life insurance calculator for Canada, shows a comparison of term, whole life, and universal life insurance premiums that consumers pay for Life Insurance in Canada. Please consider that though these are self-reported data, we found out that many consumers in Alberta are underinsured.

Life Insurance premiums will also strongly depend on a number of factors – these are average premiums.

Overall there are several important questions to answer before choosing Life Insurance:

- Coverage: How much coverage (e.g. $100,000 or $$2,000,000) do I need and how long (e.g. for the next 25 years to insure my mortgage vs till the end of my life to ensure that my family is safe)?

- Type: What types of life insurance exist (e.g. Term Life, Whole Life, Universal Life etc)?

- Provider: What provider should I choose – Sun Life, Assumption Life Empire Life, Equitable Life, Canada Life or any other?

- Banks vs Insurers: Should I buy life insurance from an insurance company or from a bank (e.g. RBC Insurance, TD Insurance, etc.)?

When you are getting a life insurance quote with us, we not only calculate the best rate for you based on your needs but also give an opportunity to speak with an experienced adviser who can answer all your questions, address your concerns and explain all insurance details.

Several numbers to know when looking for Life Insurance in Calgary

In most cases, your financial obligations (e.g. mortgages, lines of credit, need to ensure that your children and love ones have been take care of.

Here are a few numbers to help you when choosing Calgary life insurance:

| Item | Estimation |

| Average property price in Canada, October 2021 | $478,696 |

| Average property price in AB, October 2021 | $426,926 |

| Average property price in Calgary, October 2021 | $445,600 |

| Average debt in Canada, 2016 | $57,500 |

| Average debt per person in AB, 2021 | $58,200 |

| Average interest costs per person in AB, 2021 | $1,100 |

| Average financial needs to raise a child to the age of eighteen, 2021 | $276,228 |

What Aspects Impact Life Insurance Rates in Calgary and in Canada?

| # | Aspect | Rate Impact |

| 1 | Smoking | Increase of 200% |

| 2 | Drinking | Increase of 50% |

| 3 | Your Family History | Increase of 50 – 250% |

| 4 | Your Medical History | Excludes coverage for some diseases |

| 5 | Your Depression History | Increase of 50 – 200% |

| 6 | Your Physical Build | Decrease of 25% to Increase of 200% |

| 7 | Your Driving Record | Increase of 25% to 50% |

| 8 | Your Gender | Decrease of 25% for Women |

Life Insurance Regulation Body in Alberta

Similar to other provinces there is a regulation body in Alberta that regulates Calgary life insurance and Alberta life insurance matters, The Life Insurance Council of Alberta.

It is one of four Alberta Insurance Councils. The Councils are formed under the Insurance Act and they derive their authority under a delegation from the Minister of Finance for the province. Together with General Insurance Council, the Life Insurance Council is responsible for licensing and discipline of insurance agents, brokers and adjusters in the Province of Alberta.

Examples of Term Life Insurance Rates

- Life insurance quote in Calgary – Martindale for a female, 35 years old, non-smoker, Term 20 life insurance with $250,000 coverage: starting at $17 / month

- Life insurance quote in Calgary – Banff Trail for a male, 35 years old, non-smoker, Term 15 life insurance with $350,000 coverage: starting at $24 / month

- Life insurance quote in Calgary – Killarney for a female, 45 years old, non-smoker, Term 20 life insurance with $500,000 coverage: starting at $57 / month

- Life insurance quote in Calgary – Altadore for a male, 45 years old, non-smoker, Term 20 life insurance with $500,000 coverage: starting at $81 / month

Life Insurance in Calgary – What you must know: Expert view

“When looking at the Life Insurance in Calgary, the first thing you gonna want to look at, is my broker licensed in Alberta.

Once you’ve determined that he or she is licensed in Alberta, you can go over how much life insurance I need and, in fact, do I need life insurance?

People with dependents generally need life insurance much more than people without dependents. Now, those people with dependents and even the ones without they gonna want look at what types of things need to be covered in the event they pass away.

A big thing is a property, if you a have property and a mortgage on the home you gonna want make sure that’s covered.

The average home in Canada is (worth) $480k, the average detached home in Calgary is (worth) $490,000 and you also wanna look at things like consumer debt…

You look at consumer debt in Calgary – it’s $28k which is significantly higher than the country as a whole. You factor those with other needs such as covering final expenses, replacing part of your income in the event that you pass away – that determines your life insurance needs.

Once you’ve got this need covered, you gonna want determine the right type of life insurance – if that is a permanent policy or a term policy.

A good broker can make sure that he or she helps you to find the right amount of coverage and the best type of plan.”

9 tips for Calgarians to reduce their Life Insurance rates

- Smoking impacts your health and insurance rates: Stop smoking well in advance (at least a year) before applying for a policy – otherwise your premiums will double. Like cigars? Well, many life insurance companies consider smoking more than 1 cigar per month and you won’t be able to get non-smoker rates.

- Great medical record drives savings: Having a healthy medical history in the past (not equal to the good current health state in the moment of application) has impact on your life insurance. If you’ve had serious issues, some potential disease cases can be excluded from your coverage.

- Young means cheaper: Apply for the policy when you are young and your premiums will be lower.

- Say no to guaranteed issue life policy: People with good health do not need a guaranteed issue life insurance policy (these are policies that do not require a medical exam but they cost more) – do a health check / exam and enjoy lower life insurance premiums.

- Rounding mathematics matters: If you decide to buy a life insurance policy, make sure that your age rounds down and not up, i.e. if you are going to be 30 years old on December 31, buy the policy in the first 6 months of the year where your age is still rounded down to 29 and not 30.

- Avoid insurance agents: Insurance agent is not equal to insurance broker. Agents typically work for one company only and can offer only products of this company. That does not leave too many options.

- Got Life, Disability and Critical Illness? Cancel Mortgage insurance: Mortgage insurance is a fascinating product created by money lenders. Simply said, it is a different name of Life, Disability and Critical Illness insurance policy associated with payments for your mortgage. Got a mortgage of $500k together with mortgage insurance for that? Well, if you have a Life policy large enough, you can save yourself mortgage insurance.

- High blood pressure cases can mean different premiums with different insurers: Typically high-blood pressure leads to higher insurance premiums but various life insurance providers treat and price those cases differently. Often any blood pressure exceeding 140/90 can trigger higher premiums. Some insurance brokers know those cases better and will be able to navigate you to the company with better rates.

- Insurance type matters: Term insurance products have lower than initial premiums than Whole Life or Universal Life. So, if you are looking to maximize your initial coverage, choose Term.

Interested in more saving tips for Life Insurance? Get an insurance quote below and connect with an experienced insurance professional to get more tips.

Our Publications related to Life Insurance

Life, Disability and Critical Illness Insurance: Do Men or Women Pay More?

Introduction There were many articles written about men paying more for car insurance than women, but what about other insurance types? Do women always benefit from lower insurance rates? We took on this question and systematically went through various life insurance, disability insurance, and critical illness insurance by consulting with professionals who had the answers. […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

If Life Insurance Plans Were Cars: How to Look at Various Types of Life Insurance in Canada

Overall, insurance is considered a somewhat boring, though necessary, topic. On top of that, it is not always clear – there are plenty of various types of life insurance products in Canada that work differently. I decided to explain it in a bit of a different and funny way – I hope that you will […]

Insurance Companies in Canada – Easily Explained

The life insurance landscape in Canada is quite unique. The infographic below shows all the key players and their size, reflecting their assets under management (AUM) based on life and wealth segments of the company’s business. scroll further down to continue reading In Canada, the majority of insurers fall under the umbrellas of three large […]

What is Travel Insurance, and Why Do I Need it?

By RateHub.ca When it comes to budgeting for your vacations, travel insurance is one of those things that’s often overlooked. It’s easy to understand why: we have publicly funded healthcare in Canada, so many people assume that benefit applies to wherever we travel in the world. Unfortunately, that’s not the case. The cost of seeking […]