Tangerine MASTERCARD Consumer Reviews

Looking for a Cash Back credit card?

TANGERINE MONEY-BACK CREDIT CARD

Earn 2% Money-Back Rewards on purchases in two 2% Money-Back Categories of your choice, and 0.50% Money-Back Rewards on all other purchases.

Filter

Most recent reviewsAre you interested in?

My recommendation: Keep far away from this card if you don't want to pull your hair out trying to keep it paid off.

Probably one of the worst credit cards that I have ever had when it comes to tracking the finances.

The available credit is never correct. If you have more available credit (so your limit is $1000 and you paid $1100), you don't see anything above your limit.

If you try to pay the credit card based off of the available credit, you're buggered.

The only way that I could pay this card off accurately was to pay it line item by line item. As you could imagine, that was fairly tedious but it kept me paid off. I decided to see if they fixed their crappy available credit issue and started paying off based off of a sum from the last time I paid off the card. BIG mistake. I don't know how much I owe now.

Try asking customer service to see what didn't get paid off and what did and you're done. They tell you what the estimate to be the amount you owe, but give the disclaimer that somethings may not have shown up yet.

To compare, when I've used the CIBC Visa, TD Mastercard or RBC Visa - never had issues keeping up to date.

In any case, for their 'rewards earned' feature, it's not worth the headache of not knowing if this card is paid off properly or if I've overpaid it.

Here is the Toronto Sun article: Pearson limo, taxi drivers in credit fraud: Cops

And this is the reply from the Pearson’s security confirming those common cases of fraud Limo Cab drivers - see below. What else should I provide to Tangerine in order for me to be reimbursed???

From: Greater Toronto Airports Authority

Date: July 21, 2017 10:56:22 AM

To:

Subject: Re: Toronto Pearson - GTAA-238298

Dear ************,

Thank you for your feedback regarding Toronto Pearson. Your comments were forwarded to the Greater Toronto Airports Authority (GTAA) Manager Intelligence, Support & Compliance for his information. At Toronto Pearson, all authorized taxis and limousines are required to obtain a permit to operate from our airport. This contract allows us to set certain standards with regards to service, maintenance and availability of vehicles for our passengers and therefore have full control of the operation.

Unfortunately some vehicle operators are not able to obtain these permits and attempt to operate illegally. The GTAA recognizes the serious problem of unlicensed taxis and limousines operating at Toronto Pearson. To address this problem we are actively working with our government and security partners to make our airport undesirable and unprofitable to these individuals. We have recently hired a security firm whose role is to intervene when they identify a passenger being solicited by an unlicensed taxi operator and issue trespassing notices or have them removed from the airport property. The elimination of this activity is an on-going campaign. Please be assured that the GTAA, along with our partners and authorized taxi and limousine operators, are aggressively addressing this issue.

Further to this we will also be addressing this with the Commissionaires who are the uniformed personnel available to assist passengers in locating authorized transportation from Toronto Pearson. Under no circumstances are these individuals to direct passengers to other means of transport. That said, the illegal drivers have been known to have an individual within the terminal that they would with, also not authorized to be here and our team is also approaching these individuals and have them escorted off property.

Thank you again for bringing this matter to our attention and we hope that on your next visit here will be more pleasant.

Kind regards,

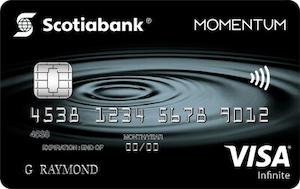

Scotia Momentum Visa Infinite Card

Earn 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases). Plus, no annual fee in the first year, including on supplementary cards. A welcome offer value of $350.

Get this card / Apply online

This credit card has amazing rewards and great features like no annual fee

best cash back rate in the market without charging a fee. enough basic benefit

A great cash back credit card - I love it!

Scotia Momentum VISA Infinite Card

Earn 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases). Plus, no annual fee in the first year, including on supplementary cards. A welcome offer value of $350. What else will you get:

- 4% on eligible recurring bill payments and grocery store purchases

- 2% on eligible gas station and daily transit purchases

- 1% cash back on all other eligible everyday purchases

- Complimentary Concierge Services 24/7 Visa Infinite Dining Series Visa Infinite Music Series Wine Country Wonders Luxury Hotel Privileges

- Comprehensive Travel Insurance & New Mobile Device Insurance coverage

Get this card / Apply online

The card has no fee and offers cashback. It was easy to apply for and the cashback is automatic. Also has extended warranty. Great value.

They came out with their credit card about 1 year ago and everything about it has been great! Great rewards and easy to use

No travel insurance or other benefits of value. Cash back is great but only in the three categories that I selected

Scotiabank® Gold American Express® Card

Earn up to 40,000 bonus Scotia Rewards points in your first year (that's up to $400 towards travel). What else will you get:

- Earn 5 Scotia Rewards points for every $1 you spend at eligible grocery stores, dining and entertainment

- Earn 3 Scotia Rewards points for every $1 you spend at eligible gas stations, daily transit, and select streaming services

- Earn 1 point for every $1 you spend on all other eligible everyday purchases

- Complimentary Concierge Services 24/7

- Comprehensive Travel Insurance coverage with 25 days of travel medical insurance for eligible persons under age 65

Get this card / Apply online

it's a new card so i'm not 100% sure yet if it will work for me. my previous card that i used exclusively changed the rewards structure so i paid them off and switched

Negative experience with this card. I would recommend another selection. I'm going back to my PC credit card.