Welcome to your condo insurance guide for Edmonton. This page will inform you about condo insurance rates in Edmonton, explain details of condo insurance and will allow you to get a free condo insurance quote.

Interestingly, 61% of Canadian condo owners don’t know or don’t understand that a flood or fire in their unit is not covered by the building’s insurance. You need to have your own personal condo insurance policy to stay protected.

What are typical rates for condo insurance in Edmonton?

Here are several numbers to give you an idea of condo insurance costs in Edmonton. You will notice that consumers in Alberta pay more, on average, in home insurance costs than other Canadians. However, condo insurance is still quite reasonably priced.

Average home insurance costs in Canada

(both owned and rented)

Average home insurance costs in Alberta

(both owned and rented):

Average home insurance costs in Alberta (owned only):

Average condo insurance cost in Alberta

Average condo insurance cost in Edmonton

What does condo insurance cover?

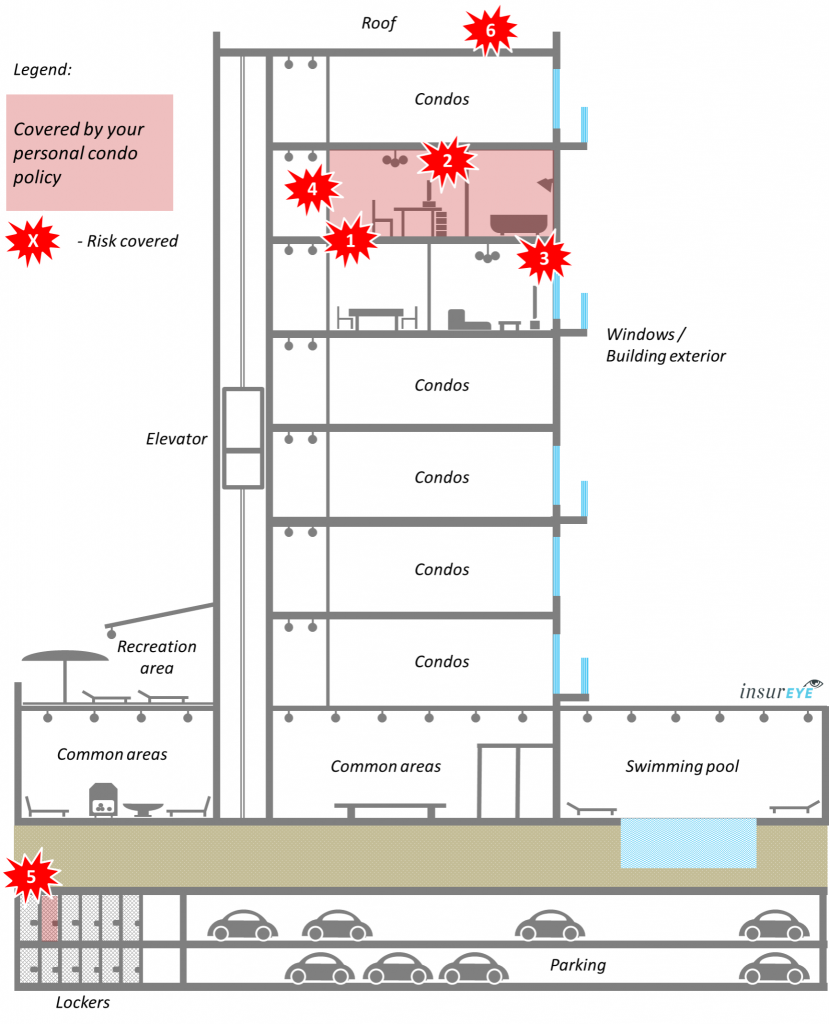

The following overview shows you what a typical condo insurance policy covers (in red). Find an explanation for each item further below.

Normally, there are two policies involved in the insurance aspects of a condo. Our detailed article explains what the commercial condo policy covers, versus your personal condo insurance policy.

Understanding what your personal condo insurance policy covers is crucial in avoiding unexpected out-of-pocket payments.

1Upgrades: Upgrades or improvements include hardwood floors, new cabinets or counter tops, crown moulding and wallcoverings. Some condo corporations have passed bylaws making unit owners responsible for all flooring materials and countertops in their units, regardless of whether or not they were upgrades or improvements. Coverage limits for upgrades usually start at $2,500.

2Contents: Any of your personal or specialty property inside your unit must be insured under your personal condo policy. This includes furniture, electronics, household goods, clothing, etc. Most policies will protect your contents against water damage, as well as other types of loss. With most policies, you can choose a limit that starts at $20,000 and goes as high as you need.

3Third party liability: Should you, for example, forget to turn off the kitchen faucet and it causes water damage to unit owners beneath you, they can sue you for damages. This coverage also protects you if somebody is injured while in your premises (e.g., slipping on a wet floor). Condo insurance would include this type of liability protection. Typical amounts of coverage range between $500,000 and $3,000,000.

4Theft: Should any of your property be lost due to theft, most condo insurance policies would cover it. Overall, the risk of theft is not that high in condos because of condo security services, for example, security staff on premises and fobs required to access elevators and common areas.

5Your locker: Did you know that from an insurance perspective, your private locker is considered to be part of your insured premises? If something is stolen from it, you can rest assured that your personal condo policy will protect you.

6Special insurance assessments: There are a number of situations where commercial condo policies do not cover all damages. In these cases, the condo corporation can make assessments against individual unit owners. This most commonly occurs when a unit owner is responsible for the damage or if the loss originates from a single unit. Condo corporations can also make assessments against unit owners if there is a shortfall in the commercial condo policy. These assessments can total $25,000 or more. As a unit owner, you can protect yourself against insurance-related assessments by having the right personal condo policy.

And the bonus one – additional living expenses: What would you do if you couldn’t live in your unit because it suffered damage and is undergoing insured repairs? If you don’t have friends or family members to stay with, you could be out of pocket by thousands of dollars for temporary accommodations. Your personal condo policy includes protection for additional living expenses, which includes the cost of temporary accommodations. Limits of coverage usually start at $10,000.

Looking for condo insurance or want to understand if you are overpaying for your existing condo insurance? Get a free condo insurance quote and start saving today.

What do condos cost in Edmonton and Alberta?

Here are a few numbers to help you better understand the condo market in Edmonton.

Average property cost in Edmonton (October 2021)

Increase vs last year in property costs

Average condo apartment cost in Edmonton

(October 2021)

Increase vs last year in condo costs

Share of condos among all properties sold (October 2021)

As an interesting comparison, an average Edmonton condo costs $288,118, an average Toronto condo comes with a price tag of $703,698 and an average Vancouver condo reaches $746,400.

Special developments in condo insurance in Edmonton

The condo rental market is experiencing rising demand. A lot of rental demand in 2021 is driven by younger people who are in college or university and want to be closer to downtown, resulting in increasing rents. Rent costs are, though, still fairly affordable. Read more here.

Condo deductibles alert: Since January 2020, the condo corporation can seek compensation from condo owners by asking them to pay a large part of the deductible if the damages originated from the owner’s unit or privately insured area of the condo. For example, let’s say you had an overflowing tub that originated from your unit and, once extended, damaged a part of common elements. The condo corporation is responsible for common elements through their condo corporation insurance, but now can pass the cost of up to $50,000 in deductibles onto you. Read more here.

Condo fees impacted by condo corporation insurance: Condo corporations in Edmonton are facing exponential growth in commercial condo corporation policy rates. These increased costs are passed on in form of condo fees to the condo owners. Some condominiums report a 50% or more increase in condo fees. Read more here.

What regulates condo insurance and condo related matters in Edmonton?

There are two organizations that affect condo insurance in Edmonton and across Alberta.

Condominium Property Regulation (Condominium Property Act) regulates all condo-related issues in a property in Alberta. Part 6 “Insurance” regulates some aspects of condo insurance e.g. deductibles that a condo corporation can try to recover from condo owners.

Link: Condominium Property Regulation of Alberta >>

Since condo insurance is a type of home insurance, it is regulated by the Alberta Insurance Council. The primary focus of the Alberta Insurance Council is on licensing and regulating insurance agents, brokers and independently licensed adjusters to protect Alberta consumers.

Link: Alberta Insurance Council >>

Data source for condo costs: Realtor Association of Edmonton (RAE) and Canadian Real Estate Association (CREA)