Welcome to your condo insurance guide for Vancouver. Condo insurance in British Columbia is also called strata insurance. This page will give you an idea of condo/strata insurance premiums in Vancouver, will guide through details of condo insurance and will help you to get a free condo insurance quote.

What are typical rates for condo insurance in Vancouver/strata insurance rates?

Here are several stats that can provide some transparency about condo insurance costs (or strata insurance rates) in Vancouver. As you may notice, Vancouver individual condo insurance is still fairly affordable though the costs are rising.

Average home insurance costs in Canada (both owned and rented)

Average home insurance costs in British Columbia for homeowners

Average home insurance costs in British Columbiafor tenants

Average condo insurance Vancouver rate (both owner and tenant):

What does your strata insurance policy cover?

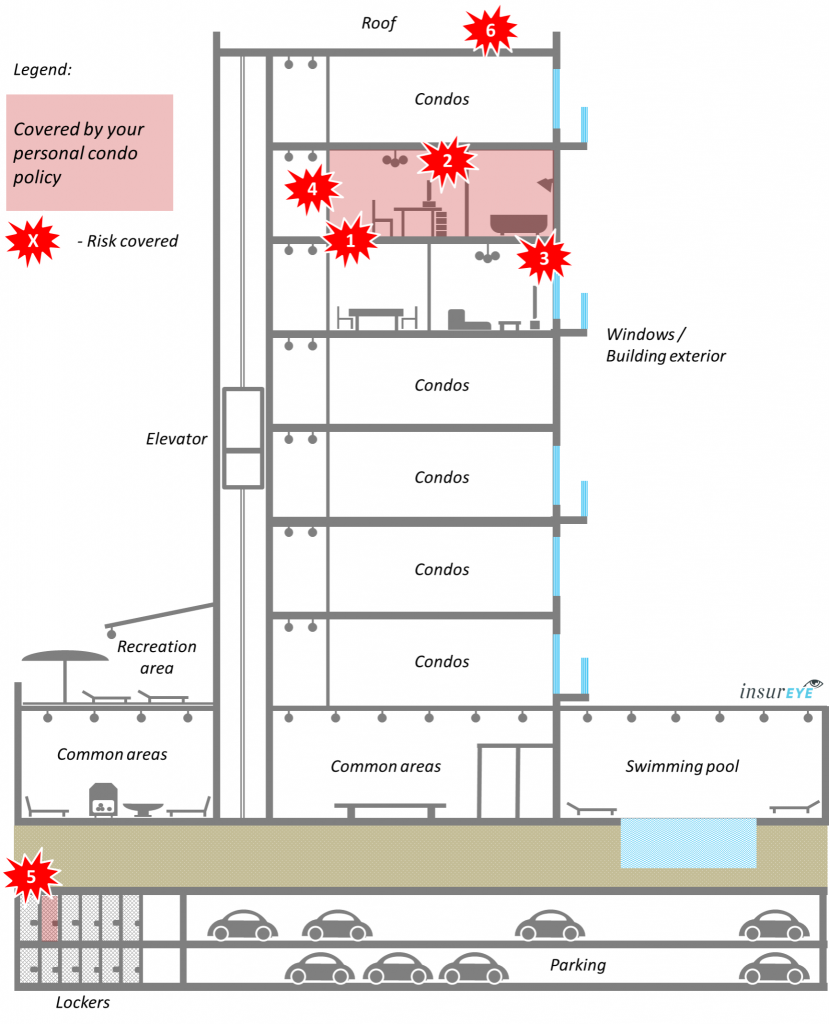

The following overview shows you what a typical strata insurance policy (or condo insurance policy) covers. Normally there are two policies involved in the insurance aspects of a strata in British Columbia:

- Strata insurance (or personal strata insurance policy/personal condo insurance policy)

- Strata corporation insurance (commercial strata insurance policy/condo corporation insurance policy)

This visual shows what your individual strata insurance policy (or personal condo insurance policy) covers (shown in RED).

Understanding what your personal strata policy covers is crucial to avoid unexpected out-of-pocket payments.

1 Upgrades: Upgrades or improvements include hardwood floors, new cabinets or counter tops, crown moulding, and wallcoverings. Some condo corporations have passed bylaws making unit owners responsible for all flooring materials and countertops in their units, regardless of whether or not they were upgrades or improvements. Coverage limits for upgrades usually start at $2,500.

2 Contents: Any of your personal or specialty property inside your unit must be insured under your personal condo policy. This includes furniture, electronics, household goods, clothing, etc. Most policies will protect your contents against water damage, as well as other types of loss. With most policies, you can choose a limit that starts at $20,000 and goes as high as you need.

3 Third party liability: Should you, for example, forget to turn off the kitchen faucet and it causes water damage to unit owners beneath you, they can sue you for damages. This coverage also protects you if somebody gets injured while in your premises (e.g., slipping on a wet floor). Condo insurance would include this type of liability protection. Typically, the amount of coverage ranges between $500,000 and $3,000,000.

4 Theft: Should any of your property be lost due to theft, most condo insurance policies would cover it. Overall, the risk of theft is not that high in condos because of condo security services, for example, security staff on premises and fobs required to access elevators and common areas.

5 Your locker: Did you know that from an insurance perspective, your private locker is considered to be part of your insured premises? So, if something is stolen from it, you can rest assured that your personal condo policy will protect you.

6 Special insurance assessments: There are a number of situations where commercial condo policies do not cover all damage and there is not enough money in the reserve fund. In these cases, the condo corporation can make assessments against individual unit owners. This most commonly occurs when a unit owner is responsible for the damage or if the loss originates from a single unit. Condo corporations can also make assessments against unit owners if there is a shortfall in the commercial condo policy. These assessments can total $25,000 or more. As a unit owner, you can protect yourself against insurance-related assessment by having the right personal condo policy.

And the bonus one – additional living expenses: What would you do if you couldn’t live in your unit because it suffered damage and is undergoing insured repairs? If you don’t have friends or family members to stay with, you could be out of pocket thousands of dollars for temporary accommodations. Your personal condo policy includes protection for additional living expenses, which includes the cost of temporary accommodations. Limits of coverage usually start at $10,000.

What do condos cost in Vancouver and British Columbia?

Knowing condo insurance costs in British Columbia informs condo insurance decisions, we collected a few important stats for you.

Average property cost in Vancouver (October 2021)

Increase vs last year’s property costs

Average condo apartment cost in Vancouver (October 2021)

Increase vs last year’s condo costs

Share of condos among all properties sold (October 2021)

As an interesting comparison, the average Calgary condo costs $288,118, the average Edmonton condo comes with a price tag of $225,449, and the average Toronto condo reaches $703,698. That makes Vancouver condos the most expensive condos in Canada.

Special developments in condo insurance in Vancouver

Steep increases in condo insurance rates and condo fees: Many Vancouver and BC stratas have faced an exorbitant increase in insurance costs. That means increases in individual condo insurance costs and increases in condo fees because they were impacted by increases in strata corporate insurance costs. In some cases, strata corporation insurance rates went up by several hundred percent. Read more here >>

Condo apartment costs: Condo prices in Vancouver have seen another increase of 9% in October 2021 as compared to October 2020. Currently, average Vancouver condo costs are the most expensive in the country with an average condo price tag of $746,400.

Regulating strata matters including (strata or condo insurance) in Vancouver

It is important to know that there are several regulatory bodies/institutions that are relevant for the topics of condo living/condo insurance (i.e. all strata matters) in Vancouver and British Columbia.

The Strata Property Act is the main law that governs key strata matters and strata corporations in British Columbia. Part, “Insurance,” regulates key aspects of condo insurance (or strata insurance) with section 158 “Insurance Deductible” describing key regulations around deductibles that strata corporations can try to recover from owners.

Link: Strata Property Act >>

Since condo insurance is a type of home insurance, it is regulated by the Insurance Council of British Columbia. The primary focus of the Insurance Council is on ensuring that licensed insurance agents, salespersons, and adjusters act within a professional framework, which promotes ethical conduct, integrity, and competence. It is a trusted source of information for consumers in such matters like filing a complaint or checking insurance licenses.

Link: Insurance Council of British Columbia

Data source for condo costs: Real Estate Board of Greater Vancouver (REBGV) and Canadian Real Estate Association (CREA)