4 Reasons to get a Home Insurance Quote in Ontario

- Find out if you are overpaying today and start saving

- Request a quote from 10+ insurance providers

- Get home, tenant, house or cottage insurance including flooding coverage

- Talk to a live agent and ask any questions you want

Welcome to the ultimate home insurance guide for Ontario. Here you will find an overview of average home insurance premiums in the province while also learning about saving opportunities and other useful tips.

What Are Typical Home Insurance Premiums In Ontario?

Average tenant insurance and homeowner premiums are shown above. tenant insurance is typically lower than homeowner’s insurance.

Tenant insurance (also called renter’s insurance) only covers contents and in some cases, will also cover liability. Insurance on the building itself is the responsibility of the homeowner. For this reason, tenant insurance in Ontario costs less than homeowner’s insurance.

Homeowner’s insurance (for landlords) covers many risks associated with the property including earthquake, fire, theft, etc.

Cheap Home Insurance in Ontario: 10 Tips

- Renovations: Older, poorly maintained homes without upgrades can result in higher premiums. Renovating, even if it’s just part of the house such as the kitchen or basement, can result in savings.

- Pipes: Have galvanized or lead pipes? Upgrade to what insurers prefer – copper or plastic.

- Wiring: That old house may look charming and full of character but if it’s also full of aluminum wiring, you are facing very high premiums – that is, if you can get insurance at all! If you do find an insurer willing to offer you a policy, you’ll likely have to have a full electrical inspection first.

- Proximity matters: Some insurers offer a discount if you are located near a fire hydrant or fire station.

- Review annually: As your life changes, so do your insurance needs. Review your policy annually to ensure you have the right coverage.

- Quit smoking: Smoking is a fire risk – and any type of risk means higher premiums.

- HVAC considerations: Oil heated homes result in higher premiums than a home heated with a forced air gas or electric furnace.

- No wood stove: Wood stoves are a fire risk and, therefore, increase your premium.

- Do you need earthquake insurance? If you don’t live in an area prone to earthquakes, drop earthquake insurance from your policy.

- Bundle up: Combine your home and auto insurance to receive a discount.

5 elements that will increase your home insurance costs

- Swimming pools: Pools, especially unfenced ones, greatly increase your liability risk, so insurers raise your premium accordingly.

- Fireplaces and wood stoves: These increase your fire and smoke damage risk. A real estate transaction involving a home with a fireplace or wood stove usually requires a full inspection.

- Roofs: The more durable your roof, the lower the premium. Wood shake and shingle roofs are considered the least durable and reliable by insurance companies.

- Finished basement: While a finished basement can raise the value of your home, it also raises your premium because of the possible damage from flooding. Water flows downwards, so the basement is usually the first place impacted.

- Expensive items: Your wine collection, original art, jewelry, and sporting equipment are nice to have, but they can increase your premium dramatically. To cover this loss, insurers usually provide a separate rider for these types of expensive items in the home.

Home Insurance companies in Ontario

There are many P&C (Property and Casualty) home insurers in Ontario including:

- Intact Insurance

- TD Insurance (owned by TD Bank)

- Aviva

- RSA Insurance

- Economical Insurance (includes Sonnet Insurance)

- Desjardins Insurance

Midsize insurers include:

- Square One Insurance

- RBC Insurance (as Aviva)

- Travelers

- Gore Mutual Insurance

- CAA

- The Co-Operators

- Wawanesa Insurance

- Several others

You have several options as to where you purchase your home insurance. It is available through insurance companies, agents, brokers, and some banks.

Ontario Home insurance quotes, examples

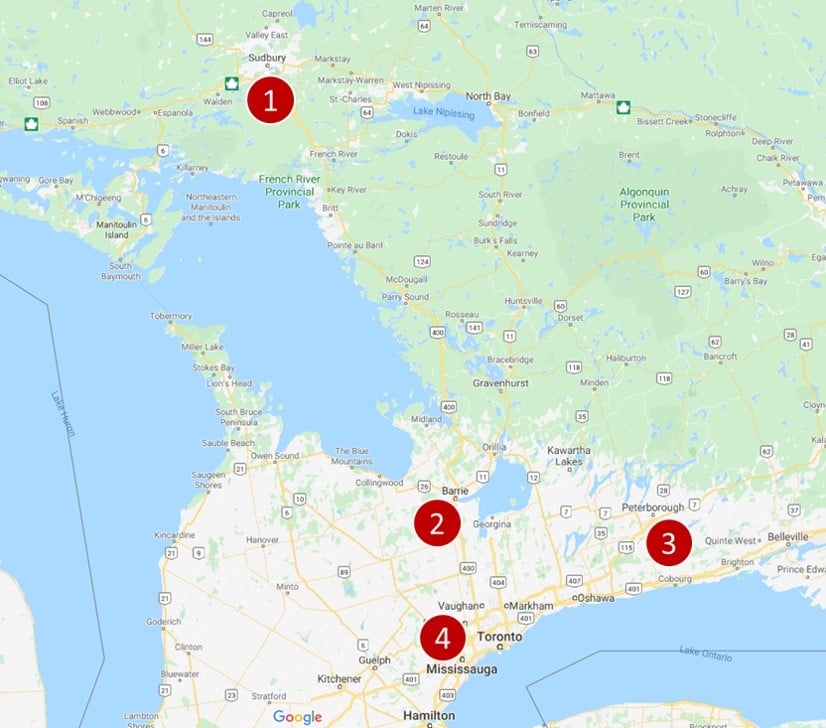

Ontario home insurance quote #1: Homeowners insurance for a house in Sudbury, ON, located at the intersection of York and Regent street, under 2,500 sq. feet, non-smoker.

Monthly costs: $78 / month

Ontario home insurance quote #2: Homeowners insurance for a house in Barrie, ON, located at the intersection of Burton and Essa street, under 2,000 sq. feet, built in year 1950, finished basement, brick.

Monthly costs: $141 / month

Ontario home insurance quote #3: Homeowners insurance for a house in Peterborough, ON, locate at the intersection of Monaghan and Charlotte Street, Brick, nearly 2,500 sq. feet, within 5 km to a fire hall, no finished basement.

Monthly costs: $112 / month

Ontario home insurance quote #4: Tenant insurance a condo in Mississauga, ON, locate at the intersection of Confederation Pkwy and Burnhamthorpe Rd, 2-bedroom unit, personal property limit $30,000 and liability coverage of $1,000,000.

Monthly costs: $18 / month

4 Home insurance Myths to Know

Myth #1: Home insurance is mandatory

While your lender may require insurance to cover a mortgage, or your landlord mandate that you have renter’s insurance, those that own their properties free and clear are not required by the government to have home insurance. However, lack of insurance is risky so home insurance, under any circumstance, is always advised.

Myth #2: Flooding is automatically covered

Do not assume that you are automatically covered for flooding. Typically, homeowner’s insurance protects you against sudden and accidental entry of water, such as a burst pipe. However, not every policy protects against water entry from the outside (overland flooding) as seen in excessive snow melt or rain causing a river to overflow. Prior to 2015, flood insurance was not available in Canada. Now, it is widely available, but only as an option or rider in most cases.

Myth #3: My home’s market value is covered by insurance

No, it isn’t. Homeowner’s insurance covers the rebuilding or replacement value of your house to the standard it was before the loss. This value is usually lower than market value, since market value also includes the land, lot, or acreage. What is sometimes included, however, is the cost to clean up the debris after a disaster like a fire.

Myth #4: Older homes are cheaper to insure

Older homes are actually more expensive to insure if they have not been upgraded because the chance for something to go wrong, like a fire from a wood stove or oil heating system, or the presence of risky elements like aluminum wiring, is much higher.

Differences between house and condo insurance

Not all insurance is created equally – especially when it comes to condo owner insurance and single family house insurance. Here are several differences between these two types of insurance.

- Policies involved in the coverage

- House Insurance: One policy on a single family home or non-condo style duplex.

- Condo Insurance: Condo insurance has two parts. Your homeowner’s insurance component covers the interior of your unit and your liability. The condo corporation’s component covers the common areas and building envelope. Your condo fees pay for part of the corporation’s insurance costs. It is very important to have your own insurance, as covering things like a slip and fall in your unit or a kitchen fire is not the responsibility of the corporation.

- Building coverage

- House insurance: The structure and building envelope are covered.

- Condo Insurance: The condo corporation’s coverage will take care of things like exterior window damage, roof shingles blown away, or concrete crumbling in your parking pad. Your own personal coverage is for theft from your unit or storage locker, in-unit fires (kitchen fire, cigarette fire), liability, etc.

- Claim processing

- House insurance: Relatively easy to process since the claim involves just the insurer and the homeowner.

- Condo Insurance: Complicated to process as it may involve your personal insurance and the condo corporation’s insurance. For example if a pipe burst in an exterior wall but the damage extends through your unit and drips water onto the unit below yours, both policies come into play.

What locations in ON do you serve?

Through our partners, we offer home insurance quotes in Ontario including but not limited to these locations: Toronto, Mississauga, Ottawa, Brampton, Hamilton, Kingston, Oakville, Burlington, Sudbury, Thunder Bay, Barrie, Windsor, London, Guelph, Peterborough, St. Catharines, Kitchener, and many others.

Home insurance costs in Ontario depend on numerous factors and the home insurance type you need (e.g. homeowners insurance vs tenant insurance, house insurance vs condo insurance)

- Tenant insurance is often the cheapest type. For a condo it can be as low as $15/month.

- Homeowner’s insurance for a condo is not very expensive since it only covers your condo unit (e.g. your upgrades, contents, liability). You typically pay around $20-$50/month.

- Homeowner’s insurance for a house can start at $50/month and go as high as several hundred dollars per month depending on your property (e.g. size, age, availability of a basement), its location (e.g. proximity to areas with increased flooding risk), your property condition (e.g. recent renovations, particular types of roofing, wiring, pipes, etc.).

Home insurance coverage depends on the type of insurance you choose:

- Tenant insurance: Covers your personal contents and liability.

- Homeowner insurance (condo): Covers the condo unit and associated upgrades (but not the condo building itself), contents (e.g. theft, damage, etc.), and liability.

- Homeowner insurance (house): Covers the entire rebuilding costs for your home, and, depending on your riders, a range of natural impacts (e.g. earthquake, flooding, snow damages, trees and garden, etc.), liability, additional structures on your land (e.g. shed, storage space, etc.).

Different home insurance companies specialize in different segments of customers (e.g. seniors, affiliated members of various organizations such as CPA, CAA, etc.), geography, types of buildings, risk types, and more. In order to find the cheapest home insurance, it is important to get a quote from as many insurers as possible and understand exactly what they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals can help you with all these questions.

Our proprietary insurance review platform has collected independent consumer reviews for different insurance and financial products since 2012 and has thousands of insurance reviews. Click here to access free home insurance reviews.