4 Reasons to get a life insurance quote if you have epilepsy

- Access to different insurance types based on the state of your epilepsy condition

- Rates from most insurers (25+ insurers)

- Access to the cheapest insurance option despite your health pre-condition

- Licensed brokers with experience in epilepsy underwriting

Life Insurance with Epilepsy: Your Options

Epilepsy is one of those health pre-conditions that seriously influence your ability to get life insurance and many Canadians ask, “can you get life insurance with epilepsy?” Don’t worry, there are several possible options for life insurance for someone with epilepsy.

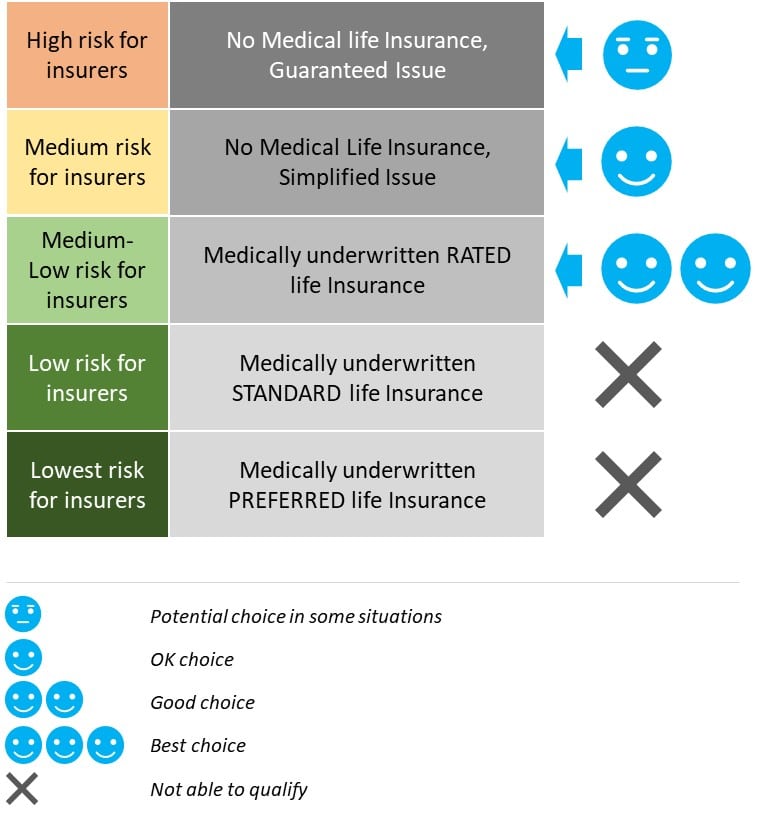

In order to understand what options are open to life insurance for epilepsy patients, we need to spend a minute understanding key life insurance types. There are basically five major insurance types based on the health of people who apply for life insurance and its associated costs – here is a brief overview.

| Highest risk for insurer | 1. No Medical Life Insurance, Guaranteed Issue |

|

| Medium risk for insurer | 2. No Medical Life Insurance, Simplified Issue |

|

| Medium-low risk for insurers | 3. Medically underwritten RATED life Insurance |

|

| Low risk for insurers | 4. Medically underwritten STANDARD life Insurance |

|

| Lowest risk for insurers | 5. Medically underwritten PREFERRED life Insurance |

|

Now, let us see closely what life insurance options are available for people with epilepsy health pre-conditions.

Life insurance with epilepsy offers you three options available as shown on the picture. Here is what you must know:

- If you have an epilepsy pre-condition, it will be nearly impossible to qualify for both PREFERRED and STANDARD medically underwritten life insurance.

- Some patients with epilepsy can qualify though for RATED medically underwritten life insurance that comes with higher premiums but provides access to the same coverage limits as a STANDARD life insurance policy (e.g., $1,000,000+).

- Most persons with epilepsy (aside from the most severe cases) can qualify for simplified issue no medical life insurance. You should choose this one if you cannot qualify for a RATED policy and require coverage up to $500,000.

- Everybody can qualify for guaranteed issue no medical life insurance, but the maximum coverage you can get is $50,000 and costs are very high. Should you pass away in the first two years of the policy, no claim will be paid.

It is important to remember that some epilepsy-related data will impact the type of policy and price that you can get:

- Date when you were first diagnosed with epilepsy

- Were you hospitalized due to epilepsy and how often?

- Type of medication for epilepsy you are on

- History of epilepsy in the family

- Stability of the current condition

Also, other general health and habit-related aspects will impact your insurance policy type and costs:

- Other medical conditions (since multiple conditions would increase the risk)

- Smoking habits

- Your build (weight, size)

Our experienced brokers will help you to choose the best life insurance for epilepsy as they have experience with many policies for Canadians suffering from the same pre-condition.

Life Insurance with Epilepsy: Rates

Here are a few sample life insurance costs for epilepsy patients. Please note that each policy depends on a number of factors such as your health, coverage amount and a number of other parameters. If you want an insurance quote tailored to your situation, our insurance experts are happy to assist you.

| Male, 40 years old, non-smoker, policy of $25,000, Term 20 | Female, 45 years old non-smoker, policy of $200,000 | Female, 60 years old, non-smoker, policy of $150,000 | ||

| Highest risk for insurer | No Medical Life Insurance, Guaranteed Issue | $62/month | Coverage of $200,000 not available | Coverage of $150,000 not available |

| Medium risk for insurer | No Medical Life Insurance, Simplified Issue | $15/month | $27/month | $104/month |

| Medium-low risk for insurers | Medically underwritten RATED life Insurance | $24/month | $41/month | $190/month |

Life Insurance Claim and with Epilepsy

One of the most important questions epilepsy patients with life insurance ask themselves – does life insurance cover epilepsy claims if I pass away from epilepsy?

The short answer is YES. If you received a life insurance policy and the company has not explicitly excluded your epilepsy pre-condition though you have disclosed it, you are good.

The full answer is, almost always, YES. There is one exception that is important to know about. If you have purchased a guaranteed issue life insurance policy and pass away within two years from the moment you purchased the policy, the insurance company will not pay and will solely return your premiums. That obviously assumes, that you have disclosed your epilepsy condition during the application/underwriting process.

Life Insurance Underwriting with Epilepsy

Life insurance underwriting with epilepsy is often not as straightforward as without this health pre-condition. There are several additional steps insurance companies might take, based on severity of your condition (e.g., how far back is your last epileptic event, how big is the coverage you are asking for, etc.).

The process will include the following steps:

| Step | Who does it | Approximate length |

| 1. Share your data (e.g. health, coverage) | You/Broker | 10-30 min |

| 2. Explain details, submit your application | Your Broker | 10 min |

| 3. Review your application, request medical records | Insurer | 1 -14 days |

| 4. Issue medical records and special documents e.g. APS | Your Doctor(s) | 2 weeks – 6 months |

| 5. Evaluate your medical records, underwrite policy | Insurer | 1 week – 2 months |

| 6. Share confirmed price, proceed with payment | Broker | 30 min |

| 7. Issue and share with you the policy | Insurer | 1 week – 2 months |

As you see, depending on the insurer, policy issue times can vary greatly from a couple weeks to several months. That is why it pays off to work with an insurance broker who works with a high number of insurers. Our specialists have access to more life insurance companies (25+ insurers) than most other brokerages in Canada, and that allows them to select the companies who can process your application the fastest.