Welcome to your condo insurance guide for Toronto. This page will give you an idea of condo insurance rates in Toronto, will guide you through details of condo insurance and will help you to get a free condo insurance quote.

According to a study:

- 61% of Canadian condominium owners do not know, or incorrectly assume, that their building’s insurance covers damage to another unit from water or fire that originated in their unit.

- 74% of respondents looking to purchase a condo do not know what their personal insurance should cover versus what the condo corporation’s insurance should cover.

What are typical rates for condo insurance in Toronto?

Here are several stats that provide transparency about condo insurance costs in Toronto. As you can see, Toronto condo insurance is very affordable.

Average home insurance costs in Canada

(both owned and rented)

Average home insurance costs in Ontario

(both owned and rented):

Average condo insurance Toronto rate:

What does your condo insurance policy cover?

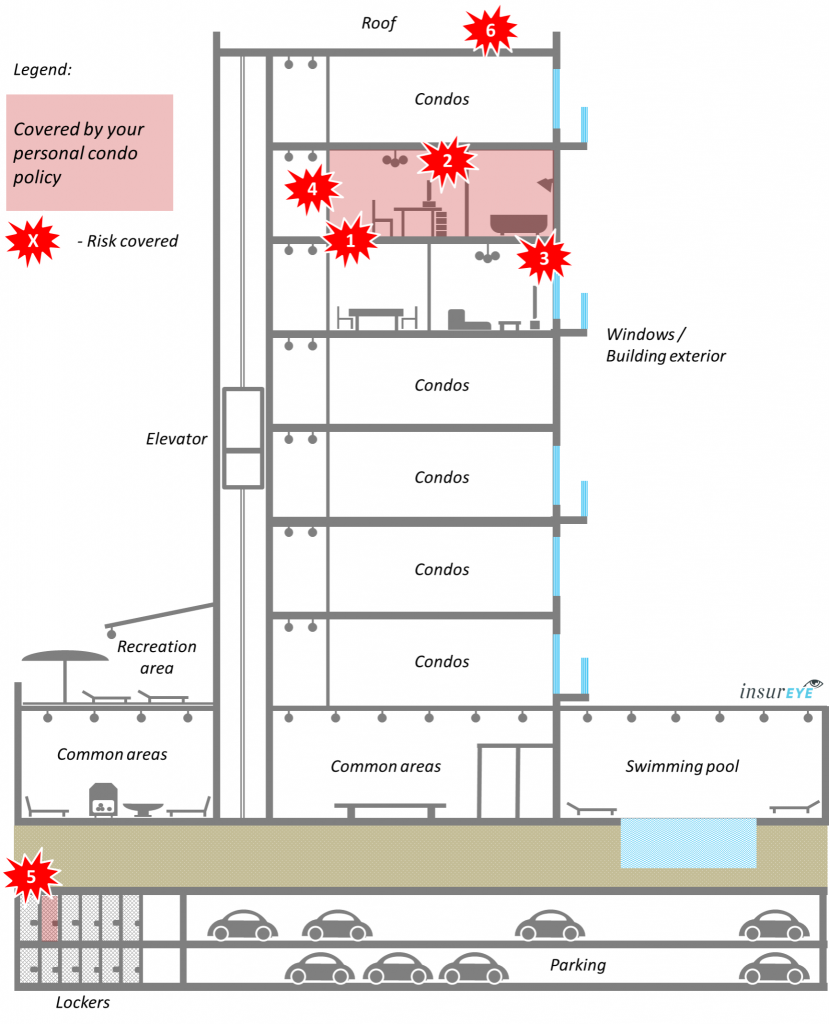

The following overview shows you what a typical condo insurance policy covers. See an explanation for each item further below.

Normally there are two policies involved in the insurance aspects of a condo.

This visual shows what your individual condo insurance policy covers (shown in RED).

Understanding what your personal condo policy covers is crucial to avoid unexpected out-of-pocket payments – see more details below.

1 Upgrades: Upgrades or improvements include hardwood floors, new cabinets or counter tops, crown moulding, and wallcoverings. Some condo corporations have passed bylaws making unit owners responsible for all flooring materials and countertops in their units, regardless of whether or not they were upgrades or improvements. Coverage limits for upgrades usually start at $2,500.

2 Contents: Any of your personal or specialty property inside your unit must be insured under your personal condo policy. This includes furniture, electronics, household goods, clothing, etc. Most policies will protect your contents against water damage, as well as other types of loss. With most policies, you can choose a limit that starts at $20,000 and goes as high as you need.

3 Third party liability: Should you, for example, forget to turn off the kitchen faucet and it causes water damage to unit owners beneath you, they can sue you for damages. This coverage also protects you if somebody gets injured while in your premises (e.g., slipping on a wet floor). Condo insurance would include this type of liability protection. Typically, the amount of coverage ranges between $500,000 and $3,000,000.

4 Theft: Should any of your property be lost due to theft, most condo insurance policies would cover it. Overall, the risk of theft is not that high in condos because of condo security services, for example, security staff on premises and fobs required to access elevators and common areas.

5 Your locker: Did you know that from an insurance perspective, your private locker is considered to be part of your insured premises? So, if something is stolen from it, you can rest assured that your personal condo policy will protect you.

6 Special insurance assessments: There are a number of situations where commercial condo policies do not cover all damage and there is not enough money in the reserve fund. In these cases, the condo corporation can make assessments against individual unit owners. This most commonly occurs when a unit owner is responsible for the damage or if the loss originates from a single unit. Condo corporations can also make assessments against unit owners if there is a shortfall in the commercial condo policy. These assessments can total $25,000 or more. As a unit owner, you can protect yourself against insurance-related assessment by having the right personal condo policy.

And the bonus one – additional living expenses: What would you do if you couldn’t live in your unit because it suffered damage and is undergoing insured repairs? If you don’t have friends or family members to stay with, you could be out of pocket thousands of dollars for temporary accommodations. Your personal condo policy includes protection for additional living expenses, which includes the cost of temporary accommodations. Limits of coverage usually start at $10,000.

What do condos cost in Toronto and Ontario?

Knowing condo insurance costs in Toronto informs condo insurance decisions, so we collected a few important stats for you.

Average property cost in Toronto (October 2021)

Increase vs last year’s property costs

Average condo apartment cost in Toronto (October 2021)

Increase vs last year’s condo costs

Share of condos among all properties sold (October 2021)

As an interesting comparison, the average Calgary condo costs $288,118, the average Edmonton condo comes with a price tag of $225,449, and the average Vancouver condo reaches $746,400.

Special developments in condo insurance in Toronto

Toronto condos and Airbnb: As of September 2020, condo owners are allowed to rent out their properties as short-term rentals only if it is their principal residence. These short-term rentals must be registered with the city to be able to operate. Read more here.

Condo insurance rates are increasing: During Q1 2021, condo insurance rates went up by 9% in Ontario driven by rising costs of materials, labour bottlenecks and ageing infrastructure. Read more here.

Condo apartment costs: Condo prices in Toronto have seen another increase of 13% in October 2021 as compared to October 2020. Currently they are second highest in the country with only Vancouver condo prices being higher than Toronto.

Claims process can be more complicated for condo owners

Since there are two policies (commercial condominium policy and personal condo policy) involved, the claim process can be quite complicated – especially, if it is not clear who covers what. The following examples of claims are known to cause difficulties:

- Pipe burst in the wall resulting in flooding of a condo unit

- Water entering a condo unit due to bad insulation of a balcony door

Make sure that when you get a condo insurance policy, your coverage is clear, and you can rely on it.

If you want to find out more about differences between commercial and personal condo policies, our detailed article explains what the commercial condo policy covers, versus your personal condo insurance policy.

Regulating condo insurance and condo matters in Toronto

It is important to know that there are several regulatory bodies/institutions that are relevant for the topics of condo living/condo insurance in Toronto and Ontario.

Condominium Act regulates all condo corporations in Ontario. Section 6, “Insurance,” regulates key aspects of condo insurance such as deductibles that condo corporations can try to recover from condo owners.

Link: Condominium Act >>

Since condo insurance is a type of home insurance, it is regulated by the Financial Services Regulatory Authority of Ontario (FSRA). The primary focus of the FSRA is on licensing and regulating insurance companies throughout the province. It is a trusted source of information for consumers in such matters like filing a complaint or checking insurance licenses.

Link: Financial Services Regulatory Authority of Ontario

Landlord and Tenants Board, as a part of Tribunals Ontario, helps to resolve disputes between residential landlords and tenants and resolves eviction applications filed by non-profit housing co-operatives. It also shares information about its practices and procedures and the rights and responsibilities of landlords and tenants under Residential Tenancies Act.

Link: Landlord and Tenants Board >>

The Condominium Authority of Ontario (CAO) was established with an objective to improve condominium living by providing services and resources for condo owners, residents, and directors. Among other services, it offers an online dispute resolution system (CAT-ODR) to help resolve certain types of condominium-related disputes in a quick and affordable fashion.

Link: Condominium Authority of Ontario (CAO) >>

Data source for condo costs: Toronto Regional Real Estate Board (TRREB) and Canadian Real Estate Association (CREA)