Get a free Condo Insurance quote and start saving today!

Consumer surveys, including a recent survey by Allstate, show that most Canadians planning to buy a condo were unclear about what insurance protection they need to purchase. Moreover, many were unaware of the commercial condo policy purchased by the condo corporation.

Commercial Condo Policy vs Personal Condo Policy

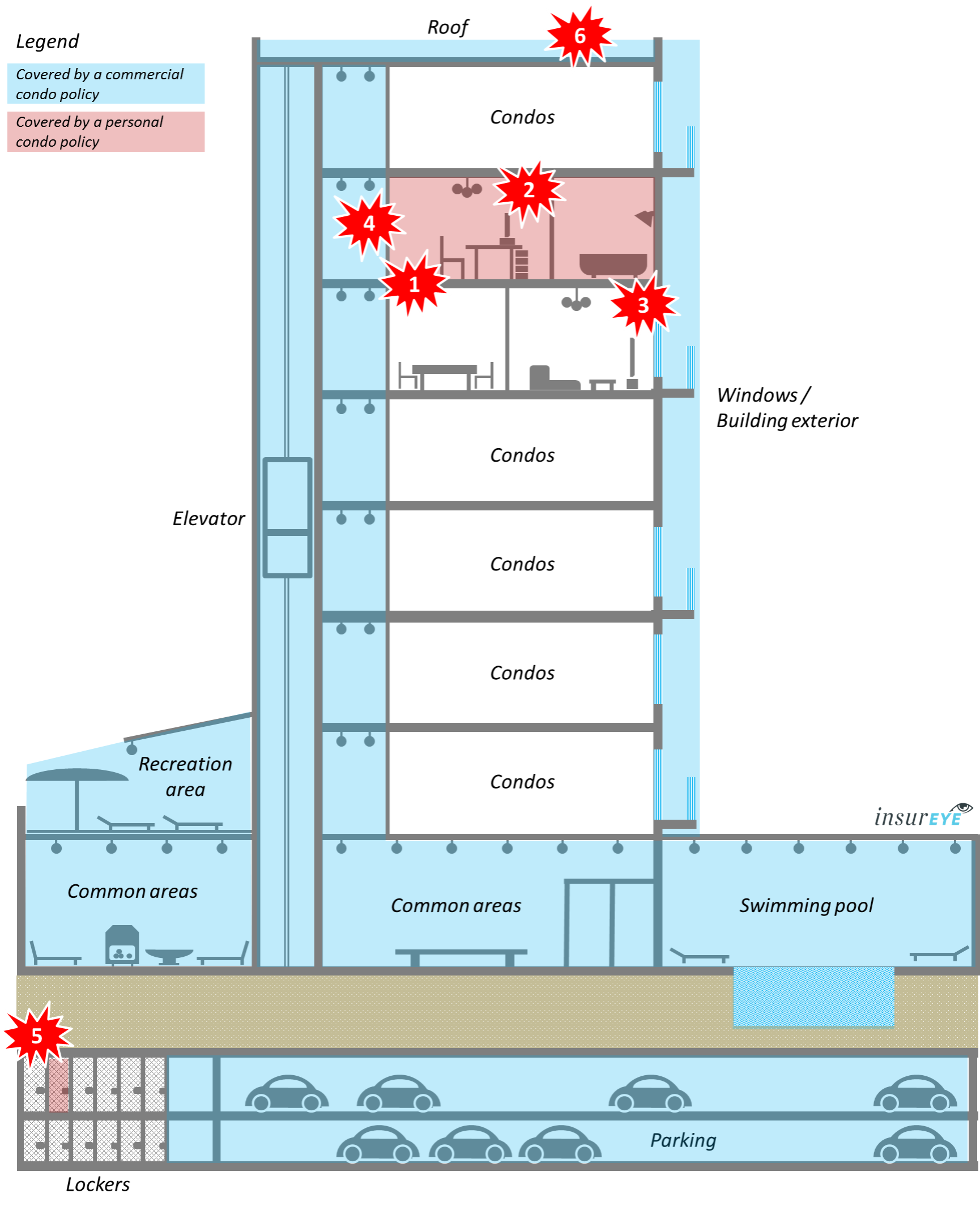

This image above distinguishes between the areas that are typically covered by a commercial condo policy (colored blue) and a personal condo policy (colored red).

- Commercial condo policy: Protects condo building itself, including common areas located both inside and outside of the condo building. Examples of such areas are shared hallways, entrance/foyer area, swimming pool, gym, elevators, roof, etc. It also protects residents in cases such as falling condo glass, which is not a rare thing in large cities. Incidents such as Toronto’s Shangri-la or Four Seasons falling glass are notable examples.

- Personal condo policy: Protects the financial interests of individual unit owners, including unit improvement and personal property. Many unit owners don’t buy this coverage as they mistakenly believe that they are covered under the commercial condo policy.

Understanding Personal Condo Policies

Understanding what the commercial condo policy covers, versus your personal condo policy, is one of the most critical things that you need to clarify as a unit owner. You also need to consider that condo owners insurance is quite affordable and it is a must if you own a condo.

And the bonus one – Additional living expenses: What would you do if you couldn’t live in your unit because it suffered damage and is undergoing insured repairs? If you don’t have friends or family members to stay with, you could be out of pocket thousands of dollars for temporary accommodations. Your personal condo policy includes protection for additional living expenses, which includes the cost of temporary accommodation. Limits of coverage usually start at $10,000.

How Much Does Personal Condo Insurance Cost?

The amount that you can expect to pay will depend on the limits of insurance that you select. The key aspect in controlling condo insurance costs is to choose protections that you really require and coverage limits that you really need.

Other Personal Condo Insurance Considerations

Roommates or tenants: It is important to know, however, that if you have a roommate or rent out a property, your roommate’s or tenants’ items are not covered by your condo insurance policy. There is a tenant insurance policy that protects his or her belongings, and you should encourage your tenant or roommate to purchase this coverage. You must also be sure to disclose to your personal condo provider that you have a roommate or tenant; otherwise, your policy could be void.

Jewelry and other expensive items: Should you have an expensive jewelry that you normally store in your condo, you should get an additional coverage (also called endorsement). Endorsements can cover jewelry and other expensive items, like: art work, bicycles, china and silverware, or collectibles. In many cases, you may need to provide appraisals or receipts for high-valued items.

Airbnb or other home sharing program: Sharing your home with others (e.g. via an Airbnb or any other program) needs to be reported to your insurance provider. If you fail to do so, your policy could be void.

[home_insurance_square_widget]These insights are shared by InsurEye and Square One insurance. InsurEye is a Canadian platform for consumers, educating them about different types of insurance, providing insurance reviews and price comparison.Square One is the true online home insurance provider in Canada, offering insurance for homeowners and renters in apartments, condos, houses and semi-attached homes.

With Square One, you decide what to insure so you only pay for the protection you need – a form on your right will navigate you through a simple and quick quoting process for condo insurance with prices starting at $15/month. Are 5-10 minutes of your time worth saving hundreds of dollars annually?

Carrick best reads: How to make Toronto home owners cry | topfinancialnew

October 23, 2015 at 3:49 pm[…] Need to know stuff about condo insuranceA primer on what condo insurance covers and doesn’t cover. […]