4 Reasons to Get a Car Insurance Quote in Calgary

- Compare auto insurance quotes from 10 car insurers

- Save several hundreds of dollars on your Calgary car insurance

- Invest 5 minutes to find out if you are paying too much today

- Talk to a car insurance professional

Average Auto Insurance Rates in Calgary

All drivers in Alberta, and in Calgary in particular, pay average car insurance rates when compared to other provinces.

The average monthly auto insurance rate in Alberta is $114 per month ($1,368/year).

Here are average car insurance rates in some other Canadian provinces:

- Ontario: $160 per month ($1,920/year)

- British Columbia: $119 per month ($1,428/year)

- Nova Scotia: $91 per month ($1,093/year)

- Quebec: $76 per month ($912/year)

Auto Insurance in Calgary – what you must know

Auto Insurance in Calgary – what you must know

- Car insurance is required by law in Calgary and across the entire province of Alberta.

- 3rd party liability: Mandatory liability coverage is the minimal 3rd party liability coverage that is prescribed by law and included in every auto insurance policy. In Alberta the coverage is for $200,000. This insurance is intended to cover possible damage that you inflict on another party.

- Tort-based insurance system: Alberta uses a tort-based insurance approach, which gives right to collision victims to sue another party.

- Other car insurance benefits you can expect in Calgary, AB:

- Disability income benefits: Max of $400 per week (up to 104 weeks)

- Medical payments: up to $50,000 per person

- Funeral expense benefits: up to $5,000

How to choose the best company to insure your car in Calgary?

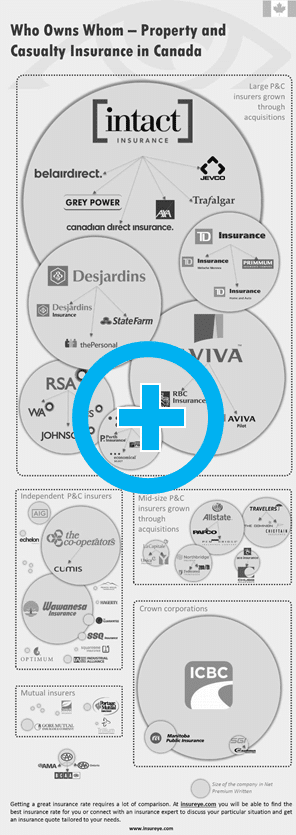

There are numerous car insurance companies that are active in Alberta. Here is an overview of nearly all the car insurance brands operating in Canada. Many of them operate in Alberta and Calgary, competing for your business.

Some insurance companies sell insurance policies directly through their call centers and agents (e.g. TD Insurance), others choose to use brokers (e.g. Intact, Aviva).

It is important to know that an insurance broker can offer and compare insurance policies from multiple insurers depending on how many companies he or she works with.

So, how can you choose the best insurance company? Two aspects are important:

- Affordable premiums – you can compare them through getting car insurance quotes for Calgary;

- Strong history of paying claims – reading consumer reviews will offer you insights into how often the company pays its claims.

Calgary auto insurance quotes: examples

- Sample car insurance quote #1:

A female driver, 48 years old, lives in Calgary (Panorama Hills), has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2010 Toyota Camry, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000$ 88 per month ($1,024 annually) - Sample car insurance quote #2:

A male driver, 52 years old, lives in Calgary, Altadore. He has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2008 Ford Escape, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000

$ 82 per month ($986 annually) - Sample car insurance quote #3:

A young, female driver, 25 years old, lives in Calgary, Sunridge, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: a leased Mercedes-Benz: 2016 GLA 250, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000$ 108 per month ($1,112 annually)

5 Tips on how to get the cheapest car insurance quote in Calgary

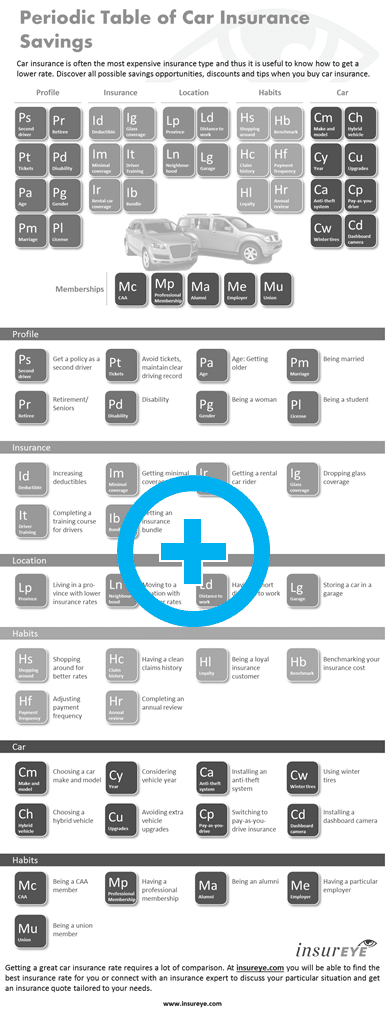

There are numerous aspects that impact your car insurance rates in Calgary. Click our infographic on the right to explore them.

Here are some of them:

1. Retiree and student discounts: Students and retired seniors could qualify for a discount from some insurers.

2. Choose to pay annually: If you can afford a lump sum payment, you’ll benefit from a lower rate, since you are saving the insurer some time and administration costs.

Read more:

https://insureye.com/101-insurance-tips-save-insurance

3. Reconsider Glass Coverage: Compare the cost of a new windshield over paying monthly for glass coverage. It may be a better deal to just save up the money.

4. Minimum Coverage: If your old car does not have a lot of resale value, and fixing it after an accident would be pointless, go for the minimum coverage that protects you from damage you inflict on other vehicles/drivers. While you’ll save money, remember that your car repair/replacement costs would become your responsibility.

5. Reward Good Driving: Ask if your insurer can capture your driving habits via a special device they add to your vehicle, and if good driving means a discount.

6. Driving Course: Some insurers offer a discount if you pass a driving course.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]

Auto Insurance in Calgary – what you must know

Auto Insurance in Calgary – what you must know