5 Reasons to get a Home Insurance Quote in British Columbia

- Find out if you are overpaying today and start saving right now

- Request a quote from 10+ home insurers in British Columbia

- BC properties are among the most expensive in Canada. Your investment needs protection!

- Get condo, home, tenant, house or cottage insurance including flooding coverage

- Talk to a live agent and ask any questions you want

What is Home Insurance cost in BC?

The chart above illustrates the average BC Tenant Insurance (also called Renters Insurance) and Homeowners Insurance premiums as compared to other regions. Renters insurance rates are typically lower than home owners premiums due to the nature of insurance: Tenants insurance in BC typically covers only the content of your rented property and, sometimes, liability. It does not cover the building itself since it is covered under the insurance property of the homeowner.

Overall average home insurance rates in BC are higher because of the several reasons:

- Earthquake protection: Seismic activity of the region often results in additional coverage (insurance riders) against earthquakes that customers prefer to purchase to have a peace of mind. It is especially important along the coast.

- High rebuilding costs: High share of more expensive real estate indirectly impacts home insurance premiums. Though home insurance is driven by rebuilding costs as opposed to market value of a property, British Columbia has a high share of premium, more expensive properties that are more expensive to rebuild. In addition to that construction of the buildings is sometimes more complicated than in other provinces since these should be build considering seismic hazards (e.g. special structure, lateral bracing requirements, etc.)

Remember that all properties are unique when dealing with home insurance in BC – get your free home insurance quote and find out how much you can save in insurance premiums.

Tenants and Condo Insurance Quotes in BC and Vancouver – Important to know

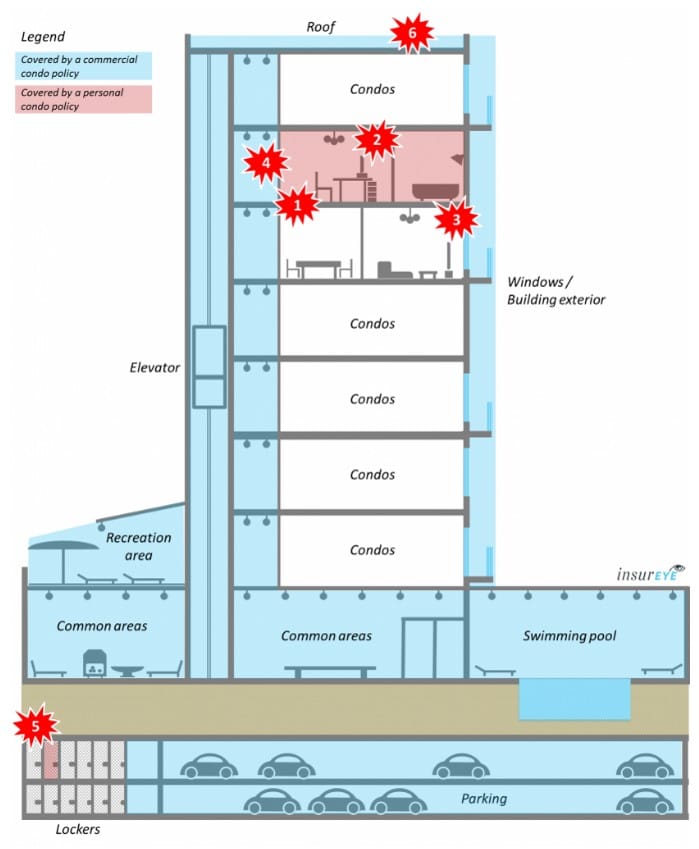

If you own or rent a condominium unit in British Columbia, remember that there are three insurance policies that might be involved in your condo protection:

- Your individual condo insurance for homeowners: covers your condo contents, upgrades, third-party liability, theft, locker contents, additional living expenses and, often, special insurance assessments.

- Tenant insurance policy: If you rent a condo in BC, chances are, your landlord will require this insurance from you. Tenant insurance (also called renters insurance) covers your contents (if they were to be damaged in a fire or a break-in, for example), 3rd party liability and additional living expenses (such as a hotel room or rental unit in case the condo unit you were renting becomes unliveable due to fire, flooding, etc.). It is, typically, cheaper than a homeowners insurance policy because it covers less risks.

- Your condo corporation’s commercial condo insurance policy: covers the building’s exterior, roof, building infrastructure, and common areas (such as the elevators, lobby, halls, etc.)

Use the overview below to understand what is covered by your individual condo policy (shown in RED) and what is covered by the commercial condo insurance (shown in BLUE).

House Insurance vs Condo Insurance

There are 5 main differences between home insurance for a single family dwelling and a condo. Here is an overview of the main differences.

1. Claim processing

- House insurance: Very straightforward to process as the claim only involves the insurer and homeowner.

- Condo Insurance: Complicated to process as the claim involves both personal insurance and the condo corporation’s insurance – and both cover different aspects. For example, a pipe burst in your exterior wall is the responsibility of the condo corporation, but the unit below yours that flooded because of the pipe burst is your liability.

2. Price

- House insurance: House insurance costs more than condo insurance because house insurance covers more risks, like your gardens, pool, yard, etc.

- Condo Insurance: Condo insurance costs less than insurance for a house because you are only covering part of the building. The condo corporation’s insurance covers the rest. An average personal condo insurance policy in Canada costs between $27 and $33 per month, but can be as low as $20 a month.

3. Policies involved in the coverage

- House Insurance: The policy is between you and your insurer and it covers your property and its associated risks.

- Condo Insurance: There are two parts to condo insurance: your personal insurance and the condo corporation’s insurance. Your insurance covers your unit’s interior and liability. The condo corporation’s insurance covers the building envelope and common areas. Your condo fees help support the corporation’s commercial policy, but you still need to have your own insurance in place. For example, if someone were to slip and fall in your kitchen, you are liable, not the condo corporation. Additionally, what is covered by the corporation can vary too. Some may cover the yard, others may not. You need to know if you are responsible for keeping your townhouse condo’s walkway free of snow and ice.

4. Amount of coverage

- House insurance: House insurance covers the rebuilding cost of your home (and debris cleanup), the contents, upgrades, and liability. Riders can be purchased for additional protection should it not be in the main policy, such as coverage for flooding or earthquakes. Rebuilding costs vary – it could be $250,000 to $500,000, or more depending on the property’s profile.

- Condo Insurance: Condo insurance only covers your contents, unit upgrades, and liability. As the coverage is not as robust as coverage for a single family home, you see lower limits of around $100,000.

5. Building coverage

- House insurance: Your house insurance covers the dwelling and the building envelope.

- Condo Insurance: The condo corporation’s commercial policy covers the majority of the building envelope. Typically, if the windows are damaged, front doors vandalized, roof shingles are ripped away in a storm, etc., this is covered by the commercial policy. However, theft from your unit or in-building storage locker, kitchen fires, flooding your neighbour’s unit, etc., falls under your own condo coverage.

5 Elements that will increase your Home Insurance costs

- Fireplace/woodstove: Fireplaces and wood stove can cause fire and smoke damage, which leads to higher premiums and a possible home inspection requirement.

- Galvanized or lead pipes: Different pipe systems can increase your premium. Modern plastic or copper pipes are preferred by insurers. Galvanized or lead pipes cost more to insure as they are more likely to be a health and environmental risk.

- Old house elements: Insurance may be denied, or cause your premiums to increase, if some of the home’s elements are outdated; for example, if the roof’s shingles are obviously past their life cycle and repairs/maintenance have not been carried out.

- Knob and tube wiring: An old and outdated type of wiring, knob and tube is easily overwhelmed by high energy consumption levels, and therefore is neither safe nor efficient. In order to get coverage for a home with knob and tube, if you are lucky enough to find an insurer you must pay extra premiums, and will likely have to foot the bill for a full inspection by a professional electrician.

- Home being a part of your business: Do you run a bed and breakfast? A daycare? Or a home based business where clients come and go? This raises your insurance risk profile as you have higher personal liability and business assets on your property. Expect to pay higher premiums to help offset these risks.

Home Insurance quotes in BC – examples

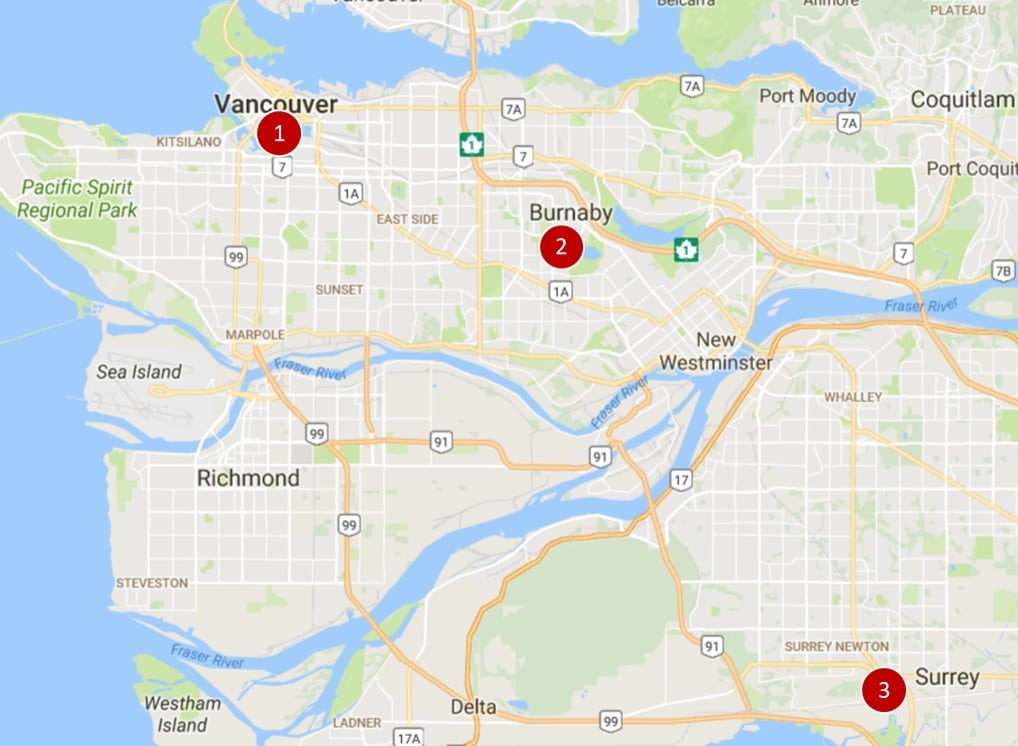

Home insurance quote in BC #1:

Condo insurance for a 2-bedroom condo in the downtown Vancouver, Homer and Nelson St, next to Emery Barnes Park

Price: $27 per month ($312/year)

Home insurance quote in BC #2:

House insurance in Burnaby, BC for a 2-storey house, located at Forest and Spruce street, approx. 2,200 sqft, including flood insurance.

Price: $77 per month ($924/year)

Home insurance quote in BC #3:

Home Insurance in Surray, Sullivan Grovenor, next to the intersection of 152 St and Panorama Drive, 2-storey house, 2500 sqft, including flood coverage.

Price: $68 per month ($797/year)

How to Get Cheap Home Insurance Quotes in BC – Several tips for you

- Change your content coverage: Do you rent an apartment or condo? You can often lower your content coverage. No need to insure your belongings to up to $250,000 if you only have a laptop and some IKEA furniture.

- Renovations: Renovating your house can result in lower home insurance premiums, as home insurance premiums for older, poorly maintained homes are usually higher. Also, updating only parts of your house, such as the basement or kitchen, may lead to savings on your insurance.

- Wiring: Not all wiring is created equal. Make sure you have approved wiring and be sure to avoid aluminum wiring, which can be very expensive to insure. Not all insurers will cover houses with aluminum wiring, and those that do usually require a full electrical inspection of the house.

- Neighbourhood: For your personal safety and possible lower premiums, live in a low-crime, safe neighbourhood. Your insurance rates in Vancouver (downtown’s east side) might be slightly higher than the rates you’d pay for the same property in safer neighbourhoods.

- Claims-free discount: You can get rewarded for being claim free. Terms and conditions vary and not all insurers offer this discount, so ask around if you have been claim free for a long time. You will get the best home insurance quotes in BC if you have never filed a claim during the last 10 years.

- Bundle: Most companies offer a discount if you bundle polices, such as home and auto.

- Mortgage insurance: Do you have life insurance? If so, you may have enough coverage to forgo mortgage insurance. Mortgage insurance is another name for a life/critical illness and disability insurance that pays off your outstanding debt on your home in case of a tragic event. For example, a term life policy large enough to pay off your home is usually cheaper.

- Stability of residence: Lived in the same residence for years? You may be eligible for a stability discount. A few insurers offers one.

Interested in more saving tips for Home Insurance in BC? Get a home insurance BC online quote below and connect with an experienced insurance professional to get more tips.

Vancouver Home insurance quotes, examples

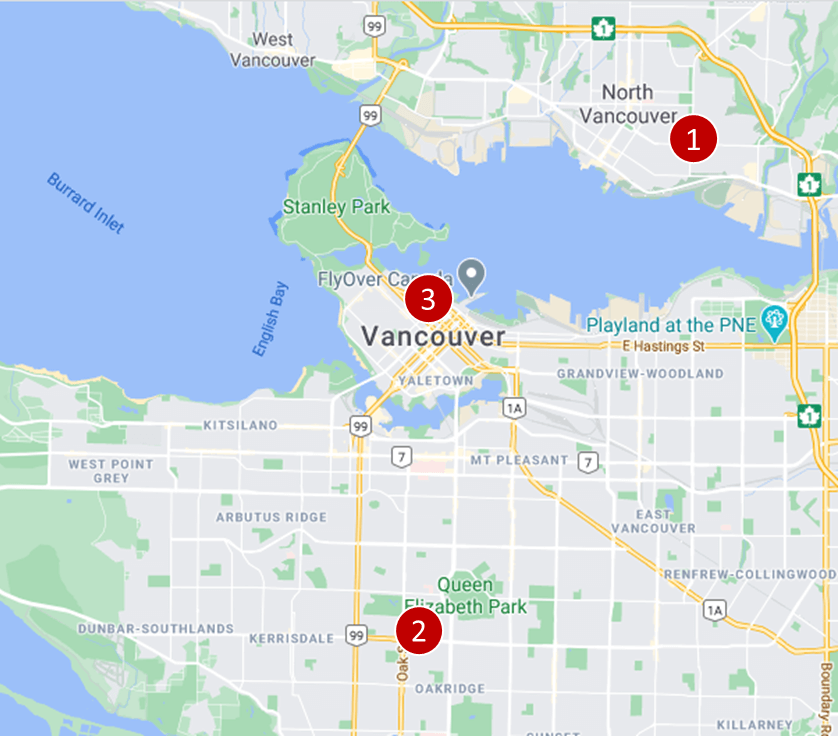

Vancouver home insurance quote #1: Homeowners insurance for a two-storey detached house about 1,200 sq. feet. This home has an attached single garage and no basement. It is located in North Vancouver at the intersection of Keith Rd E and Queensbury Ave.

$103 per month ($1,236/year)

Vancouver home insurance quote #2: Tenant insurance for a 1.5-storey detached house about 1,000 sq. feet. This home has no garage and no basement. Located on Kersland Dr next to Queen Elizabeth Park.

$40 per month ($480/year)

Vancouver home insurance quote #3: Homeowners insurance for a two-bedroom condo unit under 1,000 sq. feet in a high-rise building, located at the intersection of Bute St. and Melville St. Personal property limit of $40,000 and liability coverage of $1,000,000. Occupant is a non-smoker.

$60 per month ($720/year)

Home Insurance Companies in BC

There are several big P&C (Property and Casualty) / home insurance companies in BC including

- Intact Insurance

- TD Insurance (owned by TD Bank)

- Aviva

- RSA Insurance (includes Western Assurance – WA, Canadian Northern Shield Insurance – CNS, and Johnson Insurance)

- Economical Insurance (includes Sonnet Insurance)

- The Co-Operators

- Wawanesa Insurance

The list of mid-size and small property / home insurance companies in BC is quite long as well:

- Square One Insurance

- Travelers

- Gore Mutual Insurance

- BCAA

- Peace Hills Insurance

- Several others

Insurance brokers are also very present in BC and they also offer insurance coverage through an array of insurance companies. Examples of larger insurance brokerages in BC are

- Westland Insurance Group

- HUB International Insurance Brokers

- Western Financial Group

- Etc.

A number of Quebec-based companies though such as Desjardins Insurance, Industrial Alliance, La Capitale do not see British Columbia as their primary market.

What locations in BC do you serve?

Through our partners, we can offer home insurance quotes in BC and across the entire province, including home insurance in:

- Abbotsford

- Burnaby

- Coquitlam

- Kamloops

- Kelowna

- Nanaimo

- New Westminster

- Richmond

- Surrey

- Vancouver

- Vernon

- Victoria

- and many other BC locations

Frequently Asked Questions: Home Insurance in Vancouver

Home insurance costs in Vancouver depend on many factors including but not limited to the type of home insurance you need (e.g. homeowners insurance vs tenant insurance, house insurance vs condo insurance).

- Tenant insurance is usually the cheapest type. Insuring a condo can cost as little as $15/month.

- Homeowners insurance for a condo only covers your unit, upgrades, contents, and liability, therefore the coverage is not very expensive. Expect to pay around $20-$50/month.

- Homeowners insurance for a house is the most expensive type. It can start at $50/month and go as high as several hundred dollars per month depending on your property and its risk profile. Things that impact the coverage costs include the home’s size, age, if it has a finished basement, location, geographic risks like being in a flood prone area, the age of the home’s components, and much more.

Home insurance coverage depends on the type of insurance you need:

- Tenant insurance: is designed to cover your personal contents and liability.

- Homeowner insurance (condo): Covers the condo unit and associated upgrades, your contents (e.g. theft, damage, etc.), and liability. The condo corporation’s insurance covers the building envelope and common areas.

- Homeowner insurance (house): Covers the entire rebuilding costs for your home, and, depending on your riders, a range of natural impacts such as earthquake, flooding, snow damages, trees and garden, etc. Also covered is your liability and the additional structures on your land (e.g. shed, storage space, etc.).

Home insurance companies can specialize in demographic or geographic sectors, or specific risk profiles and building types. One company may work primarily with seniors or affiliated membership groups. One may specialize in condo insurance. Others in high-risk coverage. To find the cheapest home insurance, get a quote from as many insurers as possible and understand exactly what they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals are happy to help you with your questions.

Our proprietary insurance review platform has collected independent consumer reviews for different insurance and financial products since 2012. Now, you can access, for free, thousands of home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]