4 Reasons to get a Home Insurance Quote in Edmonton

- Find out if you are overpaying today and start saving

- Request a quote from 10+ insurance providers

- Get home, tenant, house or cottage insurance including flooding coverage

- Talk to a live agent and ask any questions you want

What Are Typical Home Insurance Premiums In Edmonton / Alberta?

This chart illustrates the average home insurance premiums across Canada and in Alberta for both rented and owned property. Renters’ insurance rates are typically lower than home owners’ premiums due to the nature of insurance:

Renter’s insurance (also called tenant insurance) typically covers only the content of your rented property and sometimes liability. It does not cover the building itself, since it is covered under the insurance property of the homeowner.

A homeowner’s policy covers numerous risks associated with the property such as earthquake, fire, theft, etc.

It’s important to know that it is not the market value of the house that is covered, but the rebuild value, which is often lower than the market value of the house. If something happens to the property, the insurance company would carry the rebuilding costs so that a home owner can get back an equivalent home.

Tenants and Condo Insurance Quotes in Edmonton – Important to know

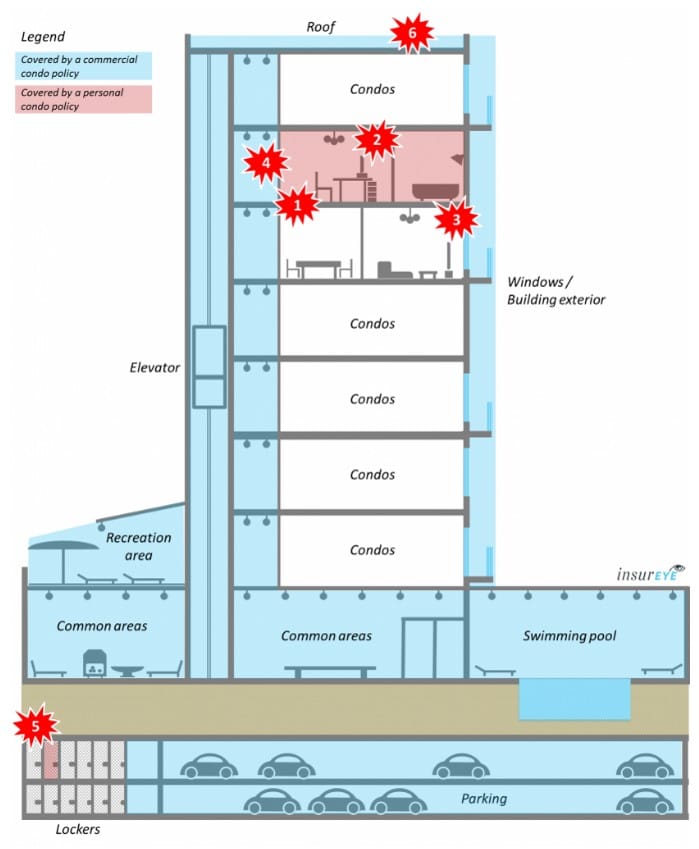

If you are a condo owner in Edmonton, remember that there are always two insurance policies involved in your condo protection:

- Your own condo insurance for homeowners: covers your condo contents, upgrades, third-party liability, theft, locker contents, additional living expenses and, often, special insurance assessments.

- Your condominium corporation’s commercial condo insurance policy: covers the building’s exterior, roof, building infrastructure, and common areas (such as the elevators, lobby, halls, etc.)

If you rent a condo in Edmonton, the policy you need is called condo tenant insurance, and it covers your contents (if they were to be damaged through fire or theft, for example), third party liability and additional living expenses (such as a hotel room or rental unit in case the condo unit you were renting becomes unliveable due to fire, flooding, etc.).

Use the overview below to understand what is covered by your individual condo insurance policy (shown in RED) vs your condominium corporation commercial condo insurance policy (shown in BLUE).

Edmonton Home insurance quotes, examples

- Edmonton home insurance quote, sample:

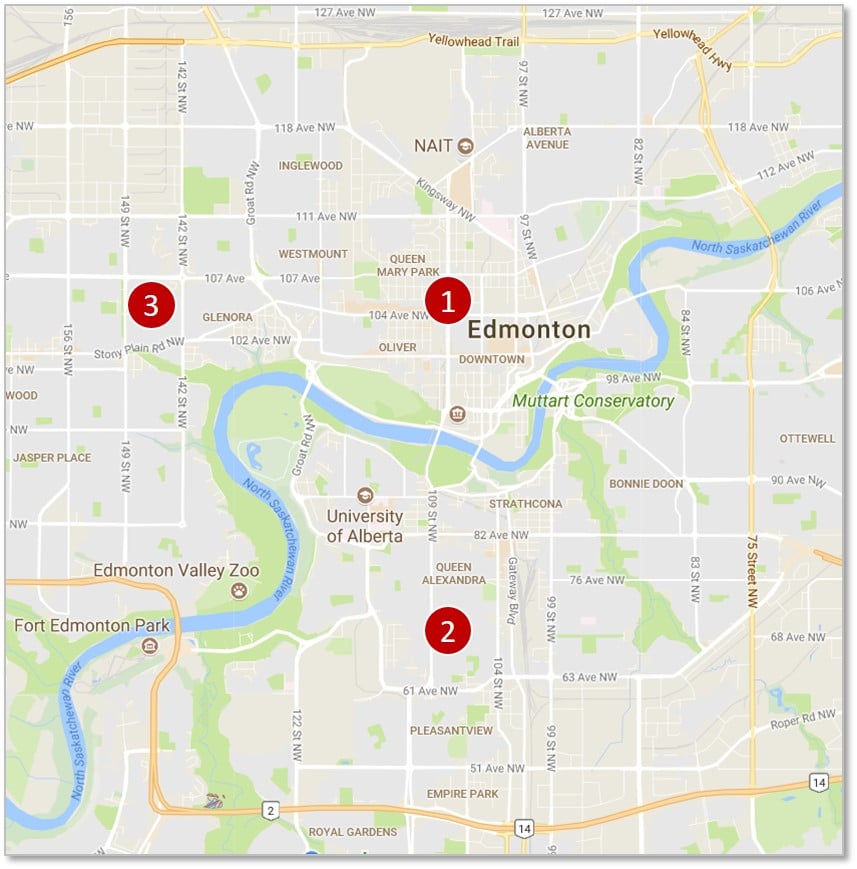

Condo insurance for a 2-bedroom condo in the downtown Edmonton (104 St NW), next to Canadian Western Bank Place:

$22 per month ($264/year) - Edmonton home insurance quote, sample:

House insurance in Edmonton for a 2-storey house, located in Allendale, approx. 2,000 sqft: $93 per month including flood insurance ($1,116/year) - Edmonton home insurance quote, sample:

Home Insurance in Edmonton, Grovenor, next to the intersection of 142 St NW and 107 Ave, 1-storey house: $65 per month including flood coverage ($780/year)

How to Get Cheap Home Insurance in Edmonton – Tips for you

- Professional Memberships:Are you a member of a professional organization such as Certified Management Accountants of Canada? Some companies offer discounts to professional members, and some organizations offer their members insurance policies.

- Renovations: Renovating your house can result in lower home insurance premiums, as home insurance premiums for older, poorly maintained homes are usually higher. Also, updating only parts of your house, such as the basement or kitchen, may lead to savings on your insurance.

- Pipes: Insurers prefer copper or plastic plumbing. Consider upgrading your galvanized/lead pipes during your next renovation cycle. It is similar for home insurance in Edmonton, AB and also for home insurance in other provinces/locations.

- Stop smoking:Some insurers increase their premiums for the homes with smokers since this means an increased risk of fire

- Claims-free discount:You can get rewarded for being claim free. Terms and conditions vary and not all insurers offer this discount, so ask around if you have been claim free for a long time.

- Alumni:Graduates from some Canadian universities, such as e.g. University of Toronto, McGill University, may qualify for a discount through select providers.

- Avoid living in dangerous locations:Steer clear of buying a house in earthquake or flood-prone zones.

- Use consumer reviews: Exploring experiences of other Canadians is a great way to save on home insurance and avoid unexpected issues. Check here to find out more about insurance, such as e.g. TD home insurance in Edmonton.

- Interested in more saving tips for Home Insurance?Get an insurance quote below and connect with an experienced insurance professional to get more tips

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]