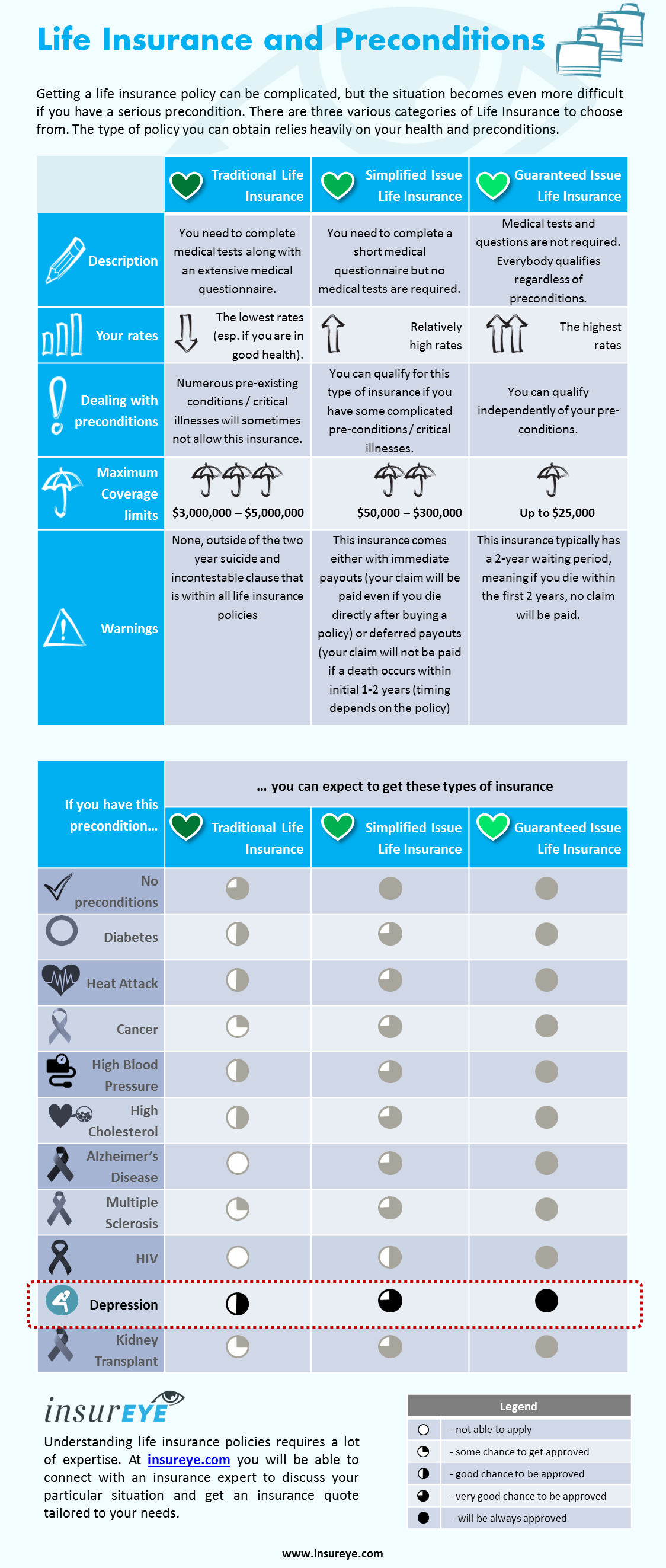

Getting a life insurance policy can be not easy, but it is even more difficult if you have a precondition such as depression. There are three different categories of Life Insurance that consumers can choose from: traditional, simplified or guaranteed issue.

Various life insurance policies are available for you if you have a Depression but they may vary depending on your condition. If you are interested in getting a free quote for Life Insurance with Depression, please, click on the button below or complete a form below.

Get a free quote for Life Insurance with Depression

If you are interested in understanding better different life insurance types such as traditional life insurance, simplified issue life insurance and guaranteed issue life insurance and want to know what types of life insurance for depression cases are available for you, have a look at our infographic further below. It will also inform you what life insurance types are available for other serious preconditions.

People with Depression: Key question asked by insurance companies

Most insurance companies that provide life insurance for people with depression will be interested in the following question: “How advanced is your depression?” That will determine the risk associated with your policy and type of insurance policy that you can apply for:

Depression: Less advanced, “mild” stage

If depression is in a less advanced, mild stage and it is stable, you can often qualify for traditional life insurance. It means that your maximum coverage limit can typically vary between $3,000,000 and $5,000,000. Depending on your state, your insurance policy can be either standard or rated (can go up to 300% of standard rate).

Depression: More advanced stage

If depression is in a more advanced stage and your condition is not stable, you can qualify only only for simplified issue life insurance. It means that your maximum coverage limit can be typically between $50,000 and $300,000. Simplified issue life insurance can come in the form of insurance with immediate or deferred benefits. The latter is similar to guaranteed issue life insurance which typically comes with a 24 month waiting time (i.e. if an applicant dies within the first 2 years, no claims will be paid).

Interested in Life Insurance with Depression pre-condition?

Contacting an experienced, licensed broker (see a form below) will help you to find a life insurance with depression that fits you needs or simply answer all your questions related to this topic. Discussion with broker is entirely free and there is absolutely no obligations to buy.

Key insurance types and serious preconditions

An overview below provides a brief overview of various life insurance types. It also explains what insurance types are available to you, if you have a serious precondition. Any other question left? Please feel free to connect with an insurance professional to discuss your situation in details.

Click on the link if you are interested in downloading this infographic Life Insurance for Depression as PDF.