Get a free Life Insurance quote from 20+ Canadian insurers

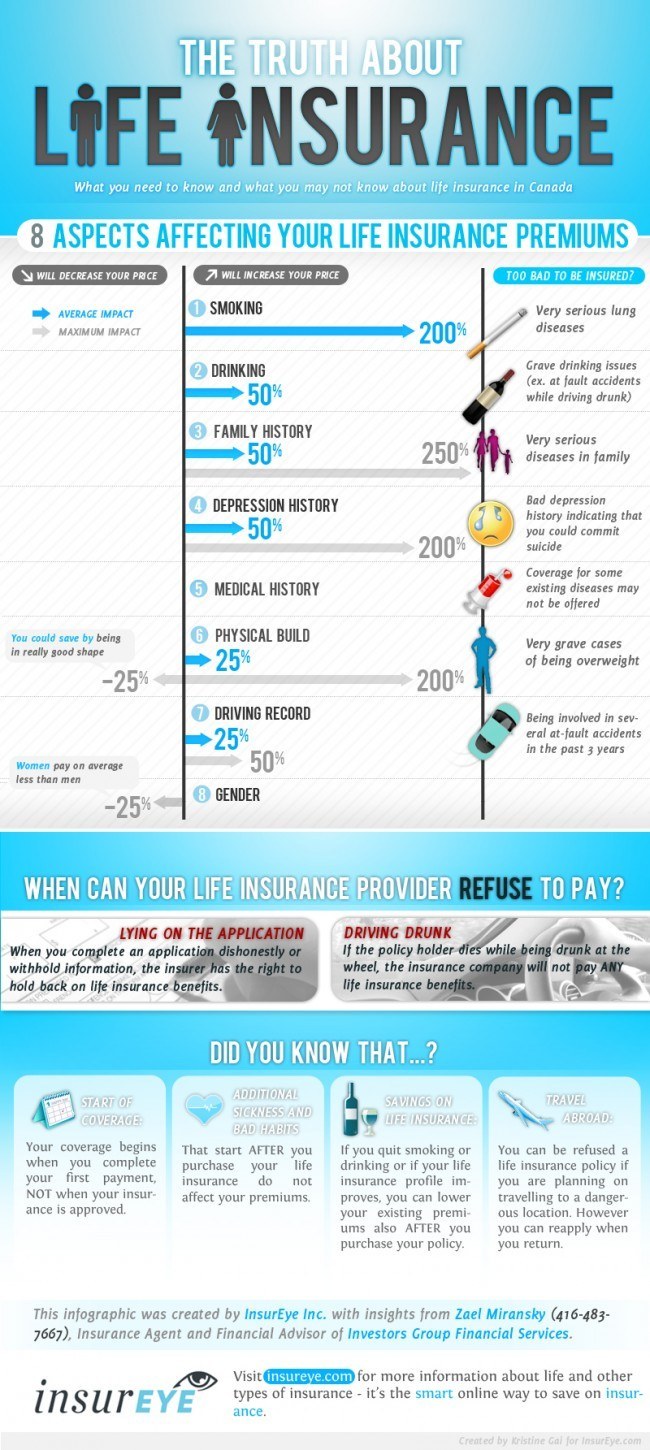

This infographic was created with the friendly support of Zael Miransky, Insurance Agent and Financial Advisor with Investors Group Financial Services. There are several factors that impact life insurance premiums. The main negative aspects that can significantly increase your life insurance premiums include: smoking, drinking, bad family health history, depression history, your own medical history, physical build (especially the ratio of weight and height), and even your driving record or gender.

There are also ways that you can actually reduce your life insurance cost as well, both before or after you get an insurance policy. So how can you do this?

You Can Reduce Your Life Insurance Costs

When we talk about reducing life insurance premiums we are not talking here about reduction of insurance coverage or insurance policy type, though you can consider doing that. For example, the average cost of a Term Insurance policy for e.g. $500K-1M coverage is ~$53/month as opposed to $117/month for Universal Life Policy.

The easiest way to reduce your life insurance premiums is to improve one of the following aspects of your risk profile. Numbers below show the increase in premiums if it applies to you (e.g. smoking is quite expensive for your wallet also from the insurance perspective).

- Smoking: increase of 200%

- Drinking: increase of up to 50%

- Bad driving record: increase of 25% to 50%

- Physical build: increase of 25% to 200% if you are in a bad shape or, ATTENTION, savings of up to 25% for being in great shape!

You should also consider that improvement of each of the aspects listed above will reduce your premiums even after you purchase a policy. You will need to check with your insurer but typically, if you can demonstrate that you eg. stopped smoking for a year, your insurer will reduce your premiums (don’t forget to ask about it, nothing happens on its own)!

There are some aspects that you can probably do nothing about, and these are your age, gender, medical history, depression history, and your family’s health history.

When Your Life Insurance Provider Will Not Pay Your Claim

Zael advises that there is one most frequent case where an insurer can decide not to pay: you lied on the application and did not share one or more aspects relevant to your insurance case (e.g. existing diseases). Another important case is being drunk at the wheel – no insurance compensation in this case either. One more reason to follow the rule: don’t drink and drive!

We hope that these tips will help you to understand the key aspects of life insurance and the ways to save on life insurance without taking any cuts to your protection. Don’t forget to choose a trusted insurance provider using independent consumer reviews, they can save you a lot of headache in the future!

If you want to have an insurance broker help you with all aspects of the application, be careful to use those who are not only interested in selling you a policy but who also want to educate you. InsurEye introduces to consumers a number of brokers awarded the InsurEye Trust Seal. It is a sign that shows how all the companies that brokers work with stack up in terms of consumer satisfaction.

Zael Miransky is a Life Insurance Agent and Financial Advisor with Investors Group Financial Services who kindly agreed to share his insights with InsurEye to better educate Canadians about Life Insurance. Zael was also awarded InsurEye Trust Seal and works with customers both in Ontario and Quebec.