What is an attending physician statement?

An attending physician statement (or APS) is a document that can be requested by an insurance company if you are applying for life insurance or living benefits products. It allows the insurance company to better understand health risks associated with an applicant. Typically, this document is requested from your family doctor and the insurance company pays a fee for the request.

Do insurance companies always request an attending physician statement?

No, insurance companies do not always request an APS. In fact, most fully underwritten insurance policies do not need an APS. It is more likely to be requested for large coverage amounts, for elderly applicants, and people who have health issues. When possible, insurance companies prefer avoiding it as it comes with a fee that the insurance company has to pay.

Which insurance products might require an attending physician statement?

Life Insurance, Disability Insurance, Critical Illness Insurance, and Long-Term Care Insurance are among insurance products that might require an APS. As mentioned earlier, not every application will require an APS. It is only for select cases such as large face amounts (coverage limits, e.g. several million), known health issues, or elderly applicants.

No Medical Life Insurance products, such as simplified issue life insurance and guaranteed issue life insurance, do not require an attending physician statement.

Who completes an attending physician statement?

Typically, it is your family doctor who completes your attending physician statement, but there are situations when this can be not possible, e.g.:

- Family doctor retires

- No family doctor available (e.g. newcomers)

In these cases, an application may be postponed until someone has the required records. In some cases, insurance companies can reach out to specialists – this will likely increase the application processing time.

What does an attending physician statement cost?

Each attending physician statement can cost around $350 for the insurance company to pay. That explains the fact that insurance companies prefer to not request it unless it is really necessary. Some companies, such as Humania, try to move away from the APS by using intelligent underwriting that assess other underwriting factors with help of artificial intelligence (AI).

How long does it take to issue an attending physician statement?

An attending physician statement issue timeline can vary greatly, anywhere between two weeks and six or more months. It varies greatly from doctor to doctor. If an insurance company has to contact a specialist, it can take even longer. Some doctors still do not use email and will only respond by fax.

Can an insurance company decline your application based on the attending physician statement?

Yes, an insurance company may decide to decline your life insurance or living benefits application based on the information in your APS. In this case, you have an option to apply with another carrier (which might decide not to request an APS) or apply for no medical life insurance, which does not require an APS. Please note that different insurance companies have different underwriting protocols and parameters.

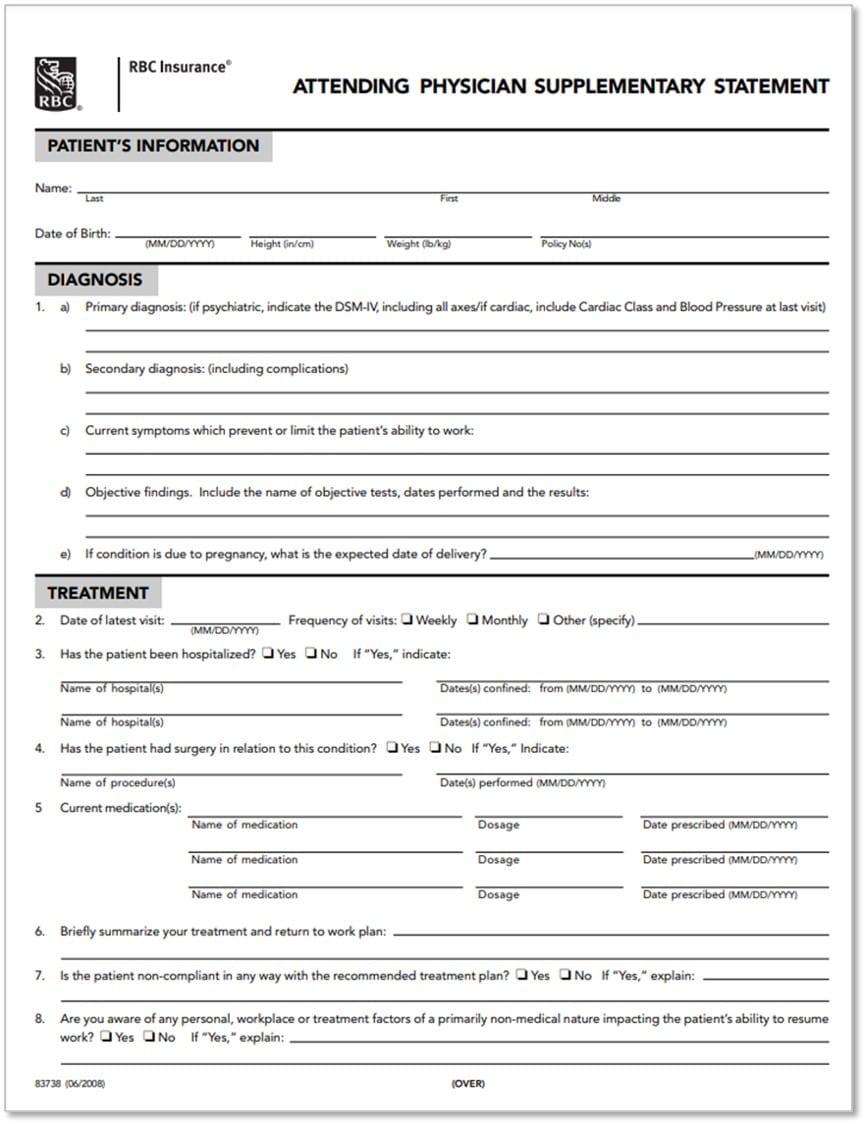

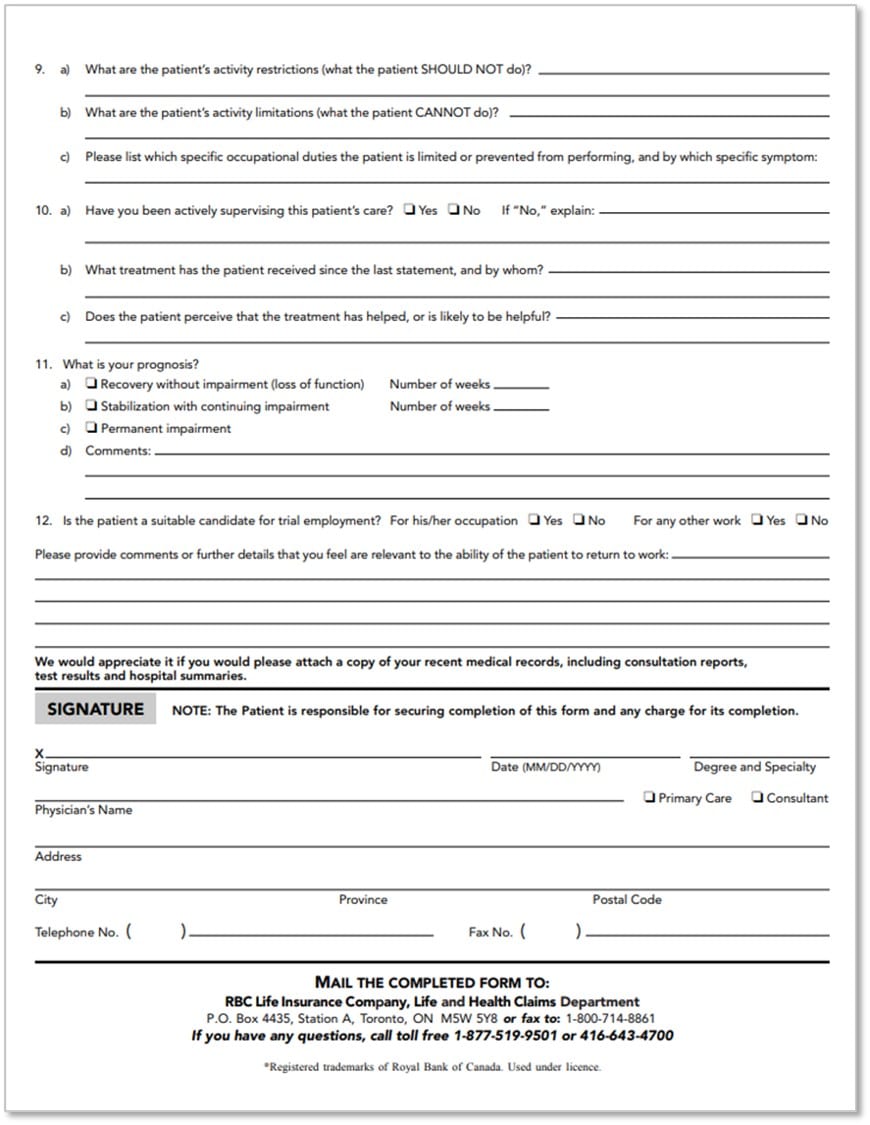

Attending physician statement, example

Here is a sample Attending Physician Statement from one of Canadian insurance companies, RBC Insurance

Source: RBC Insurance

Our Publications related to Life Insurance

Life, Disability and Critical Illness Insurance: Do Men or Women Pay More?

Introduction There were many articles written about men paying more for car insurance than women, but what about other insurance types? Do women always benefit from lower insurance rates? We took on this question and systematically went through various life insurance, disability insurance, and critical illness insurance by consulting with professionals who had the answers. […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

If Life Insurance Plans Were Cars: How to Look at Various Types of Life Insurance in Canada

Overall, insurance is considered a somewhat boring, though necessary, topic. On top of that, it is not always clear – there are plenty of various types of life insurance products in Canada that work differently. I decided to explain it in a bit of a different and funny way – I hope that you will […]

Insurance Companies in Canada – Easily Explained

The life insurance landscape in Canada is quite unique. The infographic below shows all the key players and their size, reflecting their assets under management (AUM) based on life and wealth segments of the company’s business. scroll further down to continue reading In Canada, the majority of insurers fall under the umbrellas of three large […]

What is Travel Insurance, and Why Do I Need it?

By RateHub.ca When it comes to budgeting for your vacations, travel insurance is one of those things that’s often overlooked. It’s easy to understand why: we have publicly funded healthcare in Canada, so many people assume that benefit applies to wherever we travel in the world. Unfortunately, that’s not the case. The cost of seeking […]