Get a free Auto Insurance quote from 10+ Canadian insurers in Alberta

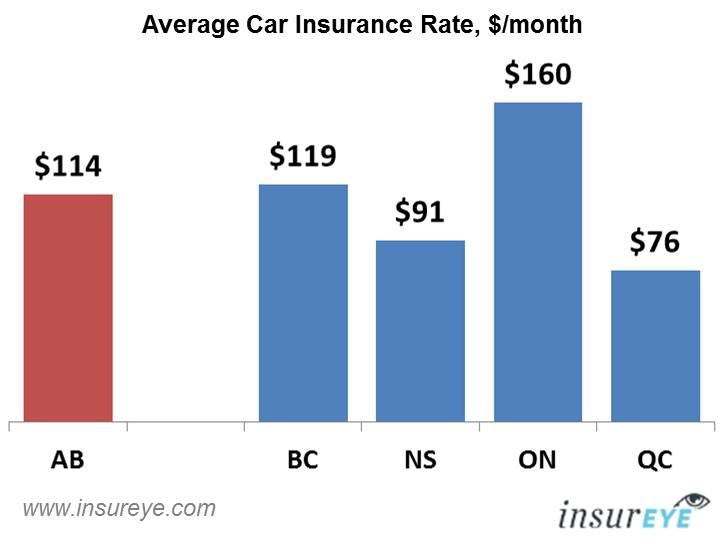

There is a lot of information available about car insurance rates in Ontario and how they are the highest in the country. That’s true — according to our own database of insurance rates, on average Ontario drivers pay $160 per month for their car insurance.

How does car insurance in Alberta compare to Ontario in terms of insurance premiums? Our data shows that on average Albertans pay $114 per month in car insurance premiums, which is nearly 30% less than Ontarians.

It is important to mention that in some Canadian provinces auto insurance is offered by crown corporations only, limiting consumer choices for basis car insurance coverage e.g. SGI in Saskatchewan, ICBC in British Columbia, MPI in Manitoba. It is not the case in Alberta though.

Gender and the Cost of Car Insurance in Alberta

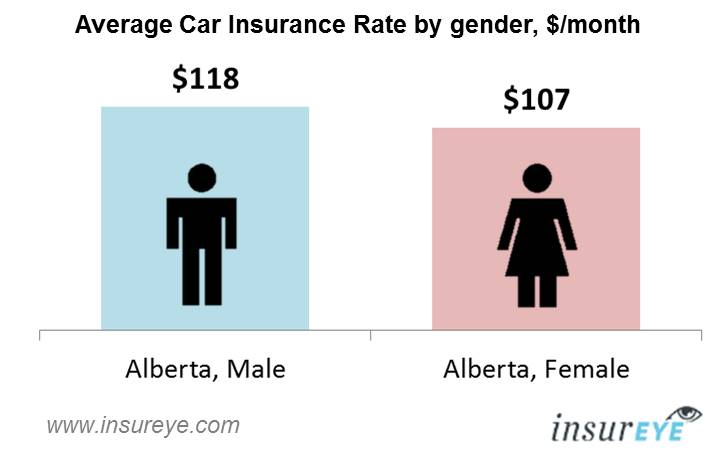

Similar to other provinces, insurance rates for male and female drivers differ given the fact that statistically women have less expensive accidents (see our article on insurance rates for men and women — “The Truth about Differences in Insurance Rates for Men and Women”).

This difference between premiums for male and female drivers in Alberta is approximately 10% with women paying $107/month and men paying $118/month.

Driving Record and Car Insurance Rates in Alberta

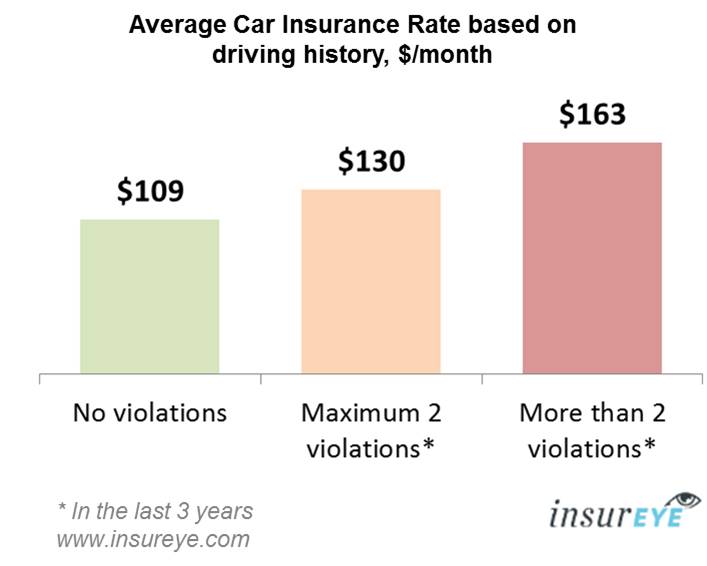

The worse your driving record, the more you pay in car insurance premiums; but what are those increased rates? If you had no driving violations in Alberta, you premiums would average $109/month, but having a maximum of two violations in the last three years will raise it up to $130/month (approx. 20% increase). Having more than two violations in the last three years can result in an increase of up to $163/month (approx. 50% increase). For serious cases, your premiums can more than double or, in the worst possible scenario such as a DUI, your licence could be suspended. Our article “What is the Insurance Price Tag on a Bad Driving Record” provides more insights for this topic.

Some Statistics on Insurance Rates and Values of a Car in Alberta

Our broker-partners provide access to 8 insurance companies if you want to get a free quote for car insurance Alberta. These companies are Economical Insurance, Gore Mutual, Wawanesa Insurance, RSA Insurance, SGI, Travelers, Aviva, Peace Hills.

Car value alone is not really driving insurance premiums. It is more a set of characteristics for a particular car model that impacts the price (e.g. age, price, claims history for this car such as theft cases etc.). However, there is still a strong correlation between different car price categories and insurance rate.

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

Despite the fact that car insurance rates in Alberta are lower than in some other provinces, it still makes sense to shop around for insurance and see what’s available on the market. The more companies a broker can compare for you, the better. Imagine if you are looking for a cheap flight; you can go through dozens sites to find the best offer. This is what an insurance broker does to ensure you get the best rate for your driving history and vehicle.