5 Reasons to Get a Car Insurance Quote in Nova Scotia

- Get your car insurance safely from the comfort of your home during the COVID-19 times

- Find out if you are currently paying too much

- Talk to a live agent

- Request a quote from 10 insurance providers

- Save hundreds of dollars on your car insurance

What are typical car insurance rates in Nova Scotia and other provinces?

Halifax and other Nova Scotia drivers benefit from lower car insurance rates when compared to many other provinces.

The average monthly car insurance rate in Nova Scotia is $91 per month ($1,093/year).

Compare this with the average car insurance rates in these provinces:

- Ontario: $160 per month ($1,920/year)

- British Columbia: $119 per month ($1,428/year)

- Alberta: $114 per month ($1,368/year)

- Quebec: $76 per month ($912/year)

Insurance in Nova Scotia – what you must know

- Car insurance is required by law in Halifax and Nova Scotia.

- Mandatory liability coverage is the minimal 3rd party liability coverage that is dictated by law and included in every car insurance policy: $500,000 (most other provinces require $200,000).

- No-fault insurance: Halifax, similarly to Nova Scotia, has a no-fault car insurance system, meaning that it does not matter who is at fault. Each party’s insurer covers each party’s costs.

- Other car insurance benefits you can expect in Halifax (Nova Scotia):

- Disability income benefits: Max of $250 per week (104 weeks for temporary disability, lifetime for permanent disability)

- Medical payments: up to $50,000 per person (4 year limit)

- Funeral expense benefits: up to $2,500

Want to learn more? You can find more information in this Legislation Highlights for Consumers brochure from the Office of the Superintendent of Insurance (Halifax office) or read more here.

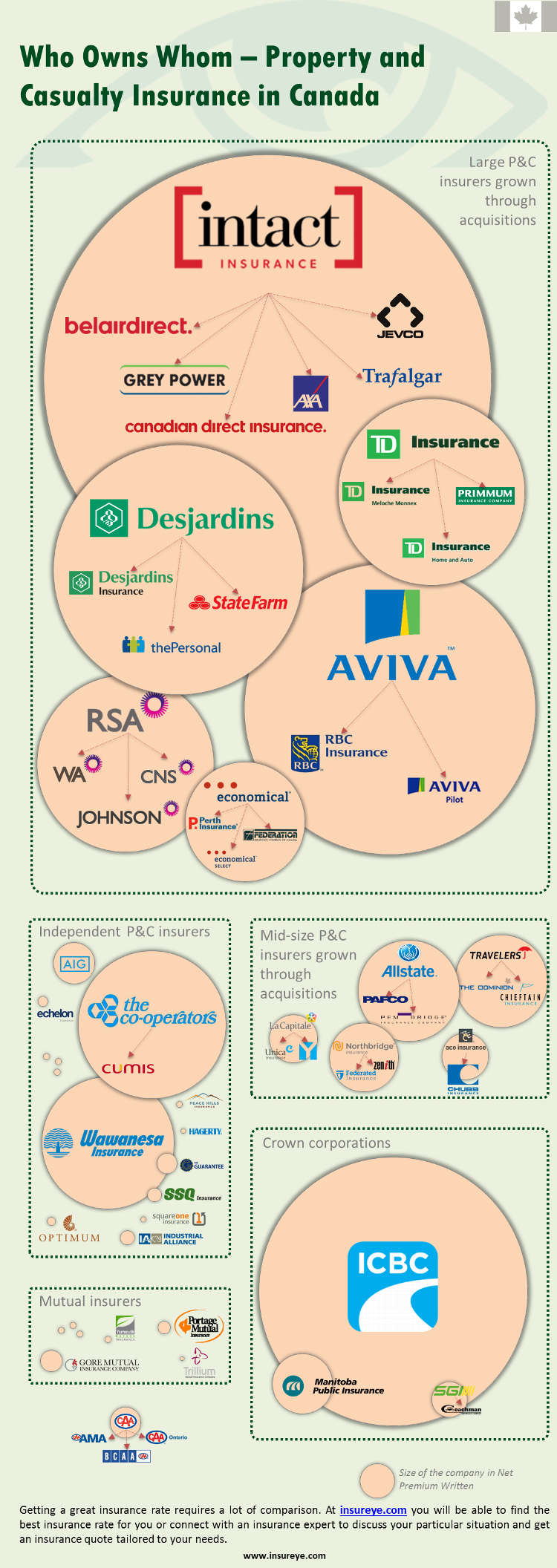

What car insurance companies are out there?

Here is an overview of nearly all car insurance brands operating in Canada. Many of them operate in Nova Scotia, competing for your business.

If you are not happy with your current insurance rates, there are plenty of other options out there.

Some sell insurance directly through their call centers and agents, others choose to use brokers.

It is important to know that a broker works with multiple insurance providers and is able to provide insurance quotes from many companies.

Nova Scotia auto insurance quotes: Halifax examples

- Sample quote:

A female driver, 48 years old, lives in downtown Halifax, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2010 Toyota Camry, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000

$ 57 per month ($684 annually) - Sample quote:

A male driver, 52 years old, lives in Halifax, Fairmount. He has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2008 Ford Escape, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000

$ 62 per month ($744 annually) - Sample quote:

A young, female driver, 25 years old, lives in Halifax’s north end, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: a leased Mercedes-Benz: 2016 GLA 250, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000

$ 159 per month ($1,908 annually)

How to get cheap auto insurance in Nova Scotia: expert tips

There are many ways to reduce your car insurance rates. See our detailed graphic on the right.

Some ideas that you can consider are:

Consider Annual vs. Monthly Payments: Your annual payment reduces paperwork and administration for your insurer. Those savings can be passed on to you.

Annual Review: An annual review catches new discounts for which you become eligible.

Do you Really Need the Glass Coverage? It may be easier to budget for a new windshield instead of paying monthly premiums on your existing one.

Driver’s Education: Some insurers provide discounts for those who complete driver’s education.

Maintain Your Driving Record: The longer your driving record stays clean, the better your premiums.

Seniors: Some insurers offer discounts to seniors.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]