5 Reasons to Get a Car Insurance Quote in Mississauga

- Compare car insurance rates in Mississauga across 30+ insurers

- Available remotely from the comfort of your home

- Find out if you are currently paying too much

- Spend 5 minutes to save hundreds of dollars

- Talk to a live agent if you have questions to your quote

Our Mississauga car insurance guide will tell you everything you need to know about car insurance rates, why rates have changed over the years, how to save on car insurance in Mississauga, and more. We’ll even bust some popular car insurance myths! Our guide includes the chance to get free car insurance quotes from more than 30 Canadian insurers. We are your all-in-one guide for car insurance in Mississauga.

What are typical Car Insurance rates in Ontario?

The chart shows average car insurance rates in Ontario and across Canada. One chart compares provinces, the other compares premiums by age of the drivers. Note that the range is considerable.

Ontario drivers spend more on car insurance than any other province. Even though government intervention has been put in place to reduce car insurance rates in Ontario, rates remain disproportionally high.

Car insurance rates in Mississauga are on the expensive side, being lower only than premiums in Brampton, Vaughan, and Richmond Hill. Average car insurance in Mississauga costs between $150 and $190 per month. These rates, though, can strongly vary case by case depending on numerous factors such driving history, car insurance policy type, car make/model and more.

Get to know all the Car Insurance components

Car insurance actually consists of different pieces. Some of them are mandatory, others depend on the policy you choose, and your coverage needs:

| Insurance component | Description | Type |

|---|---|---|

| Collision insurance | This insurance pays for damages to your vehicle after an accident. If your car is beyond repair, it pays a reasonable sum to replace it. | Not mandatory |

| Liability insurance | Liability insurance is mandatory coverage that protects the other person and vehicle in the accident. It is used to help with the resulting medical bills, lost earnings, legal fees, etc. In some provinces one driver can sue the other, and this could push your costs into the millions. For this reason, we suggest getting more than the minimum liability coverage required – a good investment since liability coverage is not expensive, but being sued is very costly. | Mandatory |

| Comprehensive insurance | Purchase comprehensive to protect yourself from non-accident related damages that affect your car, such as extreme weather, flooding, and vandalism. | Not mandatory |

| All perils | This protection is for when someone in your household steals your car, or it is damaged by an additional driver. | Not mandatory |

| Uninsured motorist / Hit-and-run coverage | Some drivers illegally operate without coverage, or flee the scene of an accident (hit and run). This coverage protects you financially from these irresponsible individuals. | Mandatory |

| Accident Benefits | Medical expenses, income replacement, and other such expenses are covered by accident benefits. | Not mandatory |

What cars are the most expensive ones to insure?

The cost to insure cars is linked to different types of claims associated with these cars: accident benefits insurance claims, collision insurance claims, comprehensive insurance claims, and direct compensation property damage insurance claims. Here are some examples of cars (model years 2014-2018) that drive high insurance costs:

- BMW X6

- BMW 4th series

- Tesla Model S

- Cayenne

- BMW 3rd series

- Audi Q7

- Mercedes-Benz S series

- Hyundai Genesis

- Audi S5

- Mercedes-Benz CLS

- Mercedes-Benz C series

- Audi A5

- Subaru/Toyota BRZ

- Dodge Charger Ford Mustang

- Lexus IS

Other elements (e.g. your driving habits, age, driving history, location, policy type and coverage) impact your car’s insurance rates as well. Car model/make alone is not a good predictor of how expensive your insurance rates will be.

10 Ways to save on Car Insurance in Mississauga

Getting cheap car insurance in Mississauga is not easy since car insurance rates in this location are fairly high – but it’s not impossible to get good insurance. We have collected a number of ways for you to reduce your car insurance rates.

- Improve Your Driving Record

Be a good and safe driver. A bad driving record affects your rates. Tickets are usually removed from your record after three years, so start practicing good driving habits now for better long term results. - Bundle

Does your insurer also offer home or life insurance? Ask about bundle discounts. - Rental Car Rider

Rent cars often? A rental rider is about $20-$30 a year on your policy. This is far cheaper than the $20+ dollars a day you’ll pay at the rental office. - Location, Location, Location

Rates vary among provinces, but also among cities within the province. When moving, be sure to check the difference in car insurance rates. For example, did you know that Burlington has one of the highest rates in Ontario? - Short Distance to Work

A shorter commute lowers you risk and your premium. Consider living closer to your workplace to save money on car insurance. - Your Garage

Make sure your insurer knows if you park in a garage or other secure parking location as this can lead to lower insurance premiums. - Annual Review

You might not need the same amount of insurance as the year before, or new discounts may apply. Review your coverage annually. - Pay-As-You-Drive

Did you know about this option? If you are an occasional driver, you can pay for just the time you are on the road. A device in your car tracks your driving profile to prove you are not a frequent driver, and to get you a lower rate. - Winter Tires

Winter tires reduce your risk of accidents when there is snow and ice on the road. Most insurers offer a discount when they know you use winter tires. - Professional Membership

Belong to Certified Management Accountants of Canada or The Air Canada Pilots Association? Are you an alumnus of a major university or college? Being an association or alumni member can get you a group discount with some insurers.

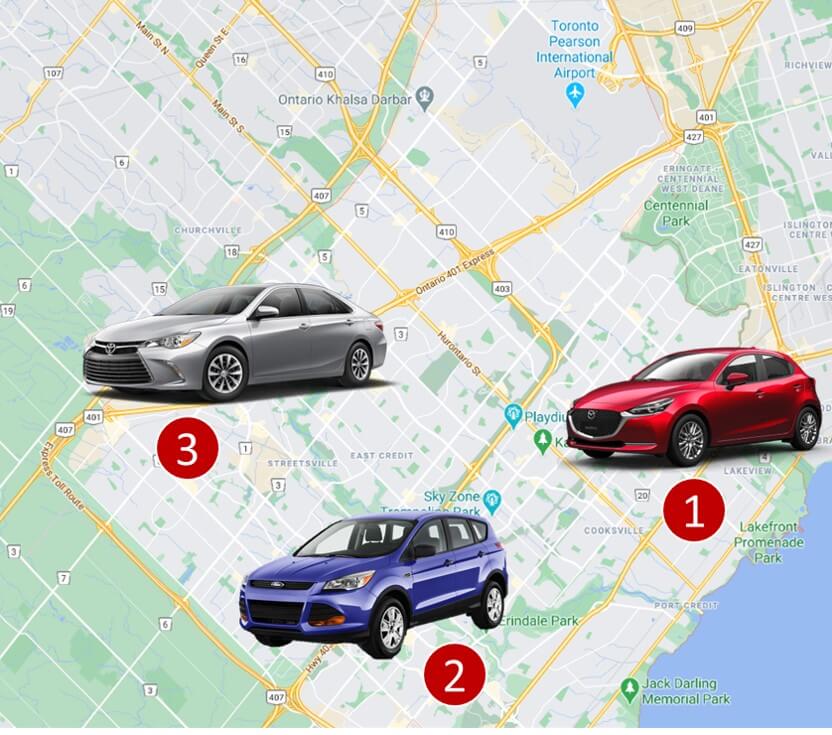

Mississauga Car insurance quotes, examples

Sample car insurance quote #1:

A female driver, 45 years old, lives in Mississauga, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2018 Mazda 3 GX, CAA member, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $2,000,000

$82 per month ($980 annually)

Sample car insurance quote #2:

A female driver, 52 years old, lives in Mississauga, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2014 Ford Escape, collision-only coverage (no comprehensive); Policy: $1,000 deductible, 3rd party liability – $1,000,000

$63 per month ($751 annually)

Sample car insurance quote #3:

A female driver, 34 years old, lives in Mississauga, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2016 Toyota Camry, comprehensive coverage (including collision); Policy: $1,000 deductible, 3rd party liability – $1,000,000

$131 per month ($1,572 annually)

Car casualty rates in Ontario (including Mississauga)

Based on casualty statistics from Transport Canada (2018), Ontario drivers appear to be quite safe when compared to other provinces.

| Province | Fatalities per 100,00 licensed drivers | Injuries per 100,00 licensed drivers |

|---|---|---|

| NU | 74.2 | 928.0 |

| YT | 24.1 | 681.1 |

| SK | 15.8 | 517.5 |

| PE | 13.2 | 573.8 |

| NS | 10.2 | 978.9 |

| NB | 9.0 | 484.3 |

| AB | 9.0 | 530.0 |

| BC | 8.0 | 555.7 |

| MB | 7.6 | 1310.0 |

| NT | 7.6 | 382.5 |

| Canada | 7.2 | 575.0 |

| NL | 6.6 | 460.8 |

| QC | 6.4 | 622.1 |

| ON | 5.8 | 491.3 |

Car Insurance in Mississauga – what you must know

- In Ontario and Mississauga, car insurance is mandatory.

- Every insurance policy includes mandatory liability. This is required by law. In Ontario it is $200,000.

- Here are some further benefits you can expect from car insurance in Mississauga, Ontario:

- Disability income benefits: Based on your gross income, 70% up to a maximum of $400 weekly.

- Non catastrophic injuries: The standard maximum for services that help you recover (such as physiotherapy, chiropractic treatments, a health aide, or medical rehabilitation) is $65,000.

- $1,000,000 is the standard maximum for catastrophic injuries.

- Caregiver benefits are $250 weekly for the first dependant. Should there be additional dependents, a further $50 per week per dependent may be added.

- Should your injuries prevent you from routine housekeeping and home maintenance, you may be eligible for benefits that allow you to hire out this service. The maximum for this benefit is $100 per week.

- The standard benefits in the case of death are $25,000 to your eligible spouse, $10,000 to each dependant, and a maximum of $6,000 for funeral expenses.

What cars are the least expensive ones to insure?

Some cars are less likely to get into an accident or, if involved, the associated costs are lower. Here are examples of cars (model years 2014-2018) that cost less than others to insure.

- Smart Fortwo

- Ford F150

- Nissan Frontier

- Chevrolet Tahoe/Yukon

- Chevrolet Silverado/Sierra

- Fiat 500

- Ford Mustang Convertible

- Jeep Wrangler

- Buick Encore

- Honda CR-V

- Jeep Compass

- Chevrolet Equinox/Terrain

- Nissan Xterra

- Honda Pilot

- Hyundai Accent

Please note that the car model is just one of the variables defining your insurance rates. Your personal driving history impacts your rates by far more than the make and model.

5 Car Insurance myths to know

Myth #1: Red cars are more expensive to insure

This is a classic and persistent myth but it’s not true. The colour of your car has no impact on your premium, so go ahead and choose your favourite colour!

Myth #2: Car insurance rates for cheaper cars are lower

Cheaper cars do not necessarily mean cheaper insurance. Your driving record and the history of the vehicle’s performance are also considered. In fact, the Honda Civic typically has higher insurance rates than more expensive models.

Myth #3: Insurance works in the same way across Canada

Not only do rates vary significantly across provinces, there is a difference between those that use no-fault, at-fault, or a mix of both systems as well. The fault systems determine whose insurance company pays for a claim, and dictates the ability of the driver to sue. In some provinces, only one company provides insurance (for example, MB, SK and BC have MPI, SGI and ICBC respectively). In other provinces, insurance is a private venture and drivers have several options.

Myth #4: If you get into an accident once or get a ticket, your insurance rates will always stay high

Typically, accidents and tickets are removed from your record after three years, which can help bring down your rate.

Myth #5: If I have comprehensive coverage, I can always expect to get OEM (original equipment manufacturers) parts for my vehicle

To keep the cost of claims down, insurers make use of aftermarket and recycled parts. If you only want OEM parts, ask if an additional rider is necessary on your policy to cover this cost. Be sure to read your policy carefully so you know if OEM is covered by the main policy or not.

Frequently Asked Questions (FAQ): Car Insurance in Mississauga

In general, car brands like Hyundai, Nissan, Ford, Buick, Chevrolet, and Jeep are on the cheaper side of insurance rates, whereas various series of BMW, Mercedes-Benz, Audi, and Lexus tend to cost more. No surprise – these are more expensive cars that drive higher repair costs. Check the tables above for the exact makes/models.

Though car insurance rates in Mississauga are not as high as in Brampton, ON, they are still among the highest in the province with average insurance rates ranging between $1,800 and $2,300 per year. Areas around City Centre, Fairview, Cooksville, and Britania East Business Park tend to be more expensive. Car insurance rates along waterfront in such areas as Lakeview, Port Credit, Lorne Park Estates, Glen Leven, Clarkson, and Rattray Park Estates are somewhat lower.

Our proprietary insurance review platform has been collecting independent consumer reviews for different insurance and financial products since 2012 and has thousands of insurance reviews. Click here for free access to all our car insurance reviews.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]