Get a free Funeral Insurance quote from 20+ Canadian insurers

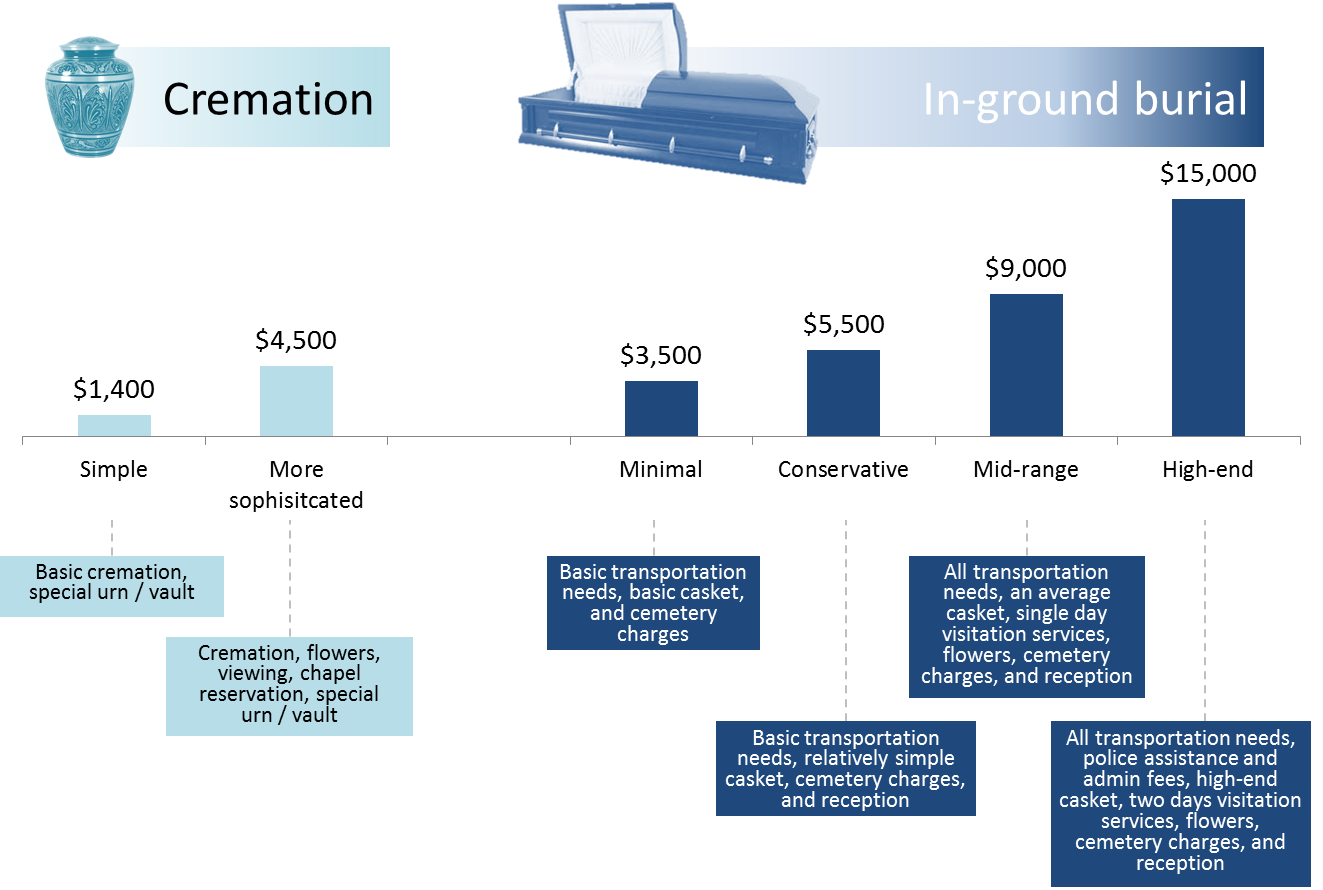

Here is a general overview of the different levels of funeral costs that affect funeral insurance in Canada, based on some online data we’ve collected:

- A simple cremation in Canada can range between $600 and $3,000 depending on the province. Toronto is around $1,400, and some areas of Quebec are around $600.

- More sophisticated or involved cremation ceremonies that include flowers, a viewing, chapel reservation, special urn or vault can go up to $4,500.

- Minimal funeral costs for a traditional interment start in the $3,000- $4000 range, and include a basic casket, cemetery charges and basic transportation needs.

- A conservative, low-end, low-key traditional funeral approach can still cost approximately $5,500, which still includes basic transportation needs, relatively simple casket, cemetery charges and a reception.

- A mid-range funeral plan that includes all transportation needs, an average casket, single day visitation services, flowers, cemetery charges and a reception runs around the $9,000 mark.

- The high-end funeral plan averages around $15,000 and tends to include all transportation needs, police assistance and admin fees, high-end casket, two days visitation services, flowers, cemetery charges and a reception.

It is interesting to know that 65% of Canadians choose cremation making it the most popular funeral type in Canada today

It’s also interesting to know that according to the law, all funeral establishments in Ontario must be able to offer a low-cost service solution called a “direct disposition,” which includes a minimal set of activities such as body transfer from the place of death, putting body into a casket, delivery of body to a cemetery or crematorium and filing of the complete paperwork. This is not true across the country, however, so plan accordingly when looking into funeral insurance in Canada.

What funeral insurance options do you have?

What funeral insurance options do you have?

There are three options that provide funeral insurance plans in Canada, and the choice will depend on your health condition and any existing pre-conditions at the time of the policy.

1. Standard Life Insurance Policy

Also called traditional life insurance or term life insurance, this will offer funeral insurance in Canada, and requires both a medical exam and answering a detailed health questionnaire. This is a good choice if you do not have any serious pre-existing health conditions and are in good overall health.

2. Simplified Issue Life Insurance

This does not require a medical exam to obtain funeral insurance in Canada, but there is still a medical questionnaire to reply.

3. Guaranteed Issue Life Insurance

This does not required a medical exam nor a medical questionnaire to qualify for funeral insurance in Canada. Anyone can qualify, but this life insurance generally comes with higher fees and smaller coverage. There is typically a two-year probationary period, whereas if you die within two years of buying this policy, your claim will not be paid.

Insurance Tips to get the Best Funeral Insurance in Canada

The many ways that you save on life insurance also apply to saving on funeral insurance in Canada as well. Things like being in good health, being a non-smoker, and having a normal BMI (body mass index), can all factor in.

You should also consider some other aspects relevant to funeral insurance in Canada:

- Know exactly what your funeral expenses will be so you can buy the appropriate coverage. Don’t wing it. Plan. The difference in fees between a $5,000 and $15,000 policy can be very substantial.

- Consider your health condition. If you are in good health, apply for traditional life insurance because it is the most affordable.

- Use an insurance broker, not an agent. Insurance brokers have access to policies from multiple insurers and can shop for the best insurance policy for you.

Allow us to help you connect with an experienced, unbiased life insurance broker who can guide you through all funeral insurance Canada options available to you and help to choose the best one for your lifestyle.

Sources:

Ogden Funeral Home

The Board of Funeral Services Ontario

CanadianFunerals.com

What funeral insurance options do you have?

What funeral insurance options do you have?

Funeral Insurance in Canada: 5 Things You Must Know

April 14, 2016 at 6:47 pm[…] of $5,000 is appropriate. For burials, coverage of $10,000 – $15,000 is best. Here is a more detailed overview of funeral costs in Canada. A Toronto Star article provides additional insights about burial and cremation costs in […]