Get a free Funeral Insurance quote from 20+ Canadian insurers

What are the Recent Changes Related to Funeral Insurance in Nova Scotia?

In the past, seniors had a chance to ensure their funerals were being taking care of via a payment into a funeral trust (also called a “pre-need program”), which kept money to pay for the final expenses. A negative side of this process was that a family might need to pay extra costs (cost remainder) when a person died (e.g. if a pre-paid amount was not high enough).

Now, funeral insurance plans can be sold directly in a funeral home. This provides more flexibility and gives families more options when it comes to funeral costs. Once coverage and other key aspects of the funeral insurance plan are decided, the amount is locked in and can be used once needed.

This new change is aligned with the way Alberta, British Columbia, Ontario, Quebec, Manitoba and Saskatchewan handle funeral insurance. Nova Scotia is the first Atlantic province to follow this path.

This new regulation can be see in details here in Cemetery and Funeral Services Regulations. One must note that the new regulations focuses on funeral insurance plans as opposed on life insurance quotes sales in general as per Canadian Life and Health Insurance Association.

In the past, seniors had a chance to ensure their funerals were being taking care of via a payment into a funeral trust (also called a “pre-need program”), which kept money to pay for the final expenses. A negative side of this process was that a family might need to pay extra costs (cost remainder) when a person died (e.g. if a pre-paid amount was not high enough).

Now, funeral insurance plans can be sold directly in a funeral home. This provides more flexibility and gives families more options when it comes to funeral costs. Once coverage and other key aspects of the funeral insurance plan are decided, the amount is locked in and can be used once needed.

This new change is aligned with the way Alberta, British Columbia, Ontario, Quebec, Manitoba and Saskatchewan handle funeral insurance. Nova Scotia is the first Atlantic province to follow this path.

This new regulation can be see in details here in Cemetery and Funeral Services Regulations. One must note that the new regulations focuses on funeral insurance plans as opposed on life insurance quotes sales in general as per Canadian Life and Health Insurance Association.

What Size of Funeral Insurance Coverage You Should Consider?

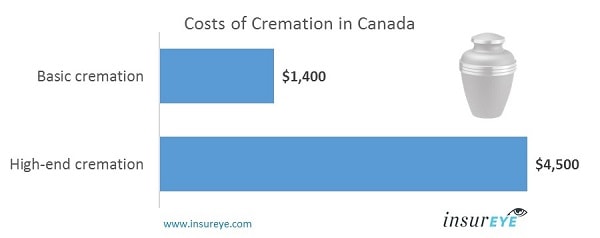

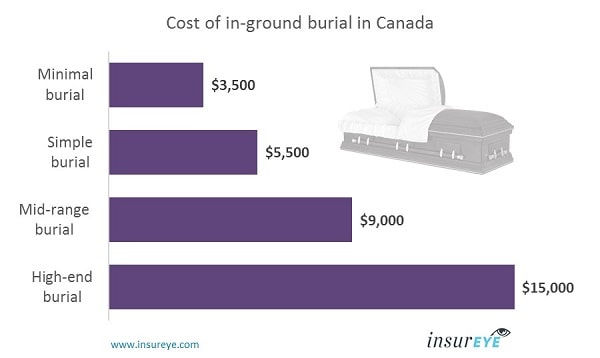

The main objective of funeral insurance (also called final expenses insurance or burial insurance) is to cover final expenses. First, let’s look at cremation as a cheaper option and the most popular type of funeral in Canada (65 per cent of Canadians prefer cremation to burial). The range of final expenses that you should be planning for is between $1,400 (basic cremation in a special urn or vault) and $4,500 (cremation, flowers, chapel reserved for viewing etc.). If you want an in-ground burial, that option quickly becomes more expensive. The price ranges between $3,500 (basic transportation, basic casket and a few cemetery charges) and $15,000+ (high-end burial with transportation, administration fees, expensive casket, flowers, visitation services, cemetery charges, reception, etc.).

If you want an in-ground burial, that option quickly becomes more expensive. The price ranges between $3,500 (basic transportation, basic casket and a few cemetery charges) and $15,000+ (high-end burial with transportation, administration fees, expensive casket, flowers, visitation services, cemetery charges, reception, etc.).

More details on what exactly each type of in-ground burial covers can be found in this article.

Equipped with these numbers, you should be able to choose the right amount of coverage when getting a funeral insurance quote or a burial insurance quote to ensure that your loved ones do not carry a burden of unexpected expenses.

More details on what exactly each type of in-ground burial covers can be found in this article.

Equipped with these numbers, you should be able to choose the right amount of coverage when getting a funeral insurance quote or a burial insurance quote to ensure that your loved ones do not carry a burden of unexpected expenses.

What do These New Changes Mean?

There are several things are impacted by these changes.-

- Consumer’s choices: Having a variety of funeral insurance plans available means that seniors and their families can choose from many different plans, therefore having a choice of different options that better suit their wishes.

- Potentially lower prices: Increasing competition puts pressure on insurers to offer competitive pricing. With many funeral plans available, costs will definitely be something that people will be looking at. In many cases, it is possible to get a funeral insurance quote online to get an idea of potential costs.

- Defined “emergency” mechanisms: Funeral plans are not funeral-home specific and, if a particular funeral home goes bankrupt, can be transferred to other establishments.

Free, no-obligation funeral insurance quote for you

Important: By submitting this quote, you confirm that contact data is correct

- Flexibility of payments: Insurance companies offer more flexible payments options – these can be tailored to the needs of policyholders.

- The need to look after details: Insurance policies can be complex and have a number of constraints and limitations. A policyholder and his/her family should make sure they fully understand the funeral insurance quotes and documents they sign.