Introduction

There were many articles written about men paying more for car insurance than women, but what about other insurance types? Do women always benefit from lower insurance rates? We took on this question and systematically went through various life insurance, disability insurance, and critical illness insurance by consulting with professionals who had the answers.

So, let’s dive in.

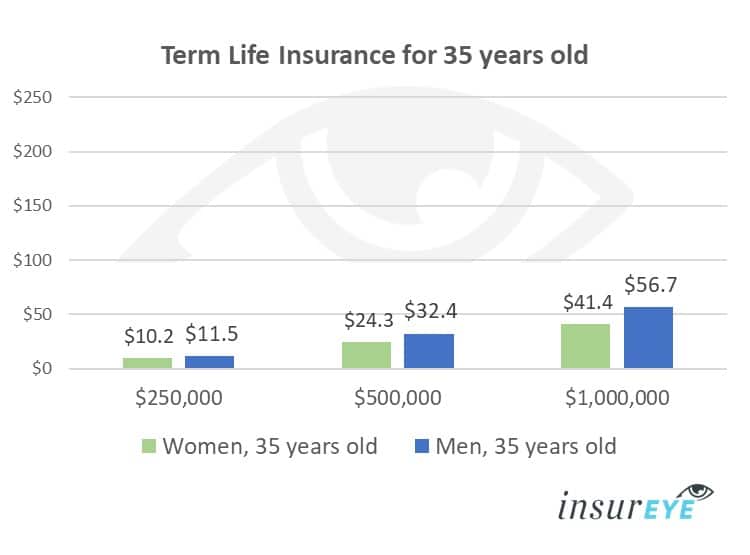

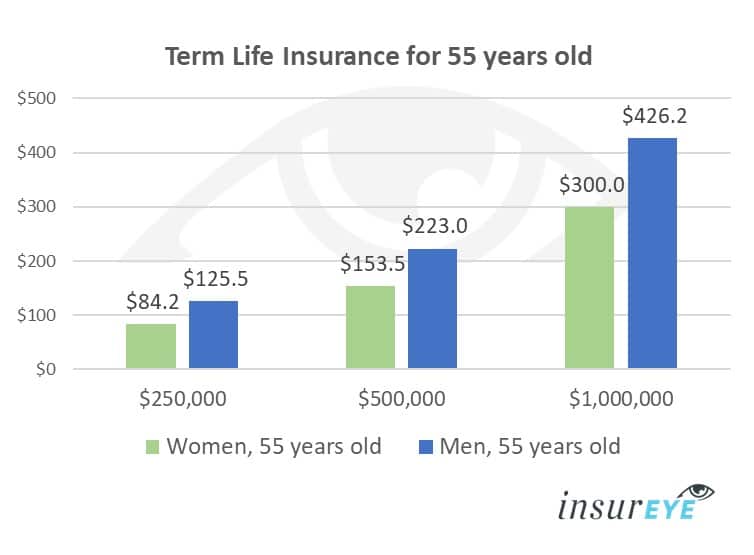

Life Insurance: Men Pay More Than Women

No surprise here – life insurance for women is usually more affordable than for men. The difference in quotes is significant – often men pay 30% more than women (as the example below shows). In this and other examples, we compare insurance rates for a 35-year-old man and woman, and a 55-year-old man and woman.

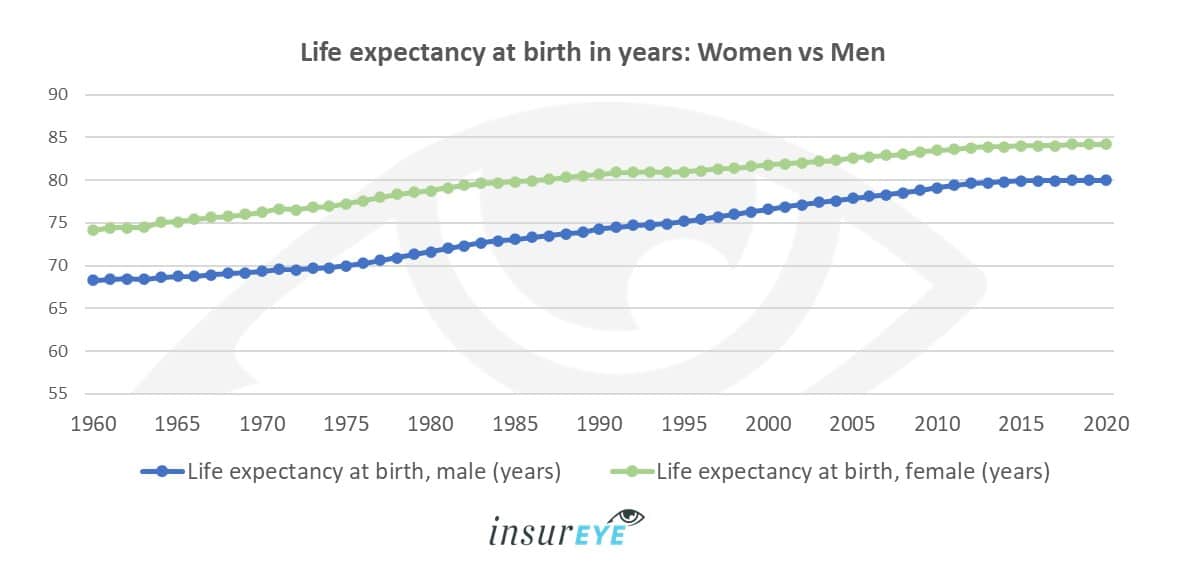

Statistically, women live longer than men – in official terms, life expectancy at birth for Canadian men is around 80 years whereas it is 84.2 years for women (as per IBRD-IDA data at the World Bank). These numbers grew significantly in the last 50 years, but there is still a clear gap in life expectancy between men and women in Canada.

Also, in terms of hobbies (car racing, martial arts, sky diving) or jobs (construction workers, bomb squad, firefighters) men often stay on the dangerous side, contributing to statistics that are less favourable for men.

It is important to mention one particular sub-set of life insurance policies: guaranteed life insurance policies (or in insurance language, guaranteed issue life insurance policies). These are life insurance policies that come without any medical exams and without a medical questionnaire. Everybody can qualify but there are a few hidden traps: coverage amounts are low, coverage cost is high, and you are not protected should something happen during the first two years a policy is in place.

Since there are no questions to answer, guaranteed issue life insurance policies cost the same for men and women with most companies (e.g., Edge Benefits) but there are a few exceptions to the rule (e.g., Canadian Protection Plan does consider gender for its guaranteed life insurance policies).

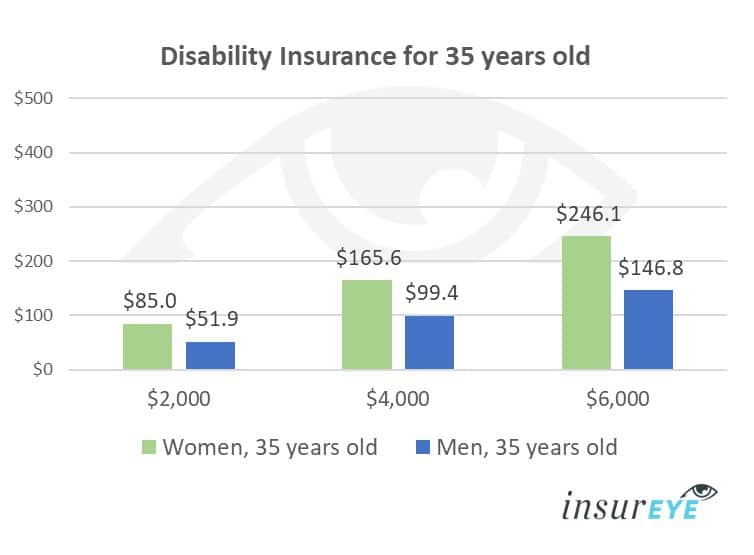

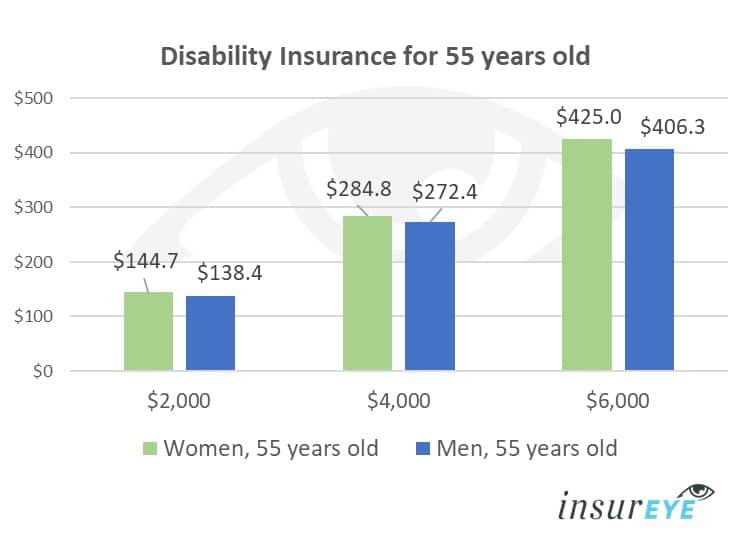

Disability Insurance: Women Pay More Than Men

The tables turn when talking about disability insurance. That is where men have their edge – they enjoy better insurance rates than women. It is worth mentioning that the difference is the largest in the younger years and slowly decreases over time.

As a reminder, disability insurance pays a defined monthly benefit for a pre-determined period, should a policyholder become disabled.

Again, let’s compare insurance rates for 35- and 55-year-old men and women for various disability benefits of $2,000, $4,000 and $6,000 monthly.

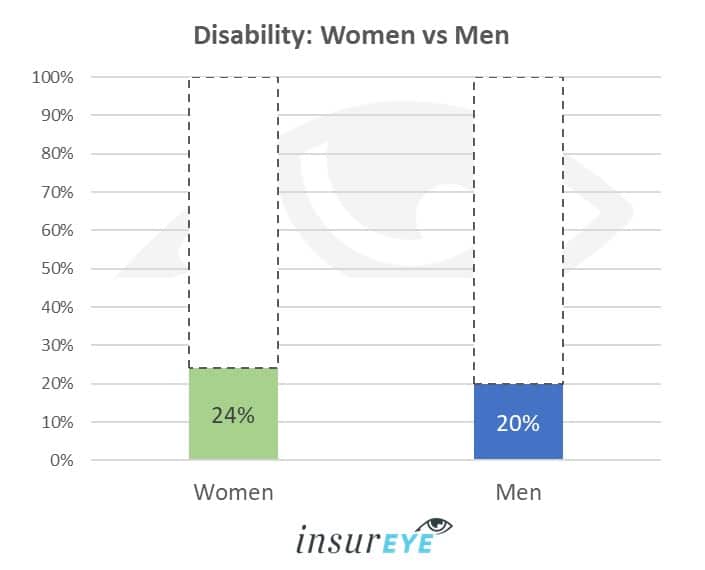

The sad reality is that women have a higher probability of disability in Canada. Number-wise, 24% of women in Canada have a disability, whereas it is only 20% for men (when looking at the population 15 years old and over as per Learning Disabilities Association of Canada.

It is important to remember that the majority of disability cases do not come from physical disabilities, but from disabilities related to mental health and learning.

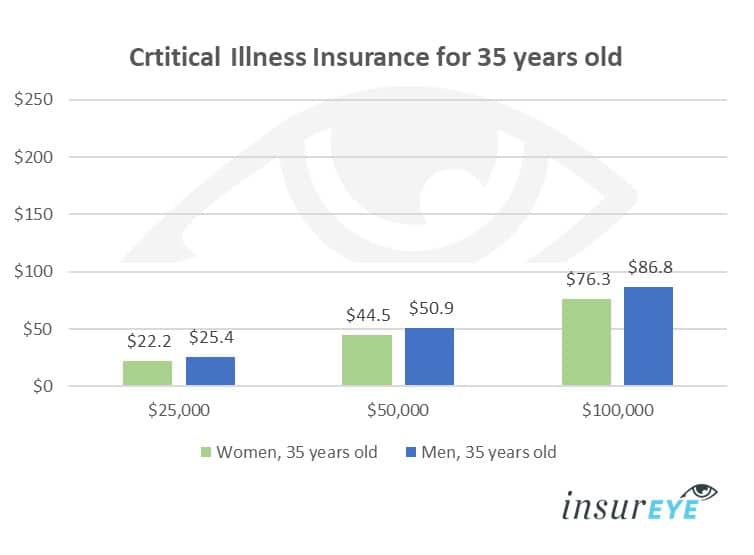

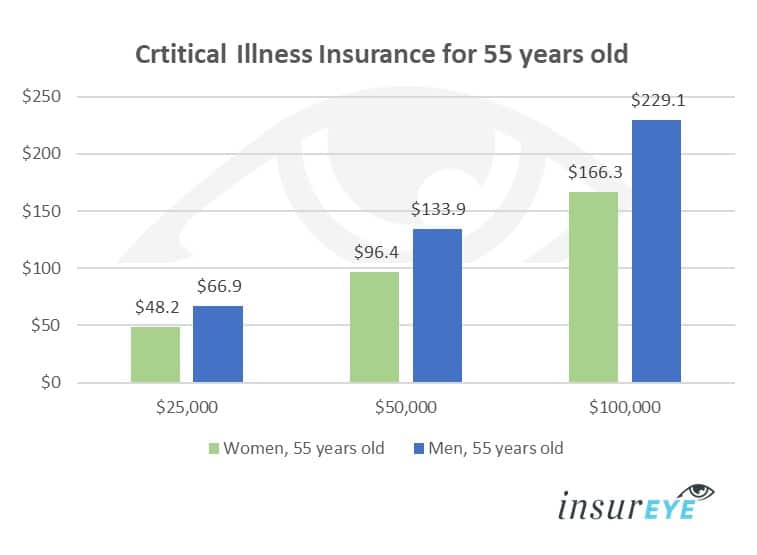

Critical Illness: Men Pay More Than Women

When talking about critical illness insurance, the tables turn again and, typically, women benefit from better insurance rates. The difference is fairly small in the younger years, but the gap increases with age.

As a reminder: critical illness insurance pays a clearly defined one-time lump sum benefit, should a policyholder be diagnosed with one of the critical illnesses listed in the policy. The policyholder can decide how to spend this one-time benefit, such as getting out-of-province treatment, covering loss of income, etc.

Again, let’s compare critical illness insurance rates for 35- and 55-year-old men and women for various critical illness insurance coverage amounts (as a lump sum): $25,000, $50,000 and $100,000.

The three most frequent critical illnesses are heart condition/heart attack, cancer, and stroke though the full list of critical illnesses can cover over 25 different conditions.

The occurrence of critical illness is still higher across men than women and that drives typically higher critical illness rates. Here are a few stats:

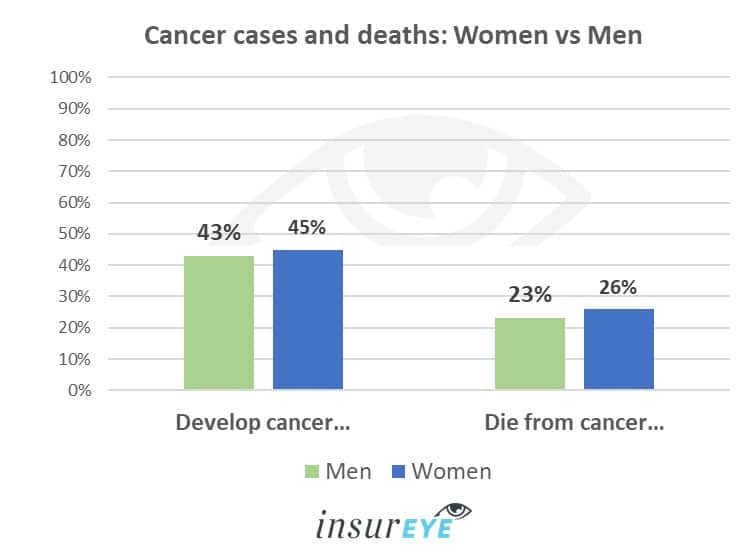

- Cancer: 45% of men and 43% of women are expected to develop cancer throughout their life in Canada; 26% of men and 23% of women are expected to die from cancer in Canada – as per the Canadian Cancer Society (see below).

- Heart condition/heart attack: As per Health Canada, men are two times more likely to face a heart attack than women. The first heart disease diagnosis (in many cases, the first heart attack) happens for men approximately 10 years earlier than for women.

- Stroke: As per Ontario Stroke Network, men have a slightly higher stroke risk than women.

It is important to mention one particular sub-set of critical illness (CI) insurance policies: guaranteed policies (or in insurance language, guaranteed issue critical illness insurance policies). These are CI policies that come without any medical exams and without a medical questionnaire. Everybody can qualify but there are a few hidden traps: coverage amounts are low, coverage cost is high, and most guaranteed issue critical illness policies have what is called a pre-existing condition clause. What this means is that in the first 24 months of the in-force policy, if your claim is for an illness you consulted with a doctor in the 2 year period prior to the policy issue date, depending on when that consultation occurred, they may not pay the claim. Once the illness claimed is beyond the 24 month period, the insurance company will pay.

Similar to life insurance, guaranteed critical illness insurance policies cost the same for men and women with most companies (e.g., Edge Benefits) but, again, there are exceptions to the rule (e.g., Canadian Protection Plan does consider gender for its guaranteed critical illness insurance policies).

Life Insurance for Non-Binary People

There are a number of people who identify with a different gender than they were at birth. Typically, insurance companies still use the term “gender-at-birth.” If a person is female though she was born a man, insurance companies will consider that, for the purpose of the application and calculation of premiums, the gender is to be male – meaning higher life insurance premiums.

Obviously, if a person is male but were born a woman, it means benefiting from lower life insurance premiums due to a different gender at birth.

There is always an option to opt-out for a no medical life insurance where rates are gender-neutral (with a few exceptions), but that would mean increased premiums for the same amount of coverage than compared to traditional life insurance.

The most important aspect here is to work with an insurance professional (agent, broker, financial planner) who is sensitive to the particular needs of non-binary applicants.

About the authors:

We thank experienced insurance professionals Richard Parkinson and Lorne Marr for their insights.

Richard Parkinson is an independent insurance broker with deep knowledge in life insurance, disability insurance, critical illness insurance, long-term care insurance, and annuities. He began his life insurance career in 2003, initially with London Life, and ultimately as an independent broker, is contracted with 23 companies, and licensed in 7 provinces.

Lorne Marr is the head of LSM Insurance. He started in the life insurance industry in 1993 with Metropolitan Life after completing his MBA at the University of Windsor. He has won numerous sales and services awards and has appeared in the Toronto Star, The Globe and Mail, The National Post, The Toronto Sun, The Investment Executive, and Money Sense Magazine.

Special Needs Insurance Policy Expense for Males And Female: That Pays Even More - Good Life Family Awareness

December 14, 2022 at 9:22 am[…] Prior to we begin, do not fail to remember to have a look at an additional write-up on exactly how critical illness insurance rates and life insurance rates compare for men and women. […]