Get a free Life Insurance quote from 20+ Canadian insurers

Life insurance. It’s

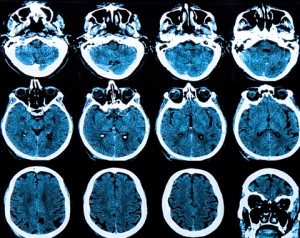

What is Parkinson’s Disease?

Parkinson’s disease is a progressive disorder of the nervous system that impacts the motor system. The disease results from the death of cells in a particular region of the midbrain, known as the basal ganglia, as well as a deficiency of dopamine, a neurotransmitter. Parkinson’s develops gradually, beginning with barely noticeable symptoms, like a tremor in one hand or stiffness and slowing of movement. It may also affect soft or slurred speech. As the disease progresses, its symptoms worsen. Unfortunately, there is no cure for Parkinson’s yet; however, medications and even surgeries have been developed to help with symptoms, and researchers are optimistic about finding a cure in the close future. Despite a diagnosis, it is still possible to get life insurance for Parkinson’s patients; however, the stage of the disease dictates the type of the policy available.

It is absolutely possible to get life insurance with Parkinson’s disease

While it is entirely possible to get life insurance for Parkinson’s patients, the ability to get life insurance and the types of policies available for patients of Parkinson’s disease all depend on the stage of the disease. In the early stages, when the patient experiences local tremors but does not yet require treatment, Parkinson’s patients may qualify for standard rates. In the more advanced stages, however, when the patient experiences more extensive tremors that require medical treatment, a Parkinson’s patient can qualify for guaranteed issue life insurance.

What is guaranteed issue life insurance?

Guaranteed issue life insurance is also known as non-medical life insurance. It does not require any health-related tests or any blood work in order for individuals to be approved. Insurance premiums for guaranteed life insurance policies typically tend to be higher, but clients need only reply to several health-related questions in a questionnaire, and most insurers will not even ask about Parkinson’s disease. It is important to note that, with guaranteed issue life insurance, if a Parkinson’s patient dies within the first two years, the claim will not be paid.

How do you get started to find life insurance for Parkinson’s patients?

It is important that you start looking into insurance policies as soon as possible in order to get the best life insurance coverage for Parkinson’s patients who’ve been recently diagnosed; however, it is even more important that you work with a skilled insurance broker—one who knows well the types of policies available, as well as one who will work together with companies who provide this type of coverage. Experienced insurance brokers can ensure you get the best possible coverage so you have one less thing to worry about as you focus on fighting the disease.

An experienced insurance broker can also help with getting insurance quotes for very specific insurance types such as e.g. cheap funeral insurance.

Source: www.mayoclinic.org