Get a free Life Insurance quote from 20+ Canadian insurers

Relax.

MS is a pre-condition but it doesn’t prevent you from getting insurance. In fact, not only are you insurable, the rates can be very reasonable too.

Let us show you how.

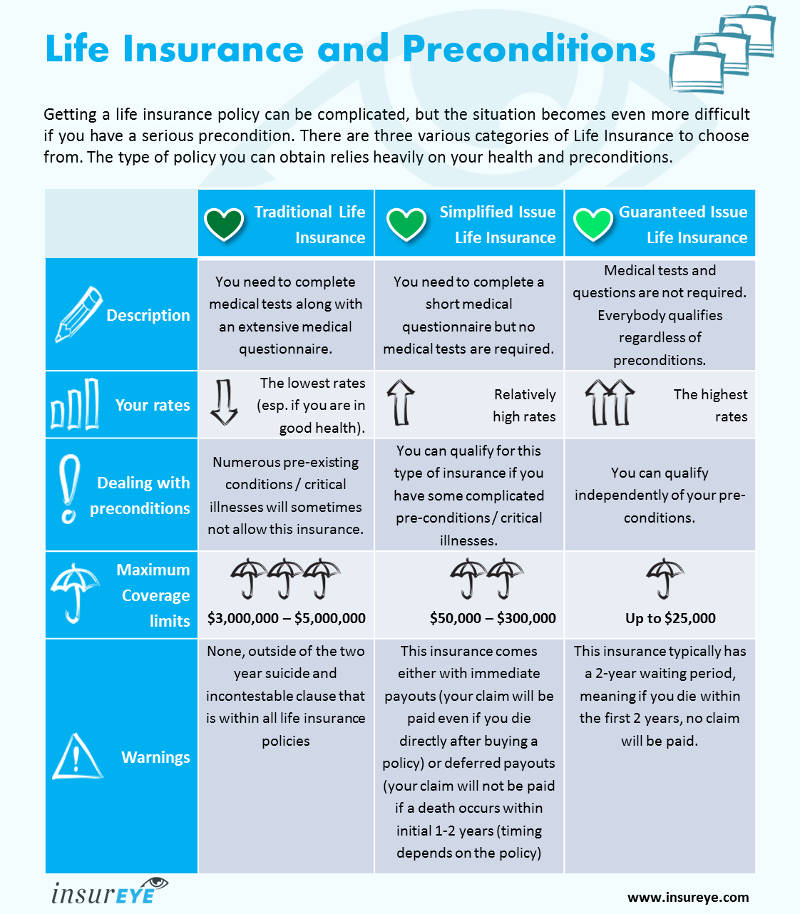

Different Types of Life Insurance Policies

To help insurers manage risk – and to make sure everyone can obtain life insurance even if they have a pre-condition like MS, insurance companies provide three distinct types of life insurance policies: standard/traditional, no medical simplified issue, and no medical guaranteed issue.

- Standard life insurance: the most affordable with the highest coverage (typically up to $5,000,000); standard insurance requires medical tests and questionnaires. Find out more here…

- No medical life insurance – simplified issue: more expensive than traditional but with coverage up to $300,000, simplified issue lets you skip the medical tests, which is great if you are in the early stages of a pre-condition. You just have to truthfully answer some medical questions. Find out more here…

- No medical life insurance – guaranteed issue: No medical questions and no medical tests means everyone gets approved, however this policy costs the most out of the three. You get coverage up to $25,000 and a two-year waiting clause. It is important to note that if a MS patient dies within the first two years of a guaranteed issue policy, the claim will not be paid. Find out more here…

So which policy is the best for MS patients? The answer is – it depends.

Traditional insurance can be offered to MS patients if they are in the early stages of the disease or if the disease is under control. If it is more advanced, a no medical policy is the best solution.

No medical guaranteed issue life insurance is costly, but the benefit greatly reduces the financial impact of treatment and final costs. Do a comparison of funeral costs against not having coverage and you’ll quickly see that guaranteed issue life insurance premiums costs less than the financial burden of not having coverage. This is a great option for those living with advanced stages of MS.

No medical simplified issue life insurance is a wonderful option for those that are past the initial stages of MS, but are not yet severely impacted. It’s more affordable than guaranteed issue and, once again, is a huge (and cost-effective) relief against the financial burden of medical and final costs.

Our overview will provide more details about different life insurance coverage types.

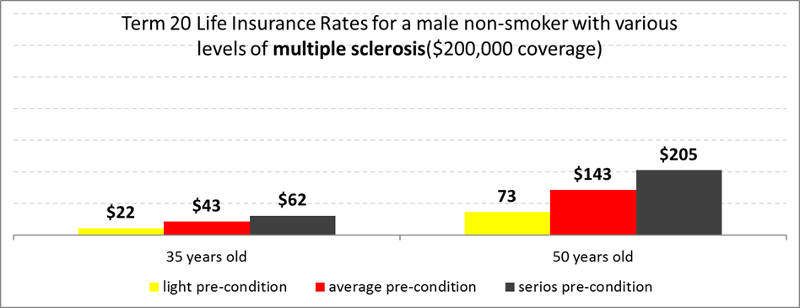

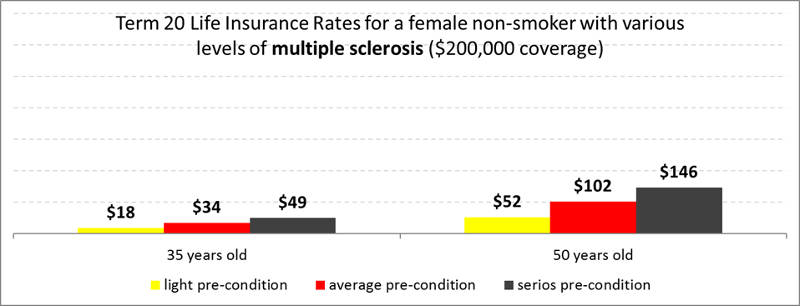

Rates for Standard Multiple Sclerosis Life Insurance

Policy rates are dependent on how your MS is classified: light, average or serious. Review the charts below for average rates based on age and condition status.

Monthly rates for men aged 35 years old usually range between $22 and $62; monthly rates for men aged 50 years old typically range between $73 and $205.

Monthly rates for women aged 35 years old usually range between $18 and $49; monthly rates for women who are 50 years old typically range between $52 and $146.

Note that these rates are for non-smokers. Rates for smokers are higher because smokers present a much higher insurance risk – whether or not they have pre-conditions. We’ll address this in more detail below.

If you have MS, your best line of financial defense is to contact an insurance broker that is familiar with underwriters specializing in pre-conditions.

Multiple Sclerosis Aspects to Consider

Age and condition are not the only factors insurers will assess. In addition to the type of policy (Term 10, Term 20, whole life, etc.), your age and your gender, underwriters also want to know:

The date of your MS diagnosis:

- The further back you were diagnosed, the better – because it proves you are coping with the disease over the span of several months or years.

- If you have an active lifestyle: The more active your lifestyle is, the healthier you are in the eyes of a life insurance company, and that means lower insurance rates.

If you have a less serious form of MS: There are various forms of MS and, depending on the type and stage, an insurer can see you as a higher or lower risk. For example, should you have a not worsening relapsing-remitting MS (RRMS), it will be rewarded with better rates than if you have progressive-relapsing MS (PRMS). Find out more about your MS stage here.

If you are a non-smoker: It does not matter if you have MS or not – smoking will always increase your life insurance rates. The next section will provide an overview of MS life insurance rates for smokers.

If you are interested in this topic, you can connect with an experienced insurance broker to discuss your MS case, or the case of a friend or family member.

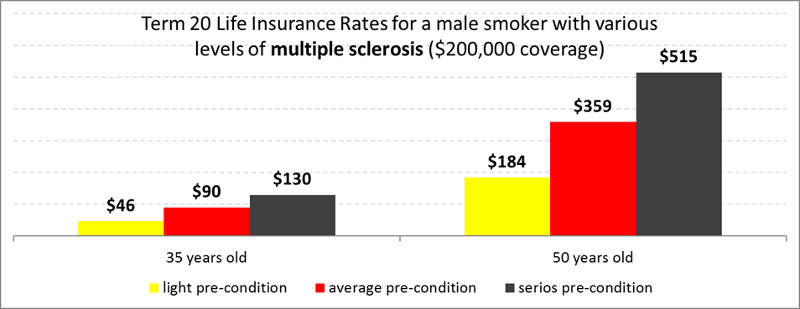

Multiple Sclerosis Life Insurance and Smoking

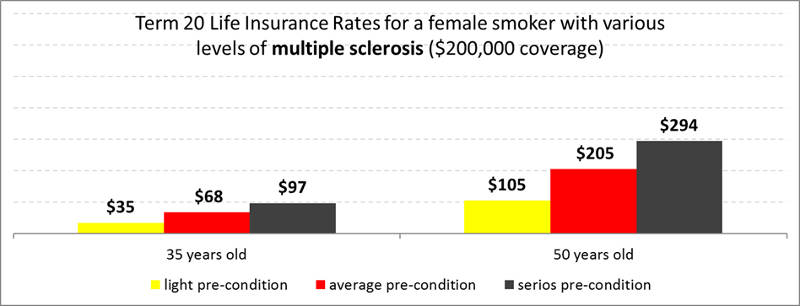

As you can see on the charts below, smokers can expect their rates to be about double what their non-smoking counterparts will pay. To get the best rate possible if you smoke and have MS, contact a life insurance broker.

Monthly rates for male smokers who are 35 years old usually range between $46 and $130, while monthly rates for male smokers who are 50 years old are between $184 and $515.

Monthly rates for female smokers who are 35 years old usually range between $35 and $97, while monthly rates for female smokers who are 50 years old are between $105 and $294.

How to Get MS Life Insurance

An experienced life insurance broker will help you get a life insurance quote even if you have a pre-condition like MS. Not only will a broker get you a quote, they will get one specifically tailored for your situation.

The advantage of brokers is that they have access to all the life insurance products on the market, unlike captive agents that can only sell the products of one company. Brokers’ wide range of access means they can give you an unbiased rate and several options. Even better, it does not cost you anything because brokers are paid via commissions on the products they sell!

Remember, an experienced life insurance broker can offer feasible solutions for any stage of MS: relapsing-remitting MS (RRMS), secondary-progressive MS (SPMS), primary-progressive MS (PPMS), or, even, progressive-relapsing MS (PRMS).

Let us connect you with an experienced life insurance broker today so you have one less thing to worry about if you have MS.

Learn More About Pre-Existing Conditions and Life Insurance

Want to learn more about life insurance and diabetes, life insurance and HIV/AIDS, life insurance and cancer, life insurance and multiple sclerosis, or life insurance and depression? Our infographic provides a detailed overview of how to get life insurance when you have a pre-condition.