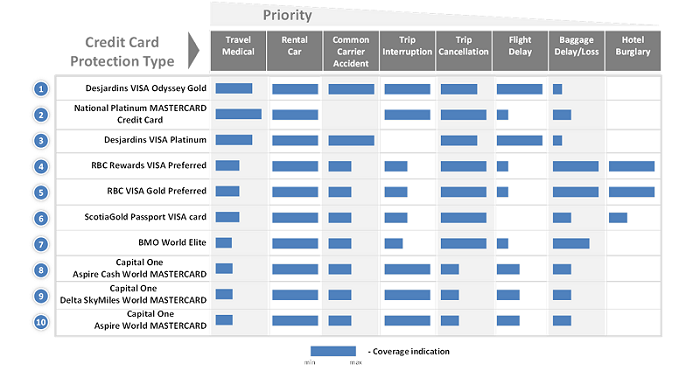

To identify the best credit cards for travellers, Canadian company InsurEye has used its Credit Card Navigator and proprietary consumer-driven data to analyze more than 160 Canadian credit cards, creating a ranking of the top 10 credit cards for Canadian travelers.

Top Five Travel Credit Cards

1. Desjardins VISA Odyssey Gold: Offers the highest protection for almost every travel-related insurance need. In addition, it extends coverage to senior card holders.

2. National Platinum MASTERCARD: Has the best medical travel protection in respect to coverage length (60 days for person aged under 54), but it has no Common Carrier Accident protection. Options for seniors are also included.

3. Desjardins VISA Platinum: Very similar to the VISA Odyssey Gold, but doesn’t offer Trip Interruption protection and costs an additional $59 per year compared to the top card in our list.

4. and 5. RBC Rewards VISA Preferred and RBC VISA Gold Preferred: These two are tied. They both have an identical average weighted rank and offer extensive Baggage Delay and Hotel Burglary protections. On the other hand, coverage for important protection, such as Travel Medical insurance and Common Carrier Accident, is significantly lower in comparison with the top three cards.

Travel Insurance… At a FEE

The typical annual fee for travel credit cards can range from $110 – $170. Don’t expect extensive travel insurance from low-cost or free credit cards. The only exceptions here are several Desjardins cards (Elegance Gold and Modulo) which offer extensive travel protection… but for only for very short trips of 3 days, which amounts to a long weekend. However, the chances that one of the pricier credit cards has already made it into your wallet are quite good, and one trip to the doctor while abroad could make the card pay for itself.

Inside the Analysis

In order to compare the cards, InsurEye analyzed the 8 travel protections: Medical Emergencies, Rental Car Accident, Common Carrier Accident, Trip Interruption, Travel Cancellation, Flight Delay, Baggage Delay or Loss, and Hotel Burglary.

Each protection was evaluated based on two factors:

- Importance of protection, based on potential costs of accident, i.e.: A medical bill from abroad could be pricey

- Level of protection, i.e.: Travel medical protection for 6 days is worth less than for 60 days

The chart below offers an overview of the results. Did your card make it into the Top 10 Canadian Travel Credit Cards? If not, check InsurEye’s free Credit Card Navigator tool, which will show you the travel perks offered on your cards.

Magnifying the Fine Print

There are several flags we need to raise about the technicalities of credit card travel insurance:

- Rental car insurance on credit cards only covers collision damages, NOT your liability (you damage someone’s property or health) or your incurred injuries

- If you have any health issues prior to the trip (e.g. treatment or sometimes even visits to the doctor), they can impact availability of your protection. Check the details of your insurance

- Nearly all types of credit card insurance are activated only if you pay for the corresponding services with the credit card and keep your bill (e.g. renting a car, booking flight tickets)

- Many cards have limitations for travellers aged 55+. The insurance protection can be reduced or not available.

Dmitry Mityagin, co-founder of InsurEye says: “We are happy to present this ranking, which should help Canadian consumers not only save their money, but also improve their knowledge about protection available through their credit cards.”

InsurEye (www.insureye.com) Inc. is a Canadian company that provides independent, innovative online services to help consumers better understand and manage their insurance. Detailed knowledge about over 160 Canadian credit cards has allowed InsurEye to compile an in-depth card assessment and provide a list of the top credit cards for travel.