While insurance is not known as an extremely innovative or exciting industry, new technology has created a platform for a number of exciting insurance information technology (IT) services for both consumers and insurance providers. Here we provide an overview of the top 5 innovative IT insurance services.

Pay-as-you-drive insurance calculates premiums according to an individual’s driving profile, rewarding secure driving while tracking and increasing premiums on dangerous driving styles. Drivers who constantly speed, brake suddenly or drive in bad weather conditions (e.g. snow, rain) find themselves paying higher premiums than those who follow the rules of the road. A “black box” device installed in the car tracks key parameters of the journey and transfers the data to the insurance company, who then regulates the premium rate.

Some insurance companies already offering simplified versions of Pay-as-you-drive solutions:

Pay-as-you-drive insurance calculates premiums according to an individual’s driving profile, rewarding secure driving while tracking and increasing premiums on dangerous driving styles. Drivers who constantly speed, brake suddenly or drive in bad weather conditions (e.g. snow, rain) find themselves paying higher premiums than those who follow the rules of the road. A “black box” device installed in the car tracks key parameters of the journey and transfers the data to the insurance company, who then regulates the premium rate.

Some insurance companies already offering simplified versions of Pay-as-you-drive solutions:

Online insurance quote platforms, such as Kanetix, all offer access to a limited number of insurance providers, allowing consumers to analyze only a subset of prices, which are based on the insurance provider’s data.

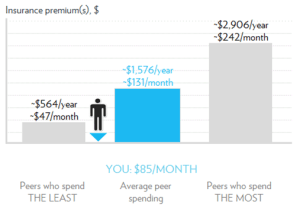

Social benchmarking of insurance premiums offers independent, consumer-generated data across all insurance providers. As consumers share information about their insurance spending, they can access the collective experience of other consumers, identifying if they pay too much and who offers the best prices for peers with a similar insurance profile.

An example of such a service is the InsurEye Peer Comparison tool, which covers not only spending information for online insurance products (20%-30% of the total market), but also for insurance offered directly by insurers, brokers, and agents.

Link: https://insureye.com/insurance_toolkit/insureye-peer-comparison

Online insurance quote platforms, such as Kanetix, all offer access to a limited number of insurance providers, allowing consumers to analyze only a subset of prices, which are based on the insurance provider’s data.

Social benchmarking of insurance premiums offers independent, consumer-generated data across all insurance providers. As consumers share information about their insurance spending, they can access the collective experience of other consumers, identifying if they pay too much and who offers the best prices for peers with a similar insurance profile.

An example of such a service is the InsurEye Peer Comparison tool, which covers not only spending information for online insurance products (20%-30% of the total market), but also for insurance offered directly by insurers, brokers, and agents.

Link: https://insureye.com/insurance_toolkit/insureye-peer-comparison

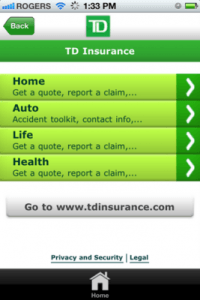

Online banking has become the norm, but online insurance management? Personal banking finance management tools and other useful online IT services are available for consumers for free. Finally, the insurance industry has started to close the gap. Now many insurance providers offer online and mobile tools to help consumers to manage their policies and provide customer support. One example is TD Insurance, which offers an online service allowing customers to perform many tasks on their own, eliminating the need to call a service line. Examples of such tasks are:

Online banking has become the norm, but online insurance management? Personal banking finance management tools and other useful online IT services are available for consumers for free. Finally, the insurance industry has started to close the gap. Now many insurance providers offer online and mobile tools to help consumers to manage their policies and provide customer support. One example is TD Insurance, which offers an online service allowing customers to perform many tasks on their own, eliminating the need to call a service line. Examples of such tasks are:

Collisions don’t happen while you are sitting at home in front of the computer. Instead, many insurance companies have developed solutions to help customers deal with their collisions and claims situations on their mobile devices. One mobile application example is from StateFarm, offering customers many handy functionalities reducing headaches in case of an accident. A typical set of features for such an IT solution includes:

Collisions don’t happen while you are sitting at home in front of the computer. Instead, many insurance companies have developed solutions to help customers deal with their collisions and claims situations on their mobile devices. One mobile application example is from StateFarm, offering customers many handy functionalities reducing headaches in case of an accident. A typical set of features for such an IT solution includes:

If you’ve ever had a road accident, you surely know the range of emotions you experience: fear for the own health and those who are in the car, concerns about financial impact on future insurance premiums, not being sure what to do and in what order, dealing with police, towing services, another car driver etc.

Some companies, e.g. RBC Insurance, have so-called Road Angels – insurance experts who physically arrive at the accident location to support the customer.

Instead of sending an agent to a scene, IT insurance services could potentially provide long distance assistance via video. Modern smartphones are capable of transmitting two-way video, making it possible to show an insurance expert what has happened, and at the same time making the customer feel more secure.

Videoconference providers such as Skype already offer these technical functionalities, and Apple has FaceTime, a new video chat for its iPhone users.

It’s likely only a matter of time before this technology results in a mature IT insurance service.

If you’ve ever had a road accident, you surely know the range of emotions you experience: fear for the own health and those who are in the car, concerns about financial impact on future insurance premiums, not being sure what to do and in what order, dealing with police, towing services, another car driver etc.

Some companies, e.g. RBC Insurance, have so-called Road Angels – insurance experts who physically arrive at the accident location to support the customer.

Instead of sending an agent to a scene, IT insurance services could potentially provide long distance assistance via video. Modern smartphones are capable of transmitting two-way video, making it possible to show an insurance expert what has happened, and at the same time making the customer feel more secure.

Videoconference providers such as Skype already offer these technical functionalities, and Apple has FaceTime, a new video chat for its iPhone users.

It’s likely only a matter of time before this technology results in a mature IT insurance service.

Interested in Auto Insurance?

#1: Pay as You Drive

Pay-as-you-drive insurance calculates premiums according to an individual’s driving profile, rewarding secure driving while tracking and increasing premiums on dangerous driving styles. Drivers who constantly speed, brake suddenly or drive in bad weather conditions (e.g. snow, rain) find themselves paying higher premiums than those who follow the rules of the road. A “black box” device installed in the car tracks key parameters of the journey and transfers the data to the insurance company, who then regulates the premium rate.

Some insurance companies already offering simplified versions of Pay-as-you-drive solutions:

Pay-as-you-drive insurance calculates premiums according to an individual’s driving profile, rewarding secure driving while tracking and increasing premiums on dangerous driving styles. Drivers who constantly speed, brake suddenly or drive in bad weather conditions (e.g. snow, rain) find themselves paying higher premiums than those who follow the rules of the road. A “black box” device installed in the car tracks key parameters of the journey and transfers the data to the insurance company, who then regulates the premium rate.

Some insurance companies already offering simplified versions of Pay-as-you-drive solutions:

- Aviva

- Hollard

- Allianz Lloyd Adriatico

#2: Social Benchmarking

Online insurance quote platforms, such as Kanetix, all offer access to a limited number of insurance providers, allowing consumers to analyze only a subset of prices, which are based on the insurance provider’s data.

Social benchmarking of insurance premiums offers independent, consumer-generated data across all insurance providers. As consumers share information about their insurance spending, they can access the collective experience of other consumers, identifying if they pay too much and who offers the best prices for peers with a similar insurance profile.

An example of such a service is the InsurEye Peer Comparison tool, which covers not only spending information for online insurance products (20%-30% of the total market), but also for insurance offered directly by insurers, brokers, and agents.

Link: https://insureye.com/insurance_toolkit/insureye-peer-comparison

Online insurance quote platforms, such as Kanetix, all offer access to a limited number of insurance providers, allowing consumers to analyze only a subset of prices, which are based on the insurance provider’s data.

Social benchmarking of insurance premiums offers independent, consumer-generated data across all insurance providers. As consumers share information about their insurance spending, they can access the collective experience of other consumers, identifying if they pay too much and who offers the best prices for peers with a similar insurance profile.

An example of such a service is the InsurEye Peer Comparison tool, which covers not only spending information for online insurance products (20%-30% of the total market), but also for insurance offered directly by insurers, brokers, and agents.

Link: https://insureye.com/insurance_toolkit/insureye-peer-comparison

#3: Online Policy Management

Online banking has become the norm, but online insurance management? Personal banking finance management tools and other useful online IT services are available for consumers for free. Finally, the insurance industry has started to close the gap. Now many insurance providers offer online and mobile tools to help consumers to manage their policies and provide customer support. One example is TD Insurance, which offers an online service allowing customers to perform many tasks on their own, eliminating the need to call a service line. Examples of such tasks are:

Online banking has become the norm, but online insurance management? Personal banking finance management tools and other useful online IT services are available for consumers for free. Finally, the insurance industry has started to close the gap. Now many insurance providers offer online and mobile tools to help consumers to manage their policies and provide customer support. One example is TD Insurance, which offers an online service allowing customers to perform many tasks on their own, eliminating the need to call a service line. Examples of such tasks are:

- Modify contact information

- Modify a car policy

- Modify a Home Policy

- Modify a payment plan

- File a claim

#4: Mobile Device Claims

Collisions don’t happen while you are sitting at home in front of the computer. Instead, many insurance companies have developed solutions to help customers deal with their collisions and claims situations on their mobile devices. One mobile application example is from StateFarm, offering customers many handy functionalities reducing headaches in case of an accident. A typical set of features for such an IT solution includes:

Collisions don’t happen while you are sitting at home in front of the computer. Instead, many insurance companies have developed solutions to help customers deal with their collisions and claims situations on their mobile devices. One mobile application example is from StateFarm, offering customers many handy functionalities reducing headaches in case of an accident. A typical set of features for such an IT solution includes:

- List of tips in case of an accident

- Capture all required accident info (incl. photos)

- Find / order towing service

- Find a repair shop

- Initiate a claim process

- Check claim status

- Find an insurance agent

#5: Adjudication from a Distance

If you’ve ever had a road accident, you surely know the range of emotions you experience: fear for the own health and those who are in the car, concerns about financial impact on future insurance premiums, not being sure what to do and in what order, dealing with police, towing services, another car driver etc.

Some companies, e.g. RBC Insurance, have so-called Road Angels – insurance experts who physically arrive at the accident location to support the customer.

Instead of sending an agent to a scene, IT insurance services could potentially provide long distance assistance via video. Modern smartphones are capable of transmitting two-way video, making it possible to show an insurance expert what has happened, and at the same time making the customer feel more secure.

Videoconference providers such as Skype already offer these technical functionalities, and Apple has FaceTime, a new video chat for its iPhone users.

It’s likely only a matter of time before this technology results in a mature IT insurance service.

If you’ve ever had a road accident, you surely know the range of emotions you experience: fear for the own health and those who are in the car, concerns about financial impact on future insurance premiums, not being sure what to do and in what order, dealing with police, towing services, another car driver etc.

Some companies, e.g. RBC Insurance, have so-called Road Angels – insurance experts who physically arrive at the accident location to support the customer.

Instead of sending an agent to a scene, IT insurance services could potentially provide long distance assistance via video. Modern smartphones are capable of transmitting two-way video, making it possible to show an insurance expert what has happened, and at the same time making the customer feel more secure.

Videoconference providers such as Skype already offer these technical functionalities, and Apple has FaceTime, a new video chat for its iPhone users.

It’s likely only a matter of time before this technology results in a mature IT insurance service.

vgikus

January 19, 2012 at 11:11 amVery useful information, thanks!

Ariel

January 24, 2012 at 12:11 pmThanks for the post. The idea of a an agent over a video stream is such a fantastic idea. It is nice to have an agent physically come to the scene, but the idea of the immediateness of a mobile video is outstanding.

accident claims

February 7, 2012 at 3:11 pmYou have done a good job, I wish to read more from you soon. Keep it up!

CD

March 14, 2012 at 5:11 pmCant read your aticle, is something wrong? I’d like to receive it by email