Get a free Auto Insurance quote from 20+ Canadian insurers

Well, annual car insurance premiums in Ontario can be compared to a few things…

- 1,222 medium coffees at Tim Hortons

- 640 single fares for adults or 960 single fares for seniors policyholders in Toronto

- One flight from Toronto to Sydney, 3 flights from Montreal to Vancouver or 8 flights between Calgary and Edmonton

- Tanking approx. 25 times

Why car insurance rates in Ontario are so high?

Despite the fact that there have been government-led initiatives to reduce car insurance rates in Ontario, they continue to be the highest in the Country. There a number of reasons for this, but the main ones are that Ontario has:

- Sufficient space for insurance fraud; and a high level of claims payouts

- Highest population density

- The worst roads

- High rate of vehicle theft

Average car insurance rates in Ontario compared to the rest of Canada

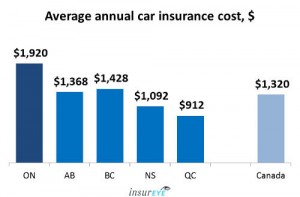

When you look at the data we compiled at InsurEye and presented on the visual overview, you can see what the average cost of car insurance is in various Canadian provinces (only provinces with enough data points are represented on the chart).

Car insurance premiums in Ontario – what affects the rates

There are a lot of factors that play a role in car insurance rates in Ontario, such as e.g. location, car make and year, driving experience, driving history,

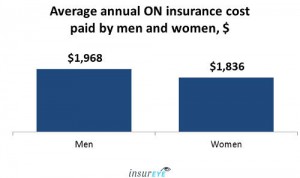

age, marital status, level of coverage, additional benefits. The ones with the largest impact in the cost of car insurance are driving history/tickets and age. Also gender is considered when calculating your car insurance rates.

Gender: The attached chart shows how gender impacts car insurance rates – on average, women pay slightly less than men; and this is based on accident history. Although it’s important to note that women don’t have less accidents than men, their accidents tend to be less costly.

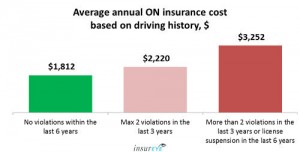

Driving History: A driver’s history is a factor that greatly impacts car insurance rates. On average, drivers with a clean driving record in Ontario pay $1,812 per year; whereas those with more than two violations in the last three years, or a license suspension in the last six years, pay $3,252 per year, which is almost double the amount. Searching for high-risk vehicle insurance? We can help.

How to Reduce the Car Insurance Rates in Ontario

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

Our Periodic Table of Car Insurance Savings will guide you through all the possible options you have to save on your car insurance in Ontario. Hopefully we’ll be able to help you put a dent in the average car insurance rates in Ontario from the current rate of $1,920 per year.

Rough road may await Ontario auto insurers - insBlogs

October 19, 2015 at 3:23 pm[…] No other province surpasses Ontario for the average cost of an automobile insurance policy. With this in mind, there is every reason to expect the government will continue to feel the pressure to see that rates are reduced. To the extent that this pressure is passed on to insurers, it will be a challenge for them to obtain a satisfactory bottom line. […]