Get a free Auto Insurance quote from 20+ Canadian insurers

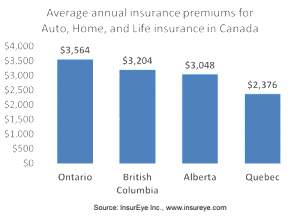

per year in Ontario, whereas the amount is much lower in Québec with approximately $2,400 annually.

Two and a Half Years of Salary in a Lifetime

If we consider a working life time to be approximately 40 years, an average Canadian would spend $124,000 on insurance over a working lifetime (with an average salary of approx. $47,500 in 2011, source “Average Salary Survey”). That means it would take about 2.5 years of salary to pay for insurance costs.

Insurance premium data originate from our proprietary and independent online service, Peer Comparison, which allows Canadians to compare their insurance rate with others

The Big Three

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

Which insurance contributes most to annual insurance costs? No surprise here – auto insurance is responsible for around half of all insurance costs. Home insurance contributes with approx. 1/3 of all costs, and life coverage with 1/4.

Insurance in Ontario Requires Bigger Wallets

Ontario has the highest overall average annual costs of ~$3,600, followed by British Columbia with ~$3,200 and Alberta with ~$3,000. Of the four most populous provinces, Quebec consumers pay the lowest average costs of ~$2,400 for their insurance protection.

How Do Insurance Premiums Change for Home Renters?

Those Canadians who don’t own but rent their homes pay less on insurance premiums and average values go down by 25%-50%. Interestingly, the provinces with higher average insurance premiums for rented dwellings are Alberta and British Columbia, where the monthly insurance premiums reach $58 and $50 accordingly.

How high is your annual insurance spending?

InsurEye Inc (insureye.com) is a Canadian company that provides independent, innovative online services to help consumers better understand and manage their insurance. InsurEye Peer Comparison is a free, interactive tool that compares consumers’ insurance costs with their peers and shows how to save using others’ insurance experience:

This tool collects, validates, and evaluates thousands of real consumer experiences to provide consumers price insights across all insurance providers and become aware of potential savings through aggregated social knowledge.