4 Reasons to get a Life Insurance Quote

- Compare life Insurance rates in Winnipeg from 20+ Canadian insurers

- Benefit from cheap life insurance rates starting at just a few dollars per month

- Protected your family and loved ones

- Talk to a live insurance broker and ask any questions you want

Average life insurance rates in Canada and in Winnipeg – how much should I pay?

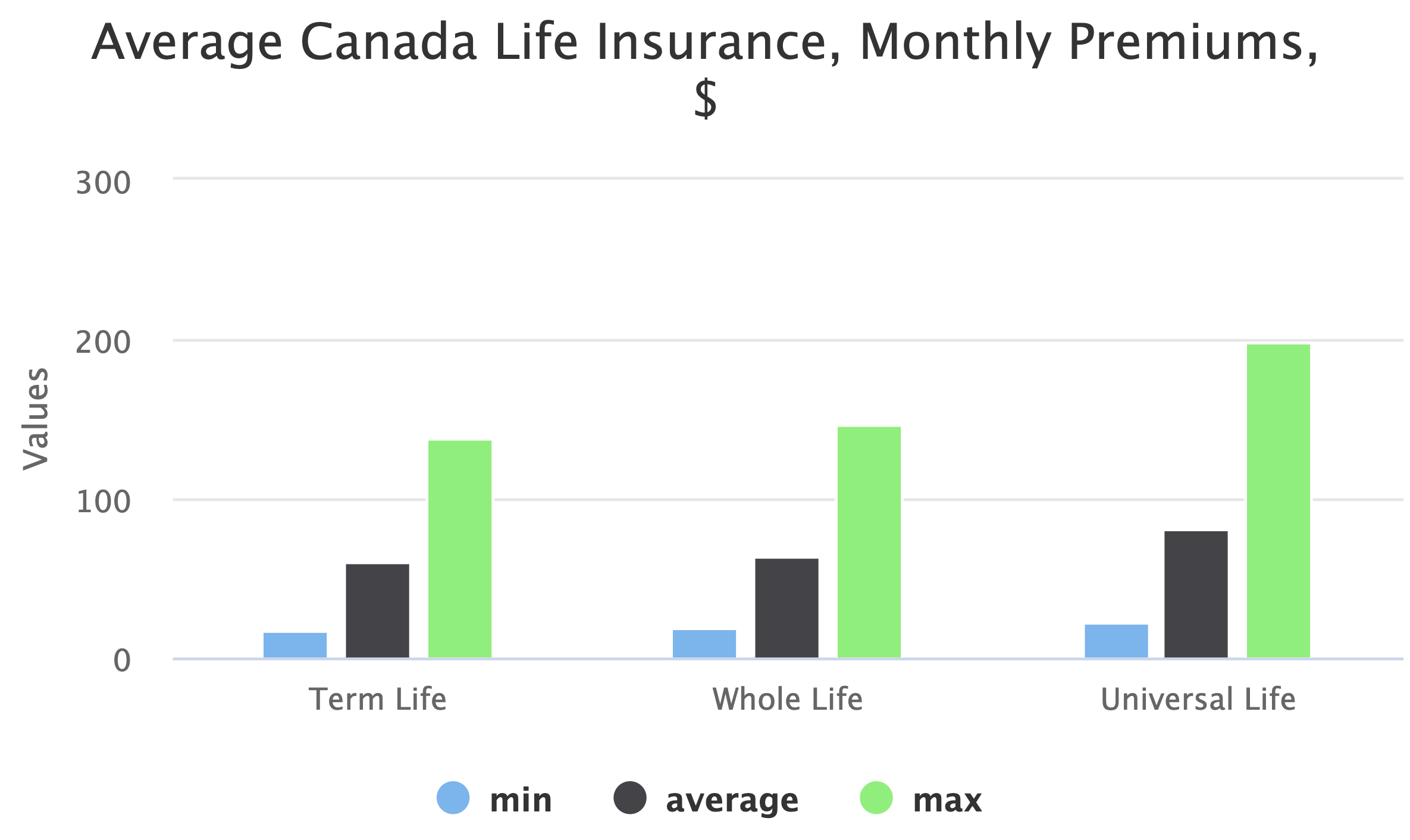

The chart, based on a life insurance calculator for Canada, shows a comparison of term, whole life, and universal life insurance premiums that consumers pay for Life Insurance in Canada and in Manitoba.

Please consider that though these are self-reported data. We found out that many consumers in Manitoba and in Winnipeg are underinsured. Life Insurance premiums will also strongly depend on a number of factors.

Overall there are several important questions to answer before choosing Life Insurance:

- How much coverage (e.g. $100,000 or $$2,000,000) do I need and how long (e.g. for the next 25 years to insure my mortgage vs till end of my life to ensure that my family is safe)?

- What type of life insurance product do I need (e.g. Term Life, Whole Life, Universal Life etc)?

- What life insurance company should I choose?

- Should I use an insurance broker or buy directly from an insurance company or bank?

When you are getting a life insurance quote with us, we not only calculate the best rate for you (from 20+ Canadian life insurers) based on your needs but also give an opportunity to speak with an experienced and licensed adviser who can answer all your questions, address your concerns and explain all insurance details.

Several Numbers You Must Know when looking for Life Insurance in Winnipeg

A big factor in choosing life insurance is the ability to cover the cost of a mortgage, should an income-earner pass away.

Here are a few numbers to help you when choosing Winnipeg life insurance:

| Item | Estimation |

| Average property price in Canada, May 2020 | $494,476 |

| Average property price in Manitoba, May 2020 | $296,101 |

| Average property price in Winnipeg, May 2020 | $276,900 |

| Average, non-mortgage debt (loans, credit cards, lines of credit), Canada, end of 2019 | $23,800 |

| Average, non-mortgage debt (loans, credit cards, lines of credit), Manitoba, end of 2019 | $18,914 |

| Average financial needs to raise a child to the age of eighteen, 2019 | $287, 534 |

What Aspects Impact Life Insurance Rates in Winnipeg, MB and in Canada?

| # | Aspect | Rate Impact |

| 1 | Smoking | Increase of 200% |

| 2 | Drinking | Increase of 50% |

| 3 | Your Family History | Increase of 50 – 250% |

| 4 | Your Medical History | Excludes coverage for some deseases |

| 5 | Your Depression History | Increase of 50 – 200% |

| 6 | Your Physical Build | Decrease of 25% to Increase of 200% |

| 7 | Your Driving Record | Increase of 25% to 50% |

| 8 | Your Gender | Decrease of 25% for Women |

Life Insurance Regulation Body in Manitoba

Similar to other provinces there is s regulation body in Manitoba that regulates life insurance matters, The Insurance Council of Manitoba. This organization is responsible for the licensing and discipline of insurance agents, brokers and adjusters in the Province of Manitoba. The key objectives of the Insurance Council of Manitoba are:

Establish standards for applicants and licensees to promote high standards of professionalism, competence and integrity in the insurance industry

Conduct investigations into the actions and/or conduct of insurance agents and adjusters in response to a complaint

Come to a determination as to whether there has been a breach of any of the provisions of The Insurance Act of Manitoba, its Regulations, the Licensing Rules or the Insurance Councils Code of Conduct

Examples of Term Life Insurance Rates in Winnipeg, MB.

- Life insurance quote in Winnipeg – Linden Woods for a female, 35 years old, non-smoker, Term 20 life insurance with $250,000 coverage: starting at $17 / month

- Life insurance quote in Winnipeg – Garden City for a male, 35 years old, non-smoker, Term 15 life insurance with $350,000 coverage: starting at $24 / month

- Life insurance quote in Winnipeg – Southdale for a female, 45 years old, non-smoker, Term 20 life insurance with $500,000 coverage: starting at $57 / month

- Life insurance quote in Winnipeg – River East for a male, 45 years old, non-smoker, Term 20 life insurance with $500,000 coverage: starting at $81 / month

Winnipeg Life Insurance: Expert Opinion

“If you are living in Winnipeg, you know that the average real estate price has gone up pretty significantly in the last year. The average house price is now over $320,000 and with those average house prices there is an increased mortgage.

You can cover your mortgage, in terms of possible ways, through a lending institution or you can work with an independent broker. But really the mortgage is only one of the things you need to cover. You gotta look at if your family needs your income replaced, do they want – do you want your family to have their education looked after if you pass away prematurely, do you have any lines of credit (or any other debt). All those things together determine how much life insurance you need and the best process to determine that need is doing some type of needs analysis and that’s where a broker can really come in handy as they can walk you through that step to determine what are your needs minus it from the assets have in place and determine if there is a shortfall or surplus. And once you’ve determined that need, then (they can help you determine) do you need a permanent policy or do you need a term policy and which company would be the best to fulfill that need and set up that policy.

We have a great team of brokers that we work with in Winnipeg who can help you to come up with the best possible solution to make sure that your family is well looked after.”

Life insurance during the COVID-19 pandemic

There were four main changes due to COVID-19. Here are they at a glance:

- Higher interest in no medical insurance: More people are deciding to go with no medical life insurance to avoid in-person medical tests

- Higher coverage limits without medical tests: Even medically underwritten insurance with limits up to $1,000,000 – $2,000,000 are now available without a medical exam

- Losing group insurance: Due to job and benefit losses, many Canadians lost their employer-sponsored group benefits and are looking into individual insurance policies

- Insurance rates may increase: Many insurers will likely rework their underwriting and prices to adjust to the new reality

- Seniors may lose out: Insurance, in future, might become harder to get for more vulnerable and higher risk demographics, like the senior population

12 tips for Winnipegians to save on Life Insurance and Reduce Their Rates

- Great medical record drives savings: Having a healthy medical history in the past (not equal to the good current health state in the moment of application) has impact on your life insurance. If you’ve had serious issues, some potential disease cases can be excluded from your coverage.

- Don’t drink excessively and reduce your insurance rates: If you do not have any drinking issues, you can benefit from lower insurance rates – otherwise your premiums can increase by up to 50%. An intensive drinker would be considered somebody who drinks 3-4 beers a day. Remember, life insurance rates in Winnipeg, similarly to other locations in Canada, depend on your driving history. Especially DUI cases are costly.

- Explore Return of Premiums conditions: Some policies allow getting back the part of the premiums if you have not made use of them – ask your broker to make the calculation for you. Slightly higher premiums upfront can make sense in case of later premiums returns.

- Say no to guaranteed issue life policy: People with good health do not need a guaranteed issue life insurance policy (these are policies that do not require a medical exam but they cost more) – do a health check / exam and enjoy lower life insurance premiums when getting life insurance quotes in Winnipeg.

- Alumni: Graduates from certain Canadian universities might be eligible for a discount at certain Insurance providers

- Bundles can be cheaper: Getting several insurance products from one provider e.g. Life insurance together with Disability Insurance and Critical Illness can be often rewarded by lower premiums. Or you can sometimes bundle Life insurance with Non-Life insurance (e.g. Home or Auto) – that depends from insurance provider.

- Time goes by, driving offenses disappear (almost): If your driving record improved while you have a life insurance policy, you can review your premiums with your insurer and get them reduced (typical time for smaller offenses to come off your driving record is 3 years).

- Say no to guaranteed issue life policy: People with good health do not need a guaranteed issue life insurance policy (these are policies that do not require a medical exam but they cost more) – do a health check / exam and enjoy lower life insurance premiums.

- Insurance type matters: Term insurance products have lower than initial premiums than Whole Life or Universal Life. So, if you are looking to maximize your initial coverage, choose Term.

- Rounding mathematics matters: If you decide to buy a life insurance policy, make sure that your age rounds down and not up, i.e. if you are going to be 30 years old on December 31, buy the policy in the first 6 months of the year where your age is still rounded down to 29 and not 30.

- Young means cheaper: Apply for the policy when you are young and your premiums will be lower.

- Smoking impacts your health and insurance rates: Stop smoking well in advance (at least a year) before applying for a policy – otherwise your premiums will double. Like cigars? Well, many life insurance companies consider smoking more than 1 cigar per month and you won’t be able to get non-smoker rates.

Interested in more saving tips for Life Insurance? Get an insurance quote below and connect with an experienced insurance professional to get more tips.

Our Publications related to Life Insurance

Life, Disability and Critical Illness Insurance: Do Men or Women Pay More?

Introduction There were many articles written about men paying more for car insurance than women, but what about other insurance types? Do women always benefit from lower insurance rates? We took on this question and systematically went through various life insurance, disability insurance, and critical illness insurance by consulting with professionals who had the answers. […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

If Life Insurance Plans Were Cars: How to Look at Various Types of Life Insurance in Canada

Overall, insurance is considered a somewhat boring, though necessary, topic. On top of that, it is not always clear – there are plenty of various types of life insurance products in Canada that work differently. I decided to explain it in a bit of a different and funny way – I hope that you will […]

Insurance Companies in Canada – Easily Explained

The life insurance landscape in Canada is quite unique. The infographic below shows all the key players and their size, reflecting their assets under management (AUM) based on life and wealth segments of the company’s business. scroll further down to continue reading In Canada, the majority of insurers fall under the umbrellas of three large […]

What is Travel Insurance, and Why Do I Need it?

By RateHub.ca When it comes to budgeting for your vacations, travel insurance is one of those things that’s often overlooked. It’s easy to understand why: we have publicly funded healthcare in Canada, so many people assume that benefit applies to wherever we travel in the world. Unfortunately, that’s not the case. The cost of seeking […]