Get a free Motorcycle Insurance quote from multiple Canadian insurers!

1. Does your license dictate a type of motorcycle?

Yes, it does. There are three different types of motorcycle insurance: M, M1, and M2. From the insurance perspective, if you have an M1 license, you should stay away from sports bikes and go with a standard or cruiser motorcycle.2. How do different insurers treat different driving licenses?

The overview below shows how motorcycle insurance providers treat different motorcycle insurance licenses. Note that M1 licenses are not treated favourably by several insurance providers.License type

M1 license

–

✔

✔

–

M2 license

✔

✔

✔

✔

M license

✔

✔

✔

✔

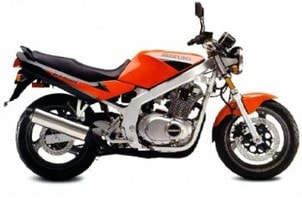

3. Does the type of motorcycle affect your motorcycle insurance?

Yes, it does. Typically, the more powerful and more expensive your motorcycle is, the higher your insurance costs. Some insurance providers specialize in particular types of bikes. See the overview below that shows insurers prefer certain bikes. The overview highlights that all insurers are happy to insure standard, cruiser and touring motorcycles, but some are less inclined to cover sport motorcycles or provide coverage under particular conditions.Motorcycle type

Aviva

Echelon

Intact

Wawanesa

Standard motorcycle

Standard motorcycle✔

✔

✔

✔

Sport motorcycle

Sport motorcycleIt depends1

–

✔

It depends2

Cruiser motorcycle

Cruiser motorcycle✔

✔

✔

✔

Touring motorcycle

Touring motorcycle✔

✔

✔

✔

4.What does motorcycle insurance cover?

A typical motorcycle insurance policy consists of several components, which are shown below:

This insurance component covers your bike, should it be damaged or totalled in an accident.

It also protects you against other risks, such a theft, fire, vandalism, etc.

This insurance component kicks in, if you caused damage to the third party’s property or personal wellbeing.

Provincial laws require a minimum amount (e.g. $200K in Ontario), but it is recommended to have $1M or $2M.

Should you or your passenger become injured as a consequence of an accident, this insurance component covers you.

Unfortunately, not everybody has insurance despite the fact that it is mandatory. This insurance component covers you, if an at-fault-driver left the accident site or turned out to be uninsured.

5.What are motorcycle insurance rates in Ontario?

To give you an idea of motorcycle insurance cost in Ontario, we have compiled a few sample insurance profiles below. It is important to know that motorcycle license class (M, M1, M2), your motorcycle make/type, and your driving history will strongly impact your motorcycle insurance rates in Ontario.

Motorcycle Insurance Premiums – Example 1 (2018 rates):

Driver: Male, 47 years old, License class: M, lives in Toronto

Motorcycle: Yamaha YZF R6 2015, owned, purchased for $12,000

Driving History: No tickets or claims in the last 10 years

Insurance details: Liability coverage: $1,000,000 and $500 deductible

Approximate motorcycle insurance rates: $91 / month (or $80 / month with a multi-line discount*)

Motorcycle Insurance Premiums – Example 2 (2018 rates):

Driver: Female, 35 years old, License class: M, lives in Mississauga

Motorcycle: BMW F800R, owned, purchased for $10,580

Driving History: No tickets or claims in the last 10 years

Insurance details: Liability coverage: $1,000,000 and $500 deductible

Approximate motorcycle insurance rates: $84 / month (or $72 / month with a multi-line discount*)

Motorcycle Insurance Premiums – Example 3 (2018 rates):

Driver: Male, $26 years old, License class M2, lives in Hamilton

Motorcycle: Honda XR650L, owned, purchased for $6,750

Driving History: No tickets or claims in the last 10 years

Insurance details: Liability coverage: $1,000,000 and $500 deductible

Approximate motorcycle insurance rates:$131 / month (or $118 / month with a multi-line discount*)

* Multi-line discount means that you get both motorcycle and home insurance from the same insurer

What types of motorcycle insurance discounts are there?

If you are buying motorcycle insurance, keep these possible insurance discounts in mind. Not all insurers offer these discounts, but never hesitate to ask your insurance broker if these money-saving discounts are available. Different insurance companies can offer various insurance discounts, some more common than others.Secure storage

Anti-theft system

Clean driving history

Lack of claims

Being a member of something, e.g. CPA

Rider training discount

Advanced rider training discount

Home-bundle discount

Auto-bundle discount

Seniors discount

richard stafford

July 20, 2018 at 3:03 amsomething else not mentioned is that insurance companies are refusing insurance IF the bike is older than 2000 as well ..

Once upon a time they couldn’t refuse anyone they had to AT least quote you a price now the scum bags rip you off and refuse you ..

32 years driving my 2003 PU costs me $70 a month and 28 years riding I pay $90 a month IF the bike is under 900 cc and this is for a full year with only liability and the PRICE sure goes up for Harleys and every CC .. it is criminal

Alex

September 1, 2018 at 6:32 pmThat is a very helpful input, Richard – thanks for sharing it. I was not aware that it is so difficult to get insurance for older bikes.

Alex @ InsurEye