Get a free Auto Insurance quote from 10+ Canadian insurers in Alberta

It’s well-known that auto insurance premiums in Ontario are the highest in Canada, and this is because of a number of factors such as the quality of roads, high claims costs, high theft rate, etc. But how does Alberta car insurance costs stack up in comparison?

Well, on average Alberta car insurance premiums are $122/month in 2017 (it was $114/month in 2015); while Ontario auto insurance premiums average at around $161/month in 2017. Albertans pay about 25% less for their car insurance than Ontario drivers.

Thus, drivers in Alberta seem to combine the best of two worlds – lower than in Ontario auto insurance premiums and variety of insurance provider choices as opposed to British Columbia, Manitoba or Saskatchewan.

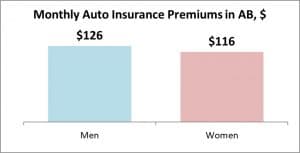

Women vs. Men Drivers for Alberta Car Insurance

It is commonly believed that men are better drivers, but why do insurance companies disagree? Statistics show that women are more likely to be involved in smaller car accidents while men are more likely to have serious accidents (e.g. from speeding) resulting in larger insurance claims.

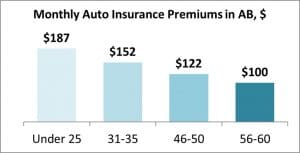

Cost of Alberta Car Insurance Considers Your Age

The logic behind these premium variations is that younger drivers tend to be involved more often into accidents than more senior, experienced drivers. It is not the case for every young driver but on average the numbers show a convincing story.

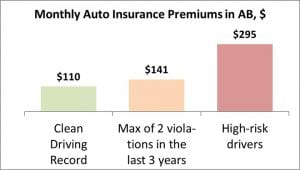

Driving History Matters for Your Insurance Rates

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

If you choose to buy a more modest car that is valued between $10,000 and $20,000, you can expect your Alberta car insurance premium to be around $123/month in 2017 (it was $115/month in 2015). That would mean you would either drive an older model of a luxury brand, or new brands of compact cars such as Mazda, Ford, Kia, etc.

If you really want to lower your Alberta car insurance premiums then your best bet would be to drive a car valued between $5,000 and $10,000. This way you would only have to pay around $108/month in 2017 for your vehicle insurance (it was $100/month in 2015).

Cost of AB Car Insurance Considers Your Driving History

A clean driving record can lower your average Alberta car insurance premium to around $110/month in 2017 (it was $109/month in 2015). However, if you have had two violations in the last three years, you will be looking at an increase up to $141/month in 2017 (it was $130/month in 2015).

High risk drivers in Alberta have to dig even deeper into their pockets for their Alberta car insurance premiums. It will cost them an average of about $295/month in 2017 which is more than double of what a driver with a clean driving record would pay in Alberta. If you need a high-risk auto insurance, take a few minutes of your time and get a quote to see if you qualify for better rates.

These insurance insights are provided by InsurEye, a consumer-focused insurance website that offers car insurance quotes in Alberta, auto insurance premium benchmarks and car insurance reviews.

Jalex

April 30, 2017 at 10:25 pmDoesn’t make sense. Just got a quote for 360 dollars a month for a new car (recently landed immigrant). How can a 155 premium go up to 360?

Alex

May 13, 2017 at 4:57 pmHi Jalex,

According to our experience, Canadian insurers often do not consider your experience of driving abroad. We saw cases, where people came from Europe with 7-10 years of driving experience and got rates of over 300 dollars per month. What happens, in this case, is that insurers treat these people as new drivers and apply higher rates to them.

These rates will go down with time.

Here is an article we had as related to this topic “Cheap Car Insurance – 7 Things to Know if You Are New to Canada”:

I hope that helps.

Alex from InsurEye

Rob

June 1, 2017 at 12:56 amI currently live in Ontario. I am wondering if my insurance/driving record will affect my insurance rates in Alberta? I have 4 tickets here in Ontario all paid and a 50/50 accident.

Alex

June 13, 2017 at 11:58 pmHi Rob,

yes, unfortunately, that will affect your rates in Alberta.

That’s the same if someone were to come from Alberta to Ontario – this driver would be rated for his/her out of province tickets.

I hope that helps.

Alex from InsurEye

Ben

June 14, 2017 at 9:39 pmHi,

Im a british citizen with a clean driving license for 9 years. Looking to get covered for 2/3 months while driving through Alberta, BC and the USA. DO you do that kind of cover?

Kind Regards

Alex

June 16, 2017 at 11:06 amHi Ben,

Our partnering brokers do not really do 2- or 3-month auto insurance policies in Alberta. We know that Allstate Isnurance does 6-month policies so you might consider them. Not entirely sure what their cancellation fees are.

There is also a difference what car you’ll drive. Two scenarios are possible:

1. You drive a rental car:

In this case, a rental agency will typically offer you a rental car insurance which, typically, (at least here, in Ontario) does not have extensive coverage (it is often called Collision and Damage Waiver) but is still better than nothing. It mostly covers damages on your car and your liability (the minimal amount that is regulated by law). It might though do not offer accident benefits or damage to other side’s property. Have a look at the policy they’ll give you to understand it better.

2. You drive somebody else’s car (e.g. friend, etc):

When you drive somebody else’s car (again, at least here, in Ontario), you are basically using their car insurance policy. Should something happen, their car insurance jumps in and pays. In this case, some insurers will cover “occasional” drivers from abroad but our advice is TO CHECK IT WITH THE INSURER FIRST.

I hope that helps,

Alex @ InsurEye