Get a free Auto Insurance quote from 20+ Canadian insurers

Car insurance is a legal requirement of car ownership, so if you own a car, you are familiar with the word “deductible”; but what is exactly is a car insurance deductible and how can it affect your insurance premium?

Your Car Insurance Deductible Explained

There are actually two types of deductibles. You pay your collision deductible always when you were involved into a collision and you are at-fault (fully or partially). You pay a comprehensive deductible to use your comprehensive coverage if your vehicle is stolen, vandalized or catches on fire.

When you set up your policy, you choose your car insurance deductible. Depending on your preference and your insurer, this deductible can range from $500 – $1,000 with an online aggregator or $300, $500, $1,000 or $2,500 with some insurance brokers.

So it’s best to choose a high deductible to get the lowest premium if you are a good driver and can pay a larger out-of-pocket-amount, and the lower deductible in other cases (e.g. you cannot pay a large out-of-pocket amount in case of an accident), right? Not so fast.

The Differences in Car Insurance Deductibles and Premiums

It sounds logical to say that higher deductibles equal lower rates, but we have discovered that the size of your car insurance deductible doesn’t significantly impact your premiums!

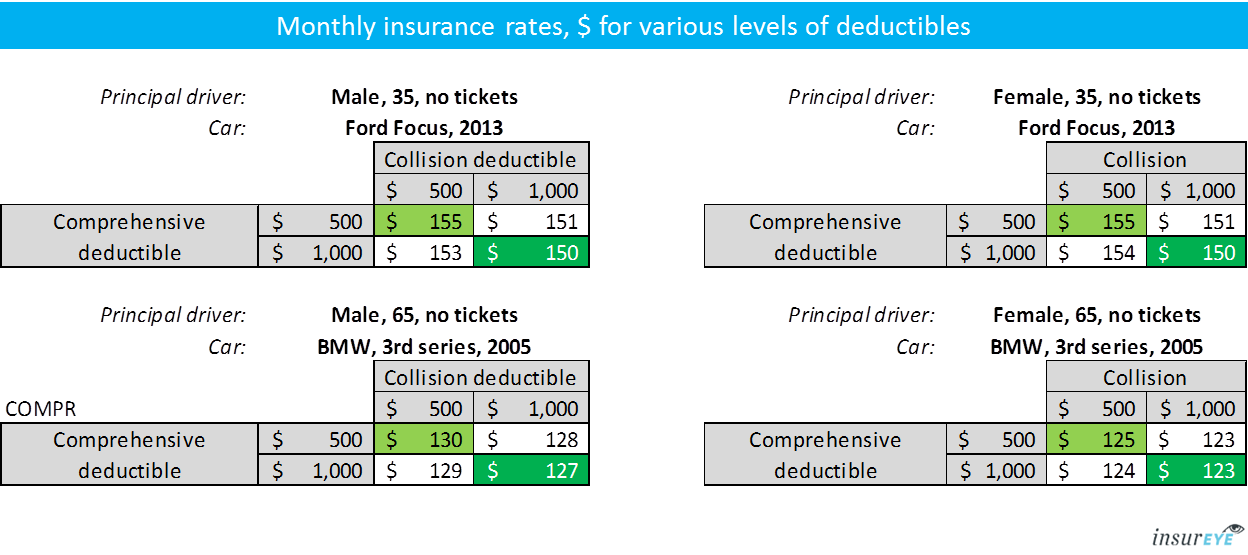

To prove our point, we looked at four different profiles: a 35 year old male and female driving a 2013 Ford Taurus and a 65 year old male and female driving a 2005 BMW 3rd series.

The difference between a $500 comprehensive/$500 collision deductible and a $1,000 comprehensive/$1,000 collision deductible through an online aggregator quote is only (see below):

- $5 per month for both males and females aged 35 driving a Ford Focus 2013

- $3 per month for males aged 65 driving a BMW 2005 3rd series

- $2 per month for females, aged 65 driving a BMW 2005 3rd series

Next we looked at the difference between $300 comprehensive/$300 collision deductible and $2,500 comprehensive/$2,500 collision deductible through an online insurance broker, and the slight differences are:

- $6 for a male aged 35 driving Ford Focus 2013

- $10 for a female aged 35 driving Ford Focus 2013

- $8 for a male aged 65 driving BMW 2005 3rd series

- $7 for a female aged 65 driving BMW 2005 3rd series

Choose Your Car Insurance Deductible Wisely

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

Ready to revise your car insurance deductible? If you are paying too much, spend a few minutes to get an online car insurance quote and start saving today.

Scott Tetz

April 9, 2016 at 5:05 pmI really appreciate your work. I have a high deductible assuming it reduced my rate. Another example where the consumer needs to be educated. Thanks for doing the leg work.