How many credit cards do you have in your wallet? Statistics show that today on average Canadians have 3 credit cards. Initially, credit card was a pure banking product whereas today it can carry a multitude of benefits. Unfortunately, most people in our survey were unsure about benefits or protection provided with their credit cards, despite paying for them. So we decided to “demystify” credit card benefits, and in particular the variety of insurance offerings provided. We hope that through a better understanding your credit card insurance protection you may find opportunities to save money by eliminating “overlapping” or “excessive” protection.

So, let us start…

There are three main categories of benefits or services attached to credit cards (though there are surely some additional benefits that vary between the cards):

- Banking benefits/services: e.g. interest rates, interest-free grace period etc.

- Rewards program: e.g. rewards points / miles, cash back etc.

- Protection/insurance: e.g. flight delay insurance, rental car insurance etc.

Incidentally, insurance is the largest area of credit card benefits and is comprised of multiple topics that provide protection in a number of life situations:

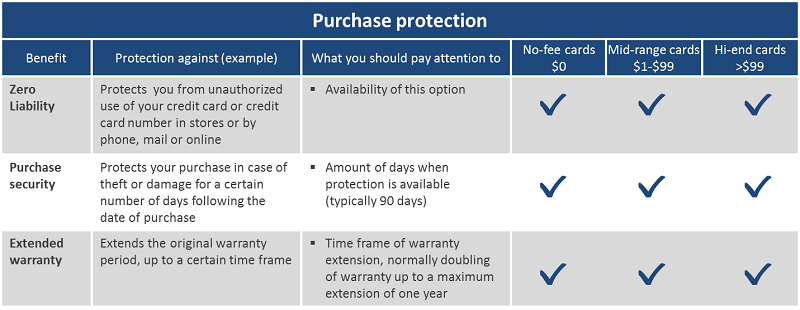

- Purchase protection

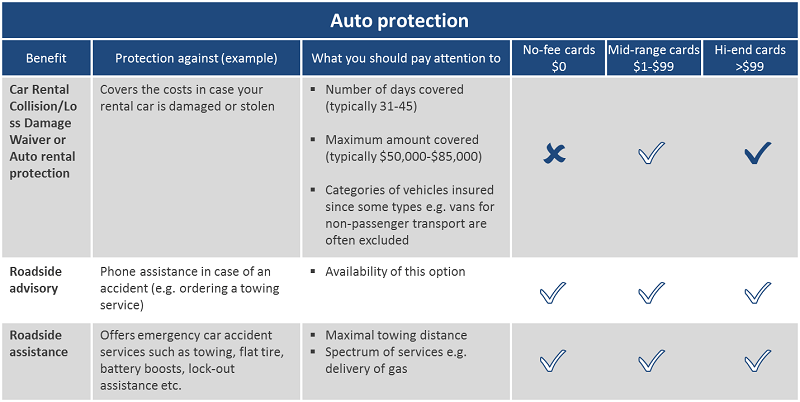

- Auto protection

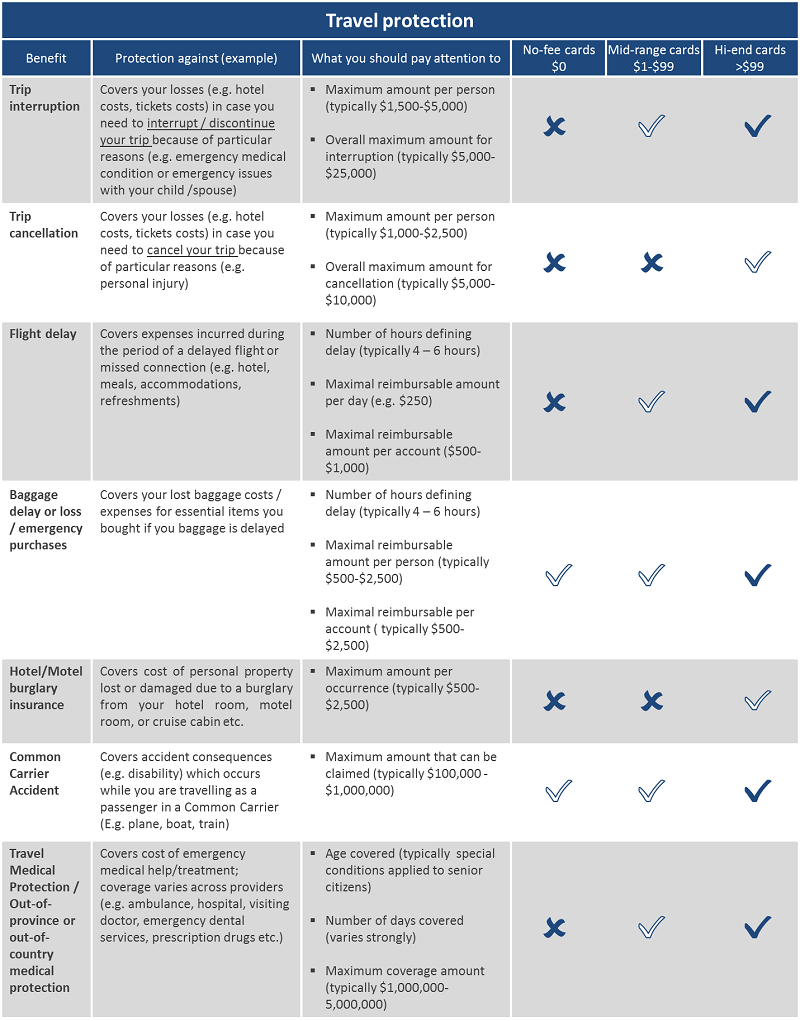

- Travel protection

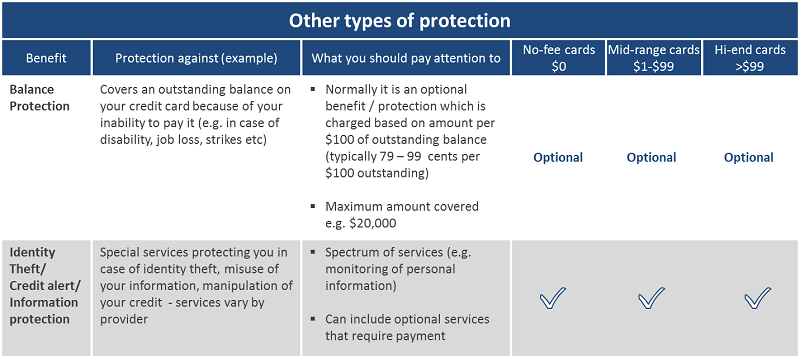

- Other types of protection

The general rule is simple – the more expensive your card, the more benefits and protection it offers. However, it may vary from card to card, which is why we’ll compare three categories of cards:

- No-fee cards, which offer limited, yet valuable, benefits and protection

- Mid-range cards (annual fee under $99), which offer a good balance of price and benefits / protection offered

- High-end cards, (annual fee over $99), which offer an extensive range of benefits and protection.

Following table provides an overview of typical protection benefits that may come with your credit card, compared across the three categories of cards. It also explains, in simple language (the type not found in your credit card agreement!) what does this benefit or protection means to you, and what the important features are for each benefit.

For a more detailed picture of benefits specific for your credit card check our Credit Card Compare Tool.

All things considered, the type of coverage you need will depend on your lifestyle and desire for different types of insurance protection. For example, if you tend not to travel that often or use rental cars, but still desire purchase protection (zero liability, purchase security, extended warranty), you should be fine using no-fee credit cards.

If you travel often or use rental cars frequently, hi-end credit cards will probably cover your needs. For example, supplementary insurance coverage provided with high-end cards will normally save you $15-$25 per day while renting a car. However, pay particular attention to the travel medical protection which varies between providers and has a number of conditions (such as your age).

If you prefer not to pay a high annual fee for your credit card, you may want to explore the benefits of mid-range credit cards. Some of them approach hi-end cards from an insurance perspective, but offer a lower annual fee.

You may also consider the fact that a great deal of insurance products (e.g. Common Carrier Accident Insurance) often covers not only you but your spouse and dependent children opening additional savings opportunities.

For a more detailed picture of credit cards protections check out the InsurEye™ Credit Card Compare Tool. You might find overlapping protection across your credit cards which cost you a significant amount per year and so you can avoid those costs (please consult with your banking specialist if cancellation of unnecessary credit card would affect your credit rating).

In our following publications we are going to explore in details benefits offered by different segments of credit cards. So, stay tuned!