Get a free Auto Insurance quote from 20+ Canadian insurers

Digging for Insight

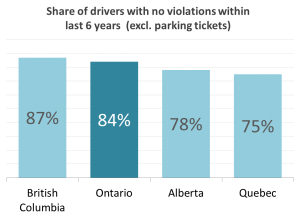

In order to answer these questions, Canadian company InsurEye conducted a study across Canadian consumers. Evaluating over a thousand insurance data points across Canada, all drivers were divided into three categories according to their driving record:

- No violations within the last 6 years (excluding parking tickets)

- Maximum 2 violations in the last 3 years

- More than 2 violations in the last 3 years, or license suspension in the last 6 years

Further insurance premiums of these driver categories were analyzed.

Example Ontario: How Safe Are Drivers Here?

15% of drivers in Ontario state to have a maximum of 2 violations in the last 3 years, and just 1% of Ontarians had more than 2 violations in the last 3 years or faced a driving license suspension in the last 6 years.

What Is the Price Tag on a Bad Driving Record?

How does a negative driving record impact our auto insurance rates? To find out, InsurEye compared the auto insurance spending of Ontario drivers across various age segments. It came out that Ontario drivers who have a maximum of 2 violations in the last 3 years pay approximately 20-25% more than drivers with a clean driving record.

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

This research was conducted using the data from InsurEye Peer Comparison – an interactive online service that compares consumers’ insurance costs with their peers, showing them how to save through aggregated social knowledge.

Any Tina

July 7, 2012 at 11:03 amImportant information provided by this site! Really I was looking forward to read about it. Love this entry.