Get a Home Insurance quote now. Start saving.

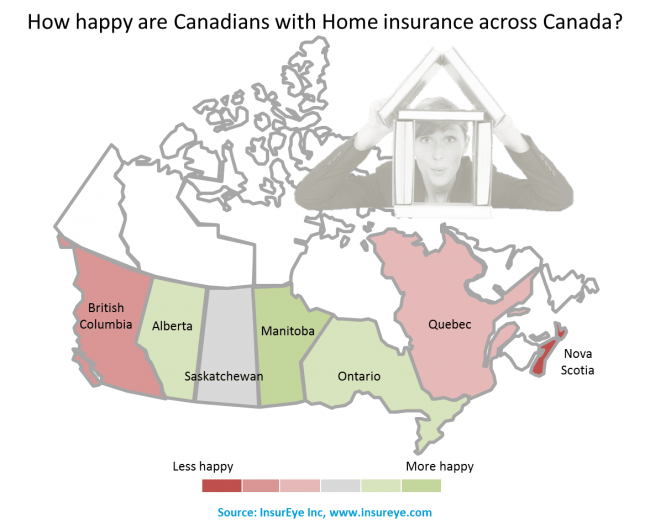

The most critical attitude towards home insurance appears to be in Nova Scotia and British Columbia. Meanwhile the most positive attitude towards home insurance was registered in Manitoba, closely followed by Ontario and Alberta.

COMPARING CUSTOMER SATISFACTION WITH HOME INSURANCE ACROSS PROVINCES…

Customer Satisfaction results are based on consumer responses from InsurEye’s new independent consumer reviews platform for insurance, the Insurance Consumer Experience.

Ratings from Ontario, Quebec, British Columbia, Alberta, Manitoba, Saskatchewan, and Nova Scotia have been evaluated according to three key dimensions: Customer Experience, Value for Money and Claim Experience. Consumers could evaluate their insurers on a scale of 1 to 5 stars. The results are as follows:

- Hurray! The leading province in terms of the customer satisfaction is Manitoba, with an overall ranking of 4.3/5. Customers seemed to be happy with all three insurance aspects: Customer Service, Value for Money, and Claim Experience.

- Wow! The second happiest two provinces are Ontario (4.1/5) and Alberta (4.0/5). Ontarians positively rate Claim Experience with their insurance provider, while they are least happy with their Value for Money. The ratings in Alberta are quite consistent across all dimensions.

- Hmmm… The middle segment of provinces is composed of Saskatchewan (3.9/5) and Quebec (3.9/5) where consumers are less happy with home insurance. Main pain points appear to be Value for Money in Quebec and Customer Service/Claims Experience in Saskatchewan.

- Booooooo… The lowest level of consumer satisfaction with home insurance was discovered in Nova Scotia (3.4/5). Consumers are most critical about Value for Money and Customer Service. British Columbia residents are not too excited about home insurance either but they are mostly unhappy with their Claim Experience. It leads to the second lowest customer satisfaction with home insurance (3.8/5).

HOW WELL AND HOW BAD THINGS CAN GO WITH HOME INSURANCE…

Some reasons are reflected in consumer feedback ratings. We are sharing with you feedback from several consumers to give you an idea about the span of customer satisfaction with home insurance.

[home_insurance_square_widget]

- Negative: “They made me feel like the perpetrator instead of the victim. Argumentative.” (Quebec)

- Positive: “We had a flood and the insurance company was not only were sympathetic but a restoration company came the next day and repairs were made speedily and the insurance company paid the bill without any hassle!” (British Columbia)

- Negative: “The process in which payout for loss was not clearly explained ahead of time. I was told to give value of lost products but was not told I would get value minus 15% until payout time.” (British Columbia)

- Positive: “Basement flood 5 years ago resulted in $50,000 claim. It took only 2 phone calls and 1 visit to complete and receive settlement…” (Ontario)

InsurEye Co-Founder Alexey Saltykov says: “Home insurance premiums do not vary as much as other types of insurance, for example auto insurance. Also, typical home insurance costs are much lower than auto insurance costs. However, there is a significant variation in the level of service provided by home insurance companies. We strongly encourage all consumers to browse through independent consumer reviews before buying home insurance. Your dwelling is probably your biggest investment – why would you spend more time reading reviews for a new photo camera than for your home insurance?”

MORE ABOUT INSURANCE CONSUMER REVIEWS

InsurEye Consumer Experience is an independent platform for consumer insurance reviews. It covers most home insurers and their products across the country and is free for Canadians to use.

Insurance companies are rated using three main criteria: Customer Experience, Value for Money and Claim Experience. Consumer comments give reviews context and allow consumers to share their opinion about insurers. Before publishing, consumer reviews are assessed by moderators to ensure the quality of the content. All reviews are anonymous, guaranteeing an independent consumer perspective.

InsurEye Inc. is a Canadian company that provides independent, innovative online services to help consumers better understand and manage their insurance.