4 Reasons to get a Home Insurance Quote in Toronto

- Find out if you are overpaying today and start saving

- Request a quote from 10+ insurance providers

- Get home, tenant, house or cottage insurance including flooding coverage

- Talk to a live agent and ask any questions you want

Welcome to your home insurance guide for Toronto, the beautiful capital of Ontario and the largest Canadian city. On this page you will learn about home insurance premiums in the area, about ways to save on premiums, and many useful tips for choosing home insurance in Toronto.

What are average Home Insurance cost in Toronto?

Displayed are average tenant and homeowner premiums. Typically, tenant insurance is lower than homeowners insurance.

It is important to note that Toronto has a high number of condominiums and, in many situations, insurance that is purchased for condo units is called condo insurance. It also can be either a tenant condo insurance (if you rent a condo unit) or homeowners condo insurance (if you own a condo unit).

Tenant insurance (also called renters insurance) covers just contents and, sometimes, liability. Insurance on the building envelope is the responsibility of the dwelling’s owner. Since tenants insurance only covers contents and liability, it is cheaper than homeowners insurance in Toronto.

Homeowners insurance (for landlords) covers the dwelling and protects against numerous risks such as earthquake, fire, and theft.

In many cases, condo insurance (either tenants or homeowner insurance) is cheaper than a tenant or homeowners’ insurance for a standalone house or freehold townhouse. The reason is that modern condominiums typically come with a considerable amount of oversight and security (e.g. concierge security at the entrance, fob-enabled access, ability to get only to your own floor, etc.). That reduces chances of an insurance claim in a condominium.

Cheap Home Insurance Toronto: 10 Tips

- Monitoring: Extra security on the property such as a doorperson or security guard will get you a discount with some insurers.

- Renovations: Older homes that have not been updated or maintained are more expensive to insure. Renovating, even just part of the home like the basement or kitchen, could lead to lower home insurance premiums.

- Hydrants and fire-station: Some insurers offer a discount if you live close to a fire hydrant or fire station.

- Annual review: Since your insurance needs can change annually, review your policy once a year to see where you can save. Adjust your insurance accordingly.

- Bundle: Many insurers offer a discount if you bundle your home and auto insurance with them.

- Repair instead claims: You must pay a deductible and could face an increase in premiums for each claim. So, for small claims ask yourself if it worth undertaking the repairs yourself instead.

- Pipes: Upgrade your galvanized or lead pipes; insurers much prefer the safer options of plastic or copper.

- Heating: Here is something to keep in mind when house hunting – oil heated homes cost more to insure. Your insurer prefers forced-air gas or electric heat instead.

- Pool: Pools are nice in the summer but are also a big liability risk that increase your premiums.

- Decrease liability risk: There are many things you can do to decrease your liability. Fence your pool. Remove snow and ice from your steps and walkway. Put your dog on a leash.

5 Elements that will increase your Home Insurance costs

- Expensive items: Your contents coverage has a cap. This means you may need extra coverage, called a rider, to insure expensive items in your home. Without it, you could be missing important coverage for heirloom jewellery, wine collections, fine art, musical instruments, sports equipment, watches, bicycles and more.

- Basement: When a pipe bursts, a sewer backs up, or overland flooding occurs, water flows downwards. This is bad news for finished basements, and also why they cost most to insure.

- Building frame: Concrete and brick homes incur less damage than wood frame homes in the case of a fire. Therefore, wood frame homes can cost more to insure.

- Roof type: Insurers find wood shake or shingled homes less reliable than some other types of roofing, and this is reflected in the premium.

- Aluminum wiring: Prior to 1970, aluminum wiring was common in homes. It is not used anymore because it is a fire risk and tends to overheat. It is very difficult to get home insurance if your house has aluminum wiring. You will either get rated (pay more), denied, or asked to provide a full electrical inspection (at your cost) from a certified professional.

Home Insurance companies in Toronto

There are several P&C (property and casualty) home insurers in Toronto including:

- Intact Insurance

- TD Insurance (owned by TD Bank)

- Aviva

- RSA Insurance

- Economical Insurance (includes Sonnet Insurance)

- Desjardins Insurance

Midsize insurers include:

- Square One Insurance

- RBC Insurance (as Aviva)

- Travelers

- Gore Mutual Insurance

- CAA

- The Co-Operators

- Wawanesa Insurance

- Several others

You have different options as to where you purchase your home insurance. These options include insurance companies, agents, brokers, and some banks.

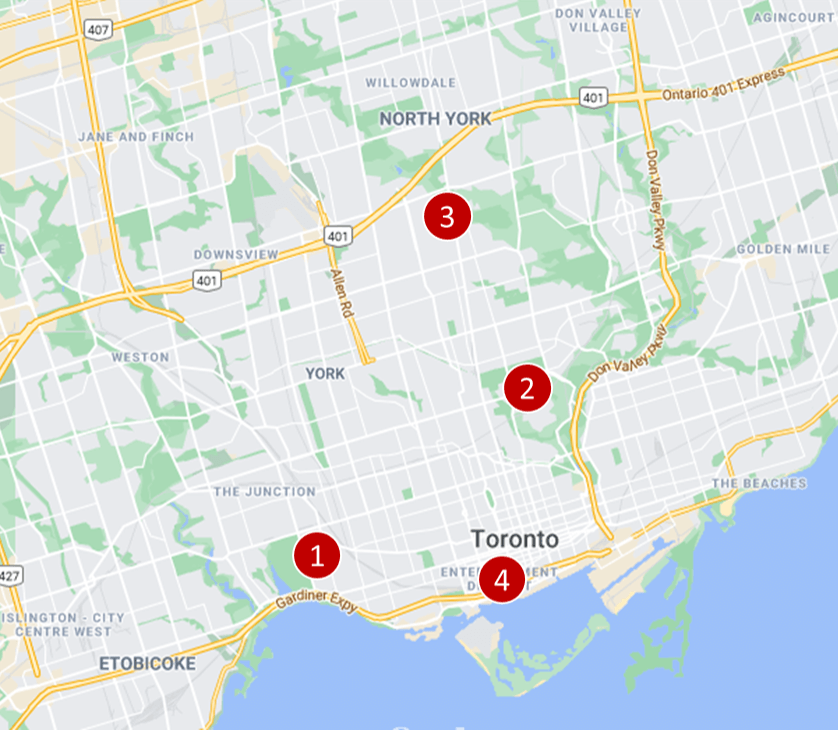

Toronto Home insurance quotes, examples

Toronto home insurance quote #1: Homeowners insurance for a unit about 1,000 sq. feet in a two-storey semi-detached house. This home has a single basement garage. Located on Parkside Drive next to High Park.

Home insurance rate: $152 per month ($1,824/year)

Toronto home insurance quote #2: Tenant insurance for a two-storey new brick detached house under 1,500 sq. feet. The house was built in 2015, no garage, no basement. Located on Moore Park at the intersection of Heath St E and Welland Ave.

Home insurance rate: $38 per month ($456/year)

Toronto home insurance quote #3: Tenant condo insurance for a unit under 1,000 sq. feet in a low-rise building, located at North York on the Yonge St.

Home insurance rate: $26 per month ($384/year)

Toronto home insurance quote #4: Homeowners insurance for a two-bedroom condo unit under 1,000 sq. feet in a high-rise building, located at the intersection of King St. W and John St. Personal property limit $40,000 and liability coverage of $1,000,000. Non-smoker.

Home insurance rate: $32 per month ($384/year)

5 Home Insurance myths to know

Myth #1: Condominium corporations provide insurance that covers my condo

Condominium corporation insurance covers the building envelope (roof, common areas, windows, etc.) but not your contents or your liability. If you cause damage to another unit, such as flooding it, the liability is your responsibility.

Myth #2: If I have valuables, they are covered

Your standard home insurance policy has cap on contents coverage. Furs, jewellery, art, wine collections, expensive watches – you many need a rider, and proof of purchase via an appraisal or receipt, to cover your valuables.

Myth #3: Home insurance automatically covers upgrades to the home or condo

Do not assume that upgrades are automatically covered. You must advise your insurance provider when you renovate or upgrade and read your policy to know how they handle these changes, and/or add them to your policy.

Myth #4: Insurance is cheaper for older, less expensive homes

Insurance is more expensive for older homes if they have not been maintained. This is because there is a greater chance that the roof system, plumbing, or wiring is unsafe, outdated, or will fail.

Myth #5: If I am a tenant, my landlord’s insurance covers everything – it is his/her responsibility

Your landlord is not responsible for your liability nor your contents. In fact, a condition of your lease may be for you to obtain tenants insurance.

Differences between house and condo insurance

There are differences between insuring a single-family home and a condo. Here is an overview.

1. Amount of coverage

- House Insurance: Coverage for a single-family home includes contents, house upgrades, and liability. Insurers also consider the rebuilding value of the home – how much it will cost to rebuild from scratch and clean up debris from an incident such as a fire.

- Condo Insurance: Coverage for your condo unit only includes contents, unit upgrades, and liability. This is why you see lower coverage limits of $100,000 for a condo.

2. Adjacent area

- House Insurance: Riders customize your insurance. You can add riders to your home insurance policy to cover things like landscaping, gardens and even trees.

- Condo Insurance: Personal condo insurance only covers the unit.

3. Policies involved in the coverage

- House Insurance: Typical home insurance for a single- family dwelling has just one component.

- Condo Insurance: Condo insurance is more complicated than single-family home insurance. There are two parts to condo insurance. First, your personal insurance, which covers your unit, upgrades, and liability. Second, the insurance of the condo corporation, which covers the common areas and building envelope. Do not think you are protected by the condo corporation’s insurance. If someone is injured in your unit (such as slipping in your kitchen) or if your belongings are stolen, that is your responsibility. Also, not all condo corporations cover your yard. You may be required to maintain your pathway and yard, which also means keeping it free from snow and ice. Ensure you know exactly what is covered by both policies if you own a condo unit.

4. Building coverage

- House insurance: With house insurance, the structure and the building envelope are covered by the policy.

- Condo Insurance: With condo insurance, the commercial policy covers the majority of the building envelope (roof, exterior windows, etc.). This means, if your windows are damaged, front door vandalized, roof shingles blown away or parking pad impacted, typically this falls under the commercial policy. That being said, if theft occurs from your locker, your stove burns down part of your kitchen or your belongings are stolen, your personal condo insurance policy comes into play.

5. Claim processing

- House insurance: It’s easy to process a house insurance claim since the only people involved are the homeowners and the insurer.

- Condo Insurance: It’s more complicated to process a condo insurance claim because it can involve both your and the condo corporation’s insurance. For example, if a pipe burst in your wall and damages the unit below yours, both policies come into play.

Home insurance costs in Toronto depend on several different factors such as if you need homeowners versus tenants or condo insurance, the age and location of the property, upgrades, and more.

- Tenant insurance is often the cheapest type because it only covers contents and (typically) liability. In fact, for a condo insurance can be as low as $15/month.

- Homeowners insurance for a condo is not very expensive since it only covers your condo unit along with your upgrades, contents, and liability. Typically, this costs around $20-$50/month.

- Homeowners insurance for a house can start at $50/month but also go as high as several hundred dollars. The costs depend on a wide range of factors including but not limited to the size of the property, its age, if it has a finished basement, the geographical location, proximity to specific risks like flooding, renovations, etc.

The coverage you get with home insurance depends on the type you need.

- Tenant insurance: Only covers your personal contents and liability.

- Homeowner insurance (condo): Covers the condo unit and associated upgrades, your contents, and liability. The condo corporation’s insurance covers the building envelope and common areas.

- Homeowner insurance (house): Covers the entire rebuilding costs for your home, your liability, and additional structures on the property. Homeowners insurance is customizable with riders. If not included in the base policy you can add riders for a wide range of perils including earthquake, flooding, and landslides.

Insurers specialize in various segments, such as working with seniors, providing coverage for affiliated membership groups like the CPA, geographical locations, specific risk types, and even types of buildings. To get the cheapest home insurance in Toronto, get as many quotes from as many insurers as possible and understand the differences among them in terms of coverage, deductibles, exclusions, etc. Our insurance professionals are more than happy to help you find quotes and to answer your questions.

Our proprietary insurance review platform has collected independent consumer reviews for a variety of insurance and financial products since 2012. Now, we have thousands of insurance reviews! Click here to access these home insurance reviews for free.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |