4 Reasons to get a Home Insurance Quote in Saskatchewan

- Find out if you are overpaying today and start saving

- Request a quote from 10+ insurance providers

- Get home, tenant, house or cottage insurance including flooding coverage

- Talk to a live agent and ask any questions you want

Welcome to your Home Insurance Guide for Saskatchewan. This page will give you an idea of Home Insurance Premiums, will inform about savings opportunities and also provide number of other useful tips for choosing Home Insurance protection in Saskatchewan.

What are average Home Insurance cost In Saskatchewan?

This chart identifies typical renter’s and homeowner’s insurance premiums across several provinces in Canada. You will note that renter’s insurance premiums are lower. Why? This is due to renter’s, also known as tenant’s, insurance only covering contents and liability. Homeowner’s insurance covers the building, the property, the liability and some extras (via riders) such as protection for gardens and trees.

Homeowners in Saskatchewan spend less than many other Canadians for home insurance because there is much less of an earthquake risk (unlike British Columbia and Quebec), and there is not much of a history of extensive flooding.

Cheap Home Insurance in Saskatchewan: 10 Tips

- Heating matters: Oil heated homes cost more to insure than the more modern options of forced-air gas or electric furnaces.

- Renovate the pipes: Do you have galvanized or lead pipes? Upgrade to copper or plastic.

- Annual vs. monthly payments: It costs insurers less to administer (paperwork, filing, etc.) annual homeowner’s insurance payments, so you save money if you pay annually instead of monthly.

- Upgrade: Older homes mean older components. Upgrade to better roofing, plumbing, etc., to save money on your insurance.

- Wiring: Aluminum wiring is very expensive to insure, and that is if you can even find an insurer willing to give you coverage. If you do find an insurer, the home will be subject to a very detailed electrical inspection.

- Water damages is an indicator of something wrong: See water damage in a home you want to buy or rent? Be careful. This can indicate major problems behind the drywall. Ask an inspector to check things out.

- Smoking is risky: Since smoking increases fire risk, insurers increase your premium.

- Swimming pools: Pools make insurers uncomfortable because of the liability risk. Pools also increase your home’s value. These two facts drive up your home insurance premiums in Saskatchewan.

- Bundle: If your insurer also sells auto insurance, bundle up to get a discount.

- Business Insurance: Do you work from home but your inventory is just a computer and some basic office equipment? Compare the difference between home and business insurance. If there are not many high-value business assets to insure, home insurance may be the cheaper option.

5 elements that will increase your Home Insurance costs

- Oil-based heating: Oil heaters are a fire and environmental hazard. Forced-air gas and electric heaters are, therefore, cheaper to insure.

- Fireplaces and woodstoves: While aesthetically pleasing, fireplaces and wood stoves can cause fire and smoke damage. This risk can increase your insurance premium.

- Business property: Your liability increases if you run a business from your home or on your property. Your contents are also a higher risk from clients visiting on site and/or having inventory stored on the premises.

- Roofing: Wood and shingle roof shingles are cheaper to buy, but insurers prefer your home to have longer-lasting options like metal.

- Expensive items: Your contents coverage has a maximum, so if you own a wine collection, expensive art, fine jewellery, rare musical instruments, etc., you may need a separate rider.

Saskatchewan Home Insurance quotes, examples

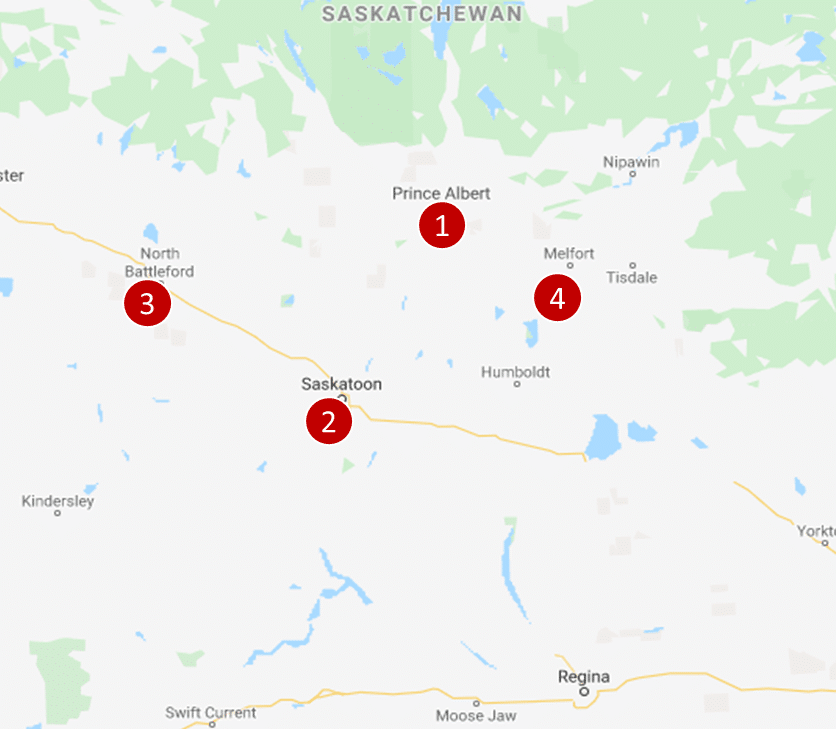

Saskatchewan home insurance quote #1: Homeowners House Insurance for a 1-store detached house without garage, basement 50 sq feet, located in Prince Albert:

Price: $82 per month ($995/year)

Saskatchewan home insurance quote #2: Homeowners house insurance for a 2-store semi-detached house, located in Saskatoon:

Price: $68 per month ($817/year)

Saskatchewan home insurance quote #3: Tenant house insurance for 1-storey detached house with basement (75 sq feet), located in North Battleford, brick:

Price: $24 per month ($288/year)

Saskatchewan home insurance quote #4: Homeowners house insurance for a 2-store detached house, with basement and attic, located in Melfort:

Price: $117 per month ($1,410/year)

5 Home Insurance Myths to Know

Myth #1: The government mandates homeowners insurance

This is commonly misunderstood. Auto insurance is mandatory, but homeowner’s insurance is not. That being said, if you have a mortgage, the lender can ask you to insure your home and list them as a beneficiary, and a landlord can insist that you get tenant’s insurance. In these cases you can be denied a mortgage or a rental if you don’t comply.

Myth #2: Claims increase my insurance

Not all insurers increase the premium with each claim. Some allow the first claim to pass without penalty. Some just revoke the “claim free” discount.

Myth #3: Older home, cheaper insurance

The opposite is usually true. Older homes have older components such as old shingles, oil heaters, and aluminum wiring. Unless the home has been upgraded and well maintained, and older home can cost you more, not less, to insure.

Myth #4: All home insurance policies are the same

Policies differ widely among insurers. Some offer protection for things like hail and flooding, while others only offer that coverage via a rider – or not at all. Be sure to fully understand the policy you wish to purchase, and compare options to ensure you are getting the best coverage.

Myth #5: If I am away on vacation, my house is covered

Your policy lists how many times your home must be checked while you are away on a business trip or vacation. Alternately, your policy may require you to shut off the water supply and empty the pipes if you are away for an extended period of time in the winter. Failure to comply with the policy’s vacation rules can result in a claim denial.

Home Insurance companies in Saskatchewan

There are many P&C (Property and Casualty) home insurers in Saskatchewan including:

- Saskatchewan Government Insurance

- Intact Insurance

- TD Insurance (owned by TD Bank)

- Aviva

- RSA Insurance

- Economical Insurance (includes Sonnet Insurance)

- Desjardins Insurance

Mid-size insurers include:

- Square One Insurance

- RBC Insurance (as Aviva)

- Travelers

- Gore Mutual Insurance

- CAA

- The Co-Operators

- Wawanesa Insurance

- Several others

You have several options as to where you purchase your home insurance. It is available through insurance companies, agents, brokers, and some banks.

Through our partners, we can offer home insurance quotes in Saskatchewan including but not limited to these locations: Prince Albert, Saskatoon, Melfort, Regina, Moose Jaw, Swift Current, Yorkton, Weyburn, Melville, Humboldt, Estevan, Flin Flon, Warman and others.

Home insurance coverage in Saskatchewan, and across Canada, depends on the type of insurance you choose. Here’s an overview:

- Tenants insurance: Tenant’s, also called renter’s, insurance covers contents and liability

- Homeowners insurance (condo): Your condo unit, contents, unit upgrades, and liability are covered. The building’s structure and common areas are not covered by this policy.

- Homeowners insurance (house): Covers the rebuilding costs for your home and includes a range of natural impacts depending on your riders (e.g. earthquake, flooding, snow damages, etc.), liability, and sometimes extras (via riders) for your trees, garden, and outbuildings.

Different home insurance companies specialize in different demographics (e.g. seniors, affiliated members of various organizations such as CPA, CAA, etc.), locations, types of buildings, risk types, and more. In order to find the cheapest home insurance, be sure to get a quote from as many insurers as possible and understand what exactly they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals help you with all these questions, and help you find quotes.

Our proprietary insurance review platform has collected independent consumer reviews for a variety of insurance and financial products.

Since 2012. Click here for free access to thousands of home insurance reviews .

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |