Get a Home Insurance quote now. Start saving.

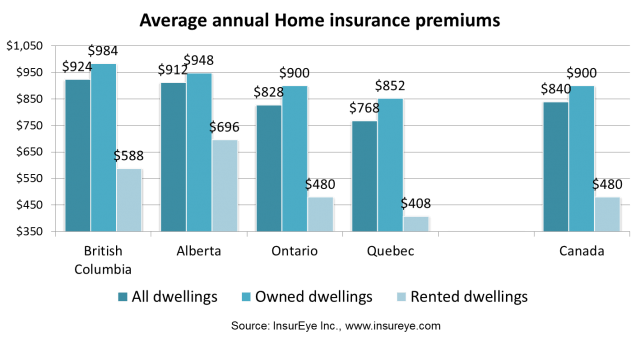

The highest level of home insurance premiums is in British Columbia at $924 annually, followed by Alberta with $912 annually. Annual home premiums in Ontario go as high as $828, and in Quebec they reach $768 per year.

Owned vs. Rented Property

Home insurance for rental properties is in general cheaper than for owned properties because of the limited coverage this type of insurance typically provides. In the case of a renter or condo owner, you are paying to insure your personal property. Insurance for a home owner covers both your dwelling and personal property. Virtually all home insurance policies cover additional aspects such as liability.

InsurEye’s research shows that home insurance premiums for owned property are 1.4 times higher (Alberta) to 2.1 times higher (Quebec) than premiums for a rented dwelling. The highest level of premiums for a rented dwelling is in Alberta at $696 per year, followed by B.C. with $588. Ontario follows with $480 and Quebec with $408 per year to round out the list.

As for owned property, British Columbia is clearly the priciest province, where home owners need to put down here the highest amount in Canada: $984 per year, compared with $948 in Alberta, $900 in Ontario and $852 in Quebec.

Why BC Home Insurance so Expensive?

[home_insurance_square_widget]A glance at real estate statistics delivers the first answer why British Columbia home insurance prices are so high. According to MLS statistics, B.C. is clearly leading in the average real estate prices. This average for Vancouver and Victoria reaches ~$750k and ~$450k respectively, whereas Toronto and Ottawa bring in ~$463k and ~$350k as averages. Calgary’s real estate average is ~$380k, with Montreal at ~$311k and Quebec City rounding out at ~$250k. The more valuable the home, the more it typically costs to rebuild and to insure.B.C.-based insurance provider Square One shares another insight as to why home insurance is so expensive in B.C. Due to the high earthquake risk, 40% to 60% of B.C. residents buy earthquake coverage, significantly more than the rest of Canada. (Only 5% to 10% of Quebec residents purchase this coverage even though it, too, is in an earthquake zone.) And, the cost of earthquake coverage in B.C. can account for as much as one-third of a policy’s premium.

InsurEye is a Canadian company that provides independent, innovative online services to help consumers better understand and manage their insurance. Insurance Rate Comparison is a free, interactive tool that compares consumers’ insurance costs with their peers and shows how to save using others’ insurance experience. If you own or rent a condo, InsurEye offers you an affordable online condo insurance quote to make sure that you are covered.

Established in 2011 and based in Vancouver, British Columbia, Square One Insurance provides Canadians living in urban centres with modern, relevant home insurance. Square One is one of the few insurance providers in Canada specializing in home insurance and offering truly customized policies that can be purchased over the phone and online. For more information about Square One, visit www.squareoneinsurance.ca

Used cars

May 14, 2012 at 12:33 pmThat’s really great report which is very informative for me. It’s good to see Canadians are very serious about their home insurance.

John Austin (in Newfoundland)

September 27, 2012 at 1:22 pmI didn’t realize that there are only four provinces in Canada.

greg stewart

March 16, 2017 at 4:19 pmvery good reply

NojobsinAlberta

March 29, 2017 at 10:51 pmYou are counted after you have worked for at least one year in Alberta.

alexey.saltykov

September 27, 2012 at 2:48 pm@John,

Thank you very much for stopping by here. Since our research was based on consumer data, we had enough data only across four most populated provinces. Meanwhile we launched our tool for Auto insurance also for consumers in Nova Scotia and hope to add other provinces soon!

Alex @ InsurEye

chuck

January 24, 2016 at 2:43 amYou only have data on 4 provinces? that’s pathetic?

NojobsinAlberta

March 29, 2017 at 10:53 pmYou will have to do a better more thorough one Chuck, I look forward to seeing what you come up with.

alexey.saltykov

January 26, 2016 at 2:17 am@Chuck,

This study was done in 2012. Since then we have collected some data on other provinces as well. If you check our insurance price comparison tool

you will see that we have numbers for MB, NB, NL, NS and SK

Alex @ InsurEye

Lonnie

June 29, 2020 at 4:44 pmI guess the transfer payments from Alberta allows Ontario and Quebec to have lower insurance premiums? What a joke!