Did you like this infographic?

Join InsurEye Newsletter now to start getting all our insightful visuals and personal fianance / insurance tips!

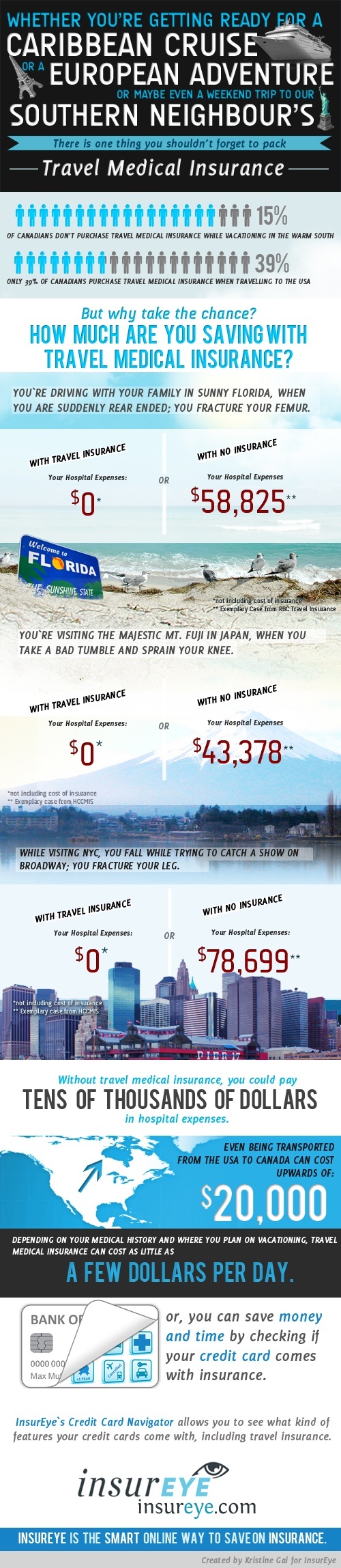

These are some scary numbers: 15% of Canadians do not purchase Travel Medical Insurance while travelling to the South and only 39% get it when going to States! Medical treatment abroad can be exorbitantly expensive: our infographic shows you a few examples using real numbers from the cases.

So maybe it’s worth asking yourself: can I afford potentially spending thousands on hospital expenses abroad, or would I rather spend just 10-15 min researching and purchasing appropriate travel insurance for just dollars a day?

There are basically two main ways to get travel medical insurance:

- First, check if you have a credit card which already comes with Travel Medical Insurance. You can do it easily, in as little as 10 seconds, using our interactive Credit Card Navigator tool that educates Canadians about credit card insurance protection

- If you do not have Travel Medical Insurance on your credit card, you might want to get it from any insurance provider offering travel medical protection or simply find a rate / coverage that looks best for you through such a site like InsuranceHotline.com where you get a rate comparison across multiple providers

And remember, we strongly encourage you do not travel outside of your home province without travel medical insurance. In the end, it does not matter where you get it, but you need to have travel medical insurance, review the policy AND understand all the details of your coverage!

Doug Hilderley

July 20, 2012 at 12:45 pmMy neighbour needed triple bypass surgery in Texas – total cost $110,000 – only had insurance for half of it

My friend broke his arm in Thailand and needed a

plate inserted – $7000 paid up front before work

began – had insurance and recouped $6500

27 year old New Zealander rented a motorbike in Thailand and suffered serious injuries in accident –

2 punctured lungs, broken ribs, muscles torn from

neck to jaw – $20,000 – had insurance which stated as “complete coverage” but hidden in it that motorbikes were not covered

Alex

July 20, 2012 at 1:46 pm@Doug,

Many thanks for sharing these examples showing how expensive travel medical issues can be…

Yes, insurance policies have many conditions and exclusions attached to them. One topic which is very important and we always try to share it with our readers is that often rental vehicle protection (can be a part of travel insurance) does NOT cover:

– Third party liability

– Bodily injuries

It is similar with Rental Car protection on a travel credit card. It’s basically only a Collision Waiver (covers only damages and loss to your rental vehicle) and not a complete protection!

Min-van can be a tricky thing too. It is often difficult to understand if this vehicle is covered or not. It may be the case that if you just giving a ride to several people, it’s fine but if you use it as a truck e.g. to transport your furniture, it is not covered…

Alex