Get a Home Insurance quote now. Start saving.

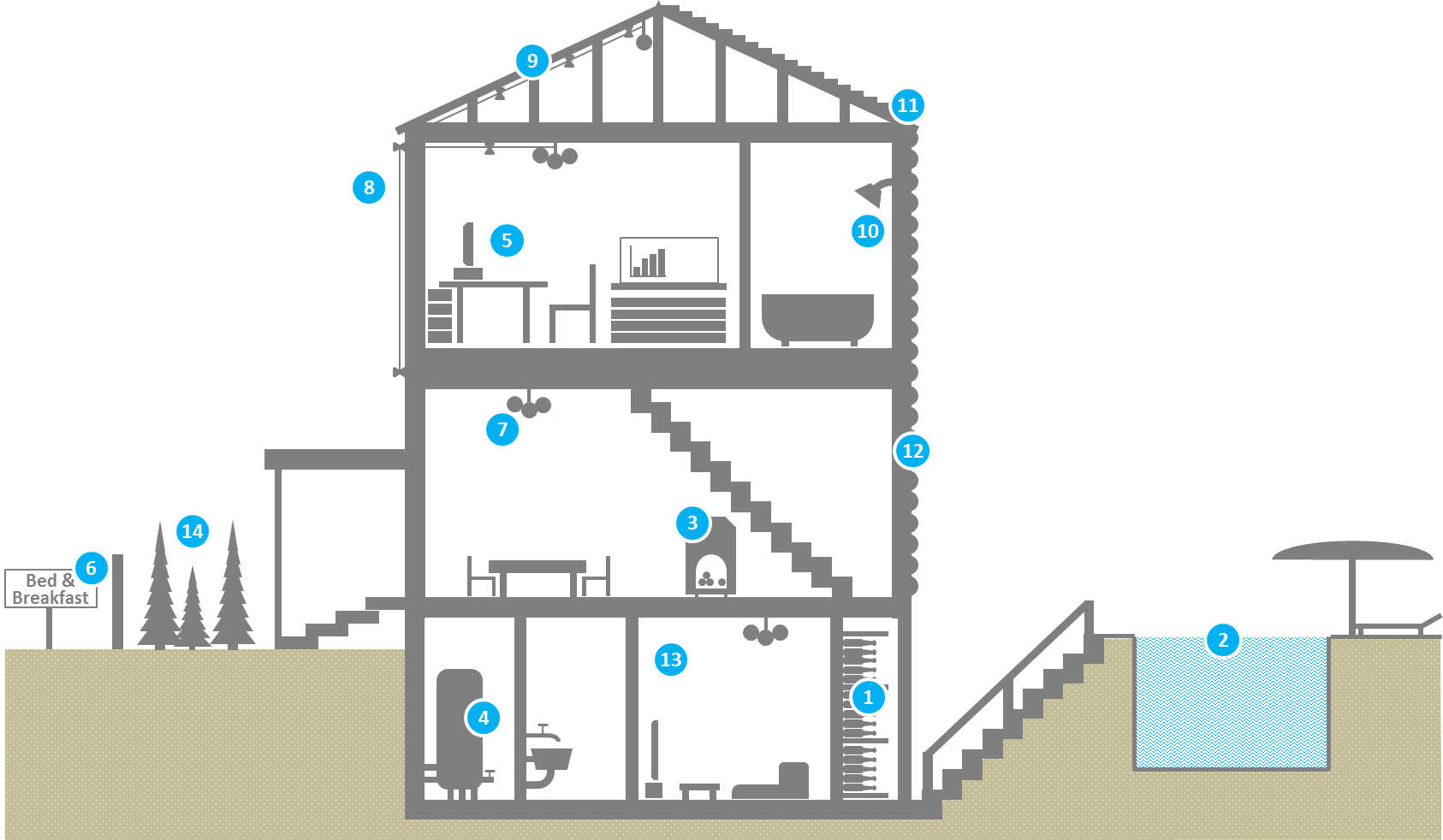

There are numerous home elements that will increase your home insurance cost when searching for insurance. Some are related to the building itself, others to things outside of the house. Are any of these elements found in your house?

home insurance cost – what home elements impact it

Expensive items: Jewelry, wine collections, art, musical instruments, expensive watches, silverware, furs, sporting equipment and bicycles – everything that potentially can increase the size of your loss will lead to additional premiums. Often, insurers offer separate products or additions to the existing policies (also called riders) to insure more expensive items.

Swimming pools: Pools represent higher liability, especially when not protected by a fence. In the eyes of insurers, it is an additional liability that can be very costly.

Fireplace / woodstove: In general, wood stoves are considered a potential source of fire and smoke damage. Insurers will look for additional premiums and/or require a home inspection prior to selling an insurance policy.

Oil-based heating: Insurers prefer electric heat or forced-air gas furnaces. It may not be easy for you to get insurance if you still have an oil-based heating system since these systems can result in environmental hazards and can easily cause a fire.

Business property: Using your home for business would typically result in higher home insurance costs since there is a higher risk associated with those policies. If something happens to your home, both your personal contents and business property could be lost or damaged.

Home being a part of your business: If your home is also used and equipped for particular types of business, it poses an additional risk in eyes of insurers. Bed and breakfasts, daycare, and customers or suppliers visiting your home will all result in higher home insurance cost.

Aluminum wiring: This type of wiring was used in houses prior to 1970. It is not used anymore and insurance companies consider it an increased risk because of its potential to overheat and cause fires. Insurance policies for houses with aluminum wiring will be either more expensive or harder to get. In many cases, you’ll also be required to secure an inspection conducted by a certified electrician.

Knob and tube wiring: That is a quite old type of wiring and requires connectors that use knobs to keep the wires isolated. Insulating tubes are used to guide wires through walls. Insurers do not like this type of wiring because it is not well-suited to today’s high energy consumption levels. As such, they will often insist on you getting the house rewired or require an additional premium.

Old house elements: Depending on the age of some building elements, like your home’s roof, insurance can be more expensive or even not available at all until a proper renovation is completed.

Galvanized or lead pipes: Some types of pipes are less reliable, such as galvanized or lead pipes. These are older pipe types that are more likely to build up corrosion, resulting in a negative impact on water pressure and water quality. This risk makes it more expensive to ensure as opposed to modern plastics or copper pipes.

Roof type: Different roof types are not seen as equal by insurers and that reflects in insurance premiums. The least reliable roofs are wood shake or shingle.

Building frame: Wood frame homes are more likely to suffer from fire, so they may be considered less safe than concrete or brick homes. As such, wood frame houses may face higher insurance costs.

Basement: Finished basements drive up costs because water flows down, which means more chance for damage if a pipe bursts or sewage backs up into the home.

Garden and Trees: Having a garden, including fencing, is not considered a higher risk just because you have them; but in most cases you do have to pay extra for this type of coverage.

Now equipped with the knowledge about what home elements can increase your home insurance cost, you are well informed about elements of your existing or future home that you might want to fix or avoid.

We thank Daniel Mirkovic from Square One Insurance for these insights. Square One is an insurance provider that is exclusively focused on home insurance. Here are three things that make them unique: 1. customizable coverage that you can fully adjust to your own needs, 2. understandable and easy to understand policy, and 3. home insurance cost that is lower than most other Canadian providers would offer (simply try out the quote below).

Our next publication will focus on home upgrades that can actually decrease your home insurance costs. Stay tuned!

Weekend Reading - Retired by 30, greatest asset, saving, one year later | My Own Advisor

May 21, 2015 at 11:31 pm[…] InsurEye listed a few reasons why your home insurance might be expensive. […]