InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent insurance reviews, each one carefully moderated in order to ensure a high quality of information. Now, the Toronto-based insurance analysis company will be able to ensure, with the help of its new web platform, easy access to the information you need about condo insurance and associated condo topics.

“Many aggregator platforms out there, including MLS, are doing a good job of providing an overview of prices,” suggests Henry Karimi, a real estate veteran who oversees real estate operations at CondoEssentials, “but what you cannot find out from them is how it actually feels to live in each condo. Only those with first-hand experience, such as condo tenants and owners, can inform about that. When you buy or rent a condo, you want to know if elevator waiting times are long, if a swimming pool is constantly under construction, if a gym is small and dingy, and how it actually is to live in this building and neighbourhood.”

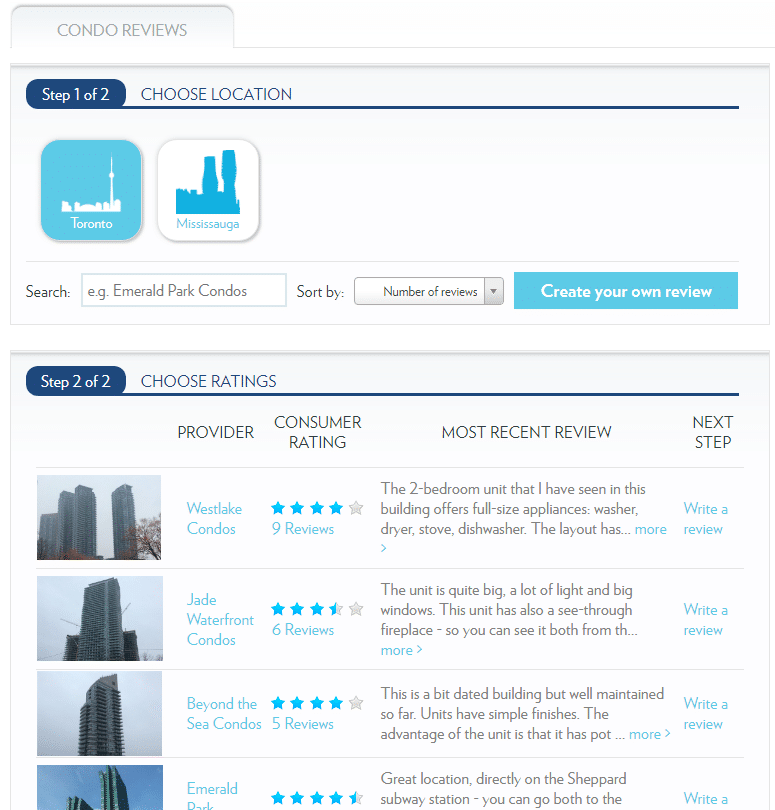

That’s where InsurEye’s new independent condo review platform comes in.

“Moving into the condo review space is the next logical step for us,” says Alexey Saltykov, one of InsurEye’s co-founders. “We started with auto insurance, life insurance and home insurance reviews a few years ago, and as of 2017, we also offered Canadians mortgage and credit card reviews.”

“Given the current real estate situation in Canada, and especially in major cities like Toronto, Vancouver and Montreal, Canadians have started looking more and more into the condo segment,” Saltykov continues. “With CondoEssentials, we are addressing this need and providing Canadians with unique information.”

“The experience we have collected in the insurance review space will be invaluable for CondoEssentials,” agrees Dmitry Mityagin, another InsurEye co-founder and CTO. “In 2011, we had about 1.6M occupied condominiums in Toronto, in 2016, it is about 1.9M. That means the condo market is growing aggressively, making it harder and harder for Canadians to compare possible options. We hope that CondoEssentials will become one of the go-to tools for Canadian condo buyers.”

CondoEssentials uses three dimensions to evaluate Canadian condominiums:

- Condo building and appearance

- Unit size and floor plan

- Condo amenities

CondoEssentials currently offers reviews for condos in Toronto and condos in Mississauga.

InsurEye Inc is a Canadian company, located in Toronto, ON. It manages the largest Canadian review platform for various insurance types and other financial products, such as credit cards and mortgages. “Many aggregator platforms out there, including MLS, are doing a good job of providing an overview of prices,” suggests Henry Karimi, a real estate veteran who oversees real estate operations at CondoEssentials, “but what you cannot find out from them is how it actually feels to live in each condo. Only those with first-hand experience, such as condo tenants and owners, can inform about that. When you buy or rent a condo, you want to know if elevator waiting times are long, if a swimming pool is constantly under construction, if a gym is small and dingy, and how it actually is to live in this building and neighbourhood.”

That’s where InsurEye’s new independent condo review platform comes in.

“Moving into the condo review space is the next logical step for us,” says Alexey Saltykov, one of InsurEye’s co-founders. “We started with auto insurance, life insurance and home insurance reviews a few years ago, and as of 2017, we also offered Canadians mortgage and credit card reviews.”

“Given the current real estate situation in Canada, and especially in major cities like Toronto, Vancouver and Montreal, Canadians have started looking more and more into the condo segment,” Saltykov continues. “With CondoEssentials, we are addressing this need and providing Canadians with unique information.”

“The experience we have collected in the insurance review space will be invaluable for CondoEssentials,” agrees Dmitry Mityagin, another InsurEye co-founder and CTO. “The market for condos is becoming more and more transparent. In 2011, we had about 1.6M occupied condominiums, in 2016, it is about 1.9M. That means the condo market is growing aggressively, making it harder and harder for Canadians to compare possible options. We hope that CondoEssentials will become one of the go-to tools for Canadian condo buyers.”

CondoEssentials uses three dimensions to evaluate Canadian condominiums:

• Condo building and appearance

• Unit size and floor plan

• Condo amenities

Each review CondoEssentials provides is moderated and checked to ensure helpfulness and truthfulness— InsurEye uses a proven, proprietary methodology to ensuring that no fake comments are represented.

CondoEssentials currently offers reviews for condos in Toronto and condos in Mississauga.

InsurEye Inc is a Canadian company, located in Toronto, ON. It manages the largest Canadian review platform for various insurance types and other financial products, such as credit cards and mortgages.