Get a Home Insurance quote now. Start saving.

Average Edmonton Homeowners Insurance Rate is $67 per month

What are typical home insurance rates in Edmonton?

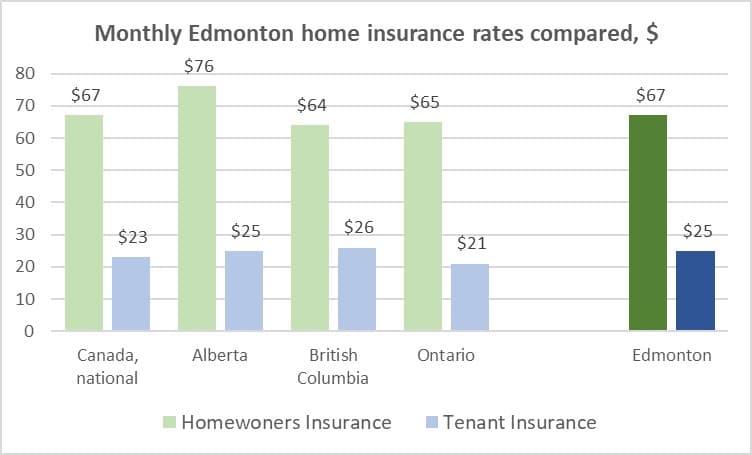

On average, homeowners in Edmonton are paying $67 per month for homeowners insurance, and renters are paying an average of $25 per month for tenant insurance rates according to the proprietary InsurEye data compiled from thousands self-reported home insurance rates. Now, let’s explore those numbers more closely to get an idea of the details that influence those figures.

How Edmonton’s home insurance rates compare to the provincial numbers

For instance, Calgary and many adjacent areas have a history of flooding and storms, Fort McMurray has a history of wildfires, and Red Deer and the Rocky Mountains have a history of heavy hailstorms. In fact, Edmonton’s homeowners insurance premiums are actually closer to those of Ontario and British Columbia, which illustrate average premiums of $65 and $64 per month, respectively.

In terms of tenant insurance, Edmonton renters ($25/month) are likewise paying similar rates to renters in BC ($26/month) and Alberta ($25/month). Ontarians are the anomaly here, paying on average significantly less for tenant insurance at $21/month.

Homeowners Insurance in Edmonton

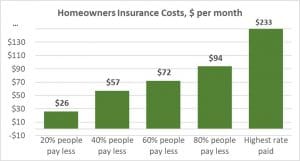

Now let’s zoom in on the details by breaking homeowners insurance rates in Edmonton down by percentile. As we’ve already discussed, the average homeowners insurance costs in Edmonton amount to $67 per month, but how does that more accurately break down—what are the rate ranges that result in that overall average?

Statistics show that 20 per cent of Edmontonians are paying $26 or less per month for their home insurance—that 20 per cent would often refer to condo owners because condo insurance in Edmonton typically costs less than house insurance. In the next demographic group, we have 40 per cent of Edmontonians paying $57 or less a month in home insurance costs; this group most likely consists of condos, apartments, or small houses that are in low-risk areas. The next group includes small to mid-size houses; these 60 per cent of Edmontonians are paying $72 or less a month for home insurance. Finally, 80 per cent of Edmontonians are paying $94 per month for home insurance.

[home_insurance_square_widget]

That leaves 20 per cent of Edmontonians who are paying more than $94 per month for home insurance. Many of these individuals or families will have either bigger homes, smaller homes in mid-risk areas, or homes that represent a higher risk due to the age of various home elements such as e.g. roofs, proximity to flood zones, storm history, etc. Where does this price cap off? Our data shows that these last 20 per cent are paying between $94 and $233 monthly for home insurance premiums.

That range reaches pretty far above the reassuring $67/month average, but it is important to remember that there are dozens of factors that can impact your homeowners insurance rates—and that is why it is so important to get a tailored home insurance quote so you can see precise assessment of your future costs (potentially before you buy).

Tenant Insurance in Edmonton

According to our data, approximately 20 per cent of Edmontonians pay $17 per month or less for their renters insurance; this demographic often includes condo tenants who need minimal coverage limits to cover their belongings and some liability.

This next group describes a similar demographic to the previous percentile: the 40 per cent of renting Edmontonians who pay $20 or less a month for home insurance most likely require lower coverage limits and have not had significant past home insurance claims. Our data further shows that 60 per cent of Edmontonians are paying $23 or less a month, and that 80 per cent of tenants in Edmonton are able to pay $28 or less a month for home insurance.

That leaves, once again, 20 per cent who are paying significantly higher-than-average rates for tenant insurance. These rates vary widely, ranging from $28 per month to $200 per month. It is important to note, however, that some of these higher rates are due to elective special coverage. For instance, individuals may choose to purchase additional insurance riders to protect expensive items, like jewelry or art collections, or their increased rates may occur due to their own past history of claims.

As an overall rule of thumb, if you are paying more than $30 per month for tenant insurance without any special reason, you are likely overpaying—but don’t despair! We can help you get a competitive tenant insurance quote already today, so you can protect yourself, your home, and your belongings while still managing to save a little for your future investments.

Key things to know about home insurance in Edmonton

Now you know more about how the price of home insurance breaks down in Edmonton, and we’ve already mentioned that Edmonton has a less severe history of flooding than Calgary and less exposure to wildfire than Fort McMurray, so what types of things should you ensure you are insured against when it comes to your Edmonton home insurance? It is helpful to start from the spectrum of possible claims, so you can know what to protect your home against.

Our data shows that, despite the fact that Edmonton is less at risk of flooding than Calgary, nearly 50 per cent of all claims in Canada originate from water damages. That doesn’t necessarily mean flood damage in the natural sense; it more commonly refers to damages that are caused by internal water issues, sewer back up, or overland flooding.

How can you protect yourself using Home Insurance in Edmonton correctly?

Make sure that you (A) have a sewer back up endorsement on your policy, and (B) also have an overland flooding endorsement on your home insurance policy—but you also need to make sure you have sufficient limits on both.

What kinds of coverage can you more safely leave off your Edmonton home insurance policy?

Unlike Vancouver and Quebec, Edmonton has a much lower risk of exposure to, and damage as a result of, earthquakes, and since that is something you are less likely to face in Edmonton, you can save a bit on your home insurance by foregoing earthquake coverage.

But remember…

When considering ways to save on your home insurance rates—whether you are insuring a home, condo, or apartment—it is important to remember that particularly expensive or valuable items (rugs, jewelry, art collections, wine collections, etc.) often need to be insured separately, and these items may require assessment or appraisal to ensure proper coverage.

We hope that these insights will help you to better understand home insurance in Edmonton, and we hope that understanding can help you to better protect yourself at reasonable cost. If you would like more clarification about the particular coverage you need, or if you want to reduce your home insurance costs today, spend a few minutes getting your homeowners or tenant insurance quote in Edmonton—you could save hundreds of dollars annually as a result!