5 Reasons to Get a Car Insurance Quote in Kitchener

- Compare car insurance rates in Kitchener across 30+ insurers

- Available remotely from the comfort of your home

- Find out if you are currently paying too much

- Spend 5 minutes to save hundreds of dollars

- Talk to a live agent if you have questions to your quote

Welcome to your guide for getting the best rates on car insurance in Kitchener. In this guide we will discuss car insurance premiums, how to save money on your auto insurance, bust some common myths that are holding you back from getting the best rates and more. Auto insurance in Ontario can be expensive, so we’ve made sure you have all the tips and tricks you need to save money on your car insurance rates.

What are typical Car Insurance rates in Kitchener?

The charts above show two types of comparisons: rates are compared across provinces and rates are compared across age ranges. As you can see, car insurance rates in Ontario are higher than any other province in Canada. Young drivers, regardless of where they live, can also expect to pay more due to their lack of experienced driving history.

It is important to know how to get the best rates on car insurance in Kitchener, because despite attempted government intervention to lower rates, premiums remain disproportionally high when compared to the rest of Canada.

Even though rates across Ontario are high, drivers in Kitchener pay less than drivers in Toronto, Brampton, Mississauga, and Hamilton. Car insurance rates in Kitchener average $90-$120/month. However, if you moved to Waterloo, your rates would be even lower. In that city, expect to pay between $80-$100/month.

Get to know all Car Insurance components

Car insurance is made up of various parts, some of which are mandatory. What you choose depends on your budget and coverage needs.

| Insurance component | Description | Type |

|---|---|---|

| Collision insurance | This insurance pays for damages to your vehicle after an accident. If your car is beyond repair, it pays a reasonable sum to replace it. | Not mandatory |

| Liability insurance | This mandatory coverage is for the damages you cause to others in an accident. Damages include but are not limited to medical bills, lost earnings, legal fees, etc. Depending on the province, you can be sued for damages, driving your costs into the millions. Since rates for liability insurance are not high, we suggest getting more than the minimum coverage. | Mandatory |

| Comprehensive insurance | Purchase comprehensive to protect yourself from non-accident related damages that affect your car, such as extreme weather, flooding, and vandalism. | Not mandatory |

| All perils | What happens if someone in your household steals your car? Or an additional driver on your policy damages it? All perils covers these concerns. | Not mandatory |

| Uninsured motorist / Hit-and-run coverage | Some drivers illegally operate without coverage, or flee the scene of an accident (hit and run). This coverage protects you financially from these irresponsible individuals. | Mandatory |

| Accident Benefits | Medical expenses, income replacement, and other such expenses are covered by accident benefits. | Not mandatory |

What cars are the most expensive ones to insure?

The cost to insure a vehicle is linked to different types of claims associated with it, including accident benefits insurance claims, collision insurance claims, comprehensive insurance claims, and direct compensation property damage insurance claims. For example, these cars (model years 2014-2018) typically have high insurance costs:

- BMW X6

- BMW 4th series

- Tesla Model S

- Cayenne

- BMW 3rd series

- Audi Q7

- Mercedes-Benz S series

- Hyundai Genesis

- Audi S5

- Mercedes-Benz CLS

- Mercedes-Benz C series

- Audi A5

- Subaru/Toyota BRZ

- Dodge Charger Ford Mustang

- Lexus IS

The make and model affect the rates, but other factors have a bigger impact on the final premium. These factors include your driving habits, age, driving history, location, policy type and coverage level.

7 Ways to save on Car Insurance in Kitchener

Cheap car insurance in Kitchener can be challenging since rates in Ontario are so high, but there are ways to save money. We’ve listed some of the ways to reduce car insurance rates in Kitchener below.

- Professional Membership: Are you a member of the Certified Management Accountants of Canada? The Air Canada Pilots Association? A post secondary alumni association? Check with your membership organization as many offer group rates on car insurance.

- Winter Tires: It’s a fact – winter tires reduce your risk. Car insurers may give you a discount for using winter tires.

- Dashboard Camera: A dashboard camera doesn’t give you a discount, but it can prove you were not at fault in an accident.

- Leverage Rental Car Coverage: If your car insurance covers rental vehicles, skip the collision damage waiver offered when you pick up your rental.

- Being Married: Apart from Nova Scotia, your insurance premiums may be influenced by your marital status.

- Drop the Glass Coverage: If you own a fairly typical car, it’s cheaper to pay for a new windshield out of pocket than to pay for years of glass coverage on your policy.

- Location, Location, Location: Rates don’t just vary among provinces, they also vary among cities. Car insurance rates, for example are among the highest across Ontario. When moving, check the rates so you can factor them into your budget.

Kitchener Car Insurance quotes, examples

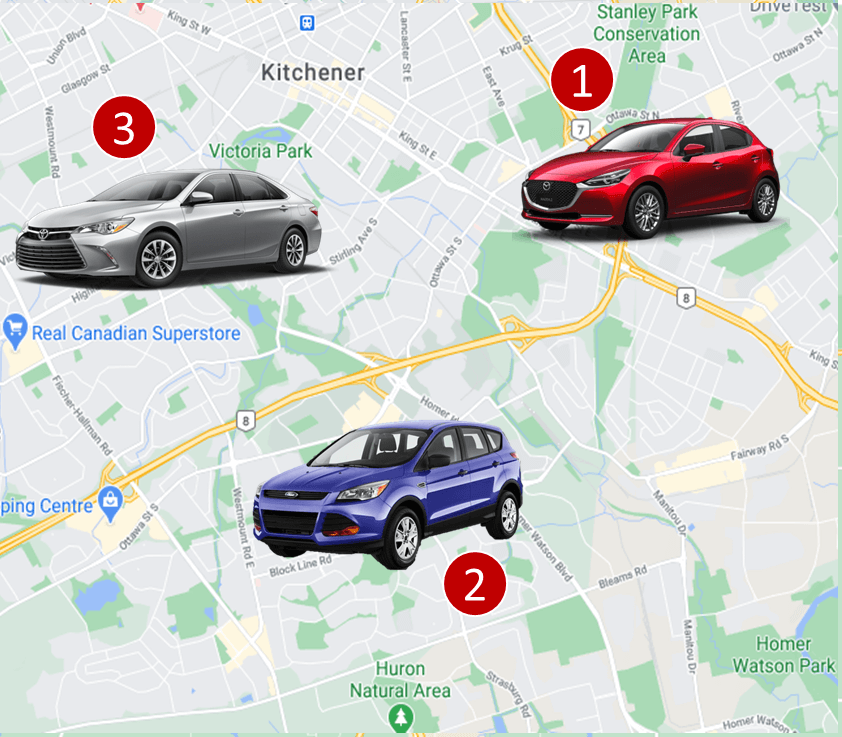

Sample car insurance quote #1:

A male driver, 45-years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2018 Mazda 3 GX, CAA member, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $2,000,000.

$85 per month ($1,020 annually)

Sample car insurance quote #2:

A female driver, 52-years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2014 Ford Escape, collision-only coverage (no comprehensive). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$62 per month ($744 annually)

Sample car insurance quote #3:

A female driver, 34-years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2016 Toyota Camry, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$123 per month ($1,476 annually)

Car casualty rates in Ontario (including Kitchener)

When we looked at casualty statistics numbers from Transport Canada (2018), Ontario drivers appear to be safer drivers than those in other provinces.

| Province | Fatalities per 100,00 licensed drivers | Injuries per 100,00 licensed drivers |

|---|---|---|

| NU | 74.2 | 928.0 |

| YT | 24.1 | 681.1 |

| SK | 15.8 | 517.5 |

| PE | 13.2 | 573.8 |

| NS | 10.2 | 978.9 |

| NB | 9.0 | 484.3 |

| AB | 9.0 | 530.0 |

| BC | 8.0 | 555.7 |

| MB | 7.6 | 1310.0 |

| NT | 7.6 | 382.5 |

| Canada | 7.2 | 575.0 |

| NL | 6.6 | 460.8 |

| QC | 6.4 | 622.1 |

| ON | 5.8 | 491.3 |

Despite a good driving record, Ontario drivers still pay more for car insurance than any other province in Canada.

Car Insurance in Kitchener – what you must know

- Car insurance is required by law in all of Ontario, including Kitchener.

- Mandatory liability coverage is the minimum 3rd party coverage that is mandated by law. It is part of every policy. In Ontario it is $200,000.

- Other car insurance benefits available in Kitchener, Ontario are:

- Disability income benefits: 70% of your gross income up to max of $400 per week.

- Non catastrophic injuries: The standard maximum for medical, rehabilitation and attendant care expenses (physiotherapy, chiropractor, an aide, etc.) is $65,000.

- Catastrophic injuries: The maximum is $1,000,000 for a catastrophic injury.

- Caregiver benefits max out at $250 per week for the first dependant, and $50 per week for each additional dependant.

- If the accident means you cannot perform usual housekeeping and maintenance duties, and you must hire help, the maximum benefit payment for this is $100 per week.

- The standard death and funeral benefit is $25,000 to your spouse, $10,000 to each dependant, and up to $6,000 for funeral expenses.

What cars are the least expensive ones to insure?

Some vehicles are less likely to get into an accident or, if involved, the repair or replacement costs are lower. Here are examples of cars (model years 2014-2018) that usually cost less to insure.

- Smart Fortwo

- Ford F150

- Nissan Frontier

- Chevrolet Tahoe/Yukon

- Chevrolet Silverado/Sierra

- Fiat 500

- Ford Mustang Convertible

- Jeep Wrangler

- Buick Encore

- Honda CR-V

- Jeep Compass

- Chevrolet Equinox/Terrain

- Nissan Xterra

- Honda Pilot

- Hyundai Accent

The vehicle’s model is just one factor that impacts your rates. Your driving history affects the rate much more than the type of car you drive.

5 Car Insurance myths to know

Myth #1: It is more expensive to insure red coloured cars

This myth prevails even though it’s false. The colour of your car does not influence your car insurance rates in Kitchener, or anywhere else in Canada.

Myth #2: Car insurance rates for cheaper cars are lower

Car insurance rates are tied to the history of the car model. Even though Honda Civics are cheaper than some luxury cars, Civics tend to be more expensive to insure.

Myth #3: If you lend your car, it will be covered through the insurance policy of another driver

If your car is in an accident and you have lent it to someone, it is your insurance policy that pays the damages.

Myth #4: Changing deductibles significantly impacts your insurance rates

InsurEye’s analysis shows that changing your deductibles do not really impact your insurance rates.

Myth #5: If a car is stored in a garage, it is covered by the home insurance policy

When in your garage your car is covered by your comprehensive policy (if you have this component), not your home insurance policy.

Cars typically cheaper to insure include Hyundai, Nissan, Ford, Buick, Chevrolet, and Jeep. Cars more expensive to insure include various series of BMW, Mercedes-Benz, Audi, and Lexus. The higher costs are because these cars cost more to repair. Check the tables above for the exact makes/models.

Drivers in Kitchener pay, on average, between $90 and $120 monthly for car insurance, and the rate depends on a variety of factors, including your driving history. Additionally, if you have two violations in the past three years (parking tickets not included), expect to pay 20%-35% higher rates. You’ll pay double rates if you have a poor driving history. Young drivers can also expect higher premiums due to their lack of driving experience.

Our proprietary insurance review platform has collected independent consumer reviews for different insurance and financial products since 2012. Click here for free access to our thousands of car insurance reviews.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]