Welcome to the Grande Prairie car insurance guide, where you’ll learn about average car insurance rates, savings opportunities, myths about auto insurance and much more. You can also get a car insurance quote from more than 30 Canadian insurers, and leverage tips you’ll learn for choosing the best policy.

What are typical Car Insurance rates in Alberta?

These charts show average rates in Alberta, and in Canada. The first chart compares several provinces. The second compares car insurance premiums by drivers’ ages. As you can see, the differences can be considerable.

When we compare Edmonton and Calgary drivers to ones in Grande Prairie, we see that Grande Prairie drivers have lower rates. At $90-$110/month, it’s cheaper here than Calgary’s average of $110-$130/month.

Get to know all Car Insurance components

Car insurance is made up of several different parts, some of which are mandatory and others that are based on individual needs.

|

Insurance component |

Description |

Type |

|

Collision insurance |

This component covers physical damage to your car after a collision with another vehicle. If your car cannot be repaired, a reasonable price is paid out to replace it. |

Not mandatory |

|

Liability insurance |

Liability insurance is mandatary as it covers damages to the other party you injure in an accident. This include medical bills, lost earnings, legal fees, etc. Some provinces also allow the injured party to sue, and this can drive costs into the millions. Since the minimum coverage is not expensive, we highly recommend purchasing more than the minimum requirement of liability insurance. |

Mandatory |

|

Comprehensive insurance |

Comprehensive insurance protects your car from non-collision damage, such as fire, theft, falling objects, and harsh weather. |

Not mandatory |

|

All perils |

Sometimes the peril is from a family member. All perils covers you if someone in your home steals your car, or if the car is damaged when used by an additional driver. |

Not mandatory |

|

Uninsured motorist / Hit-and-run coverage |

Some drivers don’t have insurance or leave the scene of an accident (hit and run). This coverage protects you from uninsured drivers. |

Mandatory |

|

Accident Benefits |

Accidents can result in significant medical and other expenses. Accident benefits help with medical costs, income replacement, etc. |

Not mandatory |

What cars are the most expensive ones to insure?

Car insurance costs are linked to the types of claims associated with the vehicle, including accident benefits insurance claims, collision insurance claims, comprehensive insurance claims, and direct compensation property damage insurance claims. Here are some examples of cars (2014-2018 models) with high insurance costs:

- BMW X6

- BMW 4th series

- Tesla Model S

- Cayenne

- BMW 3rd series

- Audi Q7

- Mercedes-Benz S series

- Hyundai Genesis

- Audi S5

- Mercedes-Benz CLS

- Mercedes-Benz C series

- Audi A5

- Subaru/Toyota BRZ

- Dodge Charger Ford Mustang

- Lexus IS

More than your car’s make and model impact your insurance costs. Your driving habits/history, location, policy type, and age have a greater impact on your final premium.

7 Ways to save on Car Insurance in Grande Prairie

- Bundle: Need to insure your home and your car? Some insurers offer a bundle discount.

- Being a Second Driver: Occasional drivers in the household can be added as a second driver, saving you both from paying primary rates.

- Driving Course: Some insurers provide a discount if you have taken a professional drivers’ training course.

- Being Married: Apart from Nova Scotia, in most provinces your insurance premiums may be influenced by your marital status.

- Good Student: Study hard! Good grades can, in some cases, reduce your insurance rate.

- Car Insurance Deductibles: Can you afford a higher deductible? Are you an experienced driver? A higher deducible means a lower premium – but remember, you must pay the higher deductible when you make a claim.

- Location, Location, Location: Rates vary by province, but even within the province, rates vary by city. When moving, be sure to check – and budget for – the location’s car insurance rates.

Grande Prairie Car Insurance quotes, examples

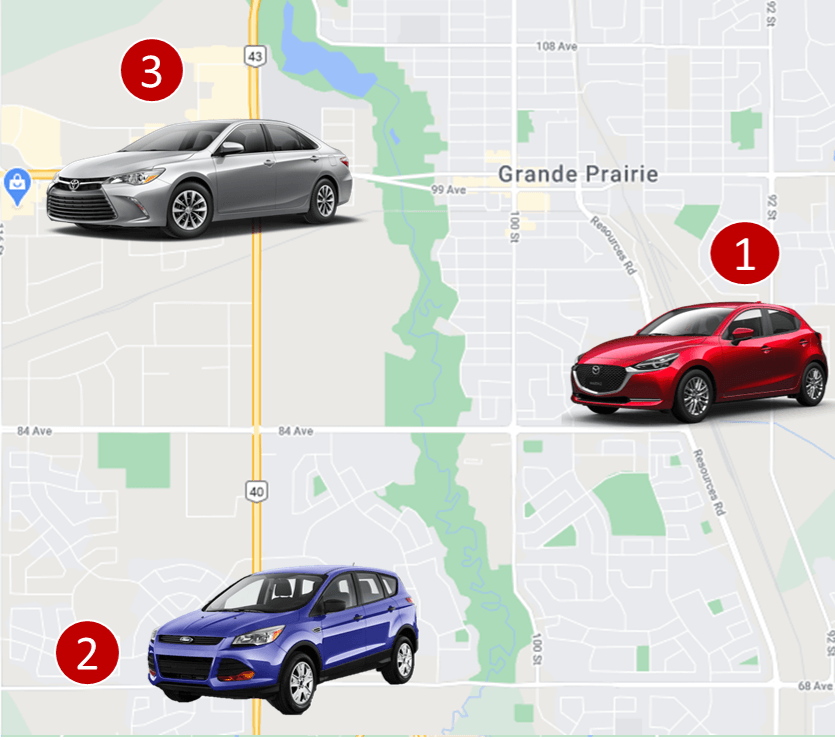

Sample car insurance quote #1:

A male driver, 45 years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2018 Mazda 3 GX, CAA member, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $2,000,000.

$107 per month ($1,284 annually)

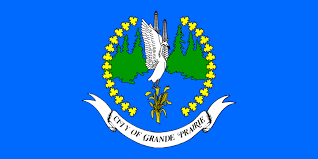

Sample car insurance quote #2:

A female driver, 52 years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2014 Ford Escape, collision-only coverage (no comprehensive). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$75 per month ($900 annually)

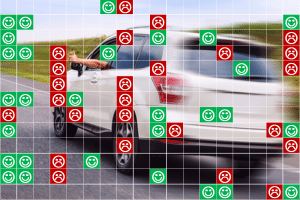

Sample car insurance quote #3:

A female driver, 34 years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2016 Toyota Camry, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$ 126 per month ($1,512 annually)

Car casualty rates in Alberta (including Grande Prairie)

Looking at casualty statistics from Transport Canada (2018), Albertans are in the middle of the road – figuratively – when it comes to being safe drivers. Alberta drivers are a little more reckless than QC and ON drivers but have less fatalities per 100,000 licensed drivers than SK or NS.

|

Province |

Fatalities per 100,00 licensed drivers |

Injuries per 100,00 licensed drivers |

|

NU |

74.2 |

928.0 |

|

YT |

24.1 |

681.1 |

|

SK |

15.8 |

517.5 |

|

PE |

13.2 |

573.8 |

|

NS |

10.2 |

978.9 |

|

NB |

9.0 |

484.3 |

|

AB |

9.0 |

530.0 |

|

BC |

8.0 |

555.7 |

|

MB |

7.6 |

1310.0 |

|

NT |

7.6 |

382.5 |

|

Canada |

7.2 |

575.0 |

|

NL |

6.6 |

460.8 |

|

QC |

6.4 |

622.1 |

|

ON |

5.8 |

491.3 |

Car Insurance in Grande Prairie – what you must know

- In Alberta, car insurance is mandatory – and Grande Prairie is no exception. It’s required by law to have car insurance in Grande Prairie.

- Alberta uses a tort system. That means an insurance company can pay for some of your costs but if you are not at fault, you can sue the other party to get compensation from their insurance company.

- Third party liability coverage in Grande Prairie is mandatory. It is part of every vehicle insurance policy. In Alberta, the minimum coverage is $200,000. However, since damages can be in the millions, we highly recommend obtaining coverage for $1,000,000 or even $2,000,000.

- The maximum limit for medical benefits is capped at $50,000 per person.

What cars are the least expensive ones to insure?

Some vehicles are less accident prone and when they do need repairs, the associated costs are lower. These cars (2014-2018 models) typically cost less to insure.

- Smart Fortwo

- Ford F150

- Nissan Frontier

- Chevrolet Tahoe/Yukon

- Chevrolet Silverado/Sierra

- Fiat 500

- Ford Mustang Convertible

- Jeep Wrangler

- Buick Encore

- Honda CR-V

- Jeep Compass

- Chevrolet Equinox/Terrain

- Nissan Xterra

- Honda Pilot

- Hyundai Accent

Your vehicle’s model is just one of the factors defining your insurance rates. Your personal driving history has a much greater impact on your rates.

5 Car Insurance myths to know

Myth #1: No-fault insurance means that none of the parties involved in an accident is at fault

There is always a party at fault in an accident. This term refers to how the insurance in handled. No fault means both insurance companies from both drivers cover the cost. This results in faster processing and payouts since time is not wasted figuring out who was at fault.

Myth #2: If I have a really bad driving record, I will not be able to get car insurance

Regardless of your bad driving record, you can get insurance. However, your options are limited, and your premiums will be high. You may need to go though a high-risk auto insurance company (e.g. PAFCO) or, as a last resort, the Facility Association, which is the last option for people to get car insurance if they failed to get it anywhere else.

Myth #3: If I have comprehensive coverage, I can always expect to get OEM (original equipment manufacturers) parts for my vehicle

To reduce costs, many insurers prefer the use of aftermarket or recycled parts. The use of OEM parts may be available as an additional rider you can purchase. Read your policy carefully to know if OEM parts are included in the main policy or not.

Myth #4: It is more expensive to insure red coloured cars

This fun myth has stood the test of time but it’s completely false. Drive any colour of car you wish – the color has no impact on the premium.

Myth #5: The tort system encourages better driving behaviours since only the insurance company of an at-fault party pays

According to the Insurance Bureau of Canada, there is no correlation between the type of insurance model used in a province and rate of accidents. The system is about how claims are handled, not about driving behaviours.

Frequently Asked Questions (FAQ): Car Insurance in Grand Prairie

Which car has the cheapest insurance in Grande Prairie?

Typically, car brands such as Hyundai, Nissan, Ford, Buick, Chevrolet, and Jeep are cheaper to insure, but various series of BMW, Mercedes-Benz, Audi, and Lexus tend to cost more. The more expensive the car is to repair, the higher the insurance costs. Check the tables above for the exact makes/models. Another aspect contributing to car insurance costs are statistics (e.g. theft, accidents, etc.) associated with each car brand / model.

How much does Car Insurance cost Grande Prairie?

Car insurance costs in Grande Prairie, AB depends on several factors. Typically, residents of Grande Prairie will pay between $90 and $110 monthly. It is important to remember that if you have a maximum of two violations in the last three years (excluding parking tickets), you can expect to pay 20%-35% higher rates. If you have a serious history of driving problems, you can expect doubled rates. Younger drivers can also expect significantly higher auto insurance premiums.

Car Insurance in Grande Prairie – Reviews: where to find them?

Our proprietary insurance review platform has collected independent consumer reviews for different insurance and financial products since 2012. We have amassed thousands of insurance reviews. Click here to access, for free, all our car insurance reviews.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]