5 Reasons to Get a Car Insurance Quote in Toronto

- Compare car insurance rates in Toronto across 30+ insurers

- Available remotely from the comfort of your home

- Find out if you are currently paying too much

- Spend 5 minutes to save hundreds of dollars

- Talk to a live agent if you have questions to your quote

Welcome to the complete guide for car insurance in Toronto. In this guide you will learn about car insurance rates in Toronto and Ontario, savings opportunities, facts vs myths, and more. Reference this guide any time you need to buy or have questions about auto insurance in Toronto.

What are typical Car Insurance rates in Toronto?

These average rates are typical for auto insurance in Ontario, and in Canada. The first chart shows rates across several Canadian provinces while the second chart shows the difference in premiums based on age. As you can see, the differences can be quite considerable.

Drivers across Ontario, and certainly in Toronto, pay more for auto insurance when compared to every other province. Even though government efforts have been made to reduce Ontario insurance rates, premiums remain disproportionately high.

That being said, car insurance rates in Toronto vary among neighbourhoods. The following are approximate insurance premium ranges for select neighbourhoods in the GTA.

| Neighbourhood | Average ranges for car insurance rates in Toronto (monthly and annual rates) |

|---|---|

| Brampton | Some of the highest rates in the GTA $200 – $240 monthly or $2,400 – $2,880 annually |

| Vaughan | Very high rates $190 – $220 monthly or $2,280 – $2,640 annually |

| Some mid-town areas around Eglinton and Caledonia/Dufferin | Combination of high and medium to high rates $190 – $220 monthly or $2,280 – $2,640 annually |

| Mississauga | High variability of rates depending on location |

| Richmond Hill | High insurance rates $170 – $200 monthly or $2,040 – $2,400 annually |

| Markham | Medium-high to high rates $150 – $200 monthly or $1,800 – $2,400 annually |

| Etobicoke | Medium-high to high rates $150 – $200 monthly or $1,800 – $2,400 annually |

| Scarborough | Medium-high to high rates $150 – $200 monthly or $1,800 – $2,400 annually |

| North York | High variability of rates depending on location $150 – $220 monthly or $1,800 – $2,640 annually |

| Downtown | Medium to medium-high $125 – $170 monthly or $1,500 – $2,040 annually |

| East York | Medium to medium-high $125 – $170 monthly or $1,500 – $2,040 annually |

Get to know all Car Insurance components

Car insurance is comprised of components. Some of them are mandatory, but others depend on what policy you choose, and your individual coverage needs.

| Insurance component | Description | Type |

|---|---|---|

| Collision insurance | Damage to your car from an accident or collision is covered by collision insurance. If your car cannot be repaired, collision insurance pays a reasonable cost to replace your vehicle. | Not mandatory |

| Liability insurance | This component covers a variety of damage to the other person or vehicle including but not limited to medical bills, lost earnings, legal fees, and other expenses. In many provinces you can get sued and the costs may go up into the millions. Mandatory liability coverage is not expensive, so it is well worth spending a little extra to get more than the minimum. | Mandatory |

| Comprehensive insurance | This covers damages outside of accidents or collisions. Comprehensive protects against things like extreme weather, vandalism, falling objects, fire, theft, and flooding. | Not mandatory |

| All perils | All perils is for when someone in your household steals your car or it has been damaged by an additional driver. | Not mandatory |

| Uninsured motorist / Hit-and-run coverage | Some drivers don’t have insurance or engage in hit and runs. This coverage protects you if you are in an accident with an irresponsible, uninsured driver. | Mandatory |

| Accident Benefits | Accident benefits cover medical and other such expenses that result from the accident. This includes but is not limited to nursing care and income replacement. | Not mandatory |

What cars are the most expensive ones to insure?

Accident benefits insurance claims, collision insurance claims, comprehensive insurance claims, and direct compensation property damage insurance claims are all linked to the cost to insure vehicles. Below are some examples of cars (model years 2014-2018) that tend to drive high insurance costs:

- BMW X6

- BMW 4th series

- Tesla Model S

- Cayenne

- BMW 3rd series

- Audi Q7

- Mercedes-Benz S series

- Hyundai Genesis

- Audi S5

- Mercedes-Benz CLS

- Mercedes-Benz C series

- Audi A5

- Subaru/Toyota BRZ

- Dodge Charger Ford Mustang

- Lexus IS

Other factors influence your rates more than the car’s make and model. Those factors include driving habits, age, driving history, location, policy type and coverage level.

Cheap Car Insurance in Toronto: 10 Ways to get it

It’s hard to get cheap insurance in Toronto since the rates are high in this region. However, we have collected 10 ways you can lower your costs.

- Annual Review: Your needs change year to year. Do a review annually to see which discounts apply, and if you still need your same level of coverage.

- Bundle: Some insurers offer a discount if you bundle your insurance with them. If you need both home and auto insurance, look for a company that offers bundle discounts.

- Rental Car Rider: A rental car rider on your policy is around $20-$30/year. The insurance through a rental agency is around $20/day.

- Location, Location, Location: Even in your province, rates vary. For example, Burlington has some of the highest car insurance rates in Ontario. When moving, take insurance rates into account.

- At-Fault Accidents: Drive safely and avoid accidents. If you have been in an at-fault accident, it can take six years of accident-free driving to lower your premium and improve your risk profile.

- Car Insurance Deductibles: Are you a good and experienced driver? Can you manage higher damage payments out of pocket? If so, you can increase your deductible to lower your premium.

- Winter Tires: Insurers know winter tires lower your risk, so some lower your premium to reward your safe choice.

- Anti-Theft System: This lowers your risk of theft. The more risks you can lower, the more you can save on your insurance premium.

- Minimal Coverage: Drive an old car with a low value? You can opt for liability-only coverage, which is the minimum mandated coverage by law. Remember though, while this saves you money this only protects damage to the other vehicle. Damages to your car will not be covered.

- Dashboard Camera: While you won’t get a discount for having a dashboard camera, you can use it to prove your innocence in an accident, which may help you avoid an unfair premium increase.

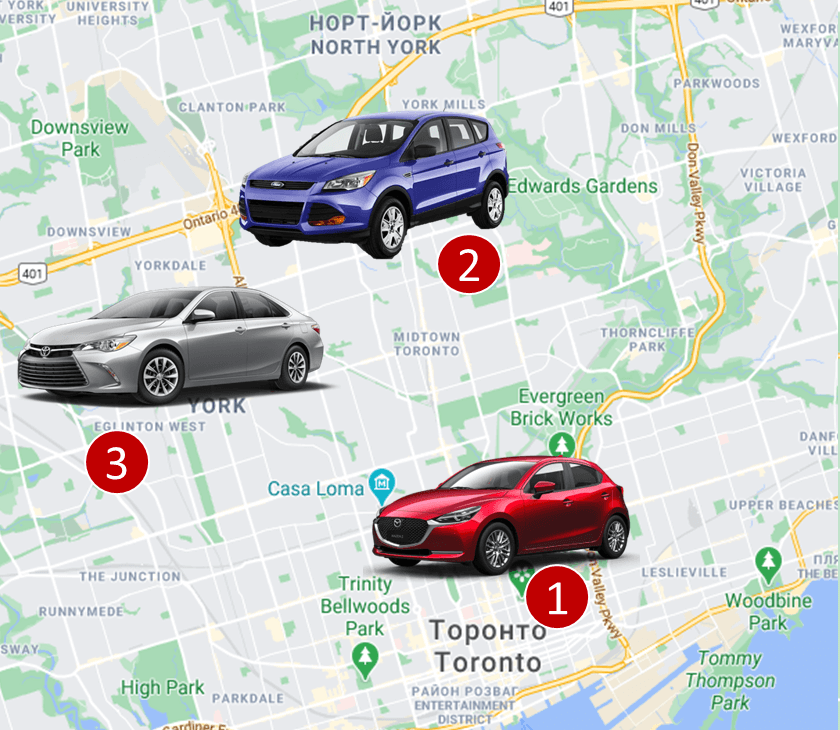

Toronto Car Insurance quotes, examples

Sample car insurance Toronto quote #1:

A male driver, 45 years old, lives in Toronto, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2018 Mazda 3 GX, CAA member, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $2,000,000.

$144 per month ($1,728 annually)

Sample car insurance Toronto quote #2:

A female driver, 52 years old, lives in Toronto, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2014 Ford Escape, collision-only coverage (no comprehensive). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$83 per month ($996 annually)

Sample car insurance Toronto quote #3:

A female driver, 34 years old, lives in Toronto, has no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2016 Toyota Camry, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$180 per month ($2,160 annually)

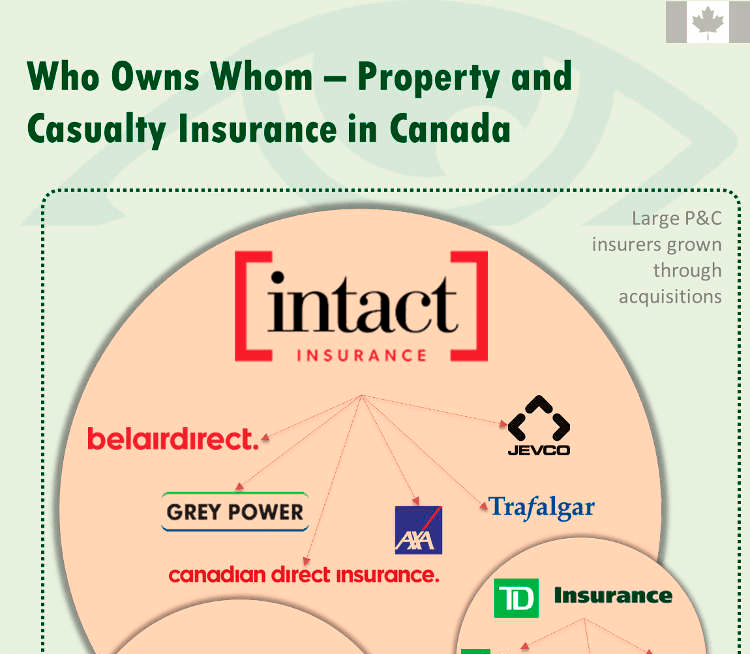

Car Insurance companies in Toronto and across Ontario

Here is an overview of nearly all the car insurance brands operating in Canada. Many of them operate in Ontario, including Toronto. If you are not happy with your current insurance rates, there are plenty of other options out there.

Some car insurance companies in Toronto sell insurance directly through their call centers and agents (e.g. TD Insurance, Belairdirect), others choose to use brokers (e.g. Intact, Aviva, Gore Mutual). A few players such as Sonnet Insurance allow you to do most things directly (such as purchase a policy, get your pink slip or confirmation of insurance, change your address) online.

It is important to know that a broker works with multiple car insurance companies and is able to provide insurance quotes from many providers.

Car Casualty Rates in Ontario (including Toronto)

Based on casualty statistics from Transport Canada (2018), drivers in Ontario operate their vehicles in a safer manner than drivers in many other provinces.

| Province | Fatalities per 100,00 licensed drivers | Injuries per 100,00 licensed drivers |

|---|---|---|

| NU | 74.2 | 928.0 |

| YT | 24.1 | 681.1 |

| SK | 15.8 | 517.5 |

| PE | 13.2 | 573.8 |

| NS | 10.2 | 978.9 |

| NB | 9.0 | 484.3 |

| AB | 9.0 | 530.0 |

| BC | 8.0 | 555.7 |

| MB | 7.6 | 1310.0 |

| NT | 7.6 | 382.5 |

| Canada | 7.2 | 575.0 |

| NL | 6.6 | 460.8 |

| QC | 6.4 | 622.1 |

| ON | 5.8 | 491.3 |

Unfortunately, this good provincial driving record is not reflected in car insurance rates in Toronto and Ontario, where rates are among the highest in the country. In fact, some neighbourhoods such as Brampton and Vaughn have the highest rates in the province. Getting auto insurance in Toronto, if you live in one of these neighbourhoods, is not easy and very costly.

Car Insurance in Toronto – what you must know

- Car insurance in Ontario is required by law.

- Mandatory liability coverage is the minimal third-party coverage that is required by law. It is automatically included in every car insurance policy. In Ontario the minimum mandatory liability coverage is $200,000.

- Other car insurance benefits you can expect in Toronto, Ontario include:

- Disability income benefits: 70% of your gross income up to a maximum of $400 per week.

- Non catastrophic injuries: There is a standard maximum amount for medical, rehabilitation and attendant care expenses (physiotherapy, chiropractic treatment, or an aide to assist you if you have been seriously injured, etc.) This amount is $65,000.

- Catastrophic injuries: The standard maximum is $1,000,000.

- The maximum amount for caregiver benefits is $250 per week for the first dependant, plus $50 per week for each additional dependant.

- If you are unable to perform your usual duties around the home or for your usual wellbeing, you may be eligible for benefits of up to $100/week to hire someone to help you.

- The standard amount of death and funeral benefits is $25,000, which will be paid to your eligible spouse, and $10,000 for each dependant. There is a maximum of $6,000 for funeral expenses.

What cars are the least expensive ones to insure?

Some vehicles are less accident prone and have lower associated costs when an accident occurs. Here are examples of cars (model year 2014-2018) with lower insurance costs.

- Smart Fortwo

- Ford F150

- Nissan Frontier

- Chevrolet Tahoe/Yukon

- Chevrolet Silverado/Sierra

- Fiat 500

- Ford Mustang Convertible

- Jeep Wrangler

- Buick Encore

- Honda CR-V

- Jeep Compass

- Chevrolet Equinox/Terrain

- Nissan Xterra

- Honda Pilot

- Hyundai Accent

Even though these makes and models cost less to insure, your driving history has a bigger impact on your overall rate.

5 Car Insurance myths to know

Myth #1: Car insurance rates for cheaper cars are lower

Car insurance rates have more to do with the history of the model than the cost. For example, Honda Civics are more expensive to insure than many other luxury vehicles.

Myth #2: You can always be added as a second driver on your parent’s insurance policy

This is insurance fraud called fronting and insurers are always on the lookout for it. If you engage in fronting your claim can be denied.

Myth #3 It is more expensive to insure red coloured cars

Despite the popularity of this myth, it is not true. The colour of the car does not impact the premium. So, you can drive a yellow, black, green, or blue car if you wish!

Myth #4: Damages to your car are always covered

You are only covered for what is stated in your policy. If you do not have collision coverage, for example, your vehicle is not protected.

Myth #5: If you get into an accident once or get a ticket, your insurance rates will always stay high

Tickets and accidents impact your auto insurance for three years. After that, if your driving record has improved, your rates can be reduced.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]