5 Reasons to Get a Car Insurance Quote in Hamilton

- Compare car insurance rates in Hamilton across 30+ insurers

- Available remotely from the comfort of your home

- Find out if you are currently paying too much

- Spend 5 minutes to save hundreds of dollars

- Talk to a live agent if you have questions to your quote

This complete car insurance guide for Hamilton will give you an idea of average car insurance premiums in the region, will show you how to save on car insurance, and will bust common myths. With our guide, you will learn everything you need to know about car insurance in Hamilton, Ontario.

What are typical Car Insurance rates in Hamilton?

These charts compare rates across Ontario and Canada, and then across ages. As you can see, the differences can be considerable.

Ontario drivers spend more on auto insurance than any other Canadian province. Even though government efforts attempted to drive down rates, they are still disproportionately high.

However when compared to Toronto, Brampton, and Mississauga, drivers in Hamilton enjoy somewhat lower rates. Car insurance premiums in the following Hamilton neighbourhoods range between $150 and $170 per month: North End, Normanhurst, The Delta, Corktown, Buchanan, Hamilton Mountain, and Inch Park. Several other neighbourhoods such as Hampton Heights, Berrisfield, Rosedale, and Bartonville have even lower rates of $120 – $150 monthly.

Get to know all Car Insurance components

Car insurance is made up of various factors. Some are mandatory, others are optional. Therefore, car insurance policies in Hamilton are built around your coverage needs.

| Insurance component | Description | Type |

|---|---|---|

| Collision insurance | This insurance pays for damages to your vehicle after an accident. If your car is beyond repair, it pays a reasonable sum to replace it. | Not mandatory |

| Liability insurance | This mandatory coverage is for the damages you cause to others in an accident. Damages include but are not limited to medical bills, lost earnings, legal fees, etc. Depending on the province, you can be sued for damages, driving your costs into the millions. Since rates for liability insurance are not high, we suggest getting more than the minimum coverage. | Mandatory |

| Comprehensive insurance | Purchase comprehensive to protect yourself from non-accident related damages that affect your car, such as extreme weather, flooding, and vandalism. | Not mandatory |

| All perils | What happens if someone in your household steals your car? Or an additional driver on your policy damages it? All perils covers these concerns. | Not mandatory |

| Uninsured motorist / Hit-and-run coverage | Some drivers illegally operate without coverage, or flee the scene of an accident (hit and run). This coverage protects you financially from these irresponsible individuals. | Mandatory |

| Accident Benefits | Medical expenses, income replacement, and other such expenses are covered by accident benefits. | Not mandatory |

What cars are the most expensive ones to insure?

The cost to insure cars is correlated, in part, to the different types of claims associated with these cars: accident benefits insurance claims, collision insurance claims, comprehensive insurance claims, and direct compensation property damage insurance claims. Here are some examples of cars (model years 2014-2018) that have high insurance costs:

- BMW X6

- BMW 4th series

- Tesla Model S

- Cayenne

- BMW 3rd series

- Audi Q7

- Mercedes-Benz S series

- Hyundai Genesis

- Audi S5

- Mercedes-Benz CLS

- Mercedes-Benz C series

- Audi A5

- Subaru/Toyota BRZ

- Dodge Charger Ford Mustang

- Lexus IS

Other factors, like your driving habits, age, driving history, location, policy type and coverage, impact your cars insurance rates as well. The model/make alone is not a good indicator of what your insurance will cost.

7 Ways to save on Car Insurance in Hamilton

Since car insurance rates in Hamilton are high, it’s not easy to get cheap insurance. However, it’s not impossible either. We’ve collected these tips so you can reduce your car insurance rates in Hamilton.

- Improving Your Driving Record: It takes three years for your driving infractions to be cleared off your record. Maintain good driving habits to avoid higher premiums.

- Direct Insurers: A direct insurer, like Belairdirect or TD Insurance, if selling commission free services, can sometimes get you a better rate.

- Leverage Rental Car Coverage: Think about skipping the collision damage waiver on your rental car if this is already covered by your own auto insurance policy.

- Annual vs. Monthly Payments: Annual payments save the insurer time and administration costs, so they pass those savings on to you.

- Pay-As-You-Drive: Not a frequent driver? Ask your insurer about a device you can install in your car that tracks your driving profile, so you only pay for the time you are on the road.

- Hybrid Vehicles: If your insurance company offers a discount for hybrid vehicles, you’ll save more than just gas money on your hybrid car.

- Alumni: Some insurance providers offer discounts or group insurance rates to alumni members. Two examples of these groups are University of Toronto and McGill University.

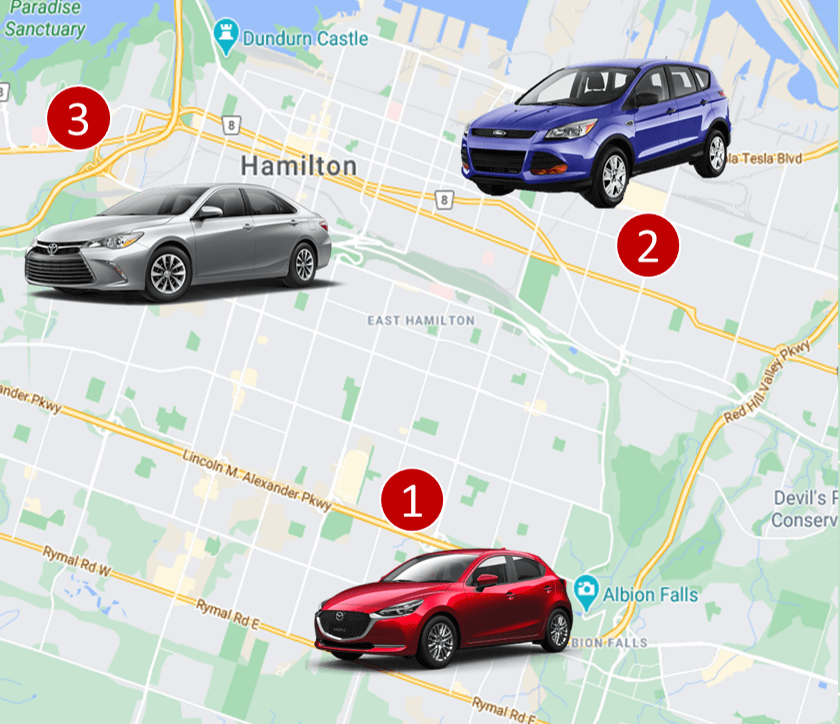

Hamilton Car Insurance quotes, examples

Sample car insurance quote #1:

A male driver, 45-years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2018 Mazda 3 GX, CAA member, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $2,000,000.

$111 per month ($1,332 annually)

Sample car insurance quote #2:

A female driver, 52-years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2014 Ford Escape, collision-only coverage (no comprehensive). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$87 per month ($1,044 annually)

Sample car insurance quote #3:

A female driver, 34-years old, no claims in the last three years, no at-fault accidents, and no license suspensions. Vehicle: 2016 Toyota Camry, comprehensive coverage (including collision). Policy: $1,000 deductible, 3rd party liability – $1,000,000.

$125 per month ($1,500 annually)

Car casualty rates in Ontario (including Hamilton)

Casualty statistics numbers from Transport Canada (2018) show that Ontario drivers appear to be quite safe as compared to other provinces.

| Province | Fatalities per 100,00 licensed drivers | Injuries per 100,00 licensed drivers |

|---|---|---|

| NU | 74.2 | 928.0 |

| YT | 24.1 | 681.1 |

| SK | 15.8 | 517.5 |

| PE | 13.2 | 573.8 |

| NS | 10.2 | 978.9 |

| NB | 9.0 | 484.3 |

| AB | 9.0 | 530.0 |

| BC | 8.0 | 555.7 |

| MB | 7.6 | 1310.0 |

| NT | 7.6 | 382.5 |

| Canada | 7.2 | 575.0 |

| NL | 6.6 | 460.8 |

| QC | 6.4 | 622.1 |

| ON | 5.8 | 491.3 |

Unfortunately, a good safety record is not reflected in car insurance rates in Ontario, as they remain among the highest in the country.

Car Insurance in Hamilton – what you must know

- Car insurance is required by law in Ontario, including the city of Hamilton.

- Mandatory liability coverage is the minimal 3rd party liability coverage that is required by law. It is automatically part of every car insurance policy. In Ontario the coverage is $200,000.

- Other car insurance benefits available in Hamilton, Ontario include:

- Disability income benefits, which are 70% of your gross income up to a max of $400 per week.

- Non catastrophic injuries: The standard maximum amount for medical, rehabilitation and attendant care expenses (for example, physiotherapy, chiropractic treatment or an aide to assist you if your injuries limit your ability to care for yourself) is $65,000.

- The standard maximum for catastrophic injuries is $1,000,000.

- The caregiver benefits maximum is $250 per week for the first dependant, plus $50 per week for each additional dependant.

- If you need help with housekeeping and maintenance as a result of the accident, you may be eligible for a maximum of $100 per week to help with the cost of hiring help.

- The standard amount of death and funeral benefits is $25,000 for your eligible spouse, with an additional $10,000 for each dependant. There is also a maximum of $6,000 for funeral expenses.

What cars are the least expensive ones to insure?

Some cars are less likely to get into an accident and when they do, the repair or replacement costs are lower. Here are examples of cars (model year 2014-2018) that are less costly to insure.

- Smart Fortwo

- Ford F150

- Nissan Frontier

- Chevrolet Tahoe/Yukon

- Chevrolet Silverado/Sierra

- Fiat 500

- Ford Mustang Convertible

- Jeep Wrangler

- Buick Encore

- Honda CR-V

- Jeep Compass

- Chevrolet Equinox/Terrain

- Nissan Xterra

- Honda Pilot

- Hyundai Accent

Remember, the car model is just one of the factors defining your insurance rates. Your personal driving history impacts your rates to a greater degree than a car make/model.

5 Car Insurance myths to know

Myth #1: You can always be added as a second driver on your parent’s insurance policy

This is called fronting and it is insurance fraud – insurers are always on the lookout for this. If you go ahead with this scheme and there is an accident, your claim could be denied.

Myth #2: If you get into an accident once or get a ticket, your insurance rates will always stay high

The accidents and tickets that affect your rates only impact your premium for three years.

Myth #3: Other parties can always sue you for damages or/and injuries if you are at-fault

This depends entirely on the system in which your province operates. In some provinces you cannot sue the other party even if they are at fault.

Myth #4 Insurance works in the same way across all Canadian provinces

Some provinces use a no-fault system, some use a tort (at-fault) system, and some use a mix of both. The system used is not to determine fault, but defines which insurance company pays the claim, and if one driver can sue the other driver.

In some provinces, car insurance is only available through one provider. In MB, SK and BC only MPI, SGI and ICBC respectively can provide car insurance coverage.

Myth #5: It is more expensive to insure red coloured cars

This is one of the most longstanding myths out there, but it is completely false. The colour of your car has no impact on the quoting process or the premium. You could drive a hot pink or lime green car and it wouldn’t impact your rates.

Frequently Asked Questions (FAQ): Car Insurance in Hamilton

Some car brands, like Hyundai, Nissan, Ford, Buick, Chevrolet, and Jeep have cheaper insurance rates. Others, like some series of BMW, Mercedes-Benz, Audi, and Lexus cost more to insure. This is because these more expensive cars have higher repair costs. Check the tables above for the exact makes/models. Another aspect contributing to car insurance costs are statistics (e.g. theft, accidents, etc.) associated with each car brand / model.

Car insurance cost in Hamilton, Ontario, depends on many different factors. On average, drivers in Hamilton pay around $120 and $170 monthly, depending on the neighbourhood. These neighbourhoods have lower premiums: Hampton Heights, Berrisfield, Rosedale, and Bartonville. Drivers in Corktown, Buchanan, Hamilton Mountain and a few other neighbourhoods have higher rates. It is important to remember that if you have a maximum of two violations in the last three years (parking tickets not included), you can expect to pay 20%-35% higher rates. If you have a serious history of driving problems, expect to pay double rates. Also, younger drivers can expect significantly higher auto insurance premiums due to their lack of experience.

Our proprietary insurance review platform has collected independent consumer reviews since 2012 for a variety of insurance and financial products. Click here for free access to all our car insurance reviews.

Our Publications related to Auto Insurance

What Analysis of 4,000+ Car Insurance Consumer Reviews Reveals about Canadian Insurers

Background: The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, […]

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

Car Insurance in Alberta – Top Media Stories, Spring 2017

Here are two summaries of top Alberta Car Insurance stories that were published in March and May 2017 in Canadian media outlets: CBC News Edmonton: Insurance company offers $5,500 for truck appraised at more than $40,000 (click to scroll to the story summary) Simcoe Reformer: Changes to benefit entitlement in 2016 adds to family’s struggle […]

Cheap Car Insurance – 7 Things to Know if You Are New to Canada

Something that is quite straight forward for Canadians often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need […]

111 Insurance Myths – Everything You Must Know

Hundreds of websites on the Internet perpetuate insurance myths. In this article, we have summarized all the insurance myths we are aware of and catalogued them by type, starting with home insurance, followed by auto insurance, life Insurance etc. If interested, you can unlock another 20 additional insurance myths at the end of our article. […]