Get a free Life Insurance quote from 20+ Canadian insurers

What to Ask before Buying Life Insurance in Canada

Life insurance is an extremely important part of financial planning, but not many people want to talk about it. To make this topic more accessible, InsurEye is laying out the statistical facts and other useful pieces of information to inform Canadians about life insurance. After discussions with consumers, we have identified the main questions and concerns of Canadians:

• What amount of life insurance should I choose?

• How much insurance protection do I need if I have children?

• What are the best life insurance companies?

• What kind of life insurance policy do I need?

Question 1: How Much Life Insurance Should I Choose?

If you get Life Insurance in Canada, you want make sure that all essential financial aspects are covered so they do not become a burden for your family. These aspects can include:

• Income substitution for your family

• Taking care of your children’s education (e.g. university or college costs)

• Paying down assets (e.g. mortgage on your house, car loan)

• Dealing with outstanding financial debt (e.g. lines of credit, credit card debt)

• Other costs (e.g. funeral)

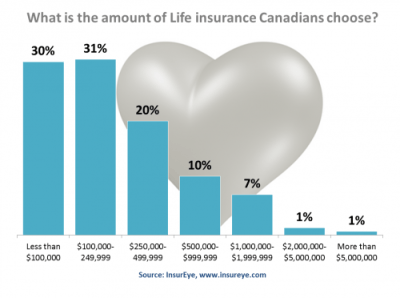

Our data shows that most Canadians choose life insurance under $500k. We recommend speaking with a knowledgeable insurance broker or insurance representative before making this big decision. There might be other potential financial responsibilities that you have not calculated. If you have children, the costs can be much higher than you think – just take a look at the next section.

A separate word on Mortgage Life Insurance Protection: In most cases having separate mortgage insurance is not recommended. Having enough life and disability insurance can encompass a mortgage, avoiding policies overlaps.

If you are looking for insurance to cover your funeral expenses only, the coverage you need, would be lower – approximately $10-30k. A funeral insurance quote will help you to understand the exact costs for this type of insurance.

Question 2: I Have Children – How Much Life Insurance Do I Need?

If you have kids, there are several areas that you need to calculate into your financial planning (see research published in the Money Sense online journal – link at the end of the article):

• Food

• Clothes

• Health Care (e.g. dental services, braces)

• Personal Care (everything from diapers to deodorant)

• School and recreation (school supplies, sports, activities etc.)

• Transportation (E.g. public transit or minivan)

• Housing (E.g. larger house with more bedrooms, furniture, additional utilities etc.)

• Child Care (e.g. nanny, daycare, babysitters)

According to MoneySense in 2002, overall costs of raising a child to the age of 18 add up to $243,660. You should consider that this number does not include any post-secondary education costs. If you consider the inflation numbers of Statistic Canada, overall costs of raising a child to the age of 18 in 2020 would add up to $276,228. This means $1,212 per month over the course of 19 years. Having several children will obviously increase this amount correspondingly. For example, if you do not consider some item re-use such as clothing items, toys, etc., raising three kids to the age of 18 would cost you around $830,000 ($828, 684 to be precise). Have you calculated these numbers into your life insurance protection?

Question 3: What Are the Best Life Insurance Companies?

This analysis is based on the data from our own independent insurance review platform. We do not promote any insurance companies, but collect and analyze what other Canadians share about their insurance providers helping to understand what are the best Life Insurance companies in Canada. All companies are evaluated based on reviews across two dimensions: Customer Service and Value for Money.

| Rating update from April, 2020 (in descending rating order for companies with 10+ review)

• BMO Insurance: 2.7 out of 5 stars (14 insurance reviews for BMO Insurance) • See the full list of insurance reviews for other companies |

We strongly encourage consumers to check the most recent version of our Independent Consumer Reviews, find out which companies appear to be best for them and share their own experiences! Remember, if auto or home insurance protect your assets, life insurance protects your family!

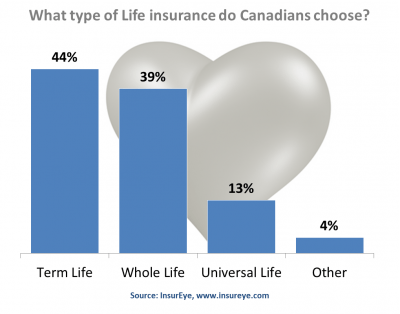

Question 4: What Type of Life Insurance Do I Need?

- Term Life: Life protection that will expire at the end of a set term (e.g. after 5, 10, 20 years) and which does not accumulate any value. A Term Life Insurance policy is a pure insurance product: simple and easy to understand.

- Universal Life: It is a combination of life insurance and an investment component. A portion of your premiums go into your account, increasing your net worth. You can choose how the investment component is invested. A Universal Life Insurance Policy typically comes at a higher cost than a Term Policy.

- Whole Life: One of the most complex life insurance products. Like Universal Life, a Whole Life Insurance policy also has both insurance and investment components. However, they typically offer less flexibility (e.g. the insurer decides how the investment component is invested). This product is also more expensive than Term Life insurance.

While each type of life insurance has its pros and its cons, we believe, the best choice for most people is very often Term Life insurance. It’s the simplest product to understand, it’s the cheapest protection you will get, and it fully fulfills its purpose – to protect.

One of the fans of simple Term life insurance is Suze Orman, one of the leading personal finance gurus in the U.S.A. This video about Suze’s perspective on life insurance is fully applicable to Canada.

According to InsurEye analysis, Term Life is the most popular life insurance protection type in Canada. Nearly 45% of InsurEye users, who have Life insurance, report that they have purchased Term Life insurance.

Please speak with a qualified insurance broker or advisor before making any important decisions associated with such an important topic. An insurance broker can also help with other types of insurance policies such as dental insurance policy, disability insurance coverage, or burial insurance protection (also called funeral insurance plans). Please note, that this article is provided for educational purposes only.

carlos fernandes

June 14, 2014 at 10:15 pmit is very clear that term insurance is the most appropriated for everybody.

Claudia Huerta

June 20, 2017 at 10:27 pmHi! Excuse me, why is more appropriate for the people?

Dis you know that if you buy a term 20 when you’re 21 year old, of course is very cheap. But, question…

at the end of that term 20 your age is going to be 41, when you apply for renewal and let’s say, if you have some illness you can’t afford for a new one. Let’s suppose that you bought term 20 convertible to permanent, if you have a critical illness is going to be so expensive. And you really need to have that protection for make sure no family left behind!

Jessica

April 13, 2015 at 8:20 pmI don’t know why Primerica is ranked the highest of all these insurance companies. Primerica is the ONLY company that states in their contract that they can DECLINE the claim post-underwriting. BMO, Great-West, Sun Life, Desjarins, Manulife etc. all complete their underwriting process BEFORE they issue the insurance contract. Meaning, if all the information provided was true, and you are not misrepresenting yourself, your claim will be paid. Primerica on the other hand has this provision in their contract “I/We understand that information obtained through thie Autorization will be used to determine eligibility for insurance and to investigate and adjudicate any claim”. This means that THEY CAN DENY your claim, despite already performing the necessary underwriting. I know this for a fact because we got denied my father’s claim back in 2012, thank god we had also purchased insurance from another company who paid out the claim.

Ron S

June 15, 2015 at 1:50 pmPrimerica is ranked highest because more people favour it. I am sorry for the experience you had, I don’t know what happened exactly, or why, but it sounds non-typical for sure. Primerica pays out $1 billion in insurance claims every year and was the first to pay out after 9/11. Primerica has helped thousands of people save on life insurance by replacing expensive low-coverage policies with much higher coverages. And it helps them invest the funds they save. You cannot beat this combination.

toolbelt

December 24, 2015 at 6:37 amPrimerica’s rates are typically 50-100% more than most competitors, and their annual policy fees and investment fees are also terrible. You can verify rates online via Term4Sale, etc etc. Most favorable comments are made by Primerican’s not only to attract clients, but recruits as well. They have a turnover rate of 35% (Reps) and 84% recruits annually so if you ever need follow up, the chances are high your rep wont be with them anymore. As their CEO mentioned in an interview, theyre not so much an insurance business as they are a distribution company. They even stoop so low as to pay a fee to an online customer feedback site to hide negative opinions;

http://www.forbes.com/sites/adamtanner/2013/05/09/love-it-or-hate-it-ripoffreport-is-in-expansion-mode/

Andrea Parker

November 13, 2017 at 5:03 pmWow

toolbelt

April 2, 2016 at 9:41 pmMore people favorite Primerica term??? Then why do they only have a 1.8% share of the term insurance market?

K.

November 18, 2015 at 10:34 pmThat is because PRI has 98% rating of death claim pay out. They undergo thorough underwriting process to make sure that when they approve your insurance application, they will pay out the death claim

JV

November 25, 2015 at 8:12 pmI’m sorry to hear that Jessica, but my sister just recently passed away with Pancreatic cancer and Primerica did pay out the claim.

Anthony

March 11, 2016 at 3:52 pmYou are severely mis-informed about life insurance in Canada Jessica! Primerica and all life insurance companies in Canada (when purchasing your own personal policy in Canada) do not practice post claim underwriting. Mortgage insurance offered by the banks practice the process of post-claim underwriting. Please get your facts straight before posting nonsense on an excellent website.

Don

July 11, 2016 at 2:59 pmJessica, you lie. Probably an agent with a competing company. Send me your fathers name and I will verify the lie. Primerica operates the same as all of the other companies.

What Type of Life Insurance Do I Need? | Bongtra Entertainment

May 7, 2015 at 8:49 am[…] Credit : https://insureye.com/top-4-things-you-should-know-about-life-insurance-in-canada/ […]

Alex @ InsurEye

May 19, 2015 at 12:55 amJessica, many thanks for your comment – that’s very useful to know. I am sorry to hear that you had that kind of claim experience. It would be great if you could share it with others by leaving an insurance review for this company. You can do it here: https://insureye.com/Reviews/Life-Insurance-Reviews/41-Primerica-Life-Insurance-Company

Thanks,

Alex

Grant Pawluk

June 5, 2015 at 3:04 amJessica,

I would do a bit more research before believing that about the Primerica life products. If you do a search on which company paid out first (almost immediately after a death claim was made) for the victims of 911, you will find that Primerica stood behind the policies while many other companies were denying coverage because the deaths were due to an act of terrorism. Primerica does their underwriting BEFORE any policy is issued, not after. In my experience, the ones doing post qualification on insurance products are BANKS.

Johnny

July 13, 2015 at 3:56 pmHey Jessica, just based on what you are saying… things don’t add up. None of the life insurance companies in Canada do post claim underwriting! I personally don’t have Primerica insurance, but I know people that do. All policies in Canada have a 2 year contestibility clause in their contracts. They have the right to investigate the claim if the person passes away within the first 2 years. If the questions weren’t answered accurately, or sorry to say…”honestly”, then they can deny your claim.

The only way a claim will get denied in Canada is in the event of fraud. Fraud seems like a hard work, as to consumers fraud usually implies we knowingly lied. Not answering the health questions accurately, is fraud to the insurance company.

Im not saying your dad lied, but I’d be willing to bet he didn’t answer a health question honestly/accurately and thats why his claim was denied. Sometimes we omit things because we don’t feel as if its important, or afraid our premiums will be higher if we disclose… but in the end you will get burned! My sister ‘s father in law had his claim denied through Sun Life because he failed to disclose his sleep apnea.

Affirm Financial – Your Children’s Financial Future

September 9, 2015 at 5:49 pm[…] to think about the end of their life. However, as a parent, purchasing life insurance is one of the smartest things you can do for your children. When you pass away, your children may be left with considerable financial burdens, including your […]

alex sandoval

November 11, 2015 at 9:33 pma financial need analysis is required to find out the need of insurance with whole life and with universal life its too expensive to do this that’s why but term and invest the difference is the way to go.

buzz smith

March 5, 2016 at 8:37 amit’s the way to go alright, if you’re broke, plan on retiring broke and making sure to die broke with no insurance. Typical poor person mentality is what that is. Do a google search, why do the world’s wealthiest families all own permanent insurance? Because it’s an asset bud. Your term is an expense. Then you’re going to buy some mutual funds and gamble all your money away. The TAX FREE Return on PAR whole life annihilates your method over time … Oh and it’s GUARANTEED. The same people that will complain that the rich keep getting richer… Well quit thinking like a poor person, start buying assets instead of wasting your money on expenses. Helps to not be so selfish as well. If you take care of no one,no one will take care of you.Have a great day and buy yourself a PAR Plan today., You’ll thank me in 20 years.

Ben

July 9, 2016 at 11:53 pmSpoken like a true WFGer, Buzz Smith probably got this idea tattooed in his brain before he even got a license (doubtful he ever did).

Marjorie

July 10, 2016 at 1:18 amWhy would the worlds wealthiest families even need life insurance ? You buy life insurance to protect your loved ones in the event of an early death. When you are wealthy and especially the wealthiest in the world why on earth would you be paying out for life insurance. Also insurance is to cover death you can’t live and die at the same time. That’s why you invest for living and insure in the event of death happening before you become financially independent.

Angela J

June 23, 2017 at 11:43 pmTo build wealth in a tax-free manner.

toolbelt

April 2, 2016 at 9:43 pmPrimerica’s term insurance is 30+% higher priced, leaving even less to invest (in a high fee investment portfolio).

Your Children's Financial Future | Affirm Financial

January 12, 2016 at 4:36 pm[…] to think about the end of their life. However, as a parent, purchasing life insurance is one of the smartest things you can do for your children. When you pass away, your children may be left with considerable financial burdens, including your […]

San

March 27, 2016 at 12:33 pmI seriously think that this website is somewhat related to Primerica. I have been to Primerica, WFG, then finally an independent broker for most insurance companies in Canada. There are a lot of reasons why I would not offer Primerica and Transamerica Prosperity UL to my clients.

Alex @ InsurEye

March 27, 2016 at 3:22 pmHi San,

This is Alex from InsurEye. We partner with one of the leading Canadian online brokerages, LSM Insurance, to offer life insurance quotes to our site visitors. Here you can see the full list of the providers LSM Insurance works with: https://insureye.com/life-insurance-quotes/life-insurance-quotes/

Our partnering brokerage does not work with Primerica or endorses them in any form. Any discussions in the article comments reflect individual perspectives of site visitors.

Alex @ Insureye