Background:

The last two years have been marked by unprecedented challenges due to the pandemic, both for consumers and companies. Despite the pandemic, life continued, and Canadians were driving cars, were buying or renting houses, going to a doctor and continued doing many other things related to insurance. As the largest Canadian insurance review platform, InsurEye has decided to assess over 4,000 consumer car insurance reviews to investigate what topics Canadians highlighted in a positive and negative light about their experiences during the last 12 months.

It is important to note that we are not providing an absolute comparison between positive and negative topics or any type of ranking because people tend to share, in most cases, only their negative experiences about insurance companies. Nevertheless, these insights provide an in-depth perspective on most car insurance companies in Canada. Our insights help provide clarity as consumers shop for car insurance in 2022.

It is important to mention that all insights and data contributing to this study are based on consumer reviews and reflect perspectives of Canadians who took time to share their positive and negative experiences. These insights do not reflect InsurEye’s views or opinions. We are a neutral party that aggregates and interprets data.

Introduction

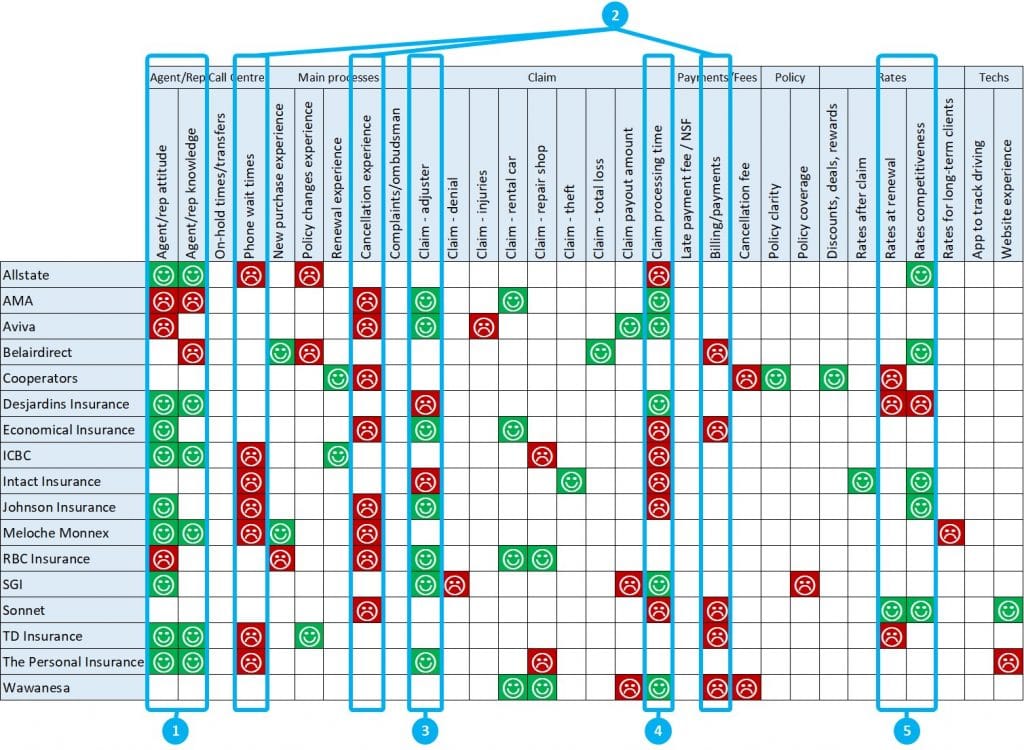

The first part of the study is an overview highlighting three main topics (both positive and negative) that were associated with each company. The list is not exhaustive, but shows the topics that made it to the top among positive and negative car insurance reviews based on how frequently Canadians mentioned these topics in their responses.

The second part of this article shares some similarities we identified across various car insurance companies and the common groups of strengths and weaknesses as demonstrated by insurers. We will also talk about areas where car insurance companies can improve service to consumers.

Car Insurance Providers: Strengths and Weaknesses by Insurer

| Company / Insurance type | Key strengths mentioned in reviews | Key issues mentioned in reviews | Total number of reviews | Summary |

| Allstate Car insurance |

|

| 207 reviews | Among the positive aspects in dealing with Allstate, Canadians mention agent/rep

attitude and knowledge

along with customer service. Similar to a number of other companies, Canadians experienced long waiting

times and difficulties reaching the company when trying to call them. Also claim processing times and policy

change experience were highlighted as areas where consumers wished for improvements. Continue reading Allstate Car Insurance Reviews |

| AMA Car Insurance |

|

| 54 reviews | AMA customers recognize its motor association roots and positively mention experience with claim adjusters during their claim, reasonable claim processing times, and positive rental car claim experiences. At the same time agent/rep attitude, knowledge and cancellation experience (e.g. continue charging account even after the cancellation) could be better. Continue reading AMA Car Insurance Reviews |

| Aviva Car Insurance |

|

| 402 reviews | There are some positive experiences Canadians had with Aviva’s claim processing

with respect to people who

process claim and claim payouts. At the same time, processing of injury claims, agent/rep attitude, and,

most of all, challenging experience when cancelling an existing policy (e.g. in form of cancellation fees in

hundreds of dollars) are highlighted as key issues. Continue reading Aviva Car Insurance Reviews |

| Belairdirect Car Insurance |

|

| 428 reviews | During the last 12 months Canadians mentioned positive aspects as rate competitiveness, strong new purchase experience and handling total loss claims. Consumers highlight agent/rep knowledge as one area of concern together with some billing/payments issues and challenges they face while making policy changes. Continue reading Belairdirect Car Insurance Reviews |

| Cooperators |

|

| 123 reviews | Canadians who are with Co-operators are quite complementary about

discounts/rewards they are getting, and

they appreciate the clarity of Co-operators’ policies and the easy renewal experience. Also, a number of

people are praising advisors’ positive, “can-do” attitude. At the same time, cancellation seems to be a point of friction for a number of Co-operators customers – unexpected cancellation fees, or cancellation experience overall (long times to process cancellations). Also, rates at renewal sometimes come as a surprise. Continue reading Cooperators Car Insurance Reviews |

| Desjardins |

|

| 202 reviews | Desjardins’ auto insurance customers are very positive about Desjardins’ agents,

both for their professional

attitude and knowledge. Also claim processing times seem to resonate will with Desjardins’ customers. Most customer pain points are around insurance rates such as rates at renewal, rates for good drivers and overall rate competitiveness. Some customers report issues when dealing with claims adjusters (incorrect vehicle valuations, lack of support with rental car, etc.). Continue reading Desjardins Car Insurance Reviews |

| Economical Insurance |

|

| 156 reviews | Economical Insurance’s positive reviews include dealing with claims adjusters,

having a rental car as a part

of a claim experience and overall positive agent/rep attitude. Many reviews, though, highlight long claim processing times, sub-optimal cancellation experience and some billing/payment challenges (e.g. double withdrawals). Continue reading Economical Car Insurance Reviews |

| ICBC Car Insurance |

|

| 167 reviews | British Columbia drivers report good experiences with ICBC’s agents/reps,

highlighting their professional

attitude and extensive knowledge. Also, renewal experiences seem to be pre-dominantly positive. Where ICBC customers see some opportunities to improve are in claim processing times (e.g. some reports talk about multiple months), dealing with repair shops as a part of the overall claim experience and considerable phone wait times. These factors may be driven in part by the pandemic. Continue reading ICBC Car Insurance Reviews |

| Intact Car Insurance |

|

| 315 reviews | Canadians find that Intact Insurance offer competitive rates. As an additional cherry on top, rates do not tend to go up often after a claim. Also, handling of claims associated with theft was positively mentioned by reviewers. At the same time, consumers highlight longer claim processing times and opportunities to improve experience with claim adjusters. As well, long phone wait times are reported. Continue reading Intact Car Insurance Reviews |

| Johnson Car Insurance |

|

| 172 reviews | According to the reviews, Canadians appreciate such aspects of Johnson Insurance as rates competitiveness, agent/rep attitude, and claim experience with adjusters. Some professional categories of Canadians such as teachers can benefit from preferred rates. A few areas where reviews were less positive are around policy cancellation experience,

claim processing time, and phone wait times. These factors may be driven, in part, by the pandemic. Continue reading Johnson Car Insurance Reviews |

| Meloche Monnex |

|

| 372 reviews | Similarly, to its main company, TD Insurance, Meloche Monnex’s customers

highlight positive agent/rep

knowledge and attitude, along with positive purchase experience. At the same time, long waiting times (even

reaching several hours in many cases) on the phone have been on the top of the issue list, together with

high rates for existing clients and challenging cancellation experiences. Continue reading Meloche Monnex Car Insurance Reviews |

| RBC Car Insurance |

|

| 203 reviews | RBC Insurance’s positive reviews include dealing with claims adjusters, having a rental car as a part of a claim experience, and positive claim experience with repair shops.

Purchasing a new policy is highlighted by consumers as one of the challenges in doing business with RBC Insurance with a new policy requiring up to several weeks to be issued. Also, agent/rep attitude was mentioned as an issue together with challenges in the cancellation experience (e.g. high cancellation fees). It is important to note that RBC Insurance’s home and auto products are issued by Aviva, which handles all policy administration and claims services. Continue reading RBC Car Insurance Reviews |

| SGI Car Insurance |

|

| 58 reviews | SGI customers in Saskatchewan seem to be quite happy with quick claim processing

times and their claim

adjusters. They also report positive experiences from interaction with SGI Insurance team members. Most points of unhappiness are around claim payout amounts, claim denials, and unclear policy coverage. Continue reading SGI Car Insurance Reviews |

| Sonnet Car Insurance |

|

| 71 reviews | Sonnet, a fully digital Canadian insurance company (owned by Economical

Insurance) is positively recognized

by Canadians for its competitive rates (both with initial purchase and at renewal) and great website

experience, allowing them to carry out most activities online without consumers calling an insurance

company. Sonnet’s customers mostly dislike the policy cancellation experience, billing/payments issues (e.g. charging wrong amounts or continued billing after policy cancellation) and somewhat lengthy claim processing times. Continue reading Sonnet Car Insurance Reviews |

| TD Car Insurance |

|

| 442 reviews | Canadians perceive TD Insurance advisors as pre-dominantly positive and

knowledgeable. Also, any changes to

the existing policies seem to work out smoothly. During the pandemic, especially, on its onset, many

consumers reported extremely long waiting times on the phone. Many recent reviews seem to be focused on rate

increases on renewal, and billing/payment issues. Continue reading TD Insurance Car Insurance Reviews |

| The Personal Car Insurance |

|

| 141 reviews | The Personal is Desjardins’ property and casualty group insurance for Canadians

who are members of a

professional association or employees of a major company. Canadians positively mention agents’ professional attitude and deep knowledge along with great claim adjusters. At the same time, such aspects of service like phone wait times, website experience and dealing with repair shops as a part of claims experience can be improved. Continue reading The Personal Car Insurance Reviews |

| Wawanesa Car insurance |

|

| 98 reviews | Wawanesa Insurance’s policyholders highlight many positive aspects of claims

processing such as dealing with

repair shops, getting a rental car, and quick claim processing times overall. At the same time some

less-than-positive experiences are around final claim payout amounts, billing/payments, and cancellation

fees, which can be fairly high. Continue reading Wawanesa Car Insurance Reviews |

Get a free Auto Insurance quote from 20+ Canadian insurers

Car Insurance Providers: Common Issues and Challenges

As we were exploring different areas where Canadian car insurance companies were complemented or complained about, we saw a few interesting emerging patterns with some topics mentioned more often than others.

So, let us start with key observations…

Many Canadians appreciate agent/rep attitude and knowledge

This positivity appears in reviews for many companies (but not all). It shows that many insurers were successful with their team choice and their training. Customers truly appreciate friendly agents, who can explain all the ins and outs of the situation and provide necessary support. That type of support along with helpful insurance agents, representatives and brokers is very valuable in these difficult pandemic times.

There are several common areas/issues where many Canadian car insurers underperform

- Phone wait times: The pandemic very quickly drove necessity to change insurance contact centres’ agents from offices to home-based work. Not every insurer was well prepared for this change (including required processes and technology) and, simultaneously, for an increased number of calls. As a result, many Canadians mention waiting times of several hours when trying to reach their insurers.

- Billing / Payments: This dimension was a surprise for us as it seems that many Canadian car insurers are struggling with this trivial task, to invoice customers properly (at the right time point and for the correct amount). Numerous billing issues, double charges, etc. drove negative ratings here.

- Cancellation experience: Similar to billing and payments, Canadians expect that cancelling an existing policy must work well but, that is not the case. In fact, nearly every second company has negative cancellation experience among top issues mentioned by customers. That includes long times to cancel a policy, failing to deliver cancellation confirmation, unexpected cancellations without pre-warning, continued charging to customers even after they have cancelled their account, and unexpected cancellation fees (in fact, for a couple companies, cancellation fees made it to the top of the issues as its own category).

Our observation is that the lack of positive experience across these dimensions does not mean that none of the companies does it well, but rather that Canadians expect these things work and only notice them when these service elements do not work. Insurers must not expect any positive points for correct billing/invoices, quick and error-free cancellation experience and agents who can be easily reached over the phone, but should be prepared for negative feedback if these things do not work.

Mixed opinions/experience with claims adjusters

Claim experience is the one where the rubber hits the road and the claims adjuster is the face of the company in such situations. The range of experiences here is quite broad and that is where insurance really counts – that is the real purpose of insurance products, to help people in the moment of their need. Canadians remember very well if a claims advisor treated them well or not during the entire claim process and if they provided the necessary support.

Claim processing time perceptions vary by company

That is another dimension that is very critical for consumers, and, in eyes of Canadians, some companies stand out through faster claim processing times whereas others delay and stall the process for months. From our perspective, a combination of a quick and smooth claims process together with helpful claim adjuster is one of the recipes for the long-term success of an insurance company.

Rate competitiveness perspective differs across companies

That is another area that is noticed by Canadians both in positive and negative reviews. It strongly correlates with “rates at renewal.” It is interesting to note that Canadians do not evaluate every company negatively here, perceiving that car insurance is expensive overall but do realize when an insurance provider offers good value pricing.

We hope that both consumers and insurance companies find these insights interesting and helpful.

Our Methodology

InsurEye has been capturing consumer experience with insurance companies for a number of years spanning across car insurance reviews, home insurance reviews, life insurance reviews, disability insurance reviews, critical illness insurance reviews, health insurance reviews and other insurance and financial products.

Consumer reviews at insureye.com are reviewed and approved by experienced moderators. When approving reviews, one or multiple tags are assigned to each review to understand the themes consumers raise. Based on the ranking of each review, each tag is considered either positive or negative, allowing us to understand if a particular theme was mentioned in a positive or negative context. The themes which are mentioned more often than others make it to the top of our list. It is important to mention additional aspects of our assessment:

- In general, we have relied on the past year’s (2021) subset of reviews. When there were not enough reviews, we selectively used a wider timeframe for reviews to be included into the assessment.

- Only insurance companies with more than 50 reviews have been included into the assessment.

- If some topics have been mentioned both in positive and negative contexts across different reviews, we have considered the more pre-dominant presence e.g. if “rate competitiveness” has been mentioned four times in a negative context but over 50 times in a positive context, it would be considered positive with a frequency of 50 – 4 = 46.

- Please note that analysis had to account for the fact that consumers share voluntary, by far, more negative insurance reviews than positive. That means that positive themes have been weighted accordingly.

About InsurEye

InsurEye is the largest Canadian insurance and financial product review platform. Its mission is to equip Canadians with useful insights and knowledge when making insurance or financial decisions. It also connects Canadians with the best insurance brokers and insurance and financial service providers.