Welcome to your home insurance guide for Barrie. Barrie, ON became a very popular place to live for many Ontarians, offering a combination of affordable real estate prices, and being close enough to Toronto with the Go Train connecting Barrie with downtown Toronto. Let’s not forget the beautiful landscapes of Lake Simcoe’s shores. This page will give you an idea of home insurance premiums in Ontario, will inform about savings opportunities and also provide number of other useful tips for choosing Home Insurance protection in Barrie.

What are typical Home Insurance cost in Barrie?

This chart illustrates the average Renters and Homeowners Insurance premiums in Ontario and other provinces including Home Insurance in Barrie. Renters insurance rates are typically lower than home owners premiums due to the nature of insurance: Renters insurance typically covers only the content of your rented property and sometimes liability. It does not cover the building itself since it is covered under the insurance property of the homeowner.

One of the larger topics in the past years become flooding that strongly impacted Ontario a few years back. Meanwhile, the most insurers in Canada cover overland flooding (i.e. flooding where water enters your home from outside e.g. during a flood after rain or melting snow) and thus we suggest checking with your insurer what coverage options are available.

This coverage might have different names and is often sold as optional / additional coverage e.g. overland flooding endorsement or e.g. a bundled water coverage that covers both sewer backup and overland flooding).

How to save on Home Insurance in Barrie, ON: 10 Tips

- Change your content coverage: Do you rent an apartment or condo? You can often lower your content coverage. No need to insure your belongings to up to $250,000 if you only have a laptop and some IKEA furniture!

- Monitoring: Is there other security like a doorman or security guard on the premises? This may mean an additional discount.

- Hydrants and fire-station: Ask if your proximity to a hydrant or fire station will save you money.

- Professional Memberships: Are you a member of a professional organization such as Certified Management Accountants of Canada? Some companies offer discounts to professional members, and some organizations offer their members insurance policies. (e.g. Meloche Monnex Insurance)

- Students: Some carriers provide discounts for students. (e.g. State Farm)

- Alumni: Graduates from some Canadian universities, such as University of Barrie, McGill University and NAIT, may qualify for a discount through select providers. (e.g. TD Insurance)

- Dependent students: Dependent students living in their own apartment can be covered by their parents’ home insurance policy at no additional charge. Check with your insurer for this benefit. (e.g. Desjardins Insurance)

- Stop smoking: Some insurers increase their premiums for the homes with smokers since this means an increased risk of fire

- Direct insurers: Have you always dealt with insurance brokers or agents? Getting a policy from a direct insurer, also called a captive agent, may save you money. A captured agent only sells products from one company. (e.g. Belairdirect)

- Benchmark your costs: Use price comparison tools to know how much other companies are charging for similar policies, and check with your peer group to see if these comparisons are similar within your demographic.

5 Elements that will increase your Home Insurance costs

- Building frame: Wooden frame homes are particularly susceptible to damage from mold or fire, and can be considered less safe than homes made of brick or concrete. Because of this, wood frame homes are likely to incur higher insurance costs.

- Oil-based heating: Oil-based heating carries more risk for damage than electric heat or forced-air gas furnaces due to the potential for environmental hazards or fire.

- Swimming pools: Pools – particularly those not guarded by a fence – present a higher, more costly liability.

- Knob and tube wiring: This is an outdated wiring that is no longer up to code due to its lack of ground. Knob and tube wiring still in use will be very old, and is often not suited for rising consumption levels. The higher risk means insurance providers will commonly insist on having the house rewired, or tacking on higher rates to your policy.

- Home being a part of your business: Homes that double as places of business are seen as higher risk to insurers. Examples like bed and breakfasts, daycares, and traffic from customers and suppliers in your home will result in higher insurance costs.

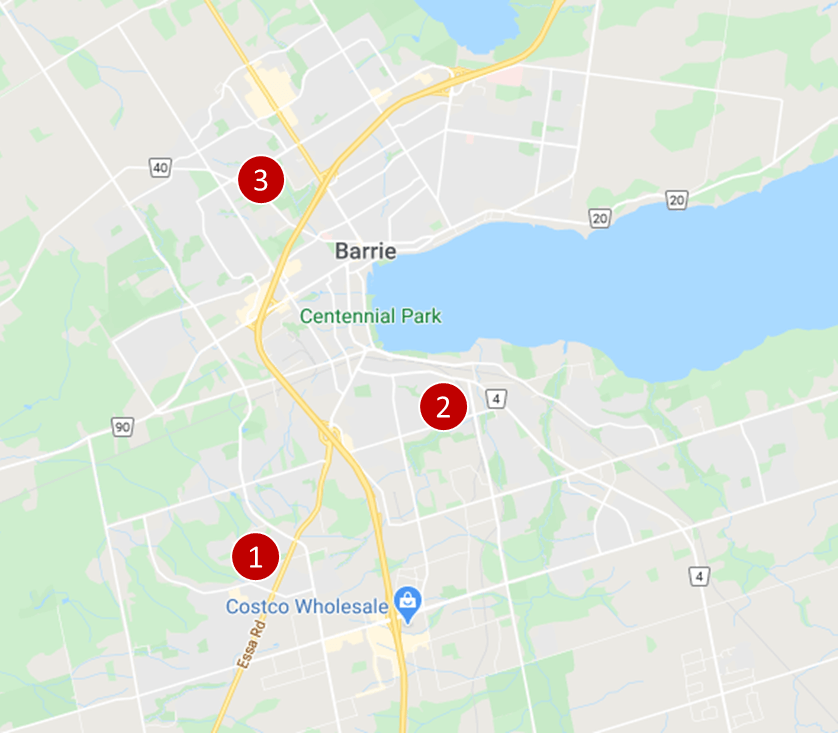

Barrie – Home Insurance quotes, examples

Barrie home insurance quote #1:

Homeowner’s insurance for a 2-storey detached house, bundling with auto insurance, a built-in garage for 2 cars, an outdoor pool, property located on Essa Rd. next to Harvie Park

$181 per month ($2,172/year)

Barrie home insurance quote #2:

Tenant home insurance for a 2-storey detached house. This is a brick house with built-in garage for one car, no basement, located next to the intersection of Woodcrest Rd. and Greenfield Ave.

$31 per month ($372/year)

Barrie home insurance quote #3:

Homeowner’s insurance for a 1-storey detached brick house, nearly 1,000 sq. feet, no garage, no basement, a new roof, located nearby Arboretum Sunnidale Park

$93 per month ($1,116/year)

5 Home Insurance, myths to know

Myth #1: Home insurance pays for required upgrades/maintenance.

Home insurance does not cover the usual wear and tear that occurs over time. Home insurance specifically covers damage from catastrophic or natural events (e.g. flash floods, hail, storm winds), and will not compensate for routine repairs or renovations.

Myth #2: Insurance is cheaper for older, less expensive homes.

Intuition may lead you to think that, since an older home is less expensive, home insurance will be less expensive. It’s actually the opposite; because of the increased risk that something could go wrong, the insurance premiums will go up as well. Older houses are more likely to have degraded structures or worn-out piping systems prone to bursting when temperatures plummets.

Myth #3: If I make a home insurance claim, my insurance costs will go up.

This depends on the policy. There are insurance providers who may not increase your costs if it is the first claim, or they may simply eliminate your option to get a “zero” claim discount.

Myth #4: Home insurance covers the market value of my house.

Home insurance will cover only the rebuilding or replacement value of your house. These costs are usually lower than market value since, unlike the market value of the house, the repair costs do not involve the value of the land. Only the costs for repair or replacement are accounted for in a claim.

If, for example, your house burns down, your insurance will cover rebuilding and often, debris clean-up. It does not cover the value of the land as the land is not “replaced” by the repairs.

Myth #5: If I am away on vacation, my house is covered.

This may not always be the case. Proper preventative precautions must be undertaken before leaving the house for extended periods. In particular, if you go on vacation during the winter it’s best to:

- Shut off the water supply, then empty all the pipes, and

- Make sure the home heat level is consistent.

Failure to take these precautions into account may mean that you’re not protected against water damage should the pipes burst while you’re away. Your insurance provider has information regarding what length of vacation requires you to take added precautions (such as getting a friend or family member to routinely check your house, and how often). Usual intervals of checkups are about every three to seven days, but it is important to consult the particulars of your policy for this information.

Frequently Asked Questions (FAQ): Home Insurance in Barrie

What does Home Insurance cover in Barrie?

Home insurance coverage in Barrie (similarly to other locations in Ontario and throughout Canada) depends on type of insurance you choose – here is a high-level view

- Tenant insurance: Typically covers your personal contents and liability

- Homeowner insurance (house): Covers the entire rebuilding costs for your property, a wide range of natural impacts depending on your riders (e.g. earthquake, flooding, snow damages, etc.), liability, tree and garden (depending on riders), additional structures on your land (e.g. shed, storage space, etc.)

Who has the best Home Insurance in Barrie?

Different home insurance companies specialize on different segments of customers (e.g. seniors, affiliated members of various organizations such as CPA, CAA, etc.), geography, types of buildings, risk types, etc. In order to find the cheapest home insurance, it is important to get a quote from as many insurers as possible and understand what exactly they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals can help you with all these questions.

Home Insurance in Barrie – Reviews: where to find them?

Our proprietary insurance review platform has been collected independent consumer reviews for different insurance and financial products since 2012 and has thousands of insurance reviews. Click here to access for free all home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |