Welcome to the complete guide for home insurance in Thunder Bay. This guide will help you understand how home insurance in Thunder Bay works, average home insurance premiums in Ontario, how to achieve savings, and other useful tips.

What are typical Home Insurance cost in Thunder Bay?

The chart shows average renters and homeowners insurance in Thunder Bay, in Ontario, and in other provinces. The reason renters rates are lower than homeowners insurance in Thunder Bay is because of what is covered. Renters insurance usually covers just contents and liability. Homeowners insurance in Thunder Bay covers the rebuilding of the dwelling, natural impacts, liability, contents, and has riders available for extra layers of protection.

Over the past few years, Ontario has become increasingly impacted by flooding. Most insurers in Canada cover overland flooding (where water from floods, heavy rain, fast snow melt, etc.) enter the home from the outside. Always check with your insurer as this coverage may be optional for purchase and have different names such as overland flooding endorsement. It could also be bundled with water coverage to protect against both sewer backup and overland flooding.

How to save on Home Insurance in Thunder Bay: 10 Tips

- Renovations: Renovating your house can help you lower home insurance premiums. This is because older and/or poorly maintained homes are more expensive to fix – and their elements tend to be more worn out. Even just renovating the kitchen or bathroom may lead to savings on your policy.

- Pipes: Upgrade from galvanized or lead pipes to the much-preferred copper or plastic to save money on your home insurance in Thunder Bay.

- Wood stoves: Wood stoves are considered a fire risk and can subject you to higher premiums, and prompt an inspection request.

- Water damages: Have your home inspector check very carefully for signs of water damage before you buy a house. Previous water damage can lead to ongoing maintenance and repair issues.

- Avoid living in risky locations: Avoid buying homes in known earthquake or flooding zones. These risks increase your insurance costs.

- Dependent students: Desjardins Insurance is one insurer that will allow dependent students (that are living in their own apartment while they attend post-secondary school) to be covered by their parent’s policy at no additional charge. Check to see if your insurance has this perk.

- Business Insurance: If you work from home but your business assets are little more than a laptop and desk, check out the difference in price between home vs. business insurance.

- Annual review: Since your needs change year to year, review your policy on an annual basis and adjust as necessary.

- Stop smoking: Smoking is a risk to your health and your home, which is why smokers pay more for insurance. Quitting smoking reduces your premium in addition to boosting your health.

- Claims-free discount: Some insurers offer a discount as a reward if your account is claims-free. Talk to your insurer to see if they offer this and how long you must be claim free to qualify.

5 Elements that will increase your Home Insurance costs

- Old house elements: If aspects of the building elements are old and in need of upgrading (shingles, pipes, wiring, etc.), expect to pay more until a renovation is completed.

- Roof type: Insurers consider wood shake and shingle roofs to be the most unreliable, and more costly to insure.

- Basement: When a pipe bursts, a sewer backs up, or water floods your home, the water flows downwards. This is bad news for finished basements, which is why they cost more to insure.

- Knob and tube wiring: This outdated style of wiring relies on connectors that use knobs to isolate the wires and insulated tubes to guide the wires through the walls. Knob and tube wiring is not safe for today’s high-energy loads. Your insurer may insist on a re-writing, may charge an extra premium, or may not offer coverage until your home has been renovated.

- Swimming pools: Pools, especially unfenced ones, create high personal liability. Insurers charge accordingly.

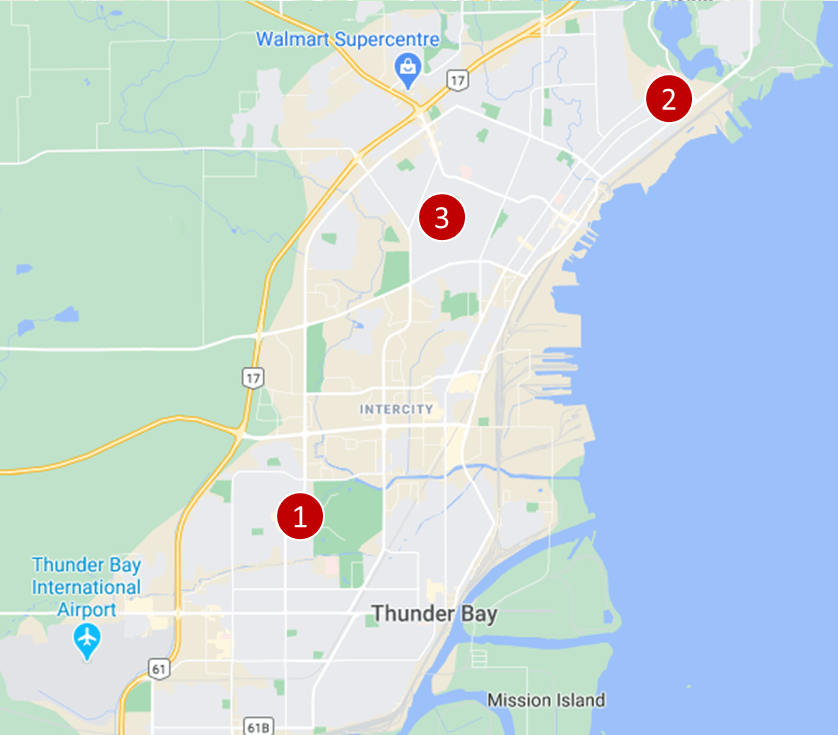

Thunder Bay – Home Insurance quotes, examples

Thunder Bay home insurance quote #1:

Homeowners insurance for a one-and-a-half-story detached house, about 1,000 square feet. This home has no garage, a wooden frame, and a brick veneer exterior. Located on Westminster St next to Chapples Park.

Price: $91 per month ($1,092/year)

Thunder Bay home insurance quote #2:

Tenants home insurance for a two-storey detached house under 1,500 square feet. Bundled with auto insurance. The house has no garage and a half-finished basement. Located on Court St. N near Boulevard Lake.

Price: $34 per month ($408/year)

Thunder Bay home insurance quote #3:

Homeowners insurance for a one-story detached house under 1,000 square feet. The building has a built-in garage for one car, no basement, vinyl siding exterior, and is located on John St next to Ecole Gron Morgan Public School.

Price: $81 per month ($972/year)

5 Home Insurance myths to know

Myth #1: Home insurance covers the market value of my house

Home insurance covers the rebuilding cost, not the market value, of your home. This is because if your home burns down, for example, your insurance will rebuild it to the standard it was before the loss. Rebuilding costs do not include the value of the land, as there is no “land” to rebuild in common perils such as a fire. That being said, however, most policies include the cost of debris clean up, and some allowance for alternative living arrangements while your home is being rebuilt.

Myth #2: I can overinflate the value of the damage

Inflating the value of the damage can ruin your credibility, and once that happens, your claim can be denied. You also impact your ability to get a new insurance policy elsewhere. Insurers always conduct an assessment or investigation into your claim; it is easy for them to spot attempts to inflate the value.

Myth #3: Termite and insect damage is covered.

Termite and insect damage are not usually covered. Check your policy to see how it treats this type of risk.

Myth #4: Claims cause my insurance premium to go up

This is not always the case. Some policies do not increase the rate after your first claim, and others may just remove your claim free discount.

Myth #5: My belongings in a rented storage locker are protected by my home insurance

This typically only applies to storage lockers that are part of the facility in which you live, such as the basement lockers in an apartment or condo complex. Most insurers do not cover belongings in rented storage lockers.

Frequently Asked Questions (FAQ): Home Insurance in Thunder Bay

What does Home Insurance cover in Thunder Bay?

As with other cities in Ontario, and throughout Canada, home insurance coverage in Thunder Bay depends on the type of insurance you choose. Here is an overview.

- Tenant insurance: is designed to cover your personal contents and liability.

- Homeowner insurance (house): is designed to protect against a variety of perils, including rebuilding your home, storm damage, additional structures on your land, etc. Depending on your riders you may also have coverage for trees/gardens, flooding, earthquakes, and more. Home insurance also includes coverage for liability.

Who has the best Home Insurance in Thunder Bay?

Insurance companies can specialize in different consumer segments. For example, some work primarily with seniors, while others work with membership organizations. Others specialize in areas of geography (like rural properties), while others focus on building type (like condos). To find the cheapest home insurance in Thunder Bay, get and understand the details of a variety of quotes from different insurers. Note the differences among the coverage levels, deductibles, exclusions, etc. Our insurance professionals can help you find quotes and answer your questions.

How much is home insurance in Thunder Bay?

The cost of home insurance in Thunder Bay depends on a variety of factors, including the type of home insurance you need. There are differences among home insurance for a house, home insurance for a condo, and tenant insurance.

- Tenant insurance can be as low as $20/month and is the cheapest type of home coverage.

- Homeowners insurance for a house can start at $50/month but go as high as several hundred dollars per month. It depends on your property (e.g. size, age, availability of a basement), the property’s location (e.g. proximity to areas with increased flooding risk), and your property conditions (e.g. recent renovations, particular types of roofing, wiring, pipes, etc.).

Home Insurance in Thunder Bay – Reviews: where to find them?

Our proprietary insurance review platform has collected independent consumer reviews for a variety of insurance and financial products since 2012. We now have thousands of insurance reviews. Click here to access insurance reviews for free.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |